Monetary Metals Supply and Demand Report: 8 Feb, 2015

The price of gold dropped about $50, and the price of silver fell about 50 cents. Is this just random market jitter, or the great breakdown?

Wait. Great breakdown?

Yes, many respected mainstream names think gold should be at most a few hundred dollars, especially given the collapse in the other commodities. Some non-mainstream names like Bob Prechter and Harry Dent also think gold will hit a price like that, though for different reasons (or they did, last I checked).

Regular readers know that we steadfastly insist that one cannot use the elastic dollar to measure gold, but the other way around. We should not think that gold is worth $1,234. We should think of the dollar as being worth 25.2mg gold.

This was driven home on Wednesday. Keith gave testimony before the Arizona House Federalism and States’ Rights Committee in support of HB2173. The bill recognizes gold and silver as legal tender money, and eliminates taxes on them. One of the objections to the bill, from Democrat Rebecca Rios, was that we pay capital gains tax when other assets go up so why should gold be exempt? She saw the bill, not as a way to move forward to the gold standard but as a ploy by special interest group seeking legislative advantage.

If it’s true that gold goes up and down, if it’s true that the dollar is the proper measure of the worth of gold, then she has a good point.

When fans of gold speak of gold going up and down, they are unwittingly supporting this view.

For an updated look at the supply and demand fundamentals in the gold and silver markets, read on…

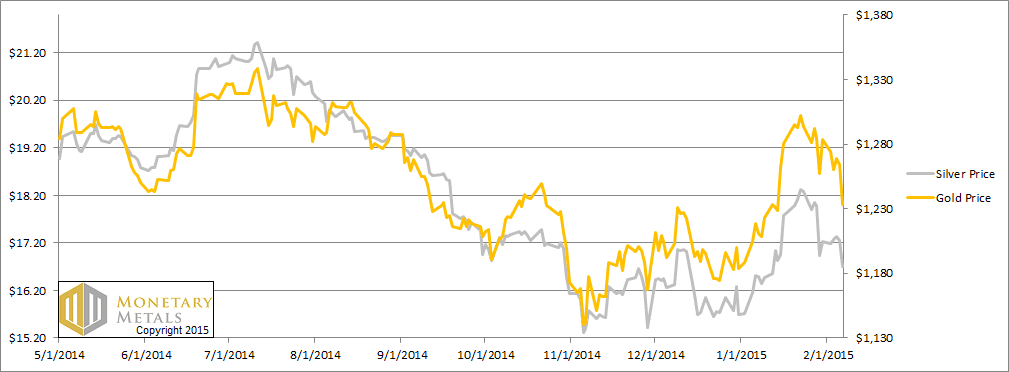

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

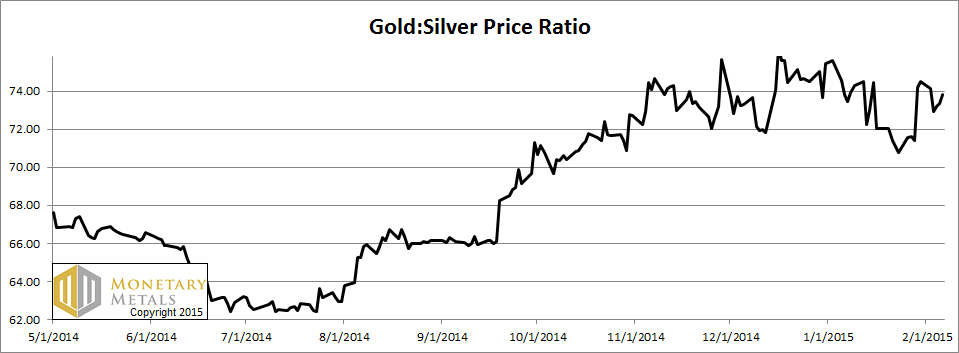

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved down a bit.

The Ratio of the Gold Price to the Silver Price

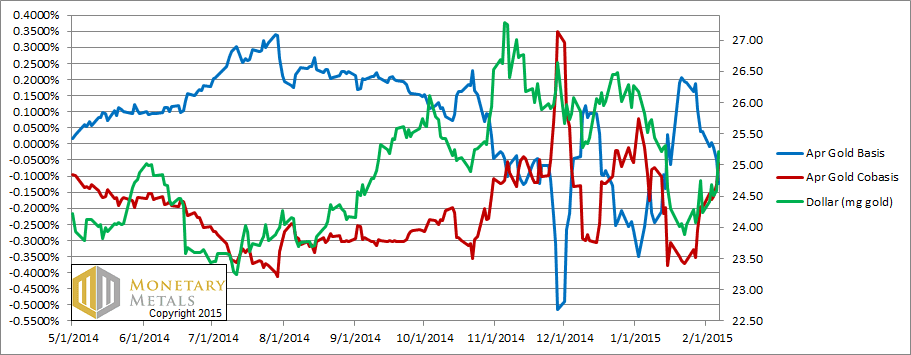

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar is up about a milligram of gold this week. Along with it, the cobasis (i.e. scarcity) is up. It is now a finger’s width away from backwardation (i.e. greater than zero).

Our calculated fundamental price for gold didn’t move much from last week. It’s still considerably over the market price.

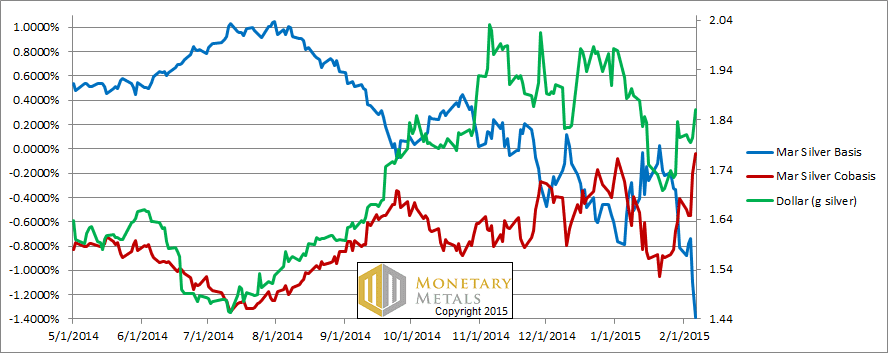

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The dollar went up about 50mg silver (i.e. the silver price fell). And, as with gold, the cobasis rose sharply. Like the April gold cobasis, the March silver cobasis is near backwardation. Unlike April gold, March silver is close to First Notice Day, and there is now already selling pressure in the March contract. The cobasis generally rises for every contract as it gets this close. So this move is expected in the post-2008 new normal. How can we put it in context?

The cobasis for every contract farther than March fell this week.

We will skip the fantasy characters like Gandalf and Dumbledore this week, and just say it in our own words.

We calculate a fundamental silver price about $2.50 under the current market price. We never recommend taking a naked short position in a monetary metal. You never know what some crazy central bank may do while you are sleeping. At the same time, be careful about putting capital in harm’s way betting on a rise in the silver price. Now is not a good time.

© 2015 Monetary Metals

Here in Europe, they decide the euro was legal tender. All amounts are calculated in euro equivalent even when you are doing a swap in assets where no money (euros) in involved or that it is FX transaction : they gave day to day official parities.

And if you “win” in euros even that is an illusion, you have to pay, they do not care that is the euros which is moving : why because if not they could not collect money, that is just as simple as that !

My first thought about the legislator in Arizona is ‘false education causes false opinions’.

Education is coming soon although at first the wrong asset will be blamed until there is a little time for the education so soak in.

It’s interesting that you mention Harry Dent. I have a few friends that follow him and are convinced the US dollar will strengthen in gold terms long term (years). I certainly see the possibility of a short term change, but that would bring on defaults and bankruptcies in the banking system, similar to 2008. Thank you for keeping us up to date on the basis data because it will provide an early warning signal for such events.

First the politicians are electable only by promising more handouts than tax revenues permit. Then they increase taxes, but it is still not enough. So, they ask the CB to print money. This destroys the value of my savings. I respond by converting paper money into real money. Then they have the wickedness to call the relative debasement of paper currency against my gold as a taxable profit! It is infuriating. STUSTEV is absolutely correct. The source of these problems is not the politicians, it is ignorant voters. They have unwittingly been indoctrinated since preschool with socialist and PC propaganda. In a constant state of media-saturated fear, they think money printing and big government is good for them. This is not going to change. The subprime crisis didn’t even make a ripple in the matrix.

~”One of the objections to the bill, from Democrat Rebecca Rios, was that we pay capital gains tax when other assets go up so why should gold be exempt? She saw the bill, not as a way to move forward to the gold standard but as a ploy by special interest group seeking legislative advantage.”~

What was that old Laurel and Hardy bit?

“You can lead a horse to water but a pencil has to be lead.”

Kind of sums up Miz Rios. You can teach them but you can’t make them think. Though you should be fair and send her a copy of your 2015 monetary outlook. If she doesn’t “get it” after that then just give up. That truly is the finest dissertation I’ve ever seen on money.

Lastly, for some good ol’ gold porn:

http://www.marketwatch.com/story/chinese-herdsman-stumbles-onto-a-17-pound-gold-nugget-2015-02-05

Now there’s a fistful of money if I’ve ever seen it.