LBMA 2017 Forecasts (for the US dollar)

Every year the London Bullion Market Association (LBMA) surveys the top precious metals analysts of bullion banks and consultancy firms for their forecasts for precious metal prices for the year ahead. We look at things a little differently, and would say that the analysts are forecasting the value of the US Dollar, priced in gold (or silver). This year the analysts are generally bearish on the Dollar, with an average forecast of 25 milligrams of gold, down 5% from the value of the dollar at the start of this year.

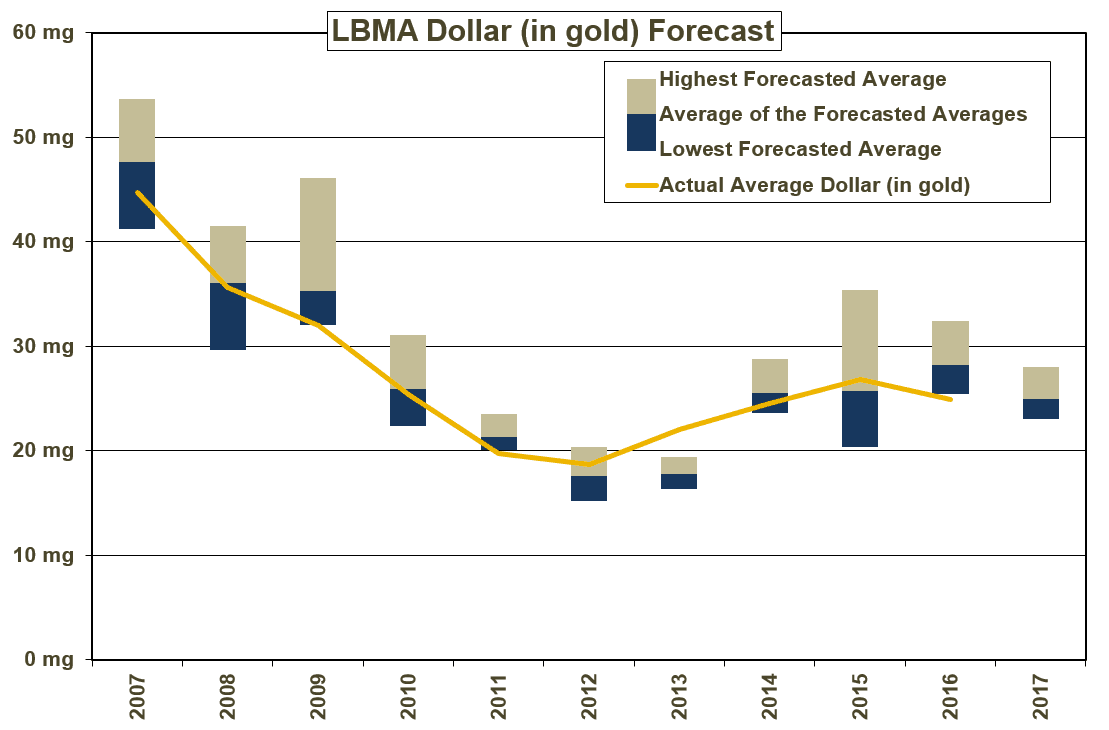

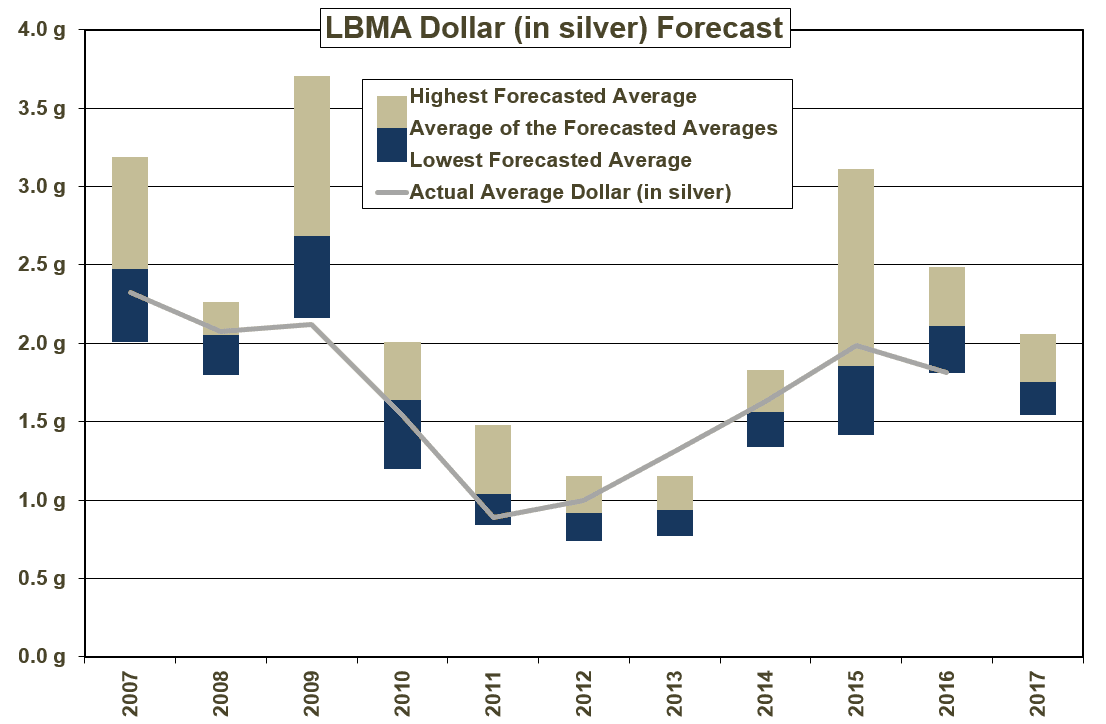

The aggregated forecasts assembled by the LBMA have a fair history of accuracy, as the chart below demonstrates. It shows the actual average value of the Dollar as a line against the lowest (bottom of the navy bar), highest (top of the dark cream bar) and average (where navy and dark cream bars meet) of the forecasts . Note that these charts are of the analysts’ yearly averages – see the survey for more detail on each analysts’ high and low range.

Again, this year the range of forecasts is quite tight, indicating more consensus among the analysts about the direction of the US Dollar. The most pessimistic analyst is Joni Teves of UBS (the 2016 forecast winner), who sees the US Dollar averaging 23.04 milligrams during 2017, whereas Bernard Dahdah from Natixis is the most optimistic, thinking it will average 28.02mg of gold. For reference, the dollar is currently 25.84mg gold.

The LBMA analysts are less accurate when looking at the US Dollar in silver terms but this year their range is tight so they must be confident. William Adams of Metal Bulletin Ltd has the lowest average at 1.54 grams of silver while Bernard Dahdah sees the average at a high 2.06g. The dollar is currently 1.78g silver.

If you want to look at things back-to-front, you can find the survey here, where they present the forecasts as if it is the value of gold and silver that is changing. Crazy, huh? We plan to release our own predictions soon, in our Outlook 2017.

Thank you again for your research and advice,always appreciated.

Attitude will change when people associate value in gold or silver weights and ignore paper values.Maybe linked to the removal of large or small paper currencies.AGS

Ditto for what Alan said. Thanks for your work on this, Keith. By the way, what’s the LBMA analysts track record for their predictions for the previous years listed? I theFy’re nailing it YOY then I’d probably pay more attention. If say in 2014 they predicted a narrow market for silver then I probably wouldn’t even bother. That said, if they could call them before they happened, they would get ot of the analyst business and make a killing in the market.

Happy Groundhogs day from Stanton, AZ!

Theo

The chart I did for this post is only showing the averages of their forecasts and thus understates the wide variance between them, which you can see if you look at the LBMA detailed pdf. In general I have found that analysts constantly change their further out forecasts and are very heavily influenced by recent price action/direction.