I received an email from a client last week referencing Ted Butler’s June 4th article on precious metals leasing. I want to clear up some confusion that might arise from reading it.

I acknowledge that Mr. Butler’s focus isn’t leasing per se. It’s why precious metals prices aren’t where they are supposed to be (higher of course). According to Butler, leasing is just a different entrée on the manipulation menu, a different tool in the toolbox of da’ banksters who want to artificially and allegorically depress, suppress, repress and compress precious metal prices lower.

Regular readers will know that historically Monetary Metals and Mr. Butler don’t agree on that issue. I won’t rehash those arguments here.

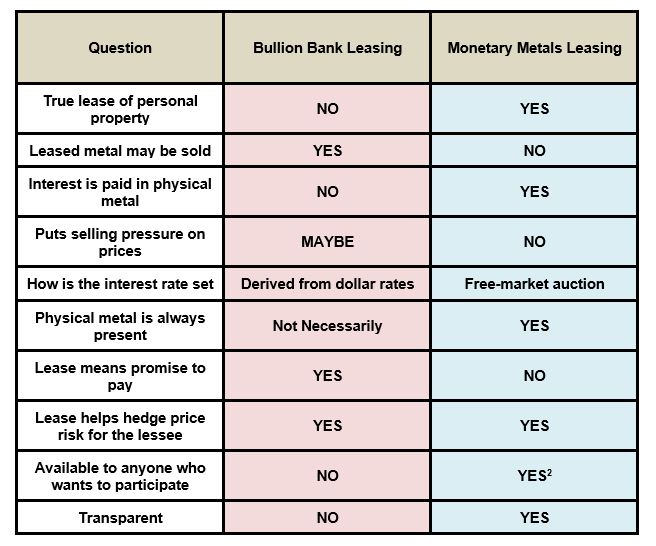

I just want to show how our Gold Fixed Income leases are different from the methods referenced in Mr. Butler’s article.

Is Mr. Butler’s Article Accurate?

Many areas of the gold market are opaque, and each gold lease or loan contract is different. Mr. Butler may get some of the details right, but I would be cautious about jumping to his conclusions.

Nevertheless, there are activities that one would not expect in leasing: selling of the gold, gold liabilities on the balance sheets of lessees, and the use of futures and forwards to hedge the price exposure.

Mr. Butler is right to point out that whatever the word for this activity may be, “leasing” seems a poor choice. “Lending” would fit better, especially if the gold is sold with a promise to pay it back later. Mr. Butler may not be aware of other methods of leasing precious metals, including our own.

The reality is that not all precious metals leases are created equal. Not all precious metals leasing is done by bullion banks or central banks, and finally, not all precious metals leasing is bad.

Let’s compare and contrast Monetary Metals Leasing to what Mr. Butler describes.

While bullion banks aren’t the only parties offering the kind of lease described by Mr. Butler, for simplicity’s sake, I will use the label of “Bullion Bank Leasing” to refer to it.

How are Monetary Metals Leases Different?

Monetary Metals’ gold and silver leases are structured as a true lease of personal property. This is the same kind of lease you might engage in with any other tangible property, like an apartment or a vehicle, to use Mr. Butler’s examples. Mr. Butler seems to think that this is not possible with precious metals. We beg to differ and have a growing track record of successful leases in our portfolio. This core difference leads to several other differences.

A True Lease, Not a Loan

Because it’s a true lease, it’s NOT “a promise to pay gold later.” It IS an agreement to rent your physical gold, for a fee, to a business, for a pre-defined term.

Physical Metal, Not Paper

Because it’s a true lease, there’s physical gold, physically present for the entire duration of the lease. Just like your apartment is physically there when you lease it, so too is your gold physically there when you lease it through Monetary Metals.

No Selling of Leased Metal

Our lease agreement strictly prohibits the selling of any leased metal. In order for the lessee to sell metal on lease, they must replenish that same amount first.[1]

This means Monetary Metals leasing does NOT exert downward pressure on precious metals prices.

Interest Paid in Metal, Not Dollars

In Monetary Metals’ leases the interest is paid in metal. Investors receive gold interest on their gold and silver interest on their silver, while retaining their exposure to the price of the metal. This is unique, as the rest of the world generally uses gold to earn dollars.

Interest Rate Set by Free Market Process

The interest rate charged by bullion banks is generally derived from the dollar funding market. The gold lease rate is the London Interbank Offered Rate minus the Gold Forward Rate (LIBOR – GOFO).

However, Monetary Metals’ leases are true gold leases and therefore have true gold interest rates. The rates are set by a market auction process. Individuals and institutions set the rate they are willing to accept.

Monetary Metals Leases Serve the Precious Metals Industry and Community

Our leases provide financing to many precious metal players such as jewelers, mints, refiners, manufacturers, bullion dealers, and recyclers (e.g. e-waste). The precious metals industry is poorly served by today’s dollar-dominated (and denominated) lending structure. Our leases are a win-win deal for gold-using businesses. They are happy to pay a fee to get the gold and silver they need. And investors are happy to earn that fee in more gold, seeing their total number of ounces rise over time.

I’ve developed a chart as a quick and easy reference:

We operate an open and transparent platform—the Gold Yield Marketplace™—where individuals and institutions can make win-win-win transactions.

Mr. Butler seems more concerned with the price of metal, and its alleged suppression. But we are focused on developing a real solution to the problems in the monetary system. With every lease we successfully bring to our marketplace, and every client we pay gold and silver interest, we get one step closer. Regardless of what the price of metal should or shouldn’t be.

With respect,

Dickson Buchanan Jr.

Registered Relationship Manager at Monetary Metals & Co.

[1] Consider an example. If we lease 1,000 oz of gold to Acme Jewelry Company, and they have a customer order for 10 oz worth of gold jewelry, then they must first buy 10 oz worth of gold before they ship the 10oz order to their customer.

[2] The minimum to open an account is 10oz of gold or 1000oz of silver.

:

:

Excellent clarification, Dickson! Am I to understand that the risk to the lessee is just the income their gold or silver wiould e

… just the income their gold or silver would, (fat thumbs on keyboard), earn, and not the principal in the event of a default by the lessor?

Re: note 1.

So what is the benefit to the Acme Jewellery Company?

They cannot use the leased gold but must go into the market to purchase whatever they wish to turn into jewellery and have an interest bill to meet!

Can someone please explain?

@StuartMD: If Acme Jewelry Company carries 1000oz gold, it stores 1,5 million USD worth of gold. If the price of gold drops 10%, the company might well be bankrupt. They need to hedge against USD price risk. If they lease gold and in the end give gold back, this price risk is eliminated. They only need to maintain a profit margin in order to pay the metal interest, but that is a much smaller amount that is subjected to USD price risk. Profit margin – i imagine – is maintained through adaptation of selling prices for the jewellery.

@Theosebes: The risk to the lessor (who lets his metal be used) extends not only to the interest. In the case of a bankruptcy of the lessee (who uses the metal) the promised interest would not be paid – that is correct. But there could also be the case in which my metal disappears. Then, I would still have the right to my metal, but I might not get it back. There could be insurance against this case, but the matter might end up in court in whatever jurisdiction, etc. This is all very improbable, but nevertheless possible. No return without risk.