Marginal Productivity of Debt

Understanding the marginal productivity of debt is key to understanding whether the amount of credit created is unsustainable, resulting in the failure of the monetary system and loss of everyone’s savings.

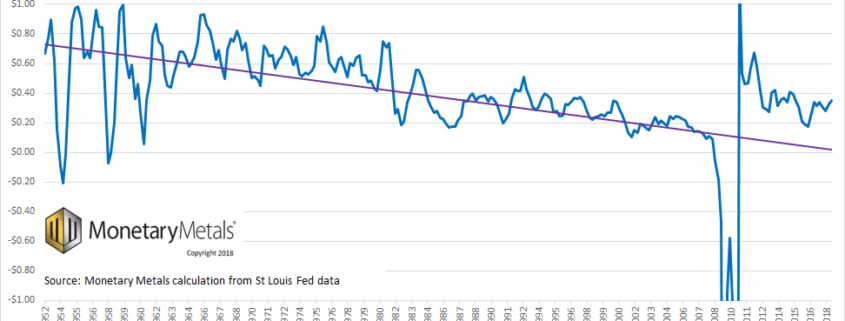

Falling Productivity of Debt introduces the idea of the marginal productivity of debt, that is, how much additional GDP is added for each newly-borrowed dollar.

In Falling Interest, Keith explains why the marginal productivity of debt is higher after the financial crisis despite the inexorable collapse of interest rates.

Heat Death of the Economic Universe explores whether our economy and its monetary system is sustainable. Will credit continue to grow, and with it the economy? Or will some force—or law of economics—prevent slow and stop it?

A Dire Warning Few economists touch Marginal Productivity of Debt, perhaps because it shows that our monetary system is failing. We encourage you to do a Google search, and you will see scant mention other than articles by Keith and Monetary Metals. This is tragic. Every monetary economist should be bellowing from the rooftops about the falling marginal productivity of debt!

Leave a Reply

Want to join the discussion?Feel free to contribute!