Monetary Metals Supply and Demand Report: 8 Sep, 2013

Welcome, we have a new name and a new format to reflect that this is fundamentally about looking at supply and demand in the gold and silver markets. For an introduction and guide to the concepts and theory, click here.

The gold price was flat, and silver was down slightly. Is the long-awaited, much-discussed silver breakout still on? We don’t think so.

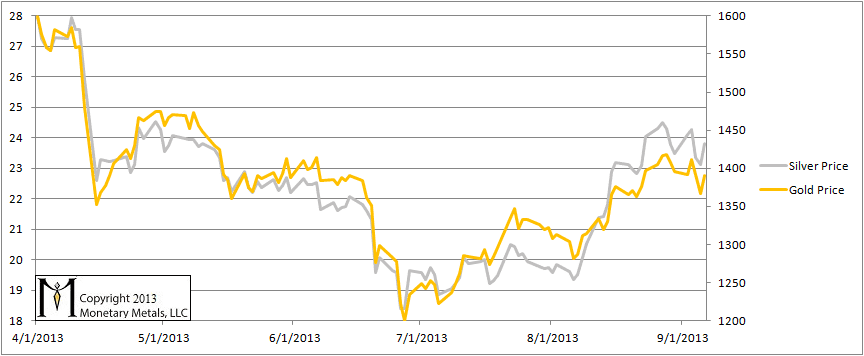

The Prices of Gold and Silver

For each metal, we will show a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary.

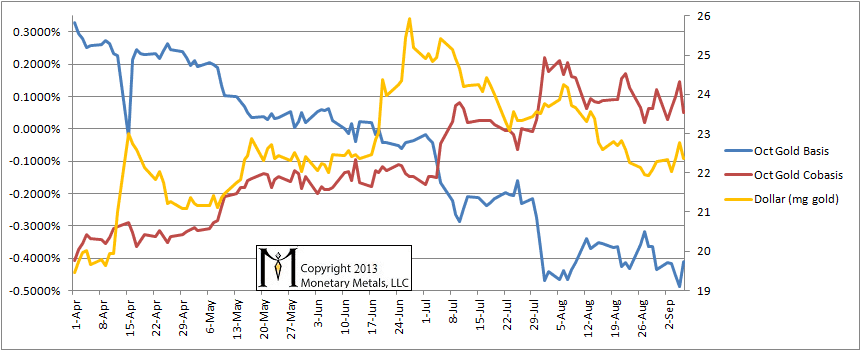

Here is gold.

The Gold Basis and Cobasis and the Dollar Price

The cobasis has been moving sideways since early August. What’s interesting is that the price of the dollar measured in gold has been falling (i.e. gold has been “going up”). The sideways cobasis, which is just ever so slightly in backwardation, shows that demand for real metal is holding strong, relative to futures.

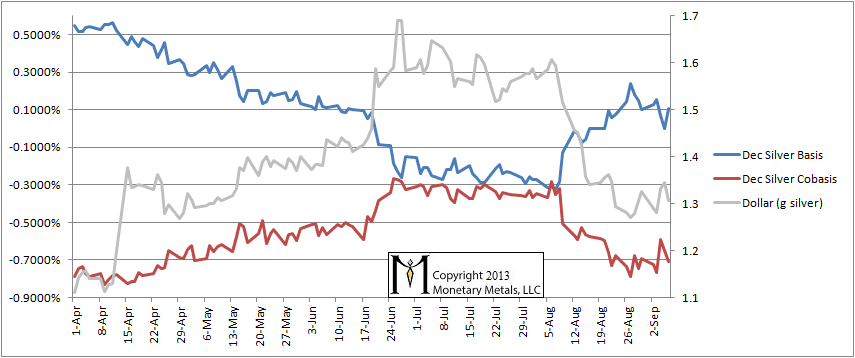

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The cobasis has been falling, but the dollar price has not. Silver does not have strong demand fundamentals at this time, and we see a very negative cobasis and indeed the basis is positive. Silver, unlike gold, is in contango. This does not mean that its price could not go higher. We never recommend naked shorting a monetary metal.

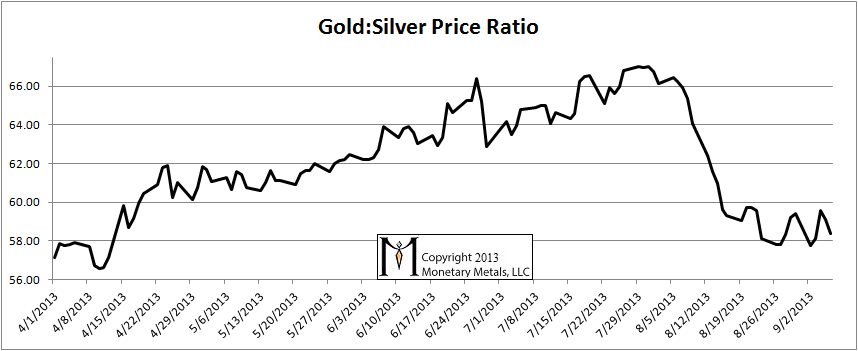

The Ratio of the Gold Price to the Silver Price

While anything could happen in the short term, we think this ratio has likely put in its low and will be heading upwards again, perhaps to break through its high of late July.

Thank you for your excellent commentaries. I like learning from you very much.

Is it possible that with so much gold held by the investment community in the form of paper – ie ETF’s that the traditional basis relationship (ie gold always in contango) has changed? What if, as seems possible this year, the investment community has begun to relinquish it’s large paper gold position as the market believes that the debt deleveraging of the last 5 years is gradually subsiding. This would explain the marked turnaround in bond yields which in turn have significantly reduced the degree of negative real interest rates (a key gold fundamental). Were this to be the case, then heavy forward selling of gold would ensue (since this is where the long investment position lies) and in the process overwhelm the gold spot market and drive the gold basis, counterintuitively, into backwardation. If this is the case, then the recent back may not be a bullish signal at all.

Hi,

I carefully read some of your articles, and I want give you some comments:

1) the world, the market are not just simple as to use a single number to predict, if it is simple, no one can make profit, or there will be no market

2) you theory has some flew points, some are fatal: investment buying is also demand (especially in Silver, which also has industrial demand). it will effect your basis itself. You must understand, even if Silver is abundant (as you say: Basis is positive and up), investment can suddenly absorb entire supplies. sentiment and demand interact each other, or say, supply/demand will affect itself.

3) you say JP morgan is not manipulating market. I totally not agree. PIC in JPM will leave probably this year, DOJ are investigating, and JPM already sued by lots of consumers in other commodity market, if you don’t know, you should check Bloomberg, check CNPC or Reuters, evidence is here. they are honored especially in Gold/Silver market and remain crime in all other market?

4) if you check daily delivery report or daily trading records there are numerous evidence that JPM is manipulating and make numbers/charts you read. from Feb to June, JPM issued around 92% of total COMEX gold delivery from his in house account and his customers account, it is obviously not you called “Free market”

5) no one store silver, there are not plenty of silver in Central banks or governments.

today’s news from WSJ:

Fed seen limiting banks’ commodities operations. The Federal Reserve is expected to soon publish guidelines that would restrict banks’ involvement in physical-commodities businesses. The new rules, which would be designed to limit banks’ risky activities, could accelerate the withdrawal of JPMorgan (JPM), Morgan Stanley (MS) and Goldman Sachs (GS) from sectors such as metals warehousing and power generation, where GS and JPM respectively have been accused of price manipulation.