Monetary Metals Supply and Demand Report: 13, Oct, 2013

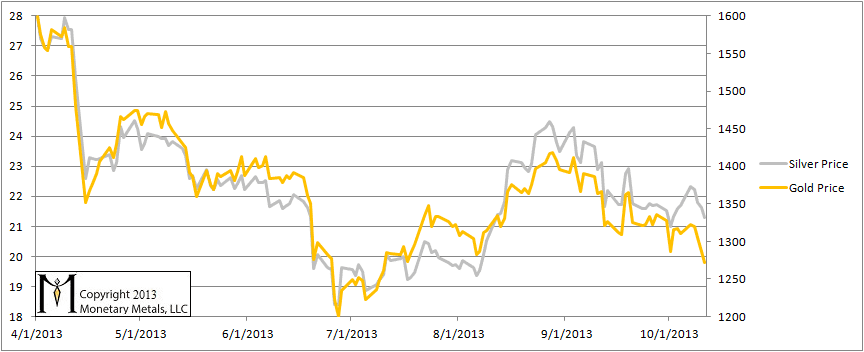

The prices of the monetary metals slid this week, especially on Friday. Gold ended the week 38 bucks lower than last Friday (-2.9%), and silver ended 42 cents lower (-1.9%).

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Here is the graph of the metals’ prices.

The Prices of Gold and Silver

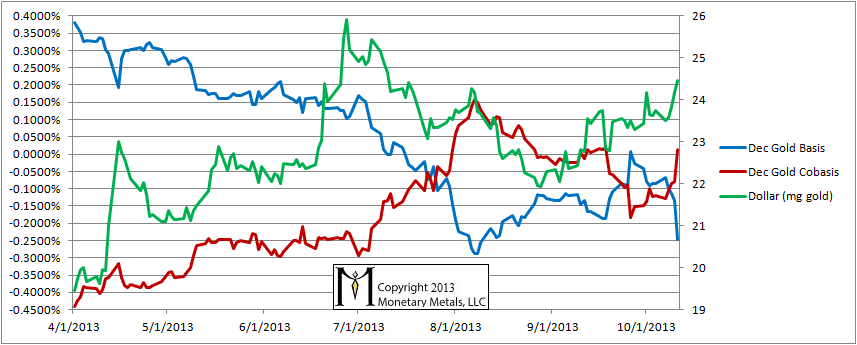

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Rather than saying that gold moved down, we prefer to think of it as the dollar moving up. It is notable that as the dollar rose this week, the cobasis rose with it. December gold is now just barely in backwardation.

Last week we noted:

“The cobasis rose a bit, indicating either that the market got a bit tighter or else that the inexorable pull of temporary backwardation is starting to tug on the December contract (we suspect a bit of both but mostly the latter).”

As the dollar price rose further, gold became scarcer. We also said

“When speculators are driving a move, then the cobasis tracks along with the dollar price. That is, as the dollar moves higher / the gold price moves lower, then gold becomes more scarce. And the opposite is true also; gold becomes more abundant when speculators bid up its price.”

That pattern continued this week.

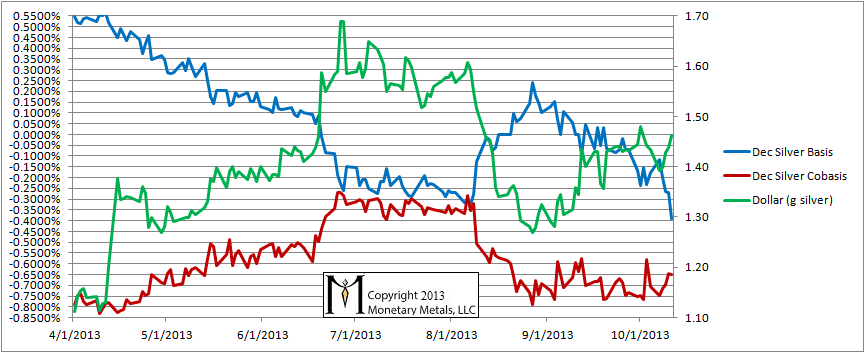

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The price of the dollar rose, but the silver cobasis barely budged. The trend of a rising dollar price, in silver terms, could have some legs.

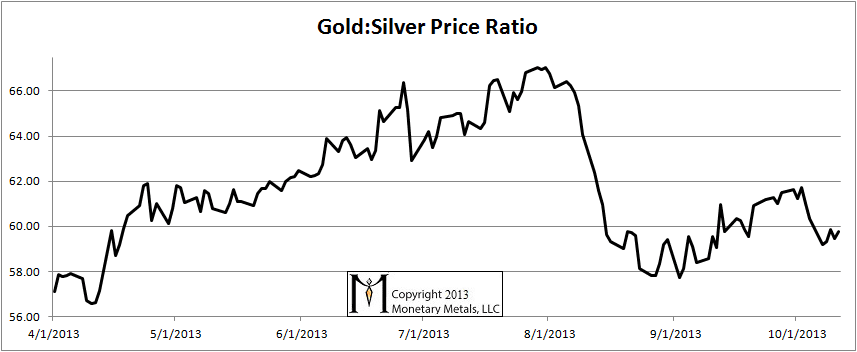

The Ratio of the Gold Price to the Silver Price

The ratio of the prices of the monetary metals fell slightly this week.

Hey Keith,

I appreciate You sharing your articles with me.

I value your theories and opinions.

Thank You…TAL

Hmmm… I used to think cobasis is simply the negative of basis. But looking at silver chart, basis has been declining since late August, implying declining supply of silver. But cobasis has been flat indicating that thre is no developing shortage. So I guess they are separate numbers!

Thank you, Keith, for this great analysis. You are the light in this vast darkness called gold and silver investing!

Hi Keith

I really appreciate that you share your knowledge and ideas here. Could you please explain why the Cobasis is not just the negative of the Basis. When i read your article you yourself describe it as:

Basis = Future – Spot

and Cobasis= Spot-Future.

Should not then the difference between the two always be the same?

Perhaps it has to do with the spreads in the market price?

Best regards from a fan in Sweden

As explained in Sept 8th report, bid and ask spread makes a difference:

“To be more precise, we must define these terms that would be experienced by anyone who tries to carry or decarry. When one buys, one must pay the ask (also called the offer). To sell, one must accept the bid. With that in mind, here are the proper definitions:

Carry = Future(bid) – Spot(ask)

Decarry = Spot(bid) – Future(ask)

Basis and cobasis are the annualized returns for carry and decarry. “