Monetary Metals Brief 2018

Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We have invested many man-years in developing the theory, model, and software to calculate it. Every week we publish charts and our calculated fundamental prices.

However, predicting the outlook for a longer period of time is much harder. The fundamental shows the relative pressures in the spot and futures markets, but they only show a snapshot. They do not predict how those pressures might change. For that, one looks at the dollar of course, credit, interest rates, other currencies, the economy, and even wild cards like bitcoin.

Review of Last Year’s Call

We did not publish an Outlook 2017, because we were in the midst of developing and launching not just our website, but the engine that powers it, our data science platform. We will look at much of this data in this Outlook 2018.

To keep ourselves honest, we like to review our call from the prior year. Without a 2017 call, we will briefly look at what we said in Outlook 2016:

We think that buying gold now is likely to turn out to be a good deal. We do not promise that the price can’t stay low (obviously, if it can be low now it can remain low or even go lower). We simply see value here.

To those looking to trade, you might buy gold for a trade.

In silver, we’re in a much better situation than last year when silver was overpriced. The price has come down. It’s now close to the fundamental, plus or minus. However, there just isn’t a strong case for buying it now. There is no case for buying silver for a trade. It’s just a roll of the dice.

…

The gold to silver ratio closed the year around 76.7. Our model suggests it could be headed over 85.

That did not turn out to be a bad call. Gold ended 2015 around $1060. By the middle of the year, its price had shot up to about $1370. This was an overshoot of its fundamentals (which we called in that year’s July 3 Supply and Demand Report). We said market price was $200 over fundamental price. By the end of the year, the market price was $1150. Our call at the start of the year was right, and so was our call at the mid-year spike.

Silver ended 2015 just under $14, and spiked over $21 in 2016—a 50% gain. In our July 3 Report, we said it was $3 over its fundamental price. That is a call for a big drop. The market obliged us, with the price coming down to Earth.

By year’s end, it was under $16. +$2. Not a bad dice roll in our Outlook 2016.

The gold-silver ratio rose to a high over 83 in early 2016 (and again in 2017), also per our call.

How Not to Think about Gold

There are several popular approaches to analyzing gold. If you visit some alternative investing or gold sites, you will find conspiracy theories about price manipulation, rumors, out-of-context-factoids, and finally mining production and manufacturing consumption.

Our view is that the dollar is indeed dying, but it is not via the instant white hot supernova of hyperinflation. It is by a long drawn-out asphyxiation, the drowning of a competent swimmer out at sea.

We have written a lot to debunk claims of price manipulation (here is our recent open letter to Ted Butler, with graphs of our data going back to 1996). There are many others on our site.

We would put rumors, Indian gold import numbers, and news into the same bucket. Even when factual, these items are the investing world’s equivalent of an attractive nuisance—they can lure you to financial harm.

Finally, there is electronics and jewelry consumption, and mine production. We firmly insist that gold and silver cannot be understood by looking at small changes in production or consumption. The monetary metals cannot be understood by conventional commodity analysis.

This is because virtually all of the gold ever mined in human history is still in human hands (to a lesser extent for silver). The World Gold Council estimates the total gold stocks at 188,538 metric tons at the end of 2017 and reported mine production averaging 3,247 tonnes over the past three years. This is just 1.7% of then-existing stocks. In other words, it would take 58 years at current production levels just to produce the same amount of gold as is now stockpiled.

If total gold mining is 1.7% of gold inventories, then small changes within that 1.7% are not likely to have much impact on the gold price.

How We Think About Gold

The implications of this are extraordinary.

All of that stockpiled gold represents potential supply, under the right market conditions and at the right price. Conversely—unlike ordinary commodities—virtually everyone on the planet represents potential demand.

Why would people be willing—not just today, in the wake of the great financial crisis of 2008 and unconventional central bank response, but for thousands of years—go on accumulating gold and silver?

There is only one conceivable answer. It’s because these metals are money. Compare gold to oil. The marginal utility of oil—the value one places on the next barrel compared to the previous—declines rapidly. For oil, it falls rapidly because once your tank is full, you have that storage problem—assuming you even directly use oil at all.

However, the marginal utility of gold hardly declines at all. People are happy to get the 1,001st ounce, and accept it on the same terms as the 1,000th or the 1st ounce.

We therefore think that changes in the desire to hoard or dishoard gold have a big impact on price and are more important than small changes in annual supply and demand flows.

How We Analyze the Gold Market

We think of the market as the coming together of 5 different primary groups.

- Buyers of metal. These are typically hoarders. Unlike buyers of other commodities, they don’t have to incorporate it into a product and sell it to make a profit (jewelry manufacturers being a very small part of the market, as discussed above). So there is no particular price that is necessarily too high, other than whatever their notion of a fair price is at any given moment. It’s worth noting that jewelry manufacturers are mere intermediaries, buying gold to put into product that is typically held owned for a long time by the buyer. And often held as money.

- Sellers of metal. They are dishoarding, for whatever reason. They may think the price has hit a high enough level to attract their greed, or a low enough level to activate their fear. Miners are a subcategory of sellers, though miners are price takers.

- Buyers of paper (e.g. futures). These are speculators, with three key differences from buyers of metal. One, they use leverage. Two (for that reason and others) they have a short time horizon. Three, their exclusive goal is to make a trade for dollar gains.

- Short sellers of paper. Not nearly so big a group as popularly imagined, there are people who take the two lopsided risks of (1) shorting something with limited profit and unlimited loss potential and (2) fighting a 100-year trend. These people are nimble and aggressive and certainly play for the short term.

- Warehousemen, aka market makers. If few people are willing to bet on a rising dollar (i.e. falling gold price), then who sells gold futures? Aren’t futures a zero-sum game, with a short for every long? Enter, the warehouseman. He stands ready to carry gold for anyone who wants future delivery. If you buy a future, you are signaling that you want gold, not to be delivered now, but at some date in the future. For a profit, this group will sell it to you. How do they do that? They buy metal in the spot market and simultaneously sell a contract for future delivery. They don’t care at all about price, as they have no exposure to price. They respond to spread. Suppose they could buy gold in the spot market for $1,350 and sell it for Dec delivery for $1,362. That is 0.9% for six months, or 1.8% on an annualized basis. That is not so attractive at the moment, with the Fed in one of its little rate-hiking fits (more on interest rates below).

The five market participants interact to form a constantly changing dynamic. It is this dynamic that we study when we look at spreads between spot and futures, and changes to these spreads. Monetary Metals has developed a proprietary model based on this theory, which outputs the Fundamental Price for each metal. This is updated as the market changes every day.

We have published more on the theory.

Our Numbers

Gold closed the year 2017 at $1,303. The Monetary Metals Fundamental Price was just about the same as the market price.

Here is a graph of the market price overlaid with the Monetary Metals Fundamental Price.

Silver closed at $16.90. The Monetary Metals Fundamental Price closed the same. Here is a graph of the market price overlaid with the Monetary Metals Fundamental Price.

In both metals, the fundamental price rose, moving through the year with less volatility than the market price.

This year is interesting, as the fundamental prices ended at the same level as the market prices for both metals. Whatever predictions we may make, cannot be made based on the fundamentals.

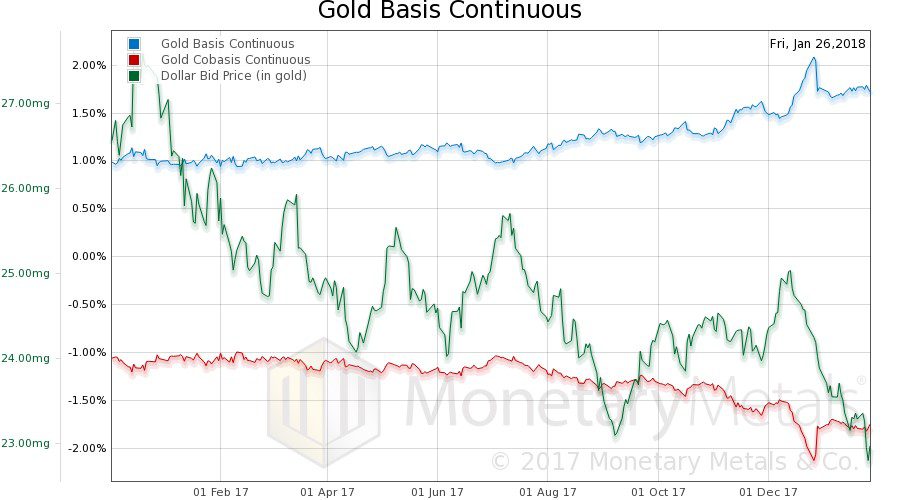

Here is a chart of the price of the dollar in gold terms overlaid with the continuous basis (our measure of abundance) and cobasis (scarcity).

The dollar is going down from almost 27mg gold to under 23mg (that’s $1,130 to $1360 stated in dollar-centric terms). There is an increased abundance of gold at the higher price, but the increase is not commensurate with the price move. In other words, the fundamentals of gold have strengthened during this move and likely were a driver (if not the driver).

Still, it must be noted, there is no backwardation in sight in gold.

In silver, the March contract has moved into what we call temporary backwardation—the tendency of the expiring contract to be pushed down due to selling pressure from traders who roll their positions to the next contract. Here is a similar graph for silver as shown for gold, above.

The basis moves are similar. The price move, not so much. There is little trend. So what do we expect this year?

Our Call

From the crisis through 2011, the prices of the metals ran up due to the inflation trade: “Oh my God, they are printing money to infinity! Buy gold and silver before they go to the moon!”

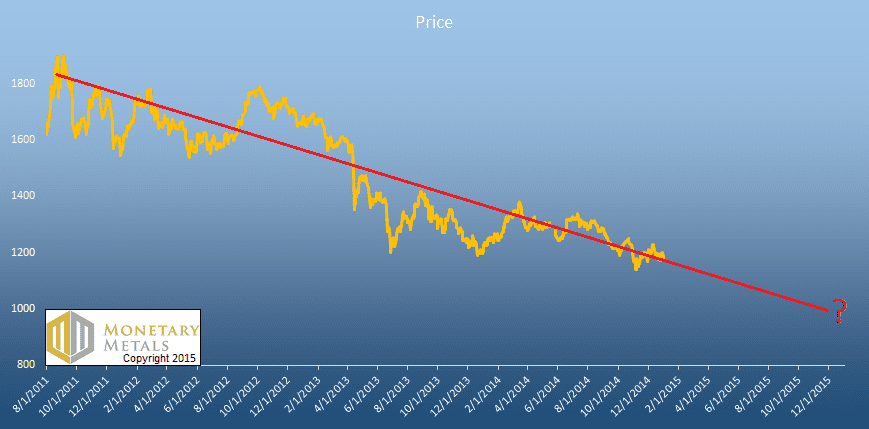

Then, that trend ended. While the money supply certainly did not collapse, supply and demand fundamentals caused lower prices in one commodity after another. Copper, for example, peaked in early 2011. Oil had an epic collapse. The decline in wheat is still ongoing.

The next several years were a period of despair alternating with hope as the prices of the metals fell and fell, and then rallied. It took from August 2011 when the price of gold hits its peak just under $2,000 until December 2015, when the price hit its trough a bit over half that level.

To anyone who does not yet own gold or silver, we offer the same advice as always. You should own some, period. Without regard to price. And we think that buying gold or silver now is likely to turn out to be a good deal.

For our gold and silver price forecast for 2018 and how we came to it, as well as an in-depth explanation of the points made above, read the full Monetary Metals Outlook 2018 (free registration required).

© 2018 Monetary Metals LLC. All Rights Reserved.

Is this manipulation?

Deutsche Bank will pay a $30 million civil monetary penalty and undertake remedial relief. The Orders finds that “from at least February 2008 and continuing through at least September 2014, DB AG, by and through certain precious metals traders (Traders), engaged in a scheme to manipulate the price of precious metals futures contracts by utilizing a variety of manual spoofing techniques with respect to precious metals futures contracts traded on the Commodity Exchange, Inc. (COMEX), and by trading in a manner to trigger customer stop-loss orders.”

UBS will pay a $15 million civil monetary penalty and undertake remedial relief. The Order finds that from “January 2008 through at least December 2013, UBS, by and through the acts of certain precious metals traders on the spot desk (Traders), attempted to manipulate the price of precious metals futures contracts by utilizing a variety of manual spoofing techniques with respect to precious metals futures contracts traded on the Commodity Exchange, Inc. (COMEX), including gold and silver, and by trading in a manner to trigger customer stop-loss orders.”

HSBC will pay a civil monetary penalty of $1.6 million, and cease and desist from violating the Commodity Exchange Act’s prohibition against spoofing, after an Order found HSBC engaged in numerous acts of “spoofing with respect to certain futures products in gold and other precious metals traded on the Commodity Exchange, Inc. (COMEX). The Order finds that HSBC engaged in this activity through one of its traders based in HSBC’s New York office.”

For those keeping count, this is roughly the 4th time HSBC has been found guilty of manipulating markets after the bank nearly lost its charter and swore it would never manipulate markets again.

https://www.zerohedge.com/news/2018-01-29/these-are-6-traders-who-were-just-arrested-manipulating-gold-market

A sensible report with some beautifully summarised comments about your thinking. Thank you.

Have you seen these?

https://www.zerohedge.com/news/2018-02-01/gold-bullion-price-suppression-end-bullion-bank-traders-arrested-manipulating

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K. – Eddie George, then Governor of the Bank of England, 1999

Rate rigging is admitted

911 was a highly organised event involving many parties and the people who organised it are enforcing dollar hegemony, by getting countries (japan, china and others) to hold dollar debt, so as to maintain the dollar’s value against their citizens best interests. it seems hard to believe and illogical, that they would allow gold and silver to trade without restraint, when gold is the biggest threat to the dollar and the monetary system.

They’ve falsified and embellished recent events, history and the war, causes of the wars etc Not forgetting that they’ve propagandaised the world or most of it into believing a false unworkable economic system. they are covering up worldwide war crimes and international crimes against humanity (Palestine Yemen and elsewhere). Not forgetting using the dollar to extract the resources of the rest of the world including heroine cocaine. .