Monetary Metals Supply and Demand Report: 21 Sep, 2014

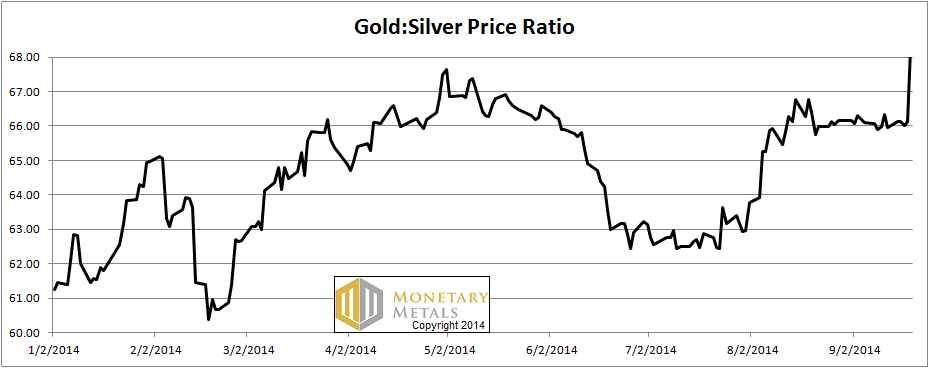

That slow-burning fuse finally lit off the fireworks in silver. We have long been calling for a rising gold to silver ratio, which means for silver to fall in gold terms (and we are not aware of anyone else who has). On Friday, that ratio spiked over 68.

The silver price is now about 456mg gold. That’s 17.81 bucks per ounce of fine silver. Alternatively, the dollar rose to a new high of 1.75g silver.

By the way, the gold price also fell this week, twelve bucks.

The fundamentals have been shifting, so read on…

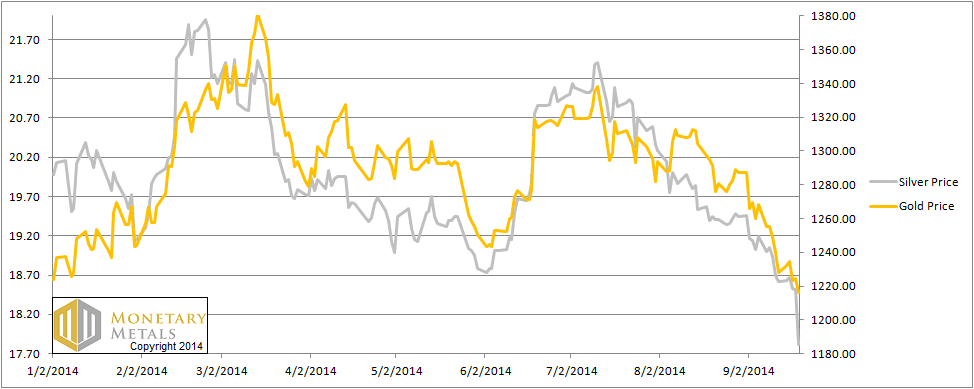

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio.

The Ratio of the Gold Price to the Silver Price

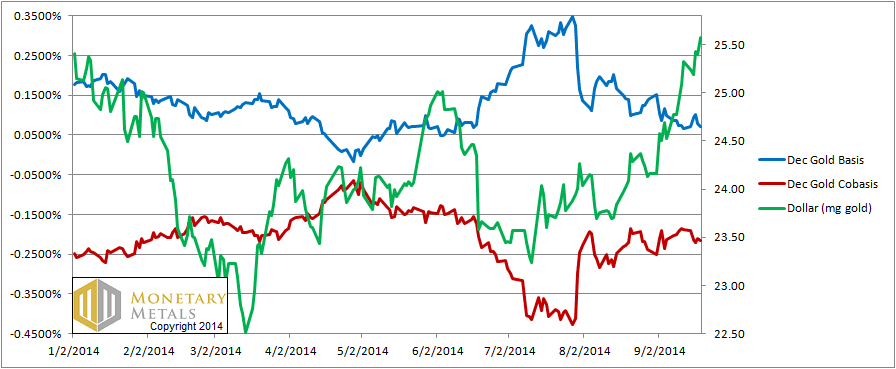

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We have switched from the October to December contract, as the former is nearing First Notice Day and longs are applying selling pressure. The October contract is firmly in temporary backwardation.

If one is wishing for a rise in the gold price, it’s not encouraging to see the cobasis fall from -0.19% to -0.22% while the gold price drops. This move was more about hoarders selling or at least not buying, than it was leveraged speculators selling. In other words, gold became less scarce and more abundant as its price fell.

The price dropped and the fundamentals got slightly weaker.

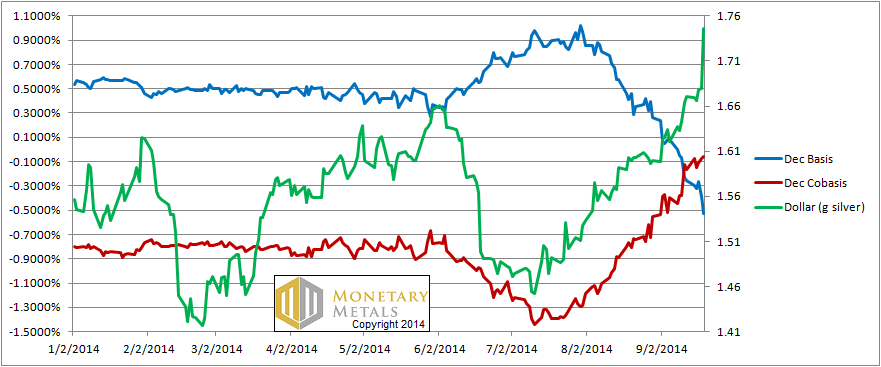

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The silver price dropped by 4.4% this week. It has been steadily dropping since the second week of July, but this week did some damage to those who trade based on those analysts (you know who) with their $50 and $250 price targets. These losses will be especially painful for traders who bought silver with leverage.

Meanwhile, the cobasis rose a few points, but nothing in proportion to the drop in price. A lot of silver metal was sold onto the bid on Friday.

Our view is that the silver fundamentals are firming up, but there is no reason why the silver price couldn’t overshoot to the downside. It had spent a long time in the other direction, several dollars overpriced. So why couldn’t it now become proportionally underpriced? We were mocked when we said that silver should have a 17 handle, and 13 was possible.

Could $13 happen next? What would it take to bring this about? In our opinion, it is possible though we would not short silver here or otherwise try to bet on it. If it happens, it will be due to the perfect storm of the permabull analysts having lost their credibility, and hence indiscriminate liquidations. In other words, this would be a final capitulation. If capitulation happens into the next wave of credit crunch, the dollar could rise much higher in silver terms.

This next week will be critical, not just the price action but the behavior of the metal’s abundance and scarcity indictors, i.e. basis and cobasis.

© 2014 Monetary Metals

That metal is looking as heavy and unattractive as an unwashed farm girl at a barn dance

I understand your analysis of ‘the market’ but how do we differentiate between the paper metal market and the metal metal market?

The paper market has the greatest influence right now but won’t the paper market lose that influence pretty soon?

Does your analysis allow a view into this relationship?

Isn’t the current state of affairs manipulated by the paper market to allow cheaper purchase of metal?