Open Letter to the Banks

Jamie Dimon, JP Morgan Chase

Brian T. Moynihan, Bank of America

Michael Corbat, Citigroup

Gentlemen:

On Friday, I attended a digital money summit at the Consumer Electronics Show. I am writing to you to warn you about the disruption that is about to occur in banking. There are many startups (and larger companies too) that are gunning for you. Perhaps you have watched what Uber has done to the taxi business? Well, these guys are planning the same thing for the banking business.

Banks used to allow even a child with a $10 deposit to spread his risk across a large portfolio of loans. At the same time, banks made it possible for a corporate borrower to raise $10,000,000 from a large group of depositors. In short, the banking business is investment aggregation and risk management.

That business cannot be disrupted. The bigger it gets, the more difficult to displace. It’s like eBay, all the depositors come to the bank because that’s where they can earn interest. All the borrowers come, because that’s where they can get the money they need. The bigger the bank gets, at least in a free market under the gold standard, the safer it is for depositors.

Today, however, you are quite vulnerable to disruption. That’s because you are not really in the banking business any more.

Over three decades, you have worked with the Federal Reserve to eliminate interest. The end result is that you now offer depositors a return-free risk. Depositors cannot earn interest in a bank account (yes, I know that in the US the yield is technically not zero yet, but it’s getting there). However, a growing number are aware of the risks. For example, you have incalculable exposure to derivatives. You own sovereign debt which the world now knows is not risk-free. In fact, you have a large staff and churn through a lot of activity in order to deliver scant yield to your depositors.

I can tell you what I observed in the digital money program. People, especially Millennials, now think of banking in terms of features like ATMs, payment clearing, fraud prevention, and point of sale solutions. However, these are just add-on services, not the core of banking. You have abandoned that core, and only the add-ons remain.

Startups can take these businesses. They have lower costs. They are more focused. They have hip new brands, untainted by the financial crisis and the bailouts. They have developed an array of new technologies. And, of course, they are less regulated (before you think to lobby to impose more regulation on them, think about that taint to your brand).

You’re in a tight spot. After decades of smoking the drug known as falling interest, you’re now dependent on it. The thought of a return to a 5% yield on the 10-year Treasury is not pleasant. Nevertheless, I urge you to think about it. The alternative is to let the fintech disruptors carve up your retail business.

Sincerely,

Keith Weiner, PhD

The Gold Standard Institute

——–

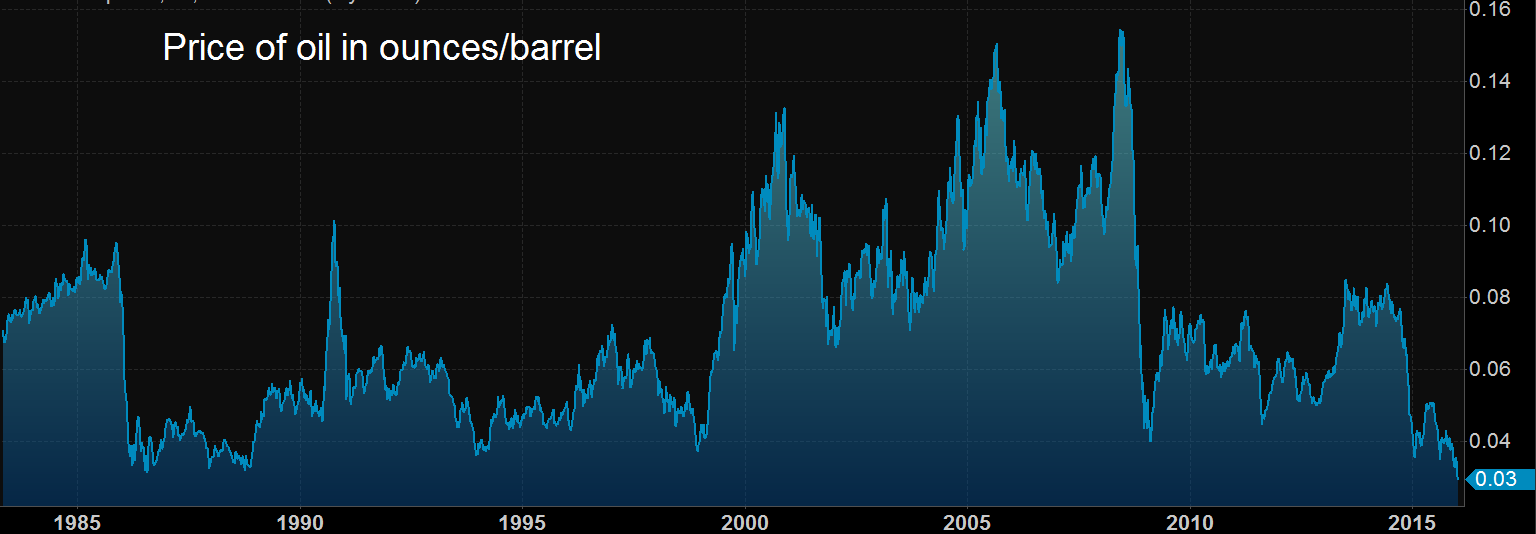

We published this here, because it is germane to the Monetary Metals vision: it should be possible to earn a yield on one’s savings. The virtue of the gold standard is not that prices are fixed. That is neither possible nor desirable (see the price of crude oil, measured in ounces per barrel below). Its virtue is the stable interest rate. In paper, the rate of interest is unhinged, and has been in a slow motion descent into the black hole of zero (and apparently, once you get to the singularity in the center there is a wormhole that takes you to the dark matter universe of negative interest).

With payments being made on their deposits with the Fed (and record profits thanks to the US taxpayer) I’m sure your message came at a good time. Jamie Dimon must be shaking in his boots.

Another way Dimon wants to make money:

http://screencast.com/t/5cHq4Root

I am 79 years old and I have been in the finance business for 40 years and a Stock-Broker for 28 of those years

Before the Banks bought all of the private Brokerage houses here in Montreal everything was fine and the average investors had a real good choice of “help” for their investments.

Now the investors have to deal with the worst “GAMBLERS” that exist.

Elite bankers are no different than other elites down through the ages. New ways of doing business and new technology tend to blindside established business.

Just like your ATM illustration; older small loan processing is gone. Thirty or more years ago small pre-payday loans made banks a lot of money. ATMs have taken that bank income away to never return. Store Cash Cards appear to be impacting bank profits too. The elite bankers better watch out for the next onslaught.

Speaking of bankers (some good, some not) the biggest banker in the country, Janet Yellen, already mentioned going into that dark-‘negative-interest-rate’-matter universe in 2015.

Will she be persuaded not to… by good reason… or sound morals?

Of course not. The central bankers’ loyalties lie elsewhere. Don’t believe for a minute their intentions are “misguided” or some other lame excuse. They print money for crying out loud! The only thing they do is confiscate wealth. Oh, I suppose they also manipulate the most important price in the world… the price of money, and cause all sorts of distortion that way.

Speaking of distortions, where should those interest rates really be? I don’t know myself. But I DO know we can barely pay the interest on the national debt by rolling over short term debt at 2% – 3%. That means there is NO WAY rates can go back up in any meaningful way… not until everything has collapsed. All this talk of rates going back up is just that… talk. They won’t raise rates again unless they want a crash. (Actually, looking at the stock market they’re off to a good start already)

I believe 2016 is the year a widespread contraction begins. The next Great Depression is a definite possibility. So stay safe everyone… this is not the year to take chances.

Dear Keith I’m afraid your words will fall on deaf ears. You are dealing with ‘human nature’ and as such it follows a well defined path in all things. The people with psychopathic tendencies and a heightened sense of greed will always rise to the top in any field you care to shake a stick at. The reason for this is ‘ambition’ in the sense that they have a burning need to be ‘on top’ and have ‘the most’. Most people are happy to rub along with each other and follow the idea of ‘give and take’. In the financial world these psychopaths eventually have more money than they can possibly spend in several lifetimes but they are unable to help themselves (even if the rest of the population dies of starvation around them). Eventually they are the authors of their own destruction and the whole system collapses. Then the cycle starts again. The only thing the average person can do is to protect themselves as much as possible and try to live a happy life. Gold is a very good protection.

Keith,

I fear your words are not falling on deaf ears at all.

Consider the evolution from PGP-phone (encrypted VoIP circa 1997-8) to skype (peer-to-peer, encrypted VoIP) to MSFT subsidiary Skype under your Microsoft account where they keep your private key safe for you on their server. Hegemons have a habit of adapting to their prey.

In the case of cyptocurrencies they’ve been on this case since the dawn of eCash systems (and I was reading papers about this by Israeli computer scientists back in the ’80s). Arguably bitcoin comes from the same parent organization as TOR onion routing, and if you read Snowden’s story from day 1, he’d been stationed in Hawaii (fiber cable capital of the Pacific), running “TOR servers” (note the plural, very very significant point!). for the NSA. Like TOR the game is to become the monopolist on the block, and in the mean time to keep the black market open to big players, because there is a lot of off-the-books money in the military industrial complex.