Irredeemable Paper Money, Feature #451

I am writing this, having just returned from the fourth course at the New Austrian School of Economics, in Munich. The single biggest theme was the rate of interest and its linkage to prices. Kondratieff, among several others, have observed that rising prices lead to rising interest rates and vice versa. And the opposite case is also true, falling interest rates go with falling prices (all else being equal). I plan to write a separate paper on this topic.

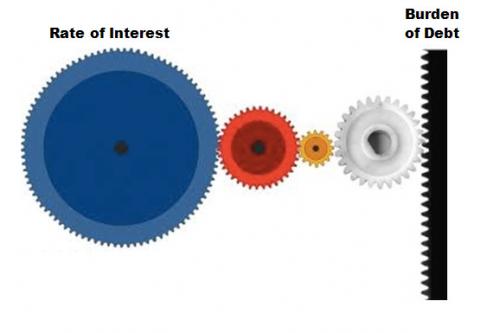

One of the most important ideas proposed by Professor Fekete is that a rise in the rate of interest reduces the burden of debt that has been accumulated previously. And a fall in the rate of interest increases the burden of debt. This is because the present value of a future payment is:

If the payment is $1000 per year, and the interest rate is 10%, then the payment at the end of the first year is worth 1000 / 1.1 = $909 today. The payment at the end of the 30th year is worth $57.31 today (1000 / 1.1^30).

But as the rate of interest falls, the present value of all future payments rises. If the rate of interest fell to zero, then the present value of each future payment would be the nominal value of the payment (1000/1^30 = 1000). The 30th year payment would be worth $1000 today.

Unlike under a gold standard, in paper money the rate of interest is subject to massive volatility. Sometimes, the government has its way, fueling rising prices and interest rates. Other times bond speculators front-run the central bank’s unlimited appetite for purchasing government bonds and the rate of interest falls. We are now in year 31 (in the US, so far) of this latter phase.

As the total accumulated debt increases (feature #450 of irredeemable money is that total debt cannot go down), the effect of a change in the rate of interest becomes larger and larger. Today, even very small fluctuations have a disproportionate impact on the burden of debt incurred at every level, from consumer to business to corporate to government at every level. To say that this is destructive is a great understatement.

With businesses, corporations, banks, and governments leveraged up into debt, small changes in the rate of interest have a large change in the real burden of debt that they bear. In a gold standard, the rate of interest is not volatile and therefore changes in the burden of debt only occur if people for some reason incur more debt or pay down debt. But in our paper system, bond speculators and central banks can make large changes to the rate of interest in a short period of time. When the burden of debt rises, the marginal debtor is squeezed to default. When the burden of debt falls, the marginal borrower is lured into borrowing more.

This, rather than the quantity of money, is what people and especially economists should be focused on.

[1] From Ray Bradbury’s book Fahrenheit 451, named for the temperature at which paper ignites spontaneously.

Make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold

Trackbacks & Pingbacks

[…] [5] https://monetary-metals.com/irredeemable-paper-money-feature-451-3/ […]

Comments are closed.