Monetary Metals Supply and Demand Report: 15 Feb, 2015

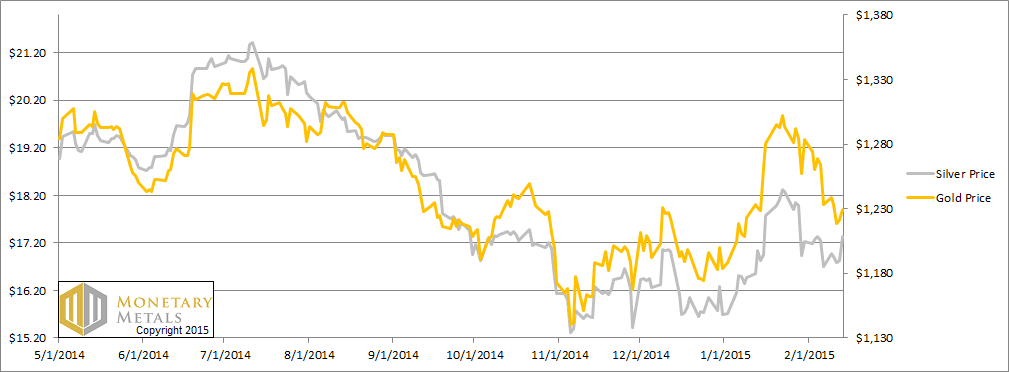

The price of gold dropped another $5 to $1,229, but the price of silver bounced back over 60 cents to $17.34. What gives? How could this be? The conventional wisdom is that silver does whatever gold does, only more.

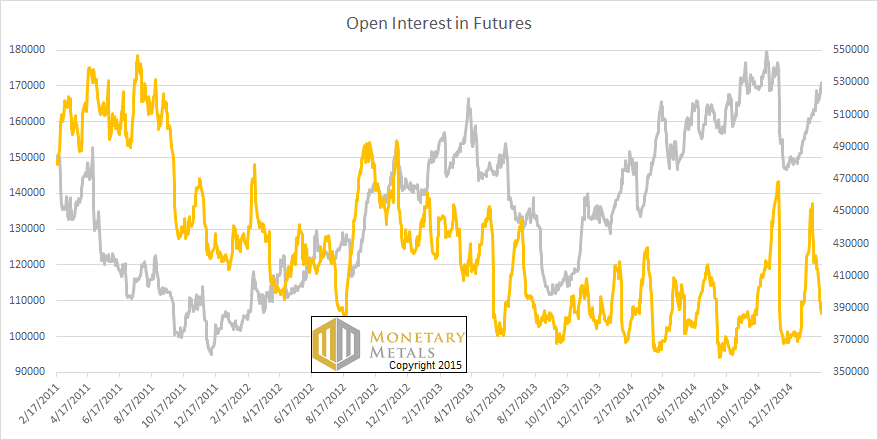

Here is a graph of the open interest in the futures markets for both metals. As we’ve written in the past, the number of contracts is not a direct measurement of speculative fever. However, it is an indirect measure of it, a reasonable proxy. This is because open interest rises in response to a high and rising basis. Recall that basis is basically future price – spot price. So the more that speculators (who use leverage in the futures market) bid up the price, the more that the market makers will increase their carry positions, and the more that open interest will tend to increase.

The Open Interest in Gold and Silver

In four years, the speculative interest in gold has barely been lower than it is now. At the same time, it’s barely been higher in silver.

This is just one of 17.34 reasons why we continue to say caveat emptor argenteos (as always, we are ready for corrections of our Google-translated Latin).

For an updated look at the supply and demand fundamentals in the gold and silver markets, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

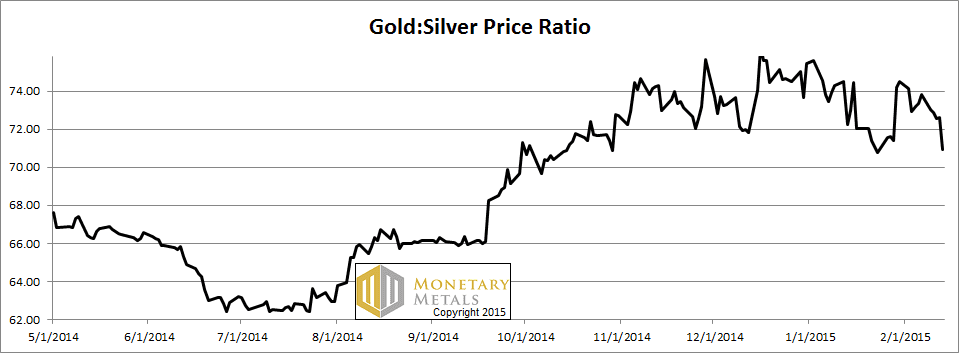

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved down a lot this week.

The Ratio of the Gold Price to the Silver Price

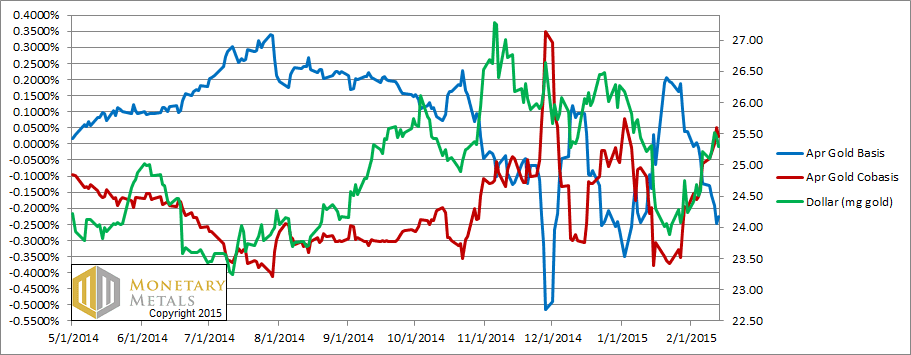

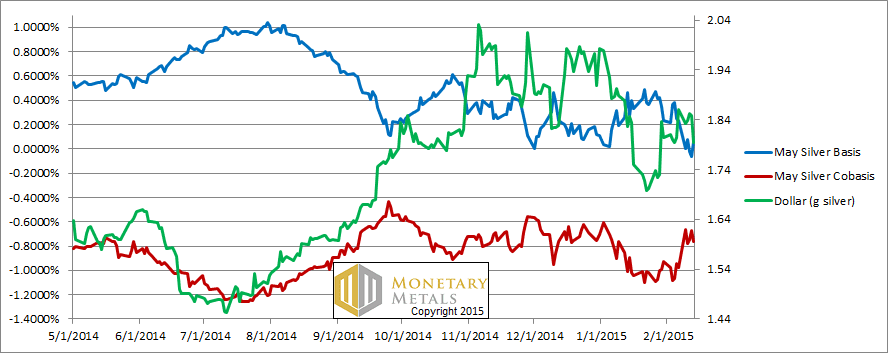

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar is up about a tenth of a milligram of gold this week. Along with it, the cobasis (i.e. scarcity) is up too. And look at that. We now have a little backwardation in the April gold contract.

Our calculated fundamental price for gold moved up further. It’s about $80 over the market price. If you want to speculate, may we suggest that gold is the better metal at the moment?

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

We moved to the May contract perhaps a bit earlier than we otherwise might have done. The distortions in the March contract are so extreme as to render it useless.

It’s not all darkness and despair for silver speculators. As the dollar fell (i.e. the silver price rose), the cobasis (i.e. scarcity) rose this week as well. Our calculated fundamental price in silver is about 95 cents higher than last week.

However, it’s still about $2 below the market.

© 2015 Monetary Metals

Keith, assuming I’m reading this right, you have a fundamental price in dollars for gold at roughly $1200; you have a fundamental price in dollars for silver at roughly $15.

Using those numbers, that places a “fundamental” number on the gold/silver ratio of about 80. Would you agree? Is there something I’m not seeing here?

Is this the kind of analysis you use to forecast/predict/guess what the future gold/silver ratio might be?

You mean $1,300?

Yes. That’s how I forecast lower silver prices all the way down from $33, and a higher ratio all the way up from 50.

Yes, a typo, but the point still held, I hope. :)

If I can actually figure out what you’re going to say before you say it, I won’t have to read what you say! J/K.

I appreciate your weekly message, and you remind me, in style, of Robert Prechter back in the old days. He always seemed to me to let his numbers do the talking rather than proselytizing. That always made him more credible in my eyes, though I wasn’t always in agreement with either his conclusions or his theory.

Thanks!

Do you every factor COT into your analysis.?For example, three weeks ago, Spec were heavily long while commercials were short–as lopsided as at previous spike tops. Now we see the price move the other way as specs sell.