Is a 13 or 15 Handle Next for Silver? 22 Nov, 2015

The price of gold dropped six bucks, and silver seven cents.

Without much price action, let’s look a few other angles to gain some perspective. First, here’s the chart of both silver and the decidedly not-monetary metal copper.

The Prices of Silver and Copper in Gold

There’s a good correlation, with the biggest divergence being late 2014 through early this year. For copper, not being money, to hold out at a high price before dropping looks like hope in the recovery. Or if not that, then at least hope in QE and the theory that rising money supply causes rising commodity prices. It didn’t work, and the price of copper dropped. It’s still dropping and may yet break down below the low it made in late 2009.

Silver has an industrial component, so it’s no surprise to see its price drop as well. Now let’s zoom in for better resolution, by looking at a chart of copper priced in silver.

The price of copper in ounces of silver is nowhere near the low it made early this year, much less the low of 2009 or 2011. As production and trade decline, and as the rate of interest declines, we would expect the non-monetary commodities to fall in price. Silver, which is partly non-monetary has been falling in terms of gold. There’s no reason why copper shouldn’t fall in terms of silver (apologies for the double negative).

The headline this week isn’t just to be gratuitously provocative. $13 represents one distinct possibility. How distinct? Read on for the only true picture of supply and demand in gold and silver…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

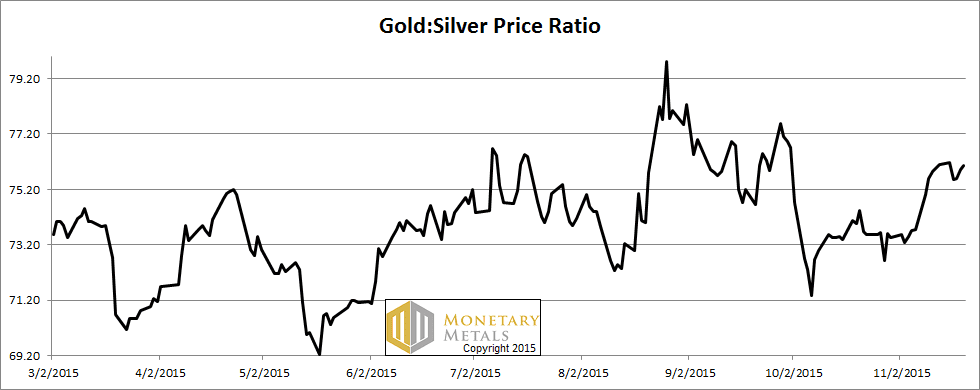

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio barely moved.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

In both gold and silver, we switched to the next contract month. For gold, that’s February and for silver it’s March.

We feel like we’re recording a record that’s broken while we’re still in the studio (for younger readers, broken records would often keep repeating the same short bit of sound over and over). The price of the dollar tracked the cobasis (i.e. as the price of gold dropped, scarcity increased).

Our calculated fundamental price of gold is about $150 over the market price. In other words, the market is offering to sell you gold at about a 12.2% discount. Remember this for a moment.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

It’s a similar picture in silver.

In fact, silver is trading below its fundamental price also. However, it’s only at a 4.2% discount. If it were to go to its full fundamental value, and assuming that doesn’t change, it would be up near $15.

But what if it were to go on the same kind of sale as gold? At a discount of 12.2%, silver would be down near $13.

© 2015 Monetary Metals

7 responses to “Is a 13 or 15 Handle Next for Silver? 22 Nov, 2015”

Leave a Reply

You must be logged in to post a comment.

Keith, well said. I prefer platinum as a precious metal for its relative “value” and scarcity, and its large discount to gold.

Copper is an industrial metal, priced at the margin. Supply is slightly higher than demand, and is likely to remain so for several years. And, almost all copper mining is well below the cash / incremental cost of production. Not a bullish scenario, but when the worm turns it will probably turn quickly, especially because there is so much money and credit chasing so few genuine opportunities worldwide. A dangerous short, and probably a premature long for those without very strong hands.

Keep up your good work!

Hello Keith. Do you have any idea on why is the December Gold Future Contract higher than February Gold Future Contract?

Last Roll (October – December) it happend the same (Backwardation)

Many thanks for your comments and for your helpfull web.

Antonio

if I understood Keith, we are In Backwardation due to the inevitable declining IR envirnonment!

Hmmm, so the government currently spends close to $40K per private sector worker, but the SSA reported that 51% of all American workers made less than $30K, and we know the parasitic public sectors pays better than the private sector, so I think it is safe to assume those 51% all belong to the private sector, which consequently means only half of the private sector is responsible for remunerating up enough for everyone and everything making the load more like $80K per private sector worker earning enough to even pay any taxes. This is just current spending only, which doesn’t include paying down past debt and/or making good on the gargantuan unfunded liabilities, both totaling about $205T, or all the private debt. The math is looking astoundingly absurd, which leaves one wondering who exactly is dishoarding gold, and thus driving the fundamental price down $50 from a couple weeks ago.

Beam me up, Scotty!

I think we have got it backwards: as they refuse to bring it to market the dollar goes up. this is a question for Keith. We are in backwardation, right? The blue line is in the negative.

squiggle. the blue squiggle. “line” is incorrect. implications of coherent thinking and all ;)

Thanks for the comments.

antoniosg: This is what I call temporary backwardation. The expiring contract sinks below spot. Sometimes the rot creeps out to the next contract (as it has now). This is the new normal, due to zero interest rate policy and, as Arie notes, declining trust.

Bob: Nearly everyone accepts that the dollar is money. So, the dollar being money, the only question is whether gold is going up or down. If it’s going down, why own it? Only when it’s going up does anyone want to own it. In the meantime, seek other assets for speculative gains.

When they stop and realize that the dollar is just a slice of this astoundingly absurd debt…