I’m interested in learning more

The fed won’t quit, and neither should you!

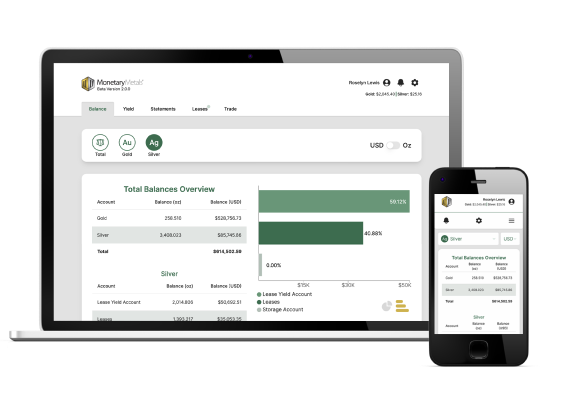

Monetary Metals offers you the ability to earn regular monthly interest income on gold and silver by leasing precious metals to qualified businesses in the industry.

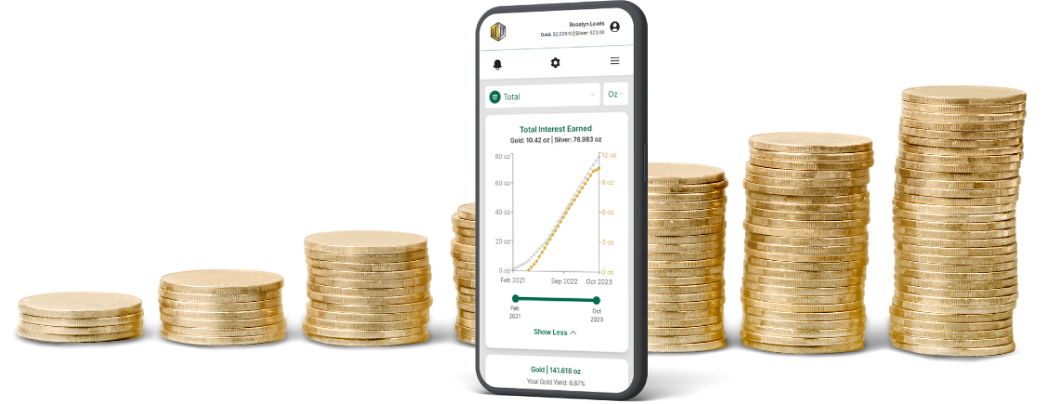

With Monetary Metals you can get paid in physical ounces of metal. Watch your total ounces grow and compound year after year without worrying about the Fed’s interest rate policy or currency debasement.

It’s an honest return, on honest money.

Serious about building and protecting your wealth?

Fill out the form to receive a free report with everything you need to know about how to start earning a Yield on Gold, Paid in Gold®

PhD economist

Would you rather earn in dollars or in gold? The answer is obvious.

Monetary Metals is providing an alternative to the dollar by paying a yield on gold, paid in gold.

Now you can own an income-generating asset that the Federal Reserve can’t debase.

Testimonials

See what our clients say

Real comments from real people who have started

earning interest with Monetary Metals.

The testimonials presented on this page have been provided by actual clients of Monetary Metals without compensation. Testimonials have been edited to remove personally identifiable information and for brevity. Testimonials were not selected based on objective or random criteria. The uncompensated testimonials presented here may not be representative of other investors' experiences, and there is no guarantee you will experience future performance or success consistent with the testimonials presented.

Complete your account set up in less than 15 minutes. We work with clients in the United States, and all over the world.

Purchase gold from us or send in metal you already own (bullion products only). Our purchase fees are below 1% for gold and silver. And we offer FREE shipping and insurance for any metal you send to fund your account.

Choose which leases or bonds you want to participate in. You can opt-out of any opportunity, and you can withdraw your metal at any time. Actively manage your account, or set it and forget. It’s your metal. You’re in control.

You work hard for your metal, now it’s time your metal works hard for you. Day or night, 24/7, 365, your metal is earning you interest without you having to lift a finger. The only thing that’s better than compound interest, is compound interest in gold and silver!

Ready to get started? Open your account today!

How to open an account

Opening an account is a simple process and can be completed online in as little as 10 minutes.