Monetary Metals Supply and Demand Report: 28 Sep, 2014

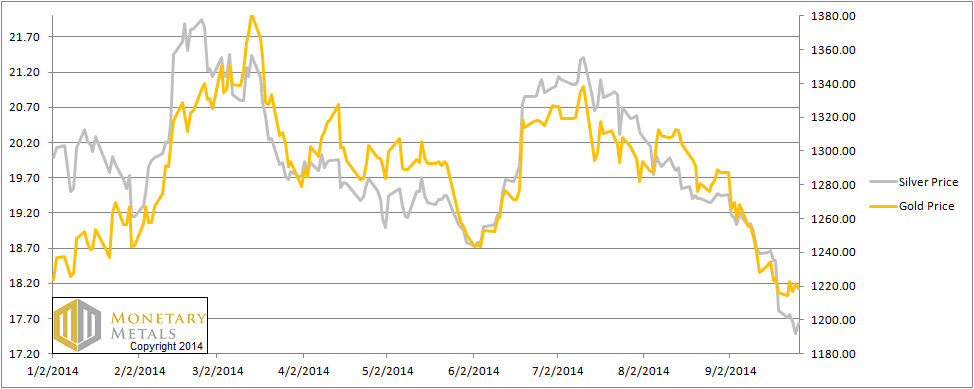

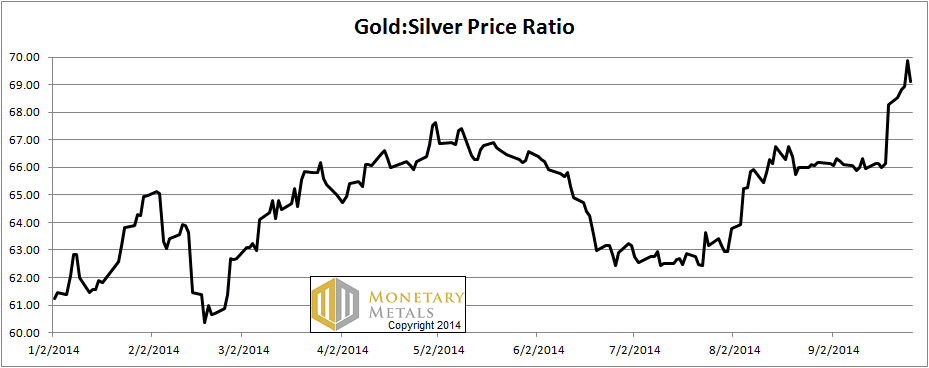

The price of silver, as measured in fiat dollars, fell this week despite a 15-cent rally on Friday. The gold price is up three bucks. The net result is that the gold to silver ratio rose higher. On Thursday, it almost kissed 70 from the underside. This is a new high going back to June 2010.

We have long predicted the ratio will hit 70 and maybe 80. So we will call our target “hit”. Is this it? Will the ratio reverse direction, and will silver begin to rise in gold terms (and dollar terms) again?

Read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio.

The Ratio of the Gold Price to the Silver Price

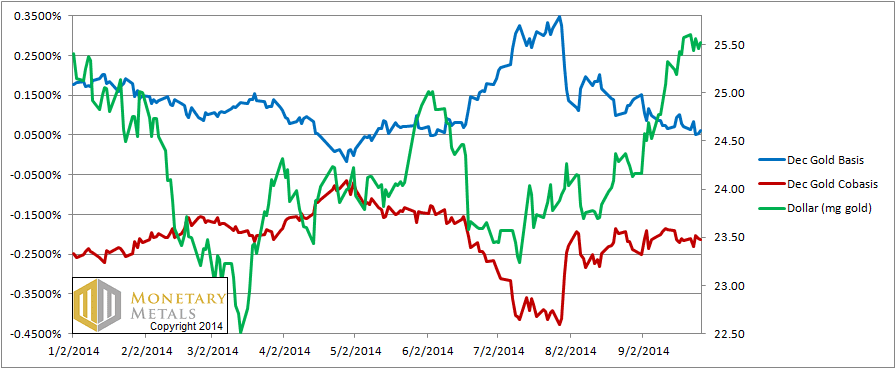

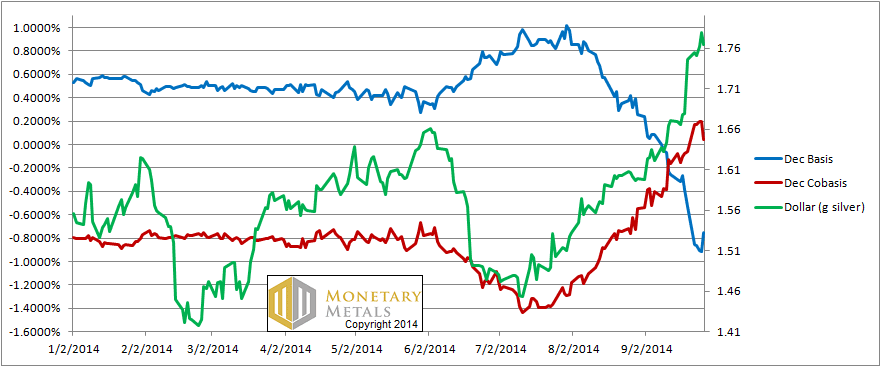

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

If one is looking for a sign that the dollar will resume its collapse (i.e. the gold price will rise) the cobasis may have given it this week, though it’s tiny. It rose a few points, while the price of gold rose $3.

The cobasis has been pretty much sideways for two months, while the dollar has risen sharply from 23.7mg gold to 25.5 as of Friday. Physical metal has come to market, notwithstanding the constant allegations of naked short selling of futures. Selling futures would push the cobasis up.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The silver price dropped a little further this week, 18 cents. But this time, the cobasis rose. In fact, it is just barely in backwardation. From -0.06%, it rose to +.04% this week. What’s interesting, and not particularly encouraging for those cheering for a dollar drop (i.e. silver price rise) is that the cobasis was up much higher Mon-Thu. It was +0.2% on Thursday and dropped to +.04% on Friday.

Was the buying on Friday heavily focused in the futures markets? The data is that the price moved up 15 cents and the cobasis plunged.

We are 18 cents closer to a bottom, which is to say .01 gram closer to a high in the dollar as measured in silver. This could be “it”, but if so the drop in the silver cobasis on Friday isn’t bolstering this view. Especially not a sharp “^” shaped turnaround in the dollar price (i.e. “v” shaped turnaround in the silver price).

The Gold Standard Institute Presents The Gold Standard: Both Good and Necessary, in Manhattan on Nov 1. You are cordially invited to join us for a discussion of ideas you won’t get anywhere else. The gold standard is the monetary system of the free market—of capitalism. Dr. Andy Bernstein, a rock star of the liberty movement, shows why capitalism is good. In my talk, I explain why capitalism is impossible with fiat money, and why we have not recovered from 2008, and we won’t without gold.

© 2014 Monetary Metals

Will Nov 1st be recorded or live streamed?

Not sure yet

Hey..Keith, thanks for all the updates on gold and silver.

Can I ask what you think of the inventory levels in the Shanghai futures exchange? There is a chart depicting lower inventories circulating on the internet.

http://srsroccoreport.com/shanghai-silver-stocks-continue-to-fall-as-silver-eagle-sales-explode-higher/shanghai-silver-stocks-continue-to-fall-as-silver-eagle-sales-explode-higher/