Monetary Metals Supply and Demand Report: 7 Dec, 2014

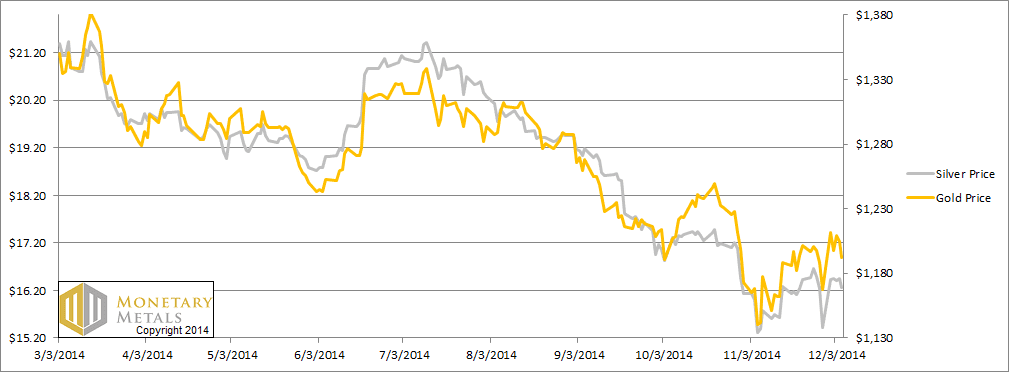

The price of gold went up $25, and silver 84 cents. But that’s not the main news in the gold market. A big reversal has occurred in the fundamentals of both metals. Few people know where to look, or would understand even if they saw it.

We have written before about the news cycle promoting an old story. The story is true at first, before much of the coverage and discussion. But by the time the majority of readers are trading on it, it may no longer be true. For example last year, we published Don’t Trade Last Week’s Silver Story.

It’s the same now in gold. Appropriately, we see the story of negative Gold Forward rates (GOFO is a rough proxy for backwardation) ricocheting around.

For a clear picture of supply and demand fundamentals, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

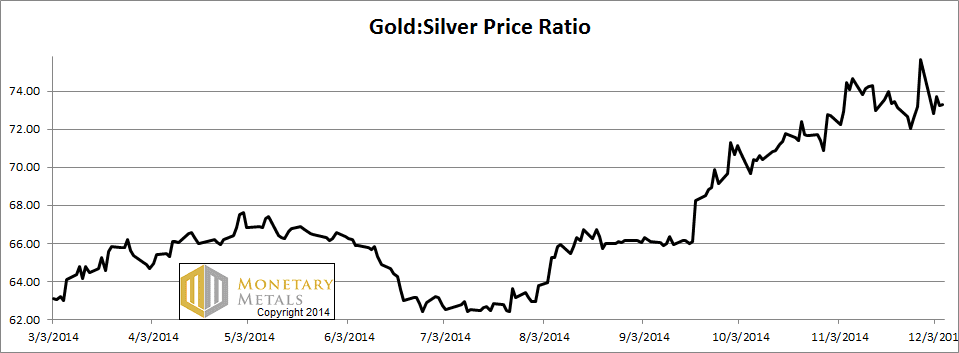

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell over 2 points this week.

The Ratio of the Gold Price to the Silver Price

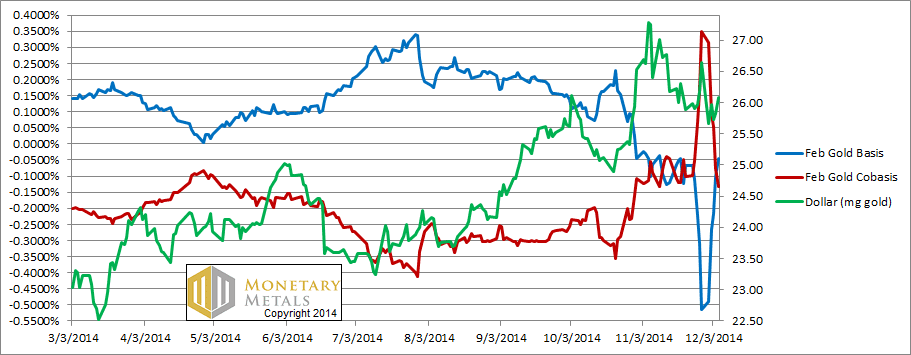

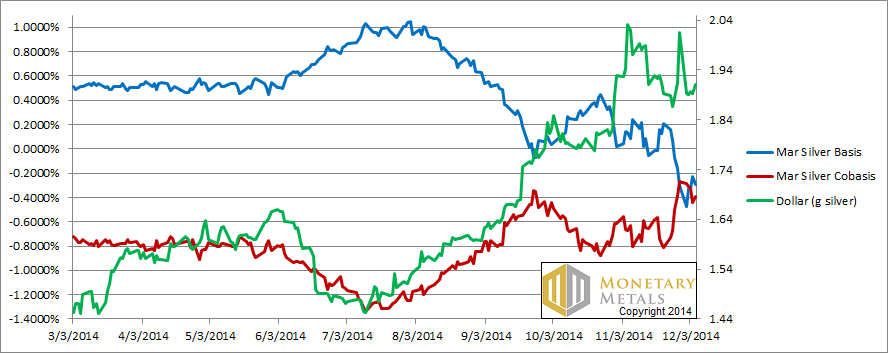

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

If last week, that skyrocketing red line cobasis line (i.e. scarcity) was a fireworks display, what’s the crash this week? It’s a downpour. The fireworks are hereby cancelled.

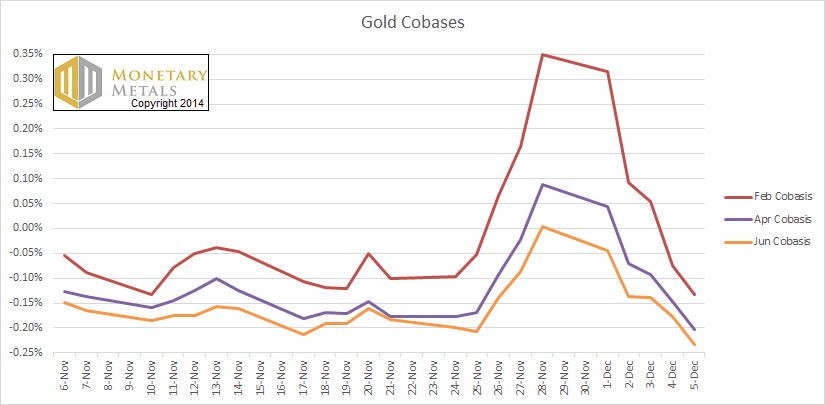

Someone did a lot of selling of metal bars, or else buying of paper contracts. Since the price is up, we assume it was buying of contracts. Scarcity in gold is down across all months. It’s not unique to February. Here’s a close up picture showing the cobases for the past month in three gold contracts.

You can see the massive spike in the cobasis from Nov 25 through 28 (Tue through Fri last week). Last week, we had backwardation in four contracts (Dec, Feb, Apr, and Jun). Right now, we have no backwardation in any contracts. That’s right, even Dec has a negative cobasis (and a rapidly rising, though still negative basis).

One explanation could be that central banks liquidated tons of gold, to correct the backwardation. However, that’s unlikely.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The movement of the March contract looks deceptively calm. The dollar fell a bit (i.e. the silver price rose a bit) and the cobasis (i.e. scarcity) fell with the price action. Looks just like typical speculators’ repositioning.

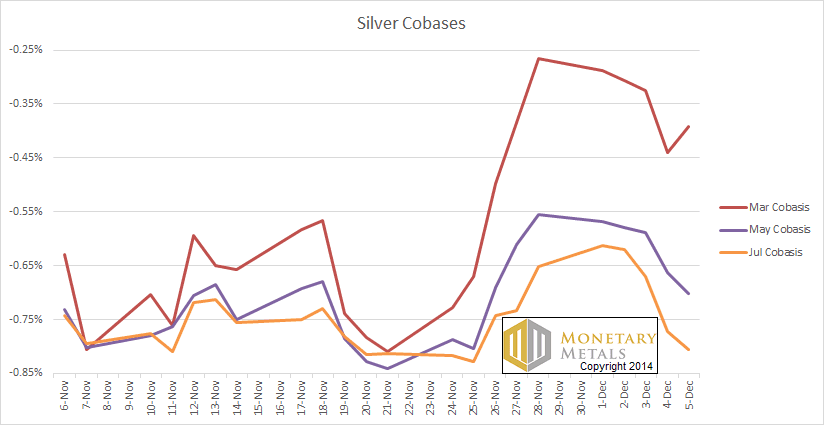

Let’s zoom in to the last month, as we did in gold.

The Mar contract doesn’t tell the full story. May and Jun are moving differently—they’re showing the same moves as in gold.

If the gold cobasis came down due to central bank sales of gold bars, then we need a different explanation for silver. Central banks don’t have any silver.

We are not enamored of this approach to the gold and silver prices. Manipulation is a dollar thinker’s complaint. He may say that the dollar will be worthless, that hyperinflation is coming soon. But really he buys gold or silver with the intent of selling. Precious metals are merely his preferred speculative vehicle. He wants profits—more of the dollars he earnestly says will be worthless.

When the price drops, he becomes frustrated. He says gold “went down”. As the dollar thinker reckons it, gold did go down. He measures the value of all things in dollars. This belies his claim that the dollar will collapse. You don’t use a collapsing currency to measure anything (as I am sure they did not in Zimbabwe and do not in Argentina and Venezuela today).

If you really believe that the dollar will collapse soon enough, then you are happy for lower prices because that affords you more opportunity to buy more gold before it becomes unavailable.

© 2014 Monetary Metals

I am amazed by the end of this article.

Most people say gold is down in dollars not because they want necessarly to hoard dollars in the future (some could) but because it means that with the same quantity of gold, they could be able to buy less farmland, factories, real estate, art works (all things being equal) and so on.

Using dollars to mesure relative prices at a determined time is just more convenient for a discussion.

RD: Then why not measure the price of farmland in terms of gold? Then they can complain when farmland goes up, or factories, art, etc.

Why ? Because we know that prices of other assets in fiat term have a much smaller volatility so that it is easier to compare at a determined time.

it is indeed a problem to mesure for example average house price in zurich in term of silver has it can experience a 100% rise in a few months…

Another thing is that I would not be surprised that in europe some transactions may be forbidden if not made in fiat, so you have to use this way of exchange even if for a small period of time, that’s a reason why measuring in fiat is more convenient.

If we find this Friday that short futures contracts were liquidated or longs increased in the COT report, then shouldn’t that effectively confirm that someone (central banks?) dumped gold on the marked to stamp out the backwardation?

Thanks,

Mark

Mark: COT can tell us how many contacts there are, but of course every contract has a long and a short. It cannot tell us if the short is naked or arbitraged. And the number of contracts does not necessarily change as a result of price action.

In any case, if the backwardation in gold was cured by central banks dumping metal, then how do we explain what happened in the silver market?

Keith, do you have a view if the carry trade on long Nikkei/short gold (that was described over at ZH last week)? Further can the exposure of this trade last week have anything with the reversal in cobasis to to? Could potentially explain the divergence in gold silver as well. Just a thougt.

Magnus

Thanks Keith,

As usual, a no nonsense, “just the facts” article.

I have been blown away by how people who were talking about backwardation and lease rates and kept saying “looky here” totally ignored it when the lease rates completely reversed.

Some of them who claim to be in the know still published gold bullish articles after the negative GOFO rates had completely evaporated. I really wonder how these hypocrites who keep asking for a higher standard and who keep claiming manipulation can look at themselves in the mirror.

I consider myself a goldbug and believe in the long term prospects of gold but these kind of people are just yanking people around and aren’t doing me any favors.