Monetary Metals Supply and Demand Report 12 July, 2015

Last week, we concluded with this:

“So now, for the first time in about two years, the fundamental price of silver is above the market price, about $0.35 over.

…

Unless you really like to trade the bleeding edge of a signal change, you may not want to jump in here. Silver’s newfound scarcity could disappear as rapidly as it appeared. And even if it’s stable, it does not mean that the fundamental price must necessarily skyrocket.”

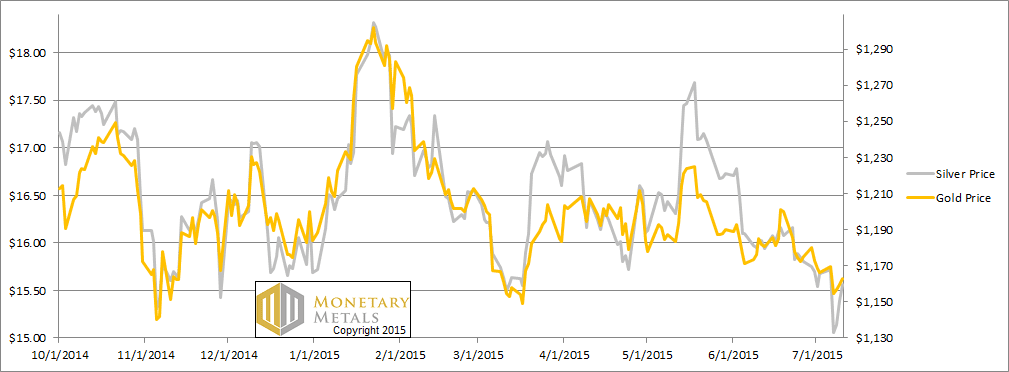

On Tuesday this week, the silver price made an intraday low of $14.70. It then rose to close the week at $15.56, 12 cents down from last week. The gold price is down $3.

Of course this week saw more Greek drama, first the referendum rejecting the bailout deal and then it seemed like a similar bailout deal is on again. The stock market had some exciting volatility.

Anyways, we’re not about the stock market here. Read on, for the only accurate picture of the supply and demand conditions in the gold and silver markets, based on the basis and cobasis.

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

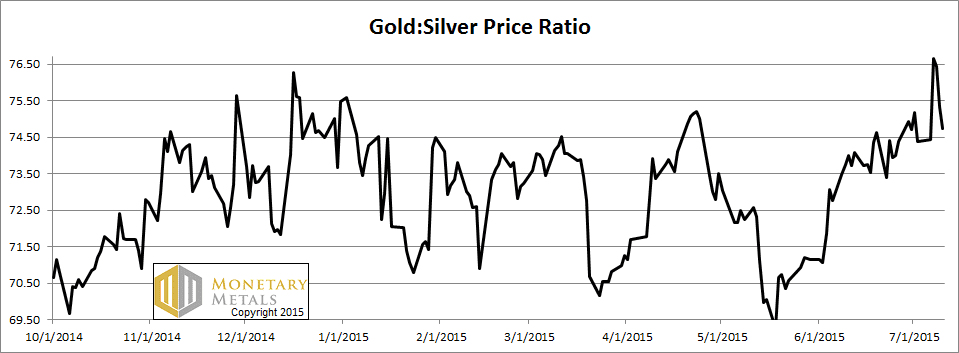

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved up a bit this week.

Notable this week is a spike, which hit 78.3 on Tuesday morning (Arizona time).

The Ratio of the Gold Price to the Silver Price

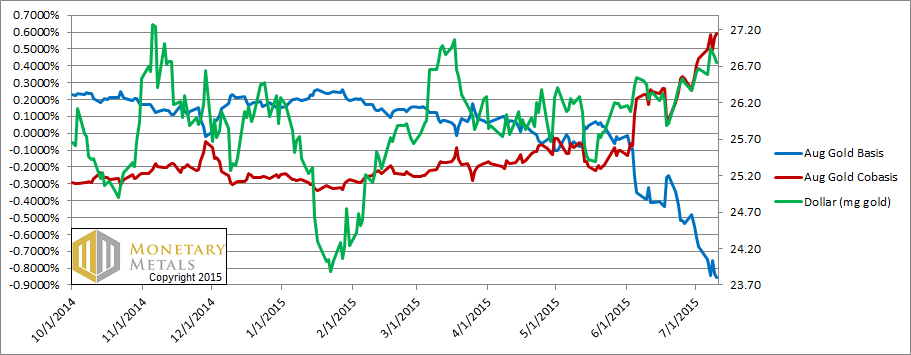

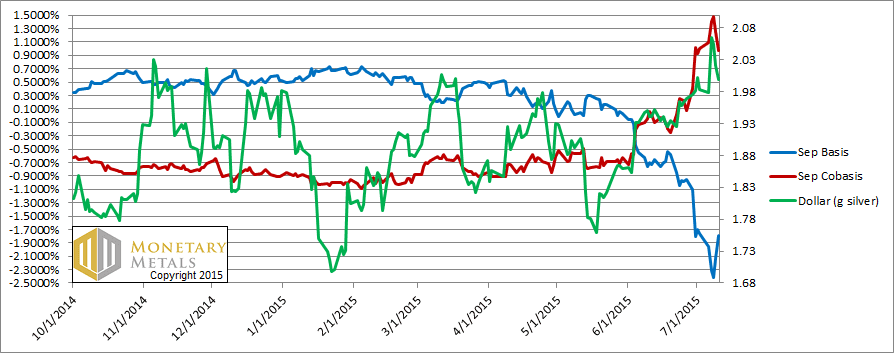

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Measured in gold, the dollar rose. Scarcity (i.e. the cobasis, the red line) rose with the move. This is the pattern that repeats time and again. When speculators buy futures contracts, the price of the dollar falls and the scarcity of gold falls with it. This week, speculators sold gold, driving up the price of the dollar (to 26.75mg) and the scarcity of gold rose as well.

The fundamental price of gold still didn’t change. It suggests the market price of gold could go up $35 give or take.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

On Tuesday, with the short, sharp drop to $14.70, the market price of silver was more than a buck twenty five under the market price. We warned many times this could happen.

The question is always, where to from here? Monday through Wednesday, we had an incredible surging cobasis. This corresponds to what we heard from dealers that buying of physical silver product was robust. Then, as we said could occur, the pressure turned off on Thursday and especially on Friday.

The cobasis (i.e. scarcity, the red line) ended the week down a hair from where it was last week. And this occurred with the price of silver down. Stated more objectively, the dollar ended up on the week, closing at exactly 2 grams of silver. Tell that to anyone who says the dollar is worthless! :)

The fundamental price is above the market price, but just barely. Call it a dime.

© 2015 Monetary Metals

Aww, I got all dressed up and now no party. What a drag !

Well I guess that if one were to dress up in drag it would always be a party. (Or something like that…) You may think there’s a Freudian slip in there but I doubt it. But say, how’s the rest of the ensemble looking? ;) Have a great week everyone!

Hi Keith,

Nice discussion—it boils down to relative demand, supply, and prices.

I think you have a typo here……

On Tuesday, with the short, sharp drop to $14.70, the market price of silver was more than a buck twenty five under the market price.