Monetary Metals Supply and Demand Report: 16 Nov, 2014

On Monday through Thursday, the uptrend in the dollar continued, but on Friday, something snapped. Usually, there is no way to know what triggers a major change. Zero Hedge believes that the fuse of Friday’s fireworks in the monetary metals was lit by the decline in so called inflation expectations in the Thomson Reuters / University of Michigan poll. Preliminary results were released Friday morning. The logic is that with lower expectations, the Fed has greater latitude to print. Printing increases the money supply. A larger money supply causes a higher gold price, or at least the commonly held theory holds this.

Also on Friday, discussion persists of the coming Swiss referendum. On November 30, the people will vote whether to require the Swiss National Bank to hold at least 20% of its reserve assets in gold kept on Swiss soil.

Discussion of $5,000 gold has resumed. We have three thoughts to share on this. One, it’s not happening today. Two, you won’t like all of the other things that will accompany $5,000 gold if it does happen. Three, it may not happen. Gold could withdraw its bid on the dollar before that price is ever hit.

No matter, the dollar began to drop. No, it didn’t drop in Russian rubles. It continued to go up, rising from ₽46.7 to ₽47.3. Russians speculating in dollars made money rubles on Friday.

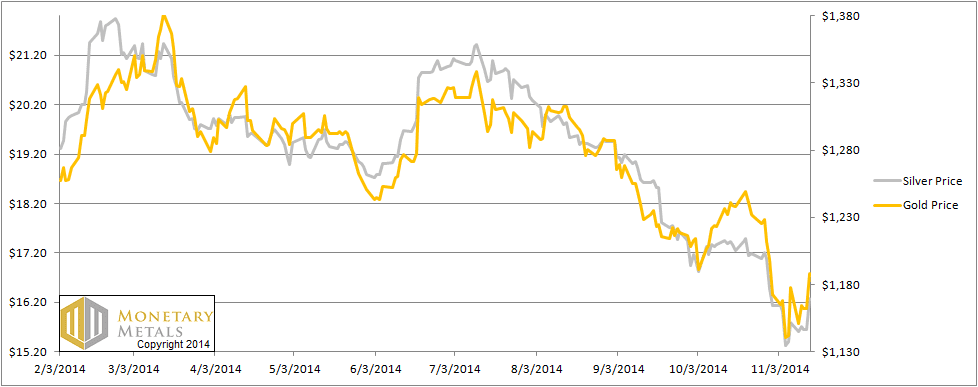

In the same way, Americans speculating in gold made money dollars on Friday. Just in one day, the dollar dropped about 0.6mg gold and .08 gram silver. In other words, the price of gold rose by $26 and the price of silver rose by $0.64.

The gold to silver ratio made a new high late Thursday night, 75.7.

For our unique pictures of supply and demand fundamentals, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

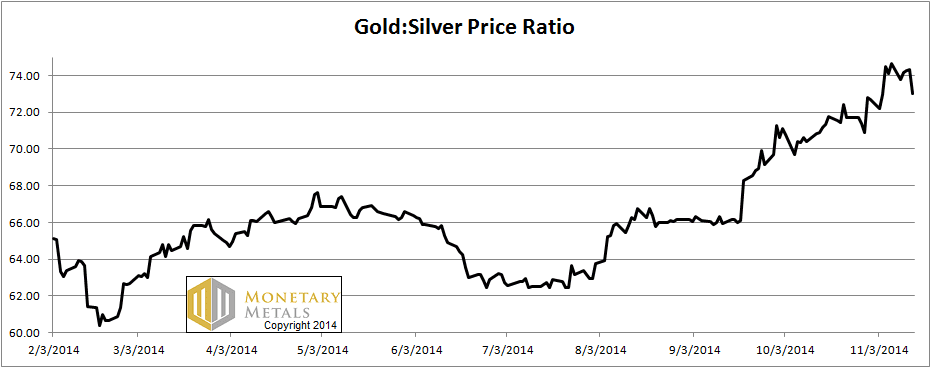

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell sharply on Friday, to 73.

The Ratio of the Gold Price to the Silver Price

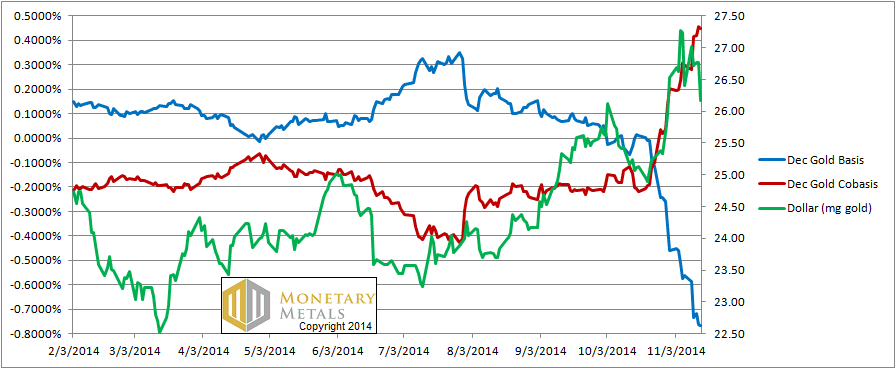

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The gold community is much abuzz about record low GOFO rates. Certainly our measure of scarcity (i.e. the cobasis) has been rising since late October. It is certainly not normal to have backwardation, but about 65 cents is not a record nor is it too remarkable in the post-2008 “new normal.” We’ve seen higher, unfortunately. We will see higher, terrifyingly.

Only one contract is backwardation right now. The February gold cobasis is -0.05%. So we’re all good. Until it moves by a few ticks, anyways.

The graph above shows the picture, mostly. As the dollar was rising, the cobasis was rising. Speculators were repositioning, but the fundamental price didn’t change much. I said mostly because it does not show the intraday action as the gold price shot up $20. We will take a look at an intraday chart below.

Incidentally the rising cobasis heading into each contract’s expiry is a compelling piece of data to debunk the manipulation theories. It shows a relentless selling pressure on the contract. If bullion banks were massively naked short, they would not be selling but buying. It is speculators. They are naked long, so they must sell before First Notice Day. This pushes down the bid. Basis = Future(bid) – Spot(ask). And we do indeed see the collapse of the basis every time. Cobasis = Spot(bid) – Future(ask). When the bid is pushed down, the market makers pull down the ask. However, as a contract heads into expiry we can expect the market makers to be less aggressive as they need to exit their own positions and close their book before First Notice Day as well.

The bottom line is that the basis collapses and the cobasis rises, but more reluctantly.

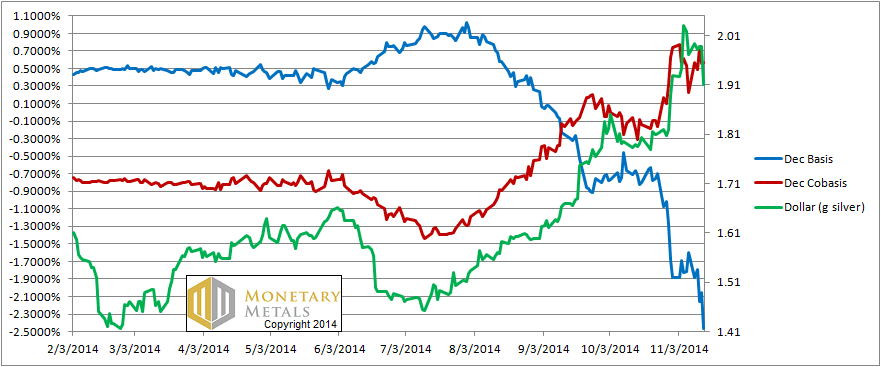

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The silver picture is similar, though the cobasis ended at the same level as last week.

Last week we said two things, which now seem prescient (we claim no powers of clairvoyance):

“…the odds of a rally rise.”

“…we NEVER RECOMMEND NAKED SHORTING A MONETARY METAL”

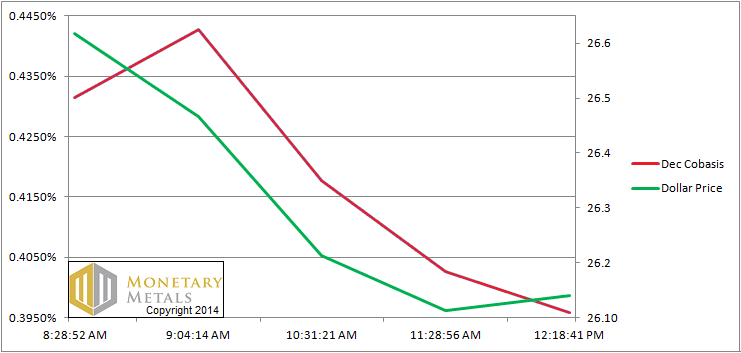

Finally, let’s take a look at the intraday action. We sampled the basis at some key points in the day. Times are MST (GMT–7).

Intraday Gold Cobasis and the Dollar Price

Aside from the initial small increase, a possibly anomaly, the cobasis fell with the dollar price. In other words, this move was speculators. As the gold price rises (the opposite of the dollar price, measured in gold, falling) gold becomes a bit less scarce.

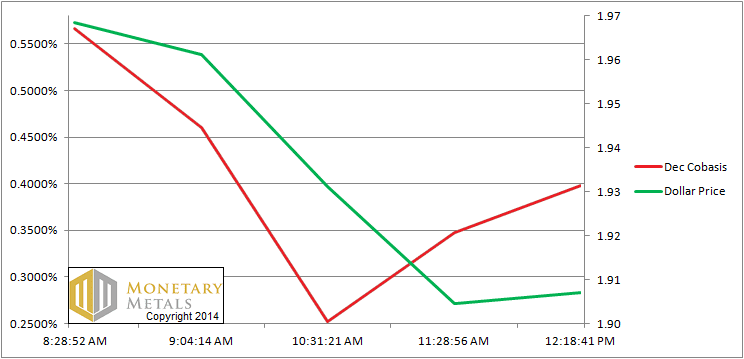

Now here is the same chart for silver.

Intraday Silver Cobasis and the Dollar Price

UPDATED: correct silver intraday chart

The same thing occurs in silver, though there is a bounce in the cobasis that looks a little more than a mere anomaly. We will have to see the data on Monday to put this to bed.

Is this the beginning of the Great Silver Breakout? It’s possible the market has begun turning. However, before you break out the champagne, we would point to the fact that the cobasis in silver has collapsed. It was +0.8% on Nov 3, then it dropped and bounced to +0.7% on Wednesday. It began Friday at +0.6% but dropped to +0.3% before bouncing to +0.4%.

This may be nothing more than an overdue rally, a correction. We would want to see not just more data, but firmer cobasis as price rises before we would be confident in that. As always, we’ll call it as we see it.

© 2014 Monetary Metals

Monthly silver chart showing in lieu of intraday chart, FYI. Thanks for the write-up, Dr. Weiner.

Please add the omitted intraday silver chart?

“Two, you won’t like all of the other things that will accompany $5,000 gold if it does happen”

Cannot agree more with this statement. I think the gold bugs need to acknowledge the problems associated with gold rising to $5k and not just thinking they’ll become very rich when it happens.

Dollar collapse also means you can’t do anything with your gold, at least temporarily anyway…

Thanks for catching the error. I have updated the post with the correct intraday silver chart.

Yuhanni: I would not say you can’t do anything with your gold per se, though revealing that you have gold could be very dangerous. That is my understanding of the first dark ages period.

Keith – I have to agree with you on the danger part. Imagine rocking up to the vault where you think your life-savings are kept safely only to be shot dead by the trust-worthy security guard….

“Incidentally the rising cobasis heading into each contract’s expiry is a compelling piece of data to debunk the manipulation theories…If bullion banks were massively naked short, they would not be selling but buying.” – It depends. My understanding of the latest manipulation theory is that “they” (usually BIS or JPM) dump supply on the market suddenly to take out the bid stack / run the stops, then buy back as the price falls. I have no idea if that’s true – but if it were, “they” would not maintain large short positions; their shorts would be transient.

“This may be nothing more than an overdue rally, a correction.” – Yes; “specs bought” in the sense that some needed to cover their shorts (or had their upside stops hit).

“you won’t like all of the other things that will accompany $5,000 gold if it does happen” – it’s funny, but that’s what people were saying in early 2009, about $2,000 gold. Inflation? :-) Because, today in 2014, one can picture gold hitting $1,500 or even $2,000 easily (which would double or quadruple the miner stocks, from where they are now).

tjmmz: So they temporarily sell but the price permanently goes down? No one front-runs their short-covering? Hmm..

The mainstream theory is rising money supply –> rising prices and that this is “inflation”. So, the theory goes, you should buy something that “keeps up with” this inflation. Gold comes to mind.

That is not what I am proposing. I am proposing higher unemployment which sooner or later means higher strife and violence. I am proposing defaults and insolvencies, shuttered plants and stores and whole malls. Picture Detroit expanding, with outcrops coming to a city near you. Are prices high? Maybe, but that’s not the greatest feature. No, what’s salient is the collapse in trust–for good reason. By the time people are so distrusting of the government’s credit that gold is priced at $5,000 I think palpable signs and real problems stemming from their distrust in all other areas will be bleeding through.

I don’t really believe the manipulation theories; just trying to understand and right now, I guess I’m Devil’s Advocate. I think the manipulation theorists might say that gold has an abnormal demand curve where stupid Americans will panic into gold when it’s up in dollar terms, and out of gold when it’s down. So yes, a “smackdown” (the manipulationists’ word) would bring on additional selling, which keeps the price down for the manipulators (biggest banks) as they neatly cover their shorts. But, whatever.

I agree that $5,000 gold would mean a massive collapse in trust; which implies a massive collapse in real debt, and with that, mass unemployment as the real economy chokes and (hopefully) re-organizes. I just don’t think we’ll necessarily get there. $2,000 gold will happen if/when the Chinese simply begin deploying their $4 trillion in forex reserves into gold. And $2,000 gold will set off enough alarm bells that America might finally get its act together, and head off worse events. Or if China-Russia-Iran form a non-dollar / Gold Standard trading bloc, and pick up some more countries (Germany?), then America would see $5000 gold, but the havoc and destruction would at least be isolated to America.

I’m just noticing that the quantity of base money does affect our expectations of what is a reasonable price vs. a high price. I am aware of your and Dr. Fekete’s criticisms of QTM, and find many of them persuasive. But in 2008, the Fed’s balance sheet was under $1 trillion and gold had never gone beyond $1000/oz; $2000 seemed like that crazy-high price which should spell the end of the world. Today, the Fed’s balance sheet is $4.4 trillion and a price of $1500 or $2000 is easily envisioned, and would not be very bad. There’s a connection. A linear QTM does not work (especially not on short time scales); nonetheless, when a money’s base quantity is being grown, the money is being depreciated.