Monetary Metals Supply and Demand Report: 2 Nov, 2014

Woe unto the gold speculators, and a curse laid upon the house of silver.

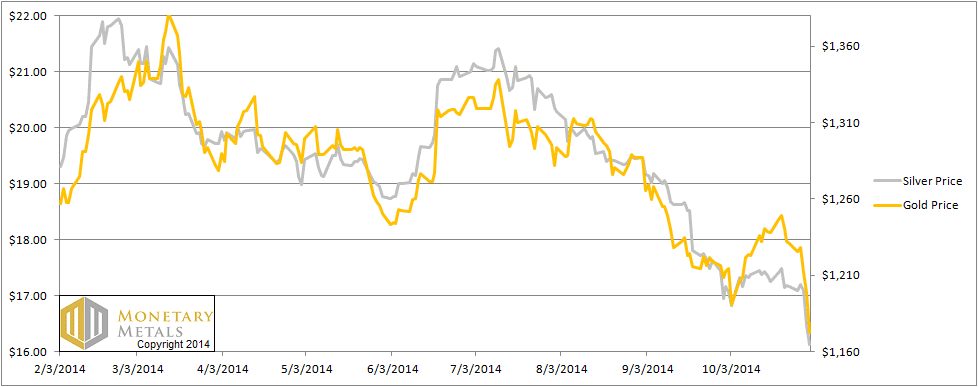

At least, that’s how it may feel. In more clinical terms, the gold price fell from $1,230.90 to $1,172.59, or $58.31. The drop this week was 4.7%. The price closed the week below the level set after the crash of 2013, which was $1180 (by the way, an intraday dip). The gold price has never closed a day below $1188 since 2010.

The silver price fell from $17.17 to $16.13. $1.04 is 6.1%. It’s never been lower in years, except briefly in 2010.

On April 9, we said:

“The neutral price of silver is in the $16’s today. If the price overshoots as far to the downside as it is now stretched to the upside, we could see silver with a 12 handle.”

We got hate mail.

In the first place, one would hope that people don’t shoot at messengers. We are of the firm belief that gold and silver are money, and the paper issued by the Fed is not. At the same time, we argue that this view is not a trading strategy. For trading, we look to market data.

Second, we were right. While other analysts called every blip with renewed forecasts of $50 and $250, the silver price has spoken. It had a false breakout in June, and has been falling steadily since then. It has traded with a 15 handle this week. Incredibly, the fundamental price we calculate for silver is still below the market price.

To see the fundamentals, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

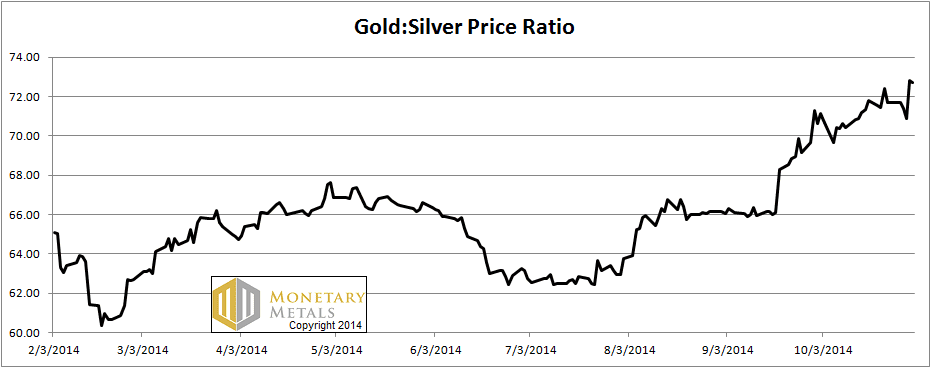

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose a full point, or 1.4%. Our original call back in 2013 (when the ratio was around 52, and most analysts were calling for it to fall) was 60 and maybe 70. We later updated that to 70 and maybe higher. Most recently, we updated it to 75 and maybe 80. Early Friday morning, the ratio hit 73.96.

The Ratio of the Gold Price to the Silver Price

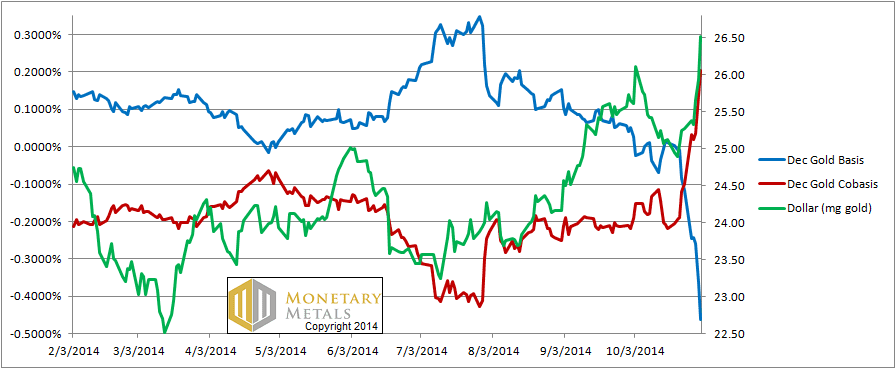

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Look at that run up in the dollar. It’s impressive!

As recently as Oct 20, the price of the dollar was under 25mg gold. Now it’s over 26.5mg.

Along with this rise in the dollar price (which most people think of as the fall in the gold price), has been a rise in the scarcity of gold. We now have a substantial positive cobasis—i.e. backwardation—in gold.

We calculate a fundamental price of gold some $48 over the market price. This does not mean that the price couldn’t drop further, but it does tend to apply an upward pressure to prices.

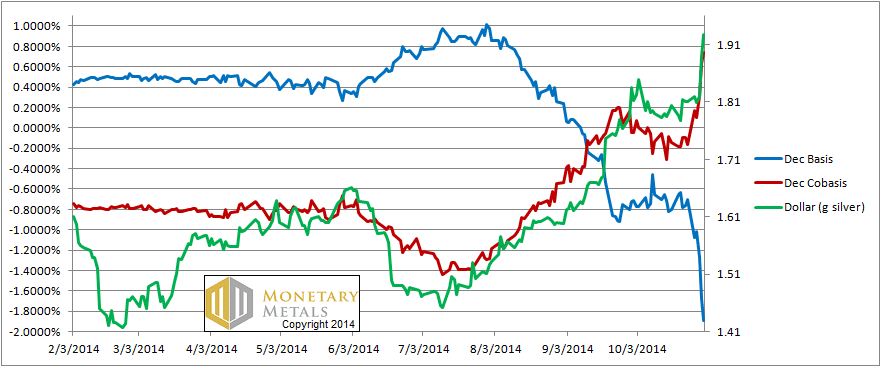

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The dollar rose even more sharply in silver. It was 1.81g silver at the end of last week, and now 1.93g. In July, it was 1.45g.

The cobasis is up sharply, and December silver is now also quite backwardated. There are some key differences between silver and gold, which we shall not elaborate here. Thus we calculate the fundamental price in silver at $0.77 below the market price.

In most of the little price moves in the past few years—do we dare assume it’s the new normal?—the cobasis (scarcity) has moved proportionally with the dollar price (opposite of the metal price, measured in dollars). In other words, at lower prices the metal becomes scarcer and at higher prices it becomes more abundant.

This week, the metal became a little scarcer but the price fell more than a little. Don’t be fooled that the price drop was caused by high frequency trading, low integrity manipulation, or zero clothing shorting of futures. It was caused by selling of futures and, just as importantly, physical metal.

© 2014 Monetary Metals

15 USD for silver, I believed it was 4 USD ???

My previous hypothesis – that the Basis-Cobasis spread carried embedded information about the relative valuation of the metals – appears to have been wrong, insofar as not only did Silver not converge, Gold has now also inverted (and widened very considerably), yet Keith asserts that it’s fair value remains above the current spot price. My notion that Basis < Cobasis = Overvaluation appears flawed.

I remain totally baffled

What is the problem with precious metals? One gold coin for every American is 9,000 tonnes, more than putatively held in Ft Knox and the NY Fed . Ans: 99% of the population does not think it is money. They do not have gold and do not see the need for it. I bought “gold” from BullionVault in 2007 when they had 13 T. Now they have 35 T. or so under management. I believe this rate of increase glacially slow and will change when people become more aware. Not much will change while they remain clueless. These services need a 10 fold increase to be meaningful and when THAT occurs the authorities will have a plan in place to convert to a gold back currency if necessary. If they can pull off another fiat heist, they will try that with SDR’s. If gold threatens the dollar, it will be confiscated and 99% will not care. Freedom is actually too dangerous for governments.

Keith’s response to his hate mail sums this up nicely. I’d just add that gov’t’s recognition of money is not the central issue, nor is the distribution of gold ownership. “Money” is what Menger said it is: the most marketable good – a thing valued for that social property above any other merits it may have. Gov’t or popular recognition may seem to matter as a way of establishing how marketable gold actually is, but they can do very little to make it more marketable. I don’t see how a wider, flatter, ownership distribution changes marketability. Reducing gov’t sanctions should help, but I submit that these are not huge impositions on active traders, only on those long term holders who’re speculating and then cashing-in for US dollars, not a significant quadrant of the “circulation” market. The largest influence of gov’t and society is that they offer the paper substitutes (and the trust networks these rely upon). Those securities are usually more marketable than bullion, by a factor of 5x to 10x; but not reliably so – Two years ago the 30day T-bill spread jumped higher than the spot gold spread during the debates over US going into mock-default. The laws of Nature and the Economy ordain gold’s role. It alone cannot make you Free, nor Smart, nor even Efficient. Gold makes you Liquid even in extreme conditions, and it stores your wealth for timespans equal to or longer than your own life. That is all. The political gamesmanship can be interesting; it can make and break speculators; and it can act to isolate and stigmatize sentimental “goldbugs”, but unless it is able to interfere in every form of exchange, it cannot usurp gold’s role as most marketable of all physical goods.

Keith, thanks for you great work. You seem to be calling it right.

Isn’t it really all about the yen right now? Yen drops, USD goes up, gold (in USD) goes down. Abenomics seems to be cracking. A currency crisis in the yen may be the siren sounding and it seems to be falling off a cliff. The yen carry trade and Japanese bond markets are huge compared to gold.

http://www.bloomberg.com/quote/jpyusd:CUR

My question is this. If there is a currency crisis, do you think we could we get a situation where both gold and the USD go up at the same time or do you think gold will be left behind?

I don’t get this. “This week, the metal became a little scarcer but the price fell more than a little…caused by selling of futures and, just as importantly, physical metal.”

I understand the selling of futures. But it seems to me that, if physical metal became more scarce as the price fell, then hoarders must have stopped selling – or even started buying (at the new low price). Why would metal become scarcer, if the price drop is indeed driven by net selling of physical? It should become more abundant.

Thanks for your comments. A few quick responses:

Andrew: I am not sure I would look at the Basis – Cobasis spread itself. However, if Basis + Cobasis drops, that means the bid-ask spread on either spot or futures gold is widening.

waknpak: When gold withdraws its bid on the dollar at the end, I don’t see how they can make it bid on the SDR.

Greg: Interesting point about the sudden widening of the spread in T Bills. That is something which “should” not happen, like an inverted yield curve or gold backwardation. Shouldn’t, but does.

opusnz: I don’t see any fundamental reason why the gold price has to drop when the other currencies fall relative to USD. Right now, I suspect that those currencies are falling as a result of credit contraction but at the same time people are trusting of credit in general (at least if the US government is the debtor).

tjmmz9843: Good question. I meant simply that there was some physical metal sold and some futures sold. If only futures were sold, then scarcity would have increased more than it did.

I am still pretty confused about the predictive ability of the basis/cobasis. It seems that the dollar price follows the basis, but I can’t see how that tells you much except that the two follow each other. Is there any predictive power to this, or is it simply observational?

Keith, your remarks about where fundamental prices are relative to the market price are most interesting. Can you please post a link or two to your work where you explain the grounds or method for estimating the fundamental price for the metals? I would love to read through it (again).

It would be most interesting to see an analysis, or even a graph, showing the dynamics between fundamental and market prices, the way them diverge and converge over time, and identify the factors that best explain these convergence-divergence movements. If there is some sort of identifiable pattern to this, it could be most fascinating and useful to know. Could it be used, for example, to time one’s purchases, to avoid overpaying for the metals?

Thanks.