Silver Rorschach Test

On Friday, August 6, the price of silver fell from around $25.15 to a low around $24.25, or -3.6%. We were told, also on Friday, that this drop occurred at a “weird hour when there was no liquidity.” In fact, it happened shortly after noon in London. We were earnestly assured that this proves the manipulation conspiracy theory because there is no other explanation.

Why did the price of silver fall on Friday?

The price chart is like a Rorschach Test. People see in it what they want to see. In other words, the price chart proves nothing. Price moves in themselves do not support any particular theory of who the actors are, what motivates them, or what they did (other than, broadly, buy or sell).

The basis chart, on the other hand, reveals a lot. Basis is basically (pun intended) (future price – spot price) / (price), quoted as an annualized rate. For example, 2.5 cents is 0.1% of $25, but if the future expires in a month, then quoted as a basis, it would be 0.1% / (1 / 12) = 1.2%.

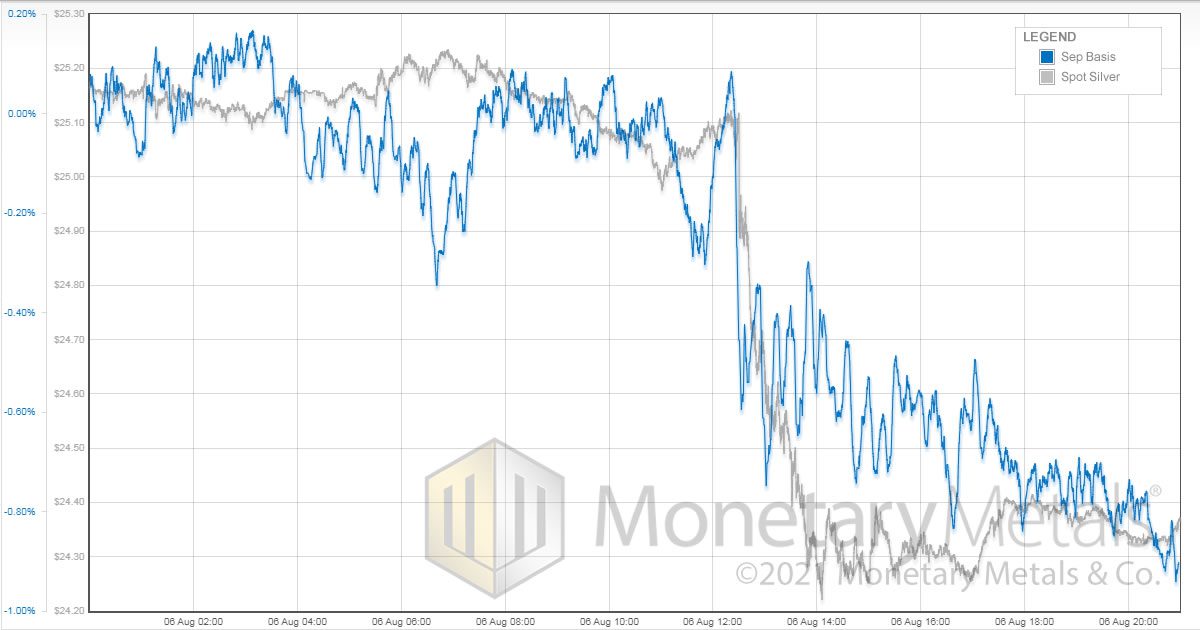

The conspiracy claims that futures were sold to push down the price, while demand for physical metal remained strong. To see if this is true, let’s look at a high-resolution intraday chart for Friday. Price is overlaid on September basis.

The basis starts around 0%. This means that the price of silver for September delivery is around the price for physical metal. By the end of the price drop, the basis is around -0.5% (annualized). Which means that the September contract price was about 1.5 cents below the price of spot. In other words, while physical metal sold off by $0.90, futures sold off by $0.915.

Note that if there had been a “smash” of futures, without any selling of physical, the basis would be something like -87%. Not minus zero point eight seven, but minus EIGHTY-SEVEN. We would be bellowing from the internet rooftops if such a huge backwardation in silver were occurring (and we would not be the only ones)!

After the price hit the bottom, we see another big move down in the basis, while there is a small move up in the price. Basis drops to around -0.9% while the price perks up to close to $24.40. In other words, buyers of silver metal came out when they saw the metal on sale. By the end of the day, physical metal was not a mere 1.5 cents above paper. It was up to a whole 2.7 cents (pun intended) higher than September paper.

The Basis of Basis and Cobasis Analysis in Silver

The first thing one notices, when looking at this, is that the spread between spot and futures is pretty stable. It does not change all that much in the face of a big price move. This is what makes it a useful indicator. If the basis moved around like an EKG, it would be too noisy to show much of a signal.

Next, we can see whether the move was concentrated in futures or spot, and the relative balance. We can see that futures sold a bit more than spot. This was leveraged speculators repositioning themselves, more than it was stackers selling. This fits a day in which commodities like oil sold off, and other currencies like the euro sold to. And do not gloss over “a bit”. Yes, futures sold more than spot. A bit. 1.5 bits, if we want to be precise. There was heavy selling of spot silver, too, along with the heavy selling of paper silver.

Is the bull market in silver still intact?

Finally, as soon as the downward momentum was done, we see buying that boosts the price a bit. Again, emphasis on “a bit”. And this buying of metal and futures, which lifted the price about $0.15, depressed the basis almost as much as the initial selling of futures and metal. And this buying was more stackers buying than leveraged speculators buying.

This is significant, as it’s what one expects to see if the post-Covid bull market in silver is still intact. Leveraged speculators are just trying to front-run whatever move they expect next. They do not move and hold the price durably. Stackers are (more often) long-term holders, who are not trying to play the price action for a quick flip. Durable moves necessarily involve stackers. And on Friday, we see that stackers were buyers at the lower price (even if they were sellers, along with leveraged speculators, at the higher initial price).

We provide basis analysis like this on a regular…basis (intended), and whenever there’s a major move in the price of gold or silver. To receive these reports as soon as they’re published, including access to premium reports with more in-depth analysis, join our mailing list here. It’s completely free to subscribe.

Monetary Metals is Hiring! For more information, click here.

Leave a Reply

Want to join the discussion?Feel free to contribute!