Monetary Metals Supply and Demand Report: 26 Jan, 2014

This week, the price of gold rose $16 but the price of silver fell 39 cents. The catalyst for higher prices was early on Thursday morning (west coast USA time), when the euro and yen rose and to a less extent other assets like crude oil. Credit poured forth somewhere, or a sudden fear of dollar devaluation occurred, or something. It changed nothing, read on…

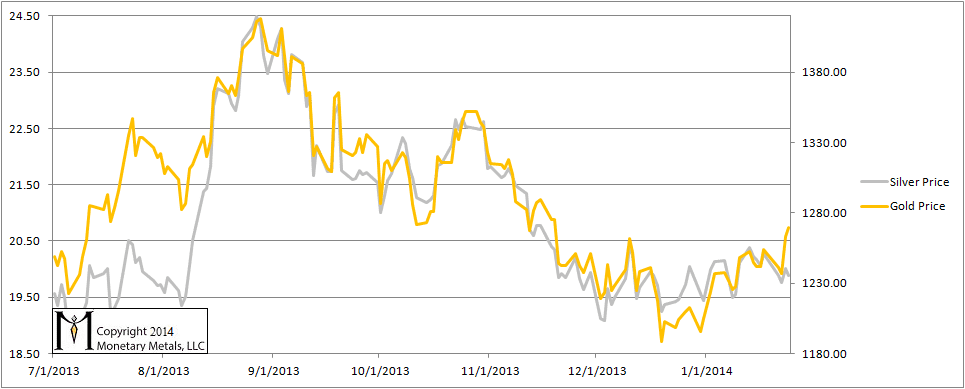

Here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

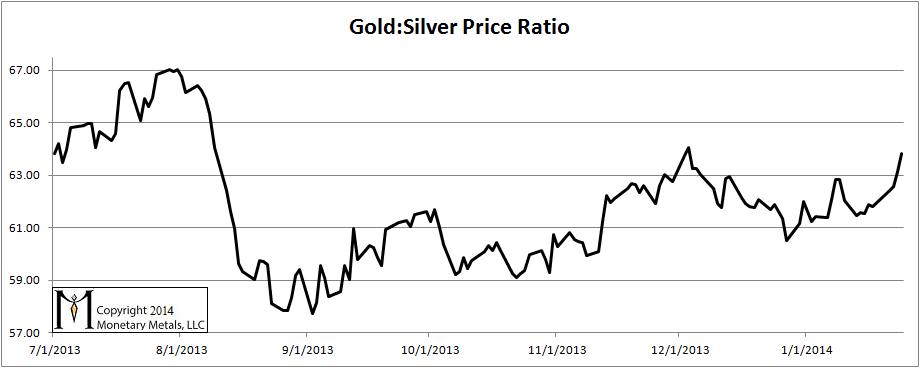

Here is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose sharply this week—3 ¼ percent. The ratio rose every day this week.

The Ratio of the Gold Price to the Silver Price

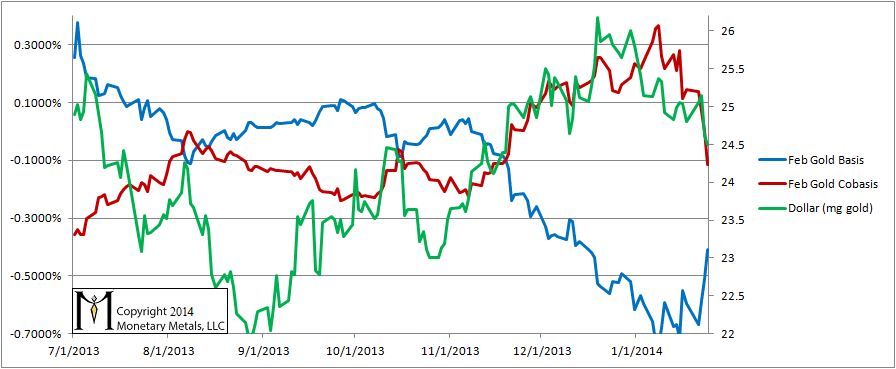

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

It’s immediately obvious that the cobasis is falling with the dollar. That is, as the gold price rises (inverse to the dollar) gold is becoming more available to the market. It’s still speculators driving things; a fundamental move would look different.

Despite this being the February contract mere days away from First Notice Day, and what we know is the new “normal”—the inexorable pull towards temporary backwardation—we see a falling cobasis. There are now no gold contract months in backwardation.

Keep this in mind the next time you read about massive demand for physical metal. At this price under this particular market, either more supply of gold bars is coming to market or demand is subsiding. It’s not huge. We’re talking about small changes to a very sensitive indicator. And yet the fact is no gold backwardation at the moment, not even in the contract that is quickly headed off the board.

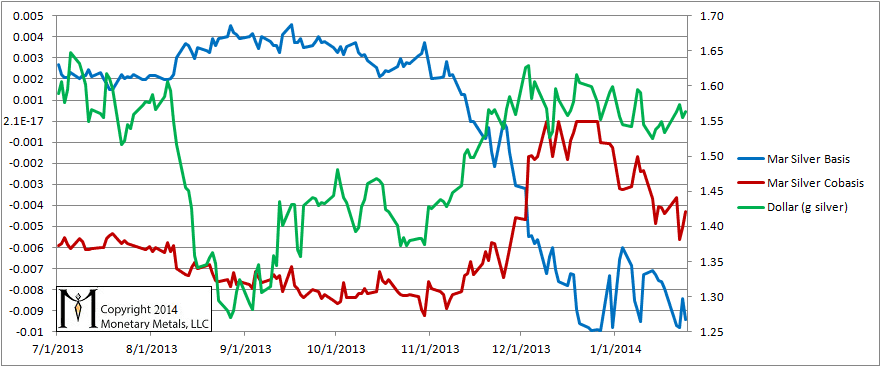

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The dollar price measured in silver went sideways this week, and so did the silver cobasis—far away from backwardation.

Many peripheral currencies appear to be in serious decline right now, if not outright collapsing like the Venezuelan bolivar. If this continues, it likely signals a major credit contraction the likes of which the world hasn’t seen in several years. That is not a time to own risk-on assets, silver included. Even without that, under current conditions our neutral price for silver is well under $19.

With gold and silver, stocks to flows is measured in decades. – silver stock is NOT measured in decades

It’s immediately obvious that the cobasis is falling with the dollar. That is, as the gold price rises (inverse to the dollar) gold is becoming more available to the market. ————————————– Totally wrong. Paper gold contract in Comex is more available, not physical gold

You should do more research on SGE, not Comex , Coemx is broken, Almost all senior gold traders knew it.

Hello Keith,

If I understand correctly you are measuring the spread between the bid/ask in the futures markets. However investing in futures markets is betting on a trend in gold prices and not in the physical stuff itself. Should you not measure the bid/ask spread in the actual physical market in order to be able to draw valid conclusions?

Regards,

Henk Thijssen

Hello Keith,

can you please provide a definition of the term ‘neutral price’ ?

Thanks for your comments.

Rabobank: Silver stocks are indeed measured in decades. Crude and other commodities are measured in months. Your comment about how COMEX is “broken” and all senior traders “know” it is one reason why I write what I write. It passes for Accepted Knowledge on the Internet that the COMEX price is suppressed, divorced from the price of “phyzz”, etc. But the truth is that the COMEX price is within a few pennies of the price of “phyzz”. When the COMEX price rises relative to the price of “phyzz” that tells us something.

Henk: I am measuring the difference between the bid in the futures market and the ask in the spot market, and also the bid in the spot market and the ask in the futures. It is not a measurement of price trend.

Kieth you mention that permanent gold backwardation will be reality before the dollar finally collapses.

But obviously many thing will occur before we get to that point. Could you share some thoughts

about what will most likely occur between now and then so people can get a sense

that things are unfolding according to your ideas. For instance you mention Capital controls

in one of your articles and how free speech in America is eroding. Obliviously not pleasant

subjects but people buy metals out of fear and thereby must be addressed

Hi cj,

I would start with When Gold Backwardation Becomes Permanent, Using Gold Bonds to Avert Financial Armageddon, Theory of Interest and Prices (6 parts plus one more), and Dollar Backwardation. Oh I’d add what I wrote about Cyprus about 10 months ago…

I am reviewing all these articles now but for now do you see any scenario

where gold and silver could go into full backwardation overnight.

Also does your gold backwardation article refer to silver equally.

at current prices many silver miners are loosing money

Many thanks

cj

Keith:

Please advise where I can find the articles of yours mentioned in your reply to cj, above.

Thanks

Crissman

cj: Overnight? I would doubt it, but maybe. Yes, silver also.

crissman: either this site or keithweinereconomics.com.

Keith, I am puzzled by this:

“If this continues, it likely signals a major credit contraction the likes of which the world hasn’t seen in several years. That is not a time to own risk-on assets, silver included.”

You seem to be suggesting that this is not a time for owning the metals. Perhaps you might want to elaborate on that, because it sure strikes me as eminently implausible, especially given the growing threat of counterparty defaults. Cyprus style bail-in legislation is being enacted, for example, in more and more countries around the world, and I would not be surprised to see savings in bank accounts being looted in coming months and years.

Having one’s savings in cash in the bank, it seems to me, is becoming more risky than holding silver in one’s own hand. Way, way, way more risky, in fact. That’s how I see it anyhow.

Oh, and a follow up question would be this:

How much warning would one get about a “bank holiday” by watching your preferred indicators, the basis and the co-basis?

cbarton: I am always a big fan of owning gold and silver.

But if one is trying to trade the metals for profits in the form of more dollars, well, that’s another story. Especially if one is using leverage. At the present, I am saying that the gold price could rise and the silver price could fall (it’s fallen 34 cents this report).

I don’t think the gold basis will necessarily give a warning for a single default (it didn’t, as I recall, for MF Global), nor a small country like Cyprus (I don’t recall it telegraphing this either). For something major, probably. It’s not magic and it does not have foresight or telepathy. It’s simply market participants refusing to take their metal to play in the markets, not even for a yield.

Ah, okay. Then, does that mean that you are following these indicators to find opportunities for going long on paper gold, such as buying shares in GLD, or buying and selling futures? If I recall it correctly, you advise against going short on monetary metals.

One more possibility comes to mind: Using your indicators to trade (buy and sell) physical. I am not sure if you would recommend doing this. Would you, and do you? The dealer margins here are considerable, so one would have to be rather patient trading physical metal, more of a long-term investor, rather than a trader, I would think.

And one more question: As a buy and hold saver, for example, would you use your indicators to select your entry points, as opposed to averaging in on a monthly or yearly basis with one’s savings?

Anyhow, it would be good if you could spell out for your readership the sorts of trades, or buying and selling opportunities you think your indicators are the most useful for, indicating especially if you have in mind physical and/or paper buying and selling. Thanks.

Keith – I’m currently not holding any precious metals. I’ve been watching your newsletter for a while to get an idea of when to start accumulating. Maybe that’s not the purpose of your newsletter, but I appreciate your commentaries very much and read most all of them. You’ve been right so far while most others seem to always say we’re at the bottom now, time to buy, etc. It took a while for me to understrand a lot of what you’re saying, but your commentaries are making more sense to me now. Thank you.

@ bvigorda – If I may offer an unsolicited opinion, my impression is that the greatest danger nowadays lies, not in getting the pricing right, but losing one’s capital altogether. WHERE you keep your savings is becoming the more critical question these days. For instance, if you keep them in a bank account, waiting for just the right time to buy some asset, you could lose access to it before you have made your move. I am not suggesting that one should forget about price risk, but counterparty risk is the first and greater risk that one must account for, in my view.