Partial Silver Crash, Report 9 October, 2016

On 18 September we said, “the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings).” Since then, we have warned every week that the fundamentals of silver were lousy.

Last week we said, “Buying silver right now—at least if you’re buying it on speculation of a price gain—is almost the textbook definition of a Ponzi scheme.”

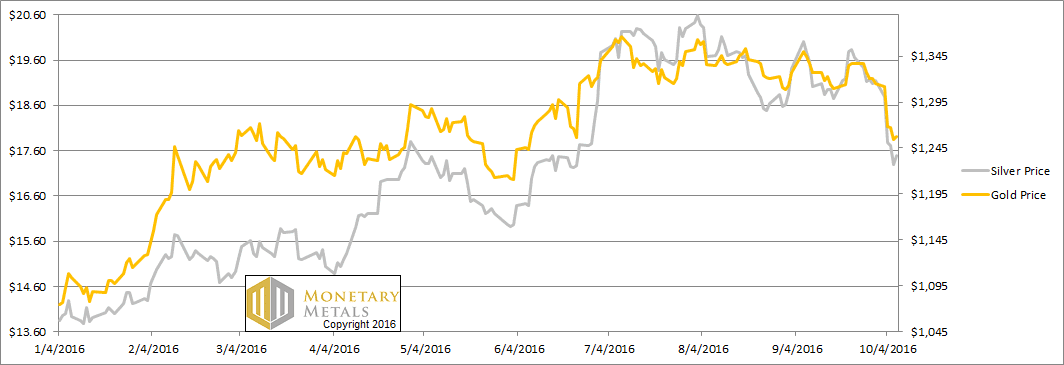

Part of the crash we predicted occurred this week. The price was $19.15 at the end of last week, but fell to a low of $17.11 before dead-cat bouncing a bit to $17.50. The drop of over $2 is almost 11%.

Wait… part of the crash?!

Yes. Last week, we said the fundamentals of silver would put its price at just over $16. Even after the crash this week, it’s still almost a buck fifty over that level.

We haven’t written anything about the persistent manipulation conspiracy theories in a long time. However, now that the prices of the metals have dropped for “no reason” (we have been discussing the reason week after week in this Report), the conspiracy theorists are out in full force. They assert that manipulation is “obvious”. In addition to our caution about putting your money in harm’s way based on trust in permabulls, we would add something else.

Australia has a great word. A spruiker is a showy salesman, a huckster, a pitchman, who touts his product.

The gold and silver spruiker has a simple modus operandi. He touts buying the metals. It’s always a good time to buy! When it turns out not to have been so good, as for example anyone who bought silver last Friday at $19.15, well then he says “manipulation”. Everyone is supposed to nod sagely. The spruiker gets off the hook, just like that.

Except… except he did not see the price drop coming (readers of this Report did). He thought that prices are supposed to keep rising to $5,000 for gold (or is it $30,000) and $150 for silver, and advised everyone accordingly.

Manipulation is his ready excuse for when it doesn’t work.

Trading is a tough game. All sorts of things can happen. Long-time readers will not that, even when we are bearish on the price of the metals, we say we don’t recommend naked shorting. A central bank could, for example, announce some cockamamie scheme on a weekend and by Monday morning, the price of silver is +10%.

You shouldn’t try to trade based on your picture of the end game, nor based on debunked conspiracy theories. And when you’re wrong, you should learn from your mistakes, not externalize it and blame others. This is good advice not just for trading, but for life and business in general.

Don’t be a spruiker.

By the way, we have had a running inside joke for three weeks so far. Now four:

Just repeat after me: “the Fed makes the economy more stable.”

A major currency crashed this week. The British pound closed last week about $1.30. It hit a low under $1.20 before bouncing back to close the week at $1.24, down six cents or 4%.

Anyways, back to silver. What is the fundamental price of silver this week?

Read on for the only true picture of the fundamentals of the monetary metals. But first, here’s the graph of the metals’ prices.

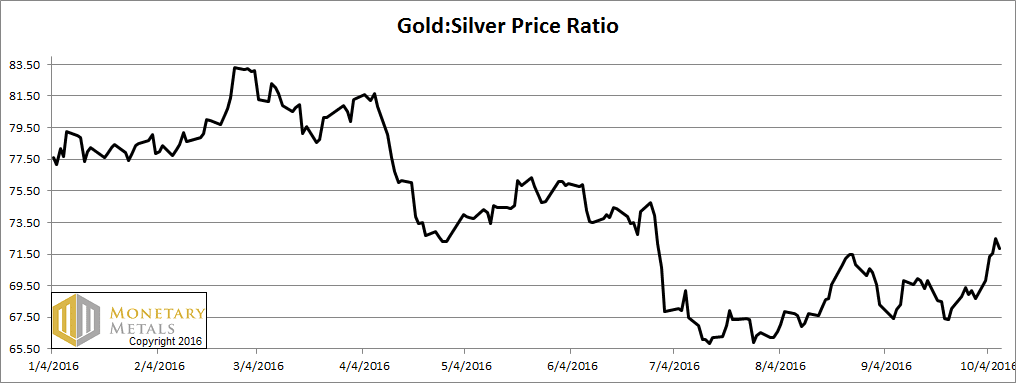

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It was up sharply this week.

The Ratio of the Gold Price to the Silver Price

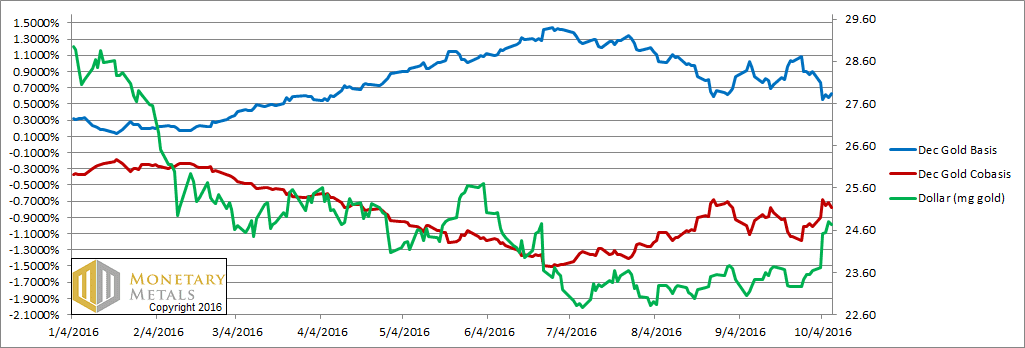

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

There is a big move up in the dollar, from 23.64mg gold to 24.74. However, the corresponding move up in scarcity (i.e. cobasis) is not as big. Contra the Internet reports about a massive “paper dump”, some real metal came to market this week.

The net result is the fundamental price moved down, now about fifteen bucks under the market price of gold.

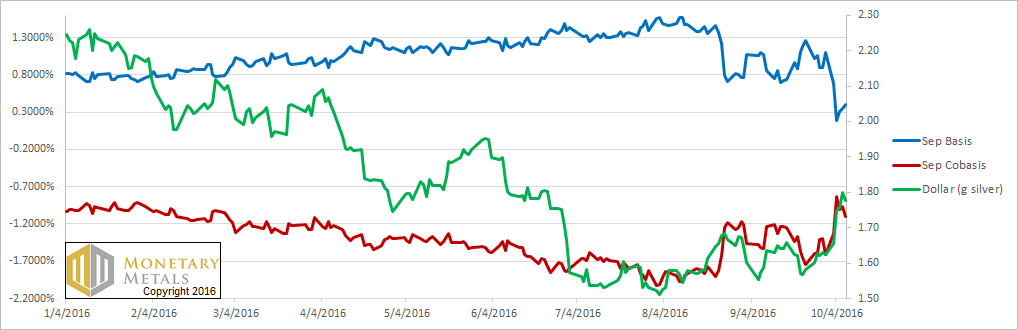

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The price of silver fell quite a bit, but the scarcity of the metal didn’t rise quite as much. And on top of that, look at Friday’s move back down in scarcity. Metal came to market on Friday, perhaps from sellers looking to get out at a slightly better price.

Last week, we calculated a fundamental price of just over $16. This week, it dropped another buck fifty. At current levels of supply and demand, silver metal would clear at $14.60. In other words, it’s still about three bucks below the market price.

So long as leveraged speculators keep bidding up the price, sure that now the price will take off like a rocket, now is a buying opportunity, now is the last chance to buy silver below $20… we will keep reporting on lousy fundamentals.

Can they bid up the price this week? Yeah, they sure could. Should they? If there is anything going on in the markets for which there is no reason, it is bidding up the price of silver. Using leverage. That is, needlessly putting your hard-earned dollars in harm’s way.

© 2016 Monetary Metals

Let’s see now,

surging overnight repo rates (per Bloomberg)

The average level of overnight general collateral repo traded with ICAP was 0.847 percent Thursday morning, the highest since October “2008.”

a developing banking crisis,

a gold dump, “some real metal came to market…”

Ho hum……..

Very coincidental that the large price drop coincided with China`s main markets being closed for the entire previous week. The gold price Sunday night looks to now be staging a minor rebound.

I get these numbers:

Gold Dec’16 Cobasis: -0.672%

Gold Dec’16 Basis: 0.528%

From these numbers:

Spot Bid: $1,261.94

Spot Ask: $1,262.24

Oct 10 2016 00:21:45 EDT

Gold Dec’16 Future Bid: $1,263.70

Gold Dec’16 Future Ask: $1,263.80

Days Till Expiration: 80

Oct 10 2016 00:21:45 EDT

Dollar = 24.647mg of gold

When your red and green lines move together it is speculation, when they diverge it is fundamental. With the dollar down, with the cobasis up it must be a fundamental move Sunday night, if every so slight. I guess that makes China a fundamental driver of price?

I saw the same “China is shut down for the week” story on ZH. Makes me wonder if that may be a yearly play in silver. Once a year the Chinese take the week off and “the bottom falls out of the market”. Remind me to short silver early next October. /s

Thanks again, Keith. Be well!

Theo

Another BS in this weekly report : nearly anybody saw a correction after the huge rise of the first half of the year.

In capitalism it is specualtor who determines the price of everything and anything and that is a process full of intrigues for sure…

this website is now entering into a permabear attitude the symmetric of the permabull attitude because his fundamentals theory has been given to him by God himself !

How does the scarcity in silver increase yet the fundamental price drop by another $1.5?

Following on from RD, from a purely investment point of view, when in the last 12 months would you have recommende being a buyer of either metal? If not yet, then what do you say about missing the huge move in winter/spring?

It was funny that 2013 precious metals paper massacre was also/done also when china was closed for one week ie twice a year. Quite low odds in term of probability that it happens twice (and maybe more) within the last few years.

Keith does not typically issue buy or sell directions. But if you read the +/- difference between his “fundamental” price and the spot market price as a sell/buy signal of greater or lesser magnitude, you, like I, would have booked a solid gain. Acting primarily as a “stacker” – still hoarding for retirement or future lean years, I appreciate the chance to buy metal when it is below its fundamental price. Last week’s drop was tempting, but I also found that my local coin shop had become well-stocked of a sudden. When the delta to fundamental price rivals the spreads on physical in actual shops, that is the point where I’d say you can convert Keith’s readings directly into buy/sell orders. You’d have been buying in the Springtime.

Mr Weiner issued some strong sell comments (even on the weekly tites on commentaries) on silver for months, even a 3 years kid could understand that.

It is not his constant disclaimer on the central banker’s actions or other BS which would change anything : indeed the same could be said on any markets or products.

An example could be : strong sell of bananas except if something creates a sudden rise of bananas demand or a great fall of its supply.

As pure capitalists there is only one rule : if your indicator says sell you have to sell…

“Mr Weiner issued some strong sell comments” – I call BS. I’ve been reading these commentaries for months and never seen any such comments from Keith. If you think you have, it’s your problem.

As for his being a supposed permabear: What part of his saying, “Never naked-short a monetary metal”, do you not understand?

I’ll spell it out for you. If you never naked-short (following his suggestion)….then you are never net-short…meaning that you are always either net-neutral or net-long (if partially hedged)…meaning that Keith’s basic disposition is to be long. There are merely some moments that are ideal for entering (if speculators have pushed the market into discount mode), and other moments that are not as ideal or where some hedging might be indicated (if speculators have pushed the market into frothiness).

Just last week, Keith said of silver, “Yes, the fundamentals call for a price $3.30 below the market price. This does not mean to go out and short silver (we never recommend naked shorting a monetary metal). It does not mean that the price of silver will drop immediately…”

RD, what part of “never” and “not”, do you not understand?

Mr Weiner described silver recently as a “ponzi scheme” but write never short a monetary metals, so that Mr Weiner is always right as other banking merchants.

I will copy another post :

Silver is crashing : he is a genius (creator of his formula).

Silver is rising (first 2016 half) and he is wrong : it is because of ponzi speculators.

For permabulls : silver is rising : they are genius, they have the right formula.

Silver is crashing : it is because of comex cartel of nasty speculators.

Thank you for the update Keith and congratulations!

The few who comprehend you are the lucky ones,

Yeah, like all sellers and merchants the success are more touted than failures !

Silver is crashing : he is a genius (creator of his formula).

Silver is rising (first 2016 half) and he is wrong : it is because of ponzi speculators.

For permabulls : silver is rising : they are genius, they have the right formula.

Silver is crashing : it is because of comex cartel of nasty speculators.

Both sounds familiar ?

Oct 13 2016 23:22:34 EDT

Gold Dec’16 Cobasis: -0.474%

Gold Dec’16 Basis: 0.321%

Dollar @ 24.77mg gold