Every year we take a step back from our regular business of paying interest on gold and silver to our clients to give our thoughts on the likely direction of gold and silver prices for the coming year. We provide this in-depth analysis, for free, in our annual Gold Outlook Report.

This year we noticed an interesting relationship between the silver price and an indicator you probably wouldn’t associate with silver, at first glance. Before we reveal what indicator we’re referring to, we need to discuss the non-obvious differences between gold and silver, and why some drivers are more important than others.

Gold and Silver, Same Genus, Different Specie

You might think that anything that affects gold, does the same for silver. It is true that gold and silver belong to the same genus since they are both monetary metals. Unlike steel or uranium, which are both metals but not money. And unlike platinum and palladium, which are both precious metals but not money.

But while gold and silver are part of the same genus, they are different species (specie, get it? Sorry, we can’t help being precious metals nerds, it’s who we are!) and therefore respond to different economic indicators.

How are gold and silver different?

Because of its higher value, gold has always been a capital asset owned by the asset-owning class. Gold is often purchased with the proceeds from selling another capital asset, such as shares, properties, and bonds (plus antique cars, works of art, etc.).

And silver?

It’s for the wage earner. Most wage-earners (especially globally) don’t have $2,000 to plunk down for a one-ounce gold coin. There are smaller gold bullion products, but they are more expensive on a per-ounce basis. And also less satisfying to hold. Think of holding a gram of gold (which, due to gold’s incredibly high density is very small) vs three silver coins.

No contest. We’d take the silver every time.

Who is Stacking Silver?

It’s primarily the wage earners that are silver stackers. Silver has always been the savings of workers, who may put 10% of their weekly wages into silver. And, during retirement, sell silver to buy groceries (or earn income on silver with Monetary Metals).

Of course, the asset-owning class can also choose to buy silver, if, for example, they think silver offers the better deal, but they usually tend to stick with gold.

So, if it’s true that the economic health of wage earners tends to have a high correlation with silver, what does the current outlook for labor look like?

The Outlook for Labor

On the one hand, the Fed is targeting labor specifically in its rate-hikes-to-reduce-demand policy. If you want to know what “reduce demand” is code for, we wrote an article and made a podcast about how harmful this policy is.

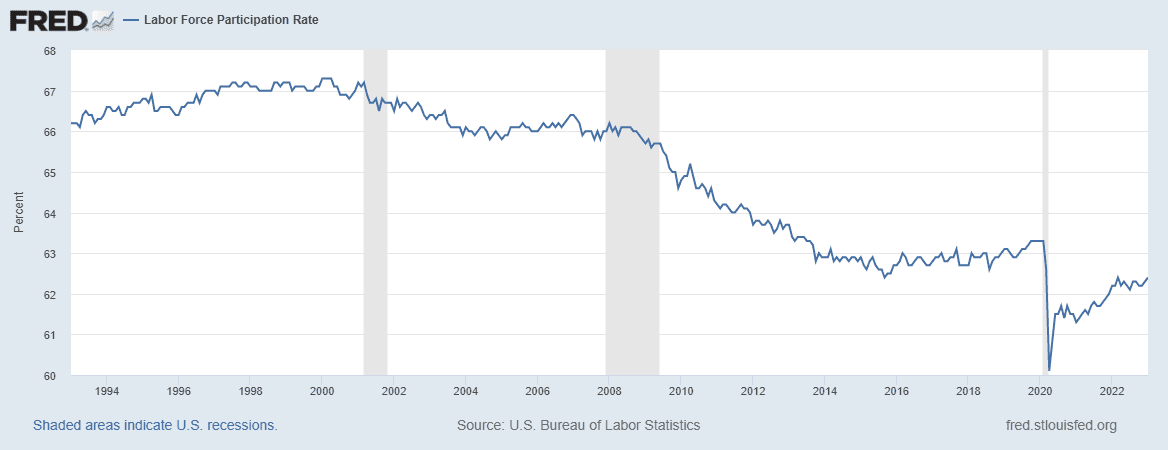

Here is a graph of the labor force participation rate for the past 30 years, which measures the percentage of the working-age population who are working or seeking work. It excludes those who have given up, taken early retirement, started collecting disability, or gone on welfare.

It’s an ugly-looking chart.

But there are secular trends that may cause robust wages for those dwindling numbers of people who want to work.One is the generous subsidies provided to drop out of the workforce which means employers have to pay more to compete with the siren song of welfare checks.

Another is the re-shoring trend caused by economic nationalism and trade war. Businesses may be less profitable, but many may be forced to hire more people just to get the same job done (a socialist’s dream in all senses of the word, it sounds good to them but it leads not to a workers’ paradise but to general impoverishment). Less work being done abroad and more needing to be done in the US may mean higher wages for US workers.

The Outlook for Silver?

To bring it home, if wage earners are hurting in 2023 so could the price of silver. If labor is happy and healthy you might expect silver prices to follow. The real question is, which of these forces will triumph in 2023? And what might we expect from labor, and silver in 2023 using historical data and economic analysis?

We go deeper into those questions and more (including our price calls for gold, silver, and the gold-to-silver ratio) in our free 2023 Gold Outlook Report.

Until then, keep stacking!

Register for our upcoming live webinar!

Our Live webinar is scheduled for March 6, at noon ET where you can ask Monetary Metals CEO Keith Weiner your questions about the Gold Outlook Report. Click here to register to attend.

:

: