Monetary Metals Supply and Demand Report: 27 July, 2014

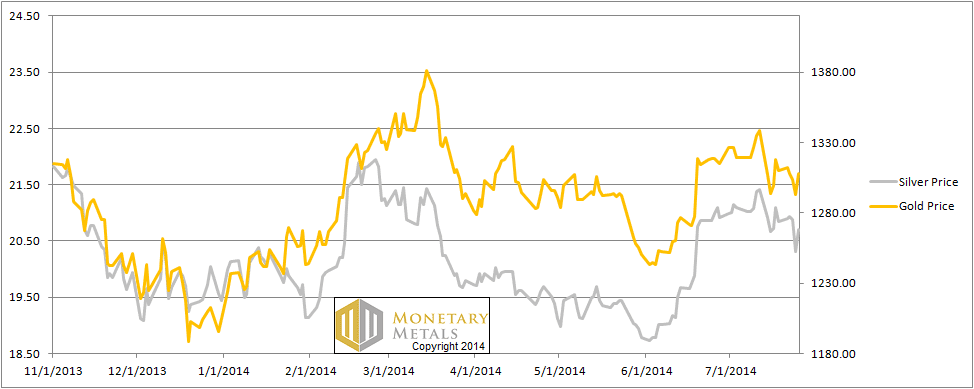

It was a quiet week, with a drop in the monetary metals’ prices on Thursday. There was a bounce back on Friday, with silver bouncing slightly but notably less.

We have some observations about the supply and demand fundamentals, so read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

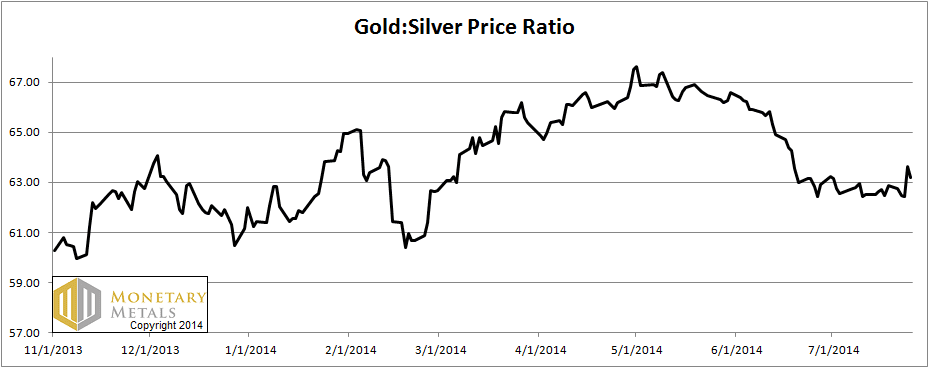

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up slightly this week.

The Ratio of the Gold Price to the Silver Price

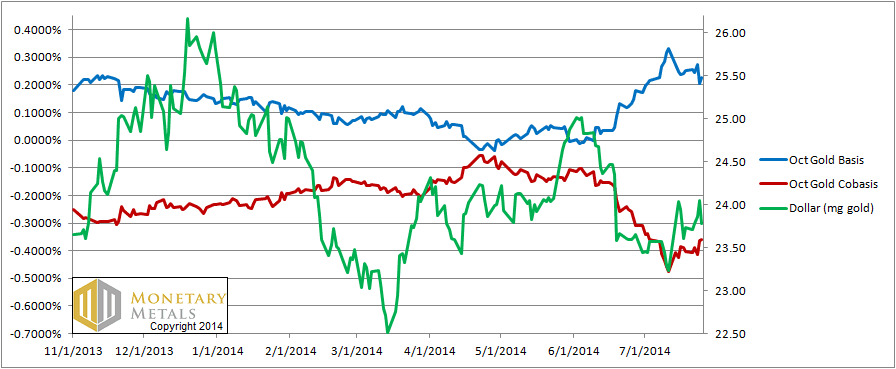

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The contract roll being nearly complete now, many speculators have sold their August contracts (and if they wished to remain long gold, they bought October or December contracts). Therefore, we have switched to showing the October bases.

As with last week looking at August, we see a strong correlation between the cobasis and the dollar price. In the October contract, the correlation begins at the beginning of June (In August the pattern emerged in mid-June).

As we noted last week, this means price moves are merely speculators shifting about. When they sell gold futures (i.e. the dollar goes higher, it becomes scarcer. When they buy gold futures (i.e. the dollar goes lower), gold becomes less scarce.

The speculators are trying to front-run hoarders, but so far hoarding demand is not materializing on cue. We saw one bullion dealer this week offering a sale on gold Eagles of $49 over spot, including insured shipping. We wonder if this is a loss, as it sure can’t be much of a profit. They must have extremely soft demand, and need to liquidate excess inventory, which costs money to finance and hedge. We spoke with another dealer who confirmed that demand is weak.

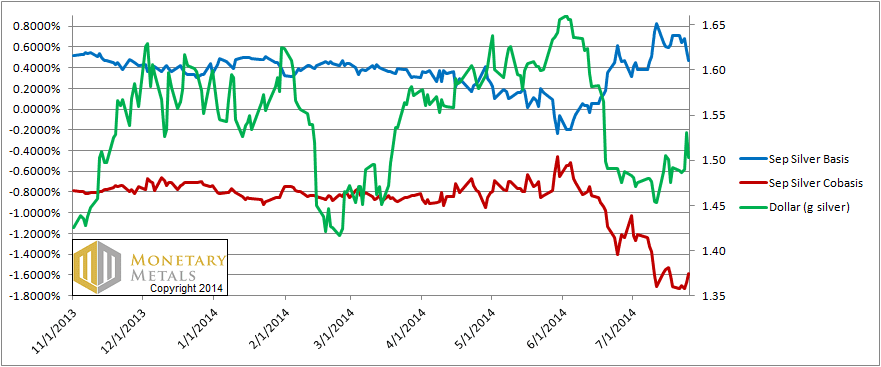

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the cobasis remains in the basement at -158 basis points (compare with gold at -36). The dollar rose in silver terms this week—i.e. the silver price fell—and the cobasis hardly bothered to rise.

Something curious happened in the silver price chart this week. We published graphs and discussion in a separate article, Like Dripping Silver Icicles.

© 2014 Monetary Metals

Leave a Reply

Want to join the discussion?Feel free to contribute!