The price of gold has been rising, but perhaps not enough to suit the hot money. Meanwhile, the price of bitcoin has shot up even faster. From $412, one year ago, to $1290 on Friday, it has gained over 200% (and, unlike gold, we can say that bitcoin went up—it’s a speculative asset that goes up and down with no particular limit). Compared to the price action in bitcoin, gold seems boring. While this is a virtue for gold to be used as money (and a vice for bitcoin), it does tend to attract those who just want to get into the hottest casino du jure.

Perhaps predictably, we saw an ad from a gold bullion dealer. This well-known dealer is comparing gold to bitcoin, and urging customers to stick with gold because of gold’s potential for price appreciation. We would not recommend this argument. Whatever the merits of gold may be, going up faster than bitcoin is not among them.

We spotted an ad today from a mainstream financial adviser. The ad urged clients not to buy gold. This firm should have little need to worry. Stocks have been in a long, long, endless, forever, never-to-end bull market. Gold is not doing anything exciting now. $1234? “WhatEVAH (roll eyes)!” Stocks, well, the prices just keep on going up. Like we said, nothing whatsoever to worry about. Other than declining dividend yields. There’s more than enough irony to go around.

Speaking of dividend yield, that leads us to an idea. Readers know that we like to compare the yield of one investment to another. This is why we quote the basis as an annualized percentage. You can compare basis to LIBOR easily. And also stocks. Or anything else.

For example, the basis for December—a maturity of well under a year—is 1.2%. The dividend yield of the S&P stocks is just 1.9%. For that extra 70bps, you are taking a number of known risks, and some unknown risks too.

It is worth noting that the yield on the 10-year Treasury is up to 2.5%. Yes, that’s right, you are paid less for the risk of investing in big corporations than you are for holding the risk free asset. Of course, the Treasury bond is not really risk free. But in any case, if the Treasury defaults then it’s safe to assume most corporations will be destroyed, if not our whole civilization.

We have heard the mainstream theory so many times, our heads are hurting. Here are the myths: the Chinese are selling, inflation is coming, and the economy is picking up.

China is selling. The Chinese people are selling the yuan to buy dollars. When they can get through the increasingly-strict capital controls. The People’s Bank of China takes the other side of the trade—selling dollars and buying yuan—to keep the yuan from collapsing. When a foreign central bank holds dollars, it does not hold paper notes. Nor does it deposit them in a commercial bank. It holds Treasury bonds. Its sales of Treasurys may look scary, but that is just the seen. The unseen is that the Chinese people are buying dollars. Those dollars come back to the Treasury market one way or the other.

Inflation is coming. The Fed is printing, the quantity of money is going up, there will be demand-pull, etc. Well, if that were true then the last place you would want to be is in an asset whose price is set by the net present value of its future free cash flows. Or at least the price should be. If you think that stock prices have to rise in inflationary periods, look at what happened in the 1970’s.

The economy is picking up. What can we say? There are two views on this. One has seen (or looked for) green shoots and nascent recoveries since the crisis. The other has seen rising asset prices, and with that a small wealth effect. We will not opine about Trump and the future of the economy here. We just wish to note that junk bonds have not sold off the way Treasurys have. Junk bonds have hardly sold off at all.

Quite the opposite. They have been massively bid up (i.e. yield has been crushed). We submit for your consideration that if inflation was coming and/or the economy was picking up, you would do even worse in junk bonds than in S&P stocks.

The 10-year Treasury hit its low yield (so far) of 1.3% in July. Since then, it has been a wild ride mostly up to 2.6% in December. Since then it’s been choppy but falling (i.e. prices rising a bit).

July also happens to be when the yield on the Swiss 10-year government bond began rising. It made a low of -0.6% (yes, negative). Since then, the yield has gone up (i.e. bond price has gone down) to near zero in December. It is currently -0.1%.

In Japan, the same occurred. Low yield on the 10-year government bond in July was -0.3%. High was hit in December. Still elevated now, but off the December high.

It’s almost as if government bond yields around the world were moved by the same drivers, or even connected by some kind of arbitrage…

Whatever the cause of this worldwide selloff of government bonds may be, it is not selling by China. It is not inflation. It is not expectations that the economy will take off under Trump.

Maybe it’s just traders looking at price charts, buying because stocks are going up?

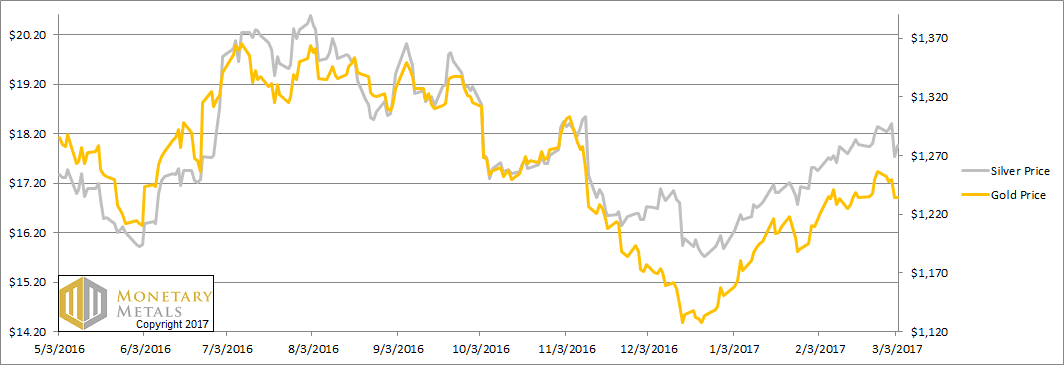

This week, the prices of the metals dropped. As always, the question is what happened to the fundamentals?

Below, we will show the only true picture of the gold and silver supply and demand. But first, the price and ratio charts.

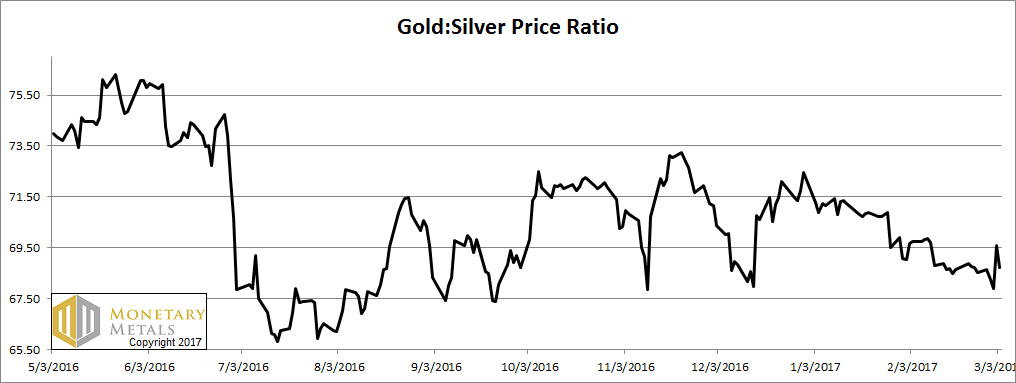

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways again this week.

The Ratio of the Gold Price to the Silver Price

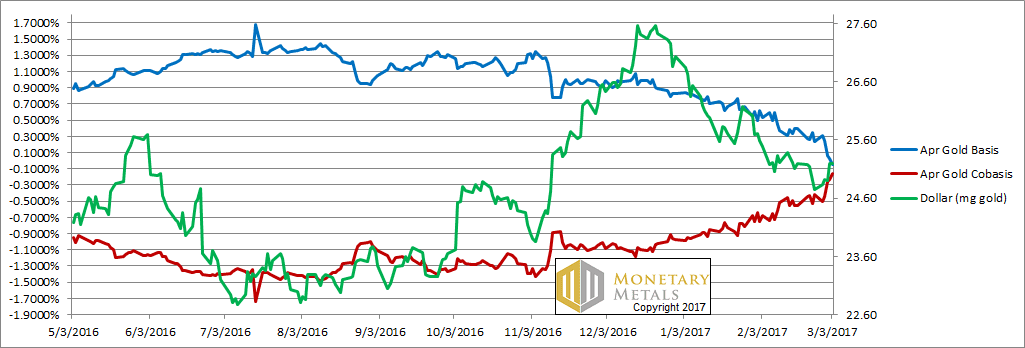

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

This week, our old friend returned. He is the correlation between the price of the gold (i.e. inverse of the price of gold in dollar terms) and the cobasis (i.e. our scarcity indicator). They had been moving together.

This week, they met up for old time’s sake. The dollar is up from 24.75mg gold to 25.20mg. And the cobasis is up from -0.41% to -0.16%. At least in the April contract which is rapidly approaching First Notice Day, and already under downward pressure. For farther contracts, the cobasis is up, but not that much.

Our calculated fundamental price dipped twenty bucks. It’s still $150 over the market price.

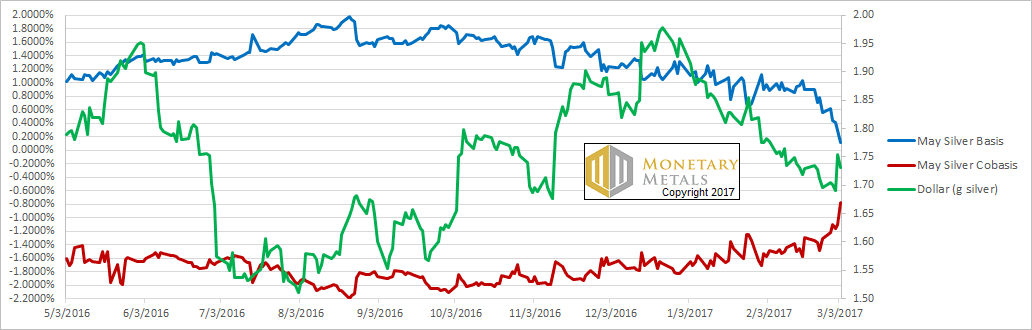

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The cobasis in silver move up big-time as well.

The silver fundamental price also fell, about fifteen cents.

© 2017 Monetary Metals

:

:

A couple of this of note upcoming this week. The first is that the USA hits hard stops on spending deficits. Although the well-known shouts of “The government is out of money!” will resound again, I believe that this time it may be more serious. I think the new president, with the aid of a majority in Congress, will give him line item veto on spending. Considering that the Andrew Briebart protégé Steve Bannon is chief strategic advisor these days, we actually may see fundamental change in the size of the US government.

The other item of note is that CME and Reuters getting out of the silver price fixing at the LBMA. Maybe we’ll see the end of events like $2 billion USD notional contracts dumped on the market on late Fridays come to an end, but don’t count on it.

All of this has to make one wonder though. The boys have cried wolf so many times no one believes them any more. So what happens when they actually are right, the Titanic is sinking, the Huns are at the gates and oh, by the way, there be wolves in the flock!?

Put your money where you can sleep soundly. And keep your rifle handy for them there wolves.

Hi Keith

Have you considered the effects, on consumer prices, of the Fed raising the deposit rate? Everyone seems so focused on the Federal Funds Rate, but the deposit rate rising means that people can now sell their inflated bonds, and deposit the proceeds in a bank to earn 0.75% p.a.. And this will only get worse as the Fed raises rates. As far as I can see, this should cause consumer prices to rise like no other, how could it not? Free money in the hands of the consumer out of nowhere — rather than just owning a bond that’s worth a lot. What is your opinion on this?

It seems to me that, when the Fed dumps rates to zero — both Fed Funds and the deposit rate — capital starts flowing from the Fed Funds rate and into the bond market. This has been happening for the past ~8 years. Then, when they start raising rates, all this capital, that has accumulated in the bond market, now moves to the money market (sell the bond and deposit the proceeds), causing inflation because it earns the speculators a risk-free income (as opposed to a risk-free capital gain from holding bonds).

I’ve come to the above conclusion from looking a lot at this chart: https://fred.stlouisfed.org/graph/fredgraph.png?g=cVHs

From looking at this chart, it should be apparent that a rise in producer prices doesn’t really happen while interest rates are falling, but only when they are rising. And there appears to be no association whatsoever between “high” interest rates (whatever that means) and rising prices. For example, in the period 1982-1987 interest rates were 6-15% p.a. yet prices only really started rising when rates increased from 6% to 10% in the two years following that. But that’s just one example; this pattern repeats itself all over the chart: a period of falling rates with steady or falling prices, followed by a period of rising rates with increasing prices.

Your SD Report is right on the money as always.

Just one favor; You always say something like “The silver fundamental price also fell, about fifteen cents”….

Could you include the fundamental price? 18.3 or whatever?

Thank you Keith.

Can anyone point to a post explaining the “fundamental” price of gold $150 over the current futures price?

Spot bullion is $150 over the April futures contract. What leads what. Seems everytime the “fundamental price is $100 plus, the gold market sells off.

Yep. That’s what i’ve observed too. :-)

Outside a Defcon 5 scenario, we see once again that when the fundamental moves dramatically higher it’s a sign of excess bullishness. In other words, it’s a warning of an imminent decline. I’ve written about this in months past and now we have another example.

Keith has often noted how silver was lagging gold…(he’s a gutsy bear given the universal love of silver) which was substantiated by the trend following hedge fund community going into silver big time, which creates a vulnerability. Now those same hedge funds are in the process of selling, as they must when leverage is employed and the market goes against them even by a little. And given the size of their positions that liquidation process could take months. That doesn’t mean silver will go down every day. But it does mean that those who use leverage have no choice but to sell when the position goes against them. The process continues as silver is transferred from weak hands to strong hands…. or simply flattened by short covering at lower prices.

When a small market like silver becomes vulnerable because of excess leverage, it also creates opportunities who kept their powder dry.

I’m not making a forecast here but don’t be surprised that IF gold drops back to $1,000 (very possible) silver could see a $12 handle.

For all you who follow technical analysis, the last intermediate low in gold was $1180. A weekly close below $1180 would suggest gold is still in bear market or (at best) a period of lengthy consolidation. If gold doesn’t drop that low and break the uptrend, we should begin to trend higher again…. although in 2017 it’s hard to see anything higher than $1480.

FYI: Martin Armstrong’s maximum price target is $5,000. (Not in 2017… but overall in the entire bull market)

Dr. Fekete believes that if/when the dollar collapses into nothingness, a single ounce of gold will pay off the national debt. Now there’a a mind-bender for you.