Silver Rocket Report 6 Dec, 2015

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.)

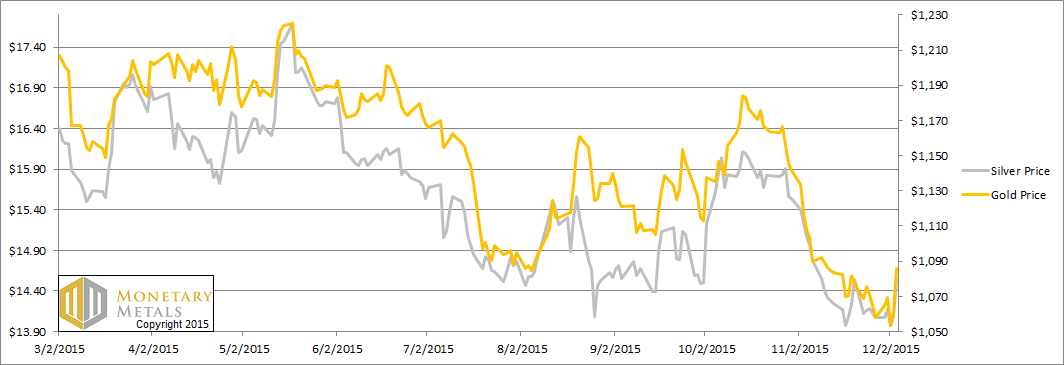

From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly, the silver price rose a greater percentage, from $14.14 to $14.59.

The catalyst seems to be the Bureau of Labor Statics jobs report. There were a few more jobs created than expected, which means the economy is doing well and/or the Fed is more likely to raise interest rates this month (the Fed has said it is basing its decision on labor market conditions, among other indicators). Whatever it was, it lit the fuse and sent the silver price up 45 cents. It held this level, and this represents the entire silver price gain for the week.

Many readers have asked us what we think of technical analysis. Our challenge with it, is the attempt to predict future price changes from past price changes. This is especially so in the gold and silver markets, as there are such large stocks relative to flows. In gold, by official estimates, the stocks to flows is around 70 years. Compare this to ordinary commodities, where this ratio is more like 0.25 years.

Why do we mention stocks to flows in this context? The speculators are trying to move something of much greater inertia. While one could conceivably corner the market in rareearthium, it’s impossible with gold or silver. Just ask Herbert and Bunker Hunt, or Warren Buffet.

The movement of stocks in and out of carry tells us about the speculators, because we can watch their impact on the basis. Speculators can push the price around—temporarily. But they can’t move it durably, because the hoarders are accumulating or decumulating much larger quantities. To use an analogy to flowing water, one could easily divert the water on one’s driveway, but not a major river.

We will look at how Friday’s price jump affected the silver term structure. But first, here’s the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

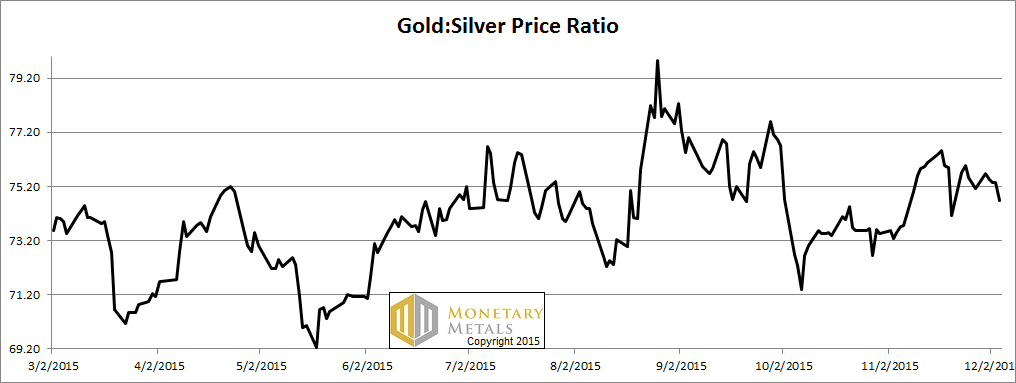

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio fell slightly this week.

The Ratio of the Gold Price to the Silver Price

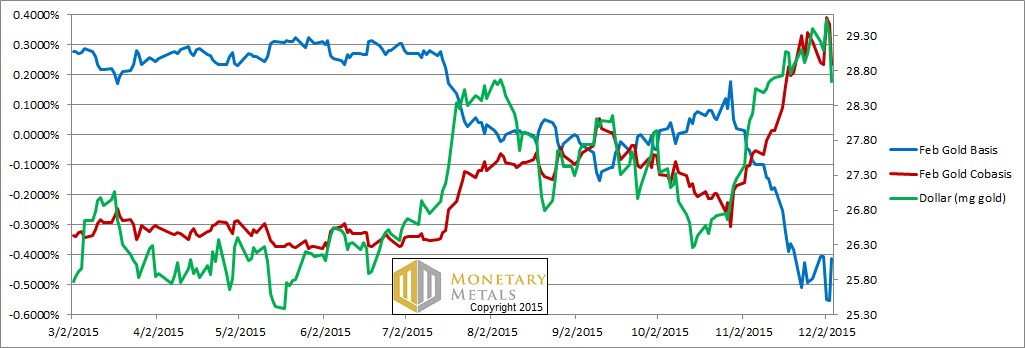

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar (i.e. the inverse of the price of gold, measured in dollars) continued its neat correlation with the cobasis (i.e. scarcity of gold). In other words, as the price of gold rises, it becomes less scarce on the market. As it falls, it becomes scarcer. This has been the market mode for quite a while now.

Friday’s price action did not break the pattern.

Unfortunately, for gold bulls, with every tick up in price the decrease in scarcity is larger, and with every tick down in price, the increase in scarcity is smaller. In other words, our calculated fundamental price continues its slow slide which began the second week of September. That said, the fundamental price is still more than $100 over the market, just under $1200.

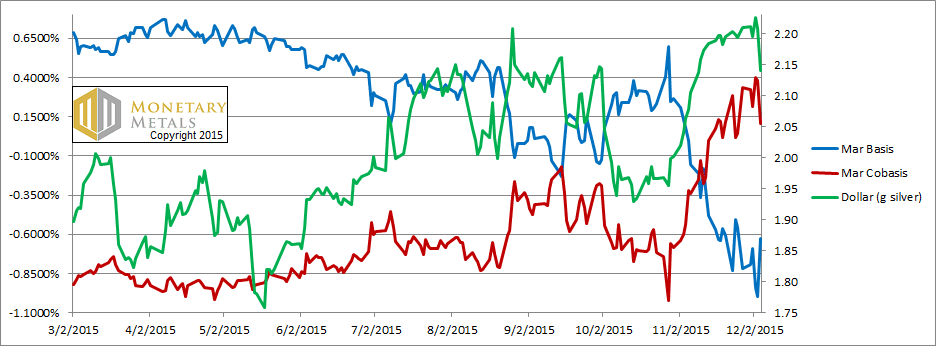

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The same pattern also occurs in silver, and more. Last week, the March silver cobasis was near the same level as the February gold cobasis. Now it has fallen quite a bit more.

The fundamental price of silver also came down a bit, now a scant quarter above the market price.

Finally, let’s take a look at what happened to the silver basis as the price rocketed up.

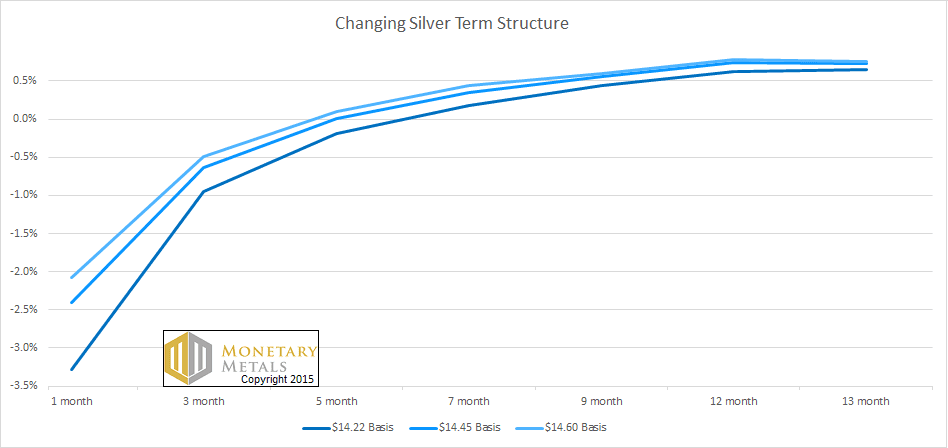

Three Snapshots of the Silver Term Structure

Think of the term structure of the basis like a yield curve for the bond market. The basis is the profit you can earn to carry silver, quoted as an annualized percentage. Since one can borrow dollars (often at LIBOR) to carry silver, the basis tends to be pretty close to LIBOR.

That said, we are interested in change at the margin.

This graph shows three snapshots. One was taken before the price began spiking, one was in the middle of it, and one was after. It is interesting to see that the greatest effect on basis occurred in the January contract, with the least on the December 2016 contract.

The graph clearly shows a dramatic increase in the basis, especially in the near contracts. Why is this significant?

Recall that basis is (to oversimplify—for a full explanation, click here) the future price – spot price. There was a frenzy of buying that pushed up the silver price more than 3% in a few hours. That frenzy was not stackers lining up to buy phyz. It was speculators buying paper.

Why does that matter? Speculators, who typically use leverage, can’t hold the market price against the tide of the hoarders. They can push for a while, but they have to close their positions sooner or later, either to take profits (as they reckon them, in dollars) or to stop losses.

There will come a day when the prices of the metals are rising due to insatiable demand for metal. As Aragorn would say, “Friday was not that day!”

© 2015 Monetary Metals

If the price of the dollar continues its “neat correlation with the cobasis” then the price of gold in dollar terms may continue to rise simply from a fall in the USD vs other currencies.

This would have very little to do with supply demand fundamentals but merely reflect a repricing of gold against general dollar weakness. For example, say the FED chickens out and does not raise rates as anticipated next week. I would presume this would be bearish USD and positive GLD even with no change in fundamental price.

Therefore, if the pricing of gold in USD terms as much about the value of the dollar vs other currencies as it is about gold fundamentals then the predictive use of your model is only partially relevant.

Keith the fundamental price of gold has been over the market for many months by a fair margin who would be covering the cost of this in the futures market is it the midnight dumper in the early hours sovereign backed whoever or just speculators funding and losing on there bets. Or is it some entity taking both sides long and short to wean the market lower. And do you see a time where the fundamental price is well under the market.

Keith: This was one of your best posts yet on these topics! From the opening explanations of the speculators’ cornered (vs cornering) market stature to the silver term structure curve–this was good stuff. I suppose your traveling this quarter has been a good stimulator to organizing these ideas.

Thanks,

Greg

Thanks for your comments.

rutz: The cobasis is a measure, not of the dollar against other currencies, but of gold scarcity to the market.

Yes Keith, I do understand that. I was just making the point that the price of gold can rise even with no change in the supply / demand fundamentals simply via a decline in the USD.

My take is that the Central Bank heads will be working out a way to talk “king dollar” down because they must realise if they don’t then major sovereign and corporate defaults in the commodity space are going to happen very soon. The corporate credit market is flashing red on this already especially in the energy sector. They cant allow the dollar to keep rising or the system will crash. This “currency war” via FED speak will be inversely beneficial for the price of gold even if the cobasis does not change.

Hi Keith

Technical analysis has kept me from buying any silver since I sold nearly all of my holdings at the very peak a few years ago..the day before Bin Laden was ?murdered.

Good luck most likely.

However when it comes to looking at a MONTHLY chart of silver it is clear that there has been zero signal to buy the stuff at all.

In fact I have lost interest in the stuff completely.

Gold is a no risk proposition.

That is not the case with silver.

Keith,

http://www.kitco.com/news/2015-12-08/Bank-Of-Canada-Still-Has-Room-To-Maneuver-As-BOC-s-Poloz-Introduces-Idea-Of-Negative-Interest-Rates.html

…”Poloz’s comments about possible negative interest rates also come less than a week after the European Central Bank cut its deposit rate by 10 basis points, bringing it down to negative 0.30% from 0.20%.

Poloz added that the Bank of Canada is also monitoring Switzerland’s monetary policy, which includes a negative rate of 0.75%.”

wow. so what’s going on over there?

and this sounds good:

“Another tool the bank highlighted is large-scale asset-backed purchases, something that the Bank of Canada talked about in 2009 but never had to use. Finally, the last unconventional tool for the central bank is funding for credit.

“The idea is to make sure that economically important sectors continue to have access to funding even when the supply of credit is impaired. In this case, the central bank would provide collateralized funding at a subsidized rate as long as banks met specified lending objectives,” he said.”

i think he means war.

Hey Keith, it`s clear that the cobasis is your measure of scarcity of gold to the market. This spread price should also be the same (percentage wise) across all world currencies as there is a global price of gold. Your report attempts to establish a fundamental price based on how the cobasis changes in relation to changes in the price of the dollar. In your August 16, 2015 report this fundamental-market price differential data was plugged in to a discount-premium chart for both metals.

If however, we change the green line of the dollar on your chart and replace it with another currency in milligrams of gold, we could quite easily obtain a very different picture of gold being under or over valued.

Let`s say the cobais remains flat for a month at 0.3% annualized, and the dollar also flat at 28.8mg. There would be no change in scarcity, market price or “fundamental price”. If however, the Norwegian krone (NOK) loses 15% against both gold and the US dollar, you will have a steeply rising price of gold in NOK (or falling green line) but the cobasis would not fall in response to indicate less scarcity.

If you plug this scenario into the algorithm, what does it say? The fundamental price of gold in NOK is now a long way above the market price? Would the chart show the market price in NOK is ABOUT TO EXPLODE!?

Do you believe your fundamental price alogrithm is valid for measuring whether gold is under/over valued in other currencies?

If not, how can this method be valid using the US dollar, but not valid with another currency?

You once claimed:

“we are looking at data that captures the whole market, not just the move from one corner of the market to another.”

But it would appear that this fundamental price analysis is only looking at gold market data through the prism of the US dollar. Those trading dollars for gold, and those trading gold for dollars.

Regardless, I appreciate your work. Interested in what you think of the effects and meaning of plotting another currency in place of the dollar on your basis chart.