Monetary Metals Supply and Demand Report: 19 Jan, 2014

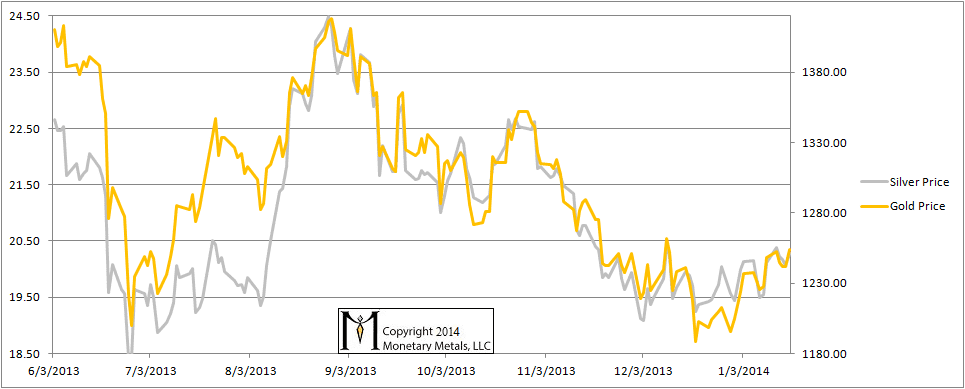

ffThis week, the prices of gold and silver were drifting slowly downwards until Friday morning. It’s not clear what the driver was (could be rumors of the German financial regulator starting to look at gold trading?) From around 7:30am in NY to 9am, the prices rose to above their close from the previous week. At the end of the day, the gold and silver prices were up $5 and 16 cents, respectively. Is this the beginning of the moonshot rallied that is much hoped-for by the gold bugs? Read on…

Here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

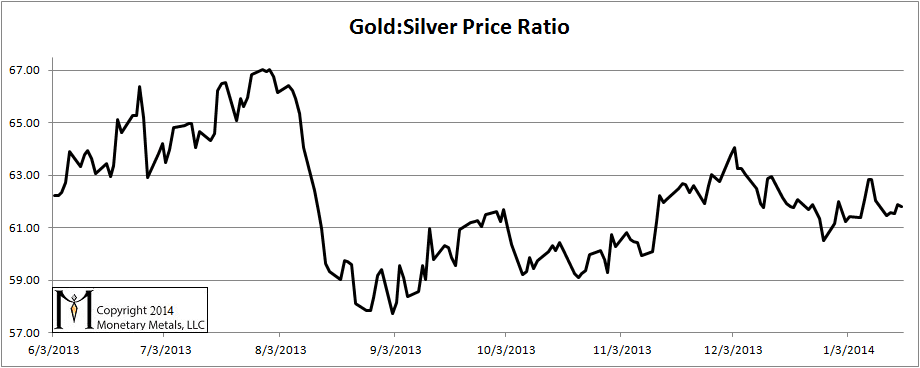

Here is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It backed down this week

The Ratio of the Gold Price to the Silver Price

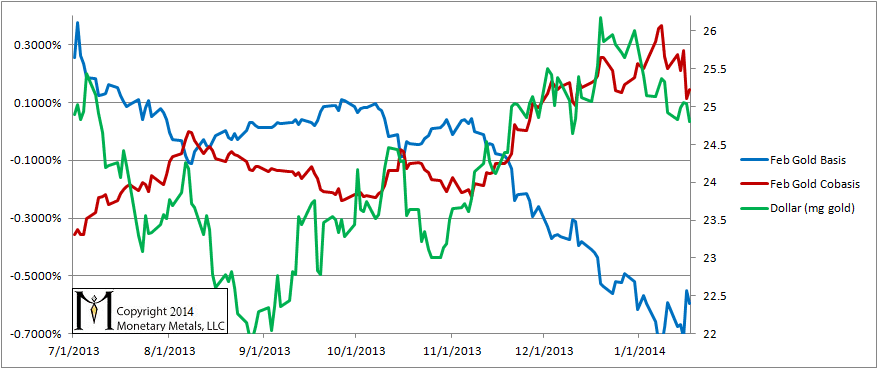

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The dollar fell a hair more this week. The cobasis fell as well. Last week, the cobasis was considerably higher than it was the previous time when the dollar was priced below 25mg. Now the cobasis has almost “caught down”. And this is the February cobasis, which we know is feeling the tug of temporary backwardation! The April cobasis is at the same level it first attained on Dec 3, when the dollar was ½mg higher than it is now.

We don’t see any fundamental reason for the gold price to drop significantly. But to see the cobasis not holding firm, much less rising, tells us that the price still can’t rise except by the leverage used by speculators to bid up futures contracts.

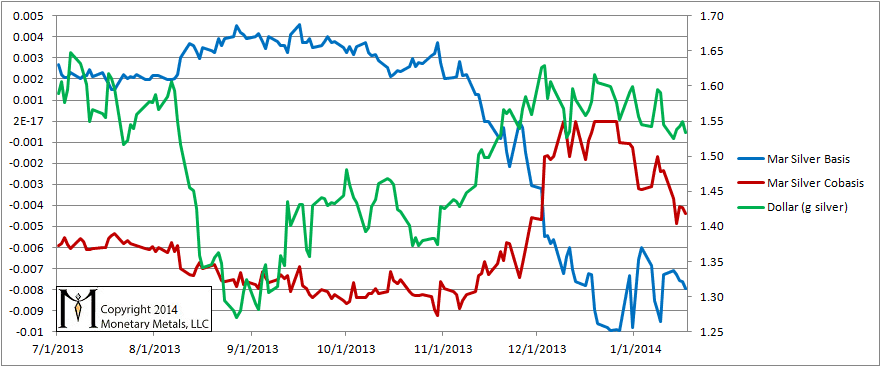

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Silver is showing the same pattern as gold, only more extreme. The March silver cobasis had shot up much more than the Feb gold cobasis, starting around Dec 1. That corresponded to a small rise in the dollar price as measured in silver, from around 1.57g to 1.62g.

Now, the dollar is selling off a bit in silver terms (i.e. silver is being bought in dollar terms). Meanwhile, the silver cobasis is unwinding its sharp rise. As with gold, the March silver contract is already feeling the strong pull of temporary backwardation. The May cobasis, for example, has collapsed back to levels of late November. The December cobasis has collapsed to levels last seen in April of 2013.

How to put this… We hope that this is correctly stated in Latin.

Emptor cavete argenti.

Keith – I’m a rather new member to the site and didn’t realize I needed to know some Latin too. ; ) Please translate in English for me. Emptor cavete argenti.

I also haven’t been able to locate an article that defines your descriptions of basis and cobasis. I’m trying to get up to speed as fast as possible and now latin has been thrown into the mix. Thank you for your articles.

dts: thanks for your questions.

Here is where we discuss the basis and cobasis: https://monetary-metals.com/?p=1974

The Latin is my best guess at a translation of “silver buyer beware”.

@ dts I suspect they’re trying to say:

Caveat Emptor – Buyer Beware – http://www.merriam-webster.com/dictionary/caveat%20emptor

argenti – Silver – http://en.wiktionary.org/wiki/argentum#Latin