Is Now a Good Time to Buy Gold? Market Report 16 March Part Two

In Part One, we laid out the general case for owning gold and silver, and the specifics of our current macroeconomic environment. In other words, people attempt to use the government’s debt paper as if it were money, but no one should be 100% all-in to this paper. And right now, the Fed is embarking on more unconventional policy responses, to try to stave off the crisis that it staved off in 2008 and which is reasserting itself right now.

Revisiting Our Silver Prediction of 2 March

A few weeks—an eternity ago—we said:

Our next prediction is twofold. One, if stocks continue to crash (and Treasury yields continue to drop) then the price of silver could drop a bit further. But, unless more silver metal comes to market and basis recovers, backwardation should provide increasingly firm support as the price declines.

If we had to guess, we would not expect silver stackers to panic and sell their metal at this point. Those who own the metal today likely hold it for reasons other than false certainty of endless gains (which did occur at certain times in the past). However, if economic hardship hits them, they may be forced to unload silver to put food on the table. This may seem premature in the US, but we will write about our observations in Asia. Here is one picture Keith took in the virtually empty Jewell Mall attached to Chiangi Airport in Singapore.

No one discounts seafood that’s kept live in a tank until the moment they sell it. If sales slow, they just reduce their orders from their suppliers. Except under one condition. When they are surprised by a sudden collapse in demand. Chiangi and Jewell are normally quite crowded. Now, they are eerily empty. Eerie like 2009.

Perhaps this restaurateur (and many others in that mall) is selling metal in order to keep the lights on, and wait for traffic to return.

Today, we would add only this: perhaps all over the globe, people are forced to sell metal to stay afloat. They won’t willingly give up their businesses if they think the downturn is temporary.

Silver, being used for industrial purposes, behaves somewhat differently than gold. Clearly, the industrial uses are down in this downturn of manufacturing (e.g. China factory shutdown). But whether the price drop is due to an increase of selling or a decrease of buying, it happened. Now we need to understand the fundamentals.

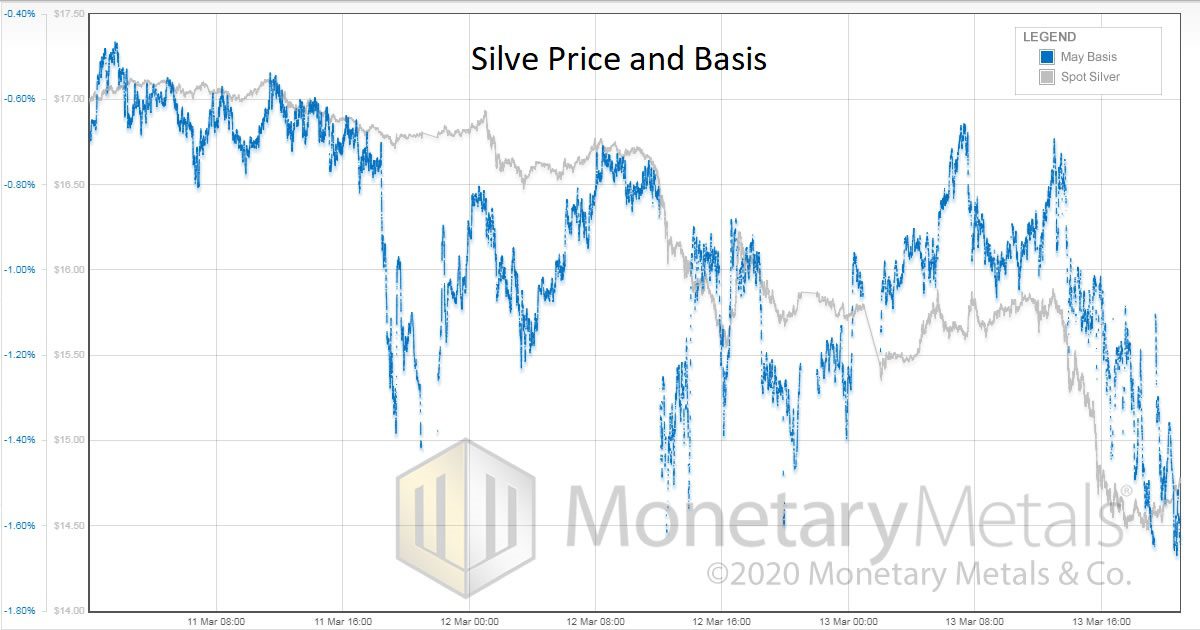

One of the most important graphs we will publish all year, is this high-resolution chart of the silver price and basis for Wednesday through Friday (times are GMT).

Not only do we see the basis falling as the price drops. We see a number of times when the basis seemed to want to drop even when the price was holding steady (and two places where it briefly spiked up).

With the price around $17, the basis was around -0.6%. With the price around $2.50 lower, the basis falls over 100bps lower.

A falling basis means that the price of a futures contract is lower relative to the price of metal (this is the coupling that the bullion dealer, mentioned in Part One, article denies). Spreads are more stable than price, as they are kept at a particular level by arbitrageurs. A fall of 100bps is very significant for the basis.

This works out to about a 2.5 cent change in the spread (i.e. silver futures minus silver spot is 2.5 cents lower at Friday close than it was on Wednesday open).

The selling of futures generated enormous pressure to push the basis spread down this much.

This is a picture of the selling of futures by leveraged speculators.

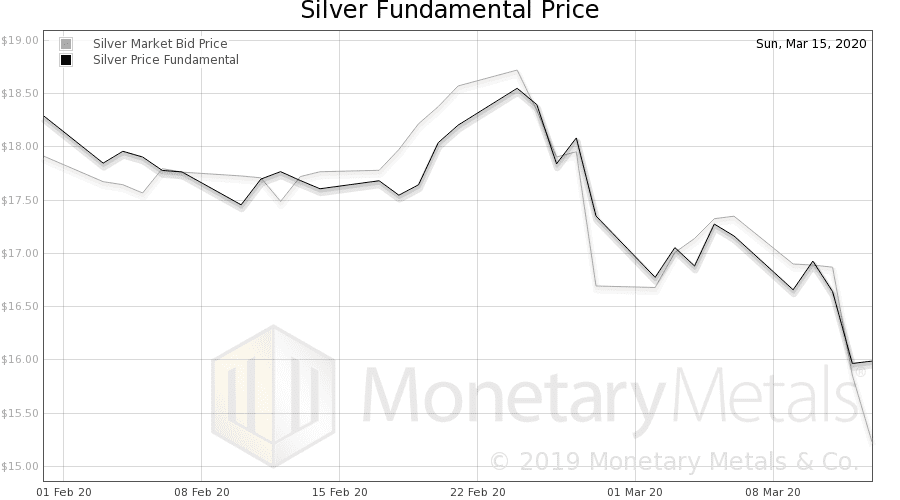

Now here is a picture of the Monetary Metals Silver Fundamental Price.

Note that the fundamental on Friday is around $16 (taken earlier in the day). And notice also that, although the price drops on Friday, the fundamental does not.

The selling of futures can change the market price, obviously. But it does not necessarily change the price at which metal would clear, if we back out the effect of the speculators on the market. That’s what our fundamental price model does.

It’s one thing to go through the logic of why people will prefer gold and silver to Treasurys and bank deposits, now that interest rates are down to near zero (or back down, in the case of bank deposits). And the logic of why they will prefer metal to the growing and opaque risk of the banking system.

However, it is something else entirely to see the data that this move was driven by speculators. As always, there is no guarantee that speculators can’t sell more, or that stackers won’t start selling. However, when the speculators are selling against rising fundamentals they are likely to be forced to capitulate soon enough.

While we would not recommend betting on silver with leverage at this moment, we certainly would not be short silver right now. If you don’t own any, this looks like a good time to buy some. If you have some, you could do worse than buying more here.

The gold fundamental is above the market price also. And likely a buy also. With the benefit (if one considers it such) that the gold price has been in a bull market.

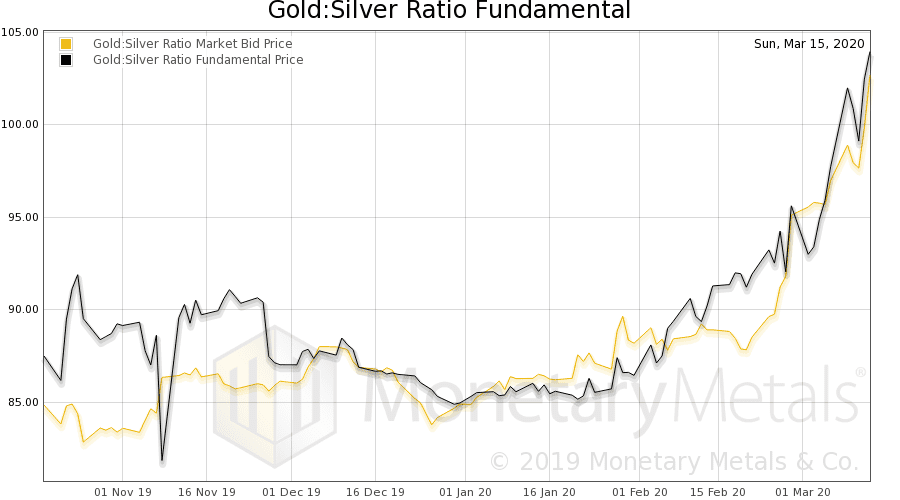

Also, it is worth noting that the gold-silver ratio is sitting on a very long term record high. That is, silver is very cheap in gold terms.

The key question that anyone ought to ask, before they buy silver: is silver still money? By money, we do not mean medium of exchange. Gold is not the medium of exchange right now either. We mean does it still have extraordinary stocks-to-flows? Do people still hold it and hoard it? And we mean does it have an extraordinarily slow fall in its marginal utility as quantity rises? By contrast, gasoline may be valuable, but once you fill up your car’s tank, you don’t want any more and can’t accept any more.

Gold does not have this problem. People will happily accept as much gold as you want to give them. How about silver?

If silver still be money, then it is a screaming buy relative to gold at this moment. A historic buy.

That said, the Monetary Metals Gold:Silver Ratio Fundamental shows the fundamental as high or higher than the market ratio.

This should be watched for a turn. A historic opportunity is coming.

© 2020 Monetary Metals

An extremely interesting article although if you want silver coins (i.e. money) it looks like the dealers are not lowering their prices by much despite the huge fall in the spot market and there are long shipping delays…

Your charts are equivocal about whether silver is a good buy: the gold:silver fundamental suggests silver may continue to fall faster than gold. If it is true that silver was a preferred store of value in Asian markets, their earlier shutdown may be driving that metal to lower bidders in preference to less-widely-held gold. Will rotation of the pain front turn this trend around? That seems unlikely given that industrial shutdowns should affect silver more than gold in all cases. For the foreseeable future cash-on-hand is going to be king, It isn’t yet clear how that pattern will break, but I’m convinced that supply line billings (classical money market) may soon be the only monetizable paper left standing.

“For the foreseeable future cash-on-hand is going to be king” ……unless the filthy dirty reality of virus contaminated cash-in-hand becomes widely known. Cleanliness is close to Godliness!

Thanks….. So many good guys have suffered at the hands of precious metals. We need balanced and meaningful commentary on price action in both gold and silver. Hopefully many will benefit from your hard work and insight. My hope is they just don’t ignore the complex reality of the precious metals and believe that it’s going to the moon at any moment.This results in them being yet another sacrificial lamb.