Silver’s Got Fundamentals, Report 8 Jan, 2017

This week was another short week, due to the New Year holiday. We look forward to getting back to our regularly scheduled market action.

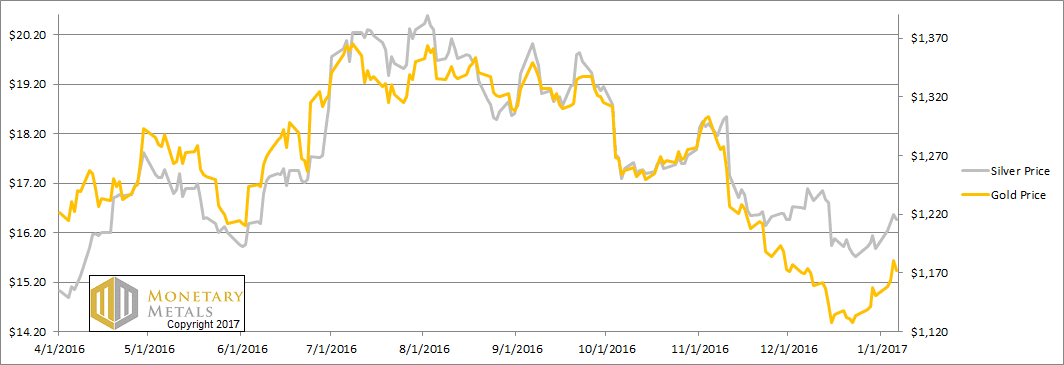

The prices of both metals moved up again this week. Something very noticeable is occurring in the supply and demand fundamentals. We will give an update on that, but first, here’s the graph of the metals’ prices.

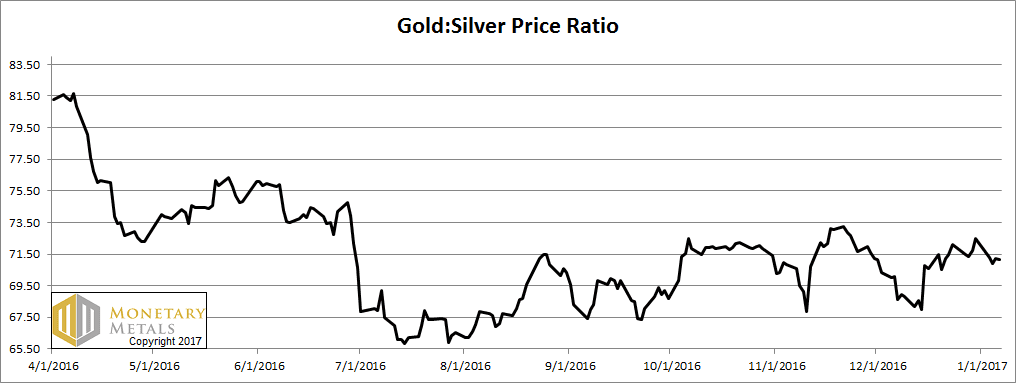

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell a bit this week.

The Ratio of the Gold Price to the Silver Price

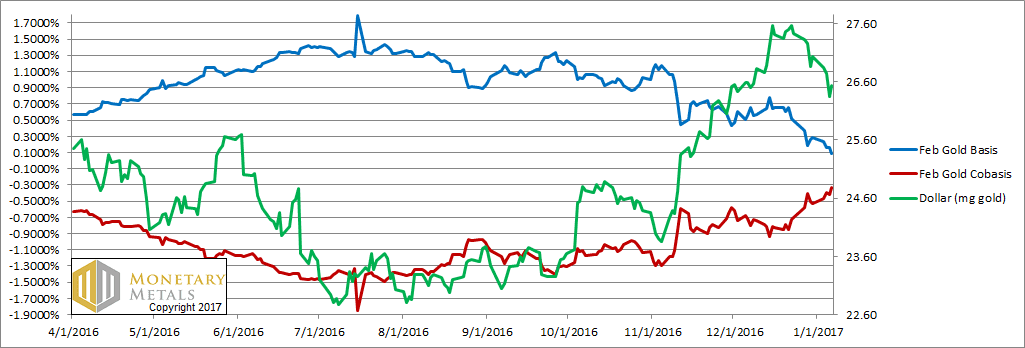

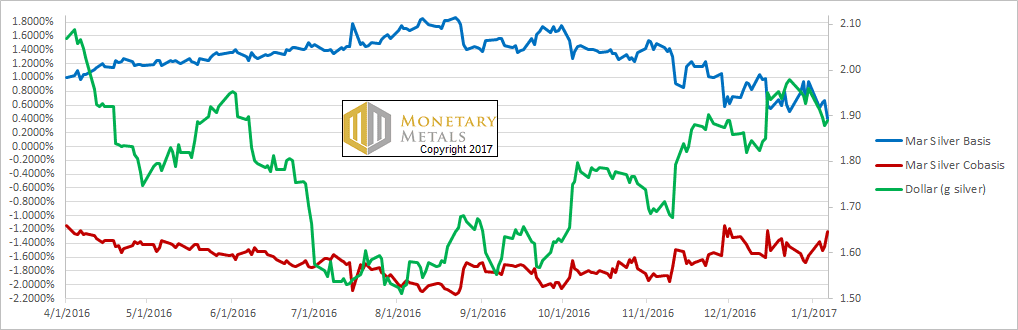

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We now have several weeks of data to see a distinct pattern. Since Dec 15, the dollar has been falling (which muggles perceive as gold rising, much the way people in a sinking ship see a lighthouse rising). What’s new is that gold has been getting more scarce while this happens. The red line (i.e. the cobasis, our measure of scarcity) is rising while the green line (i.e. the dollar price in gold milligrams) is falling. This is no mere repositioning by speculators. It’s fundamental demand.

What we don’t know yet is whether this is another flash in the pan, or if it will prove to be durable.

What we do know is that, absent speculators, gold metal would be clearing at about 90 bucks above the current market price.

No one can guarantee that the price won’t drop (or the fundamentals won’t turn), but if you’re looking for a buying opportunity, you could do worse than the present.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, we do not see the same pattern. We have a much higher basis (abundance) and a much lower cobasis. The dollar did not begin falling in silver terms until a week later than in gold. We have had a recent rise in the cobasis, but it’s hard to say if it is rising the way gold’s cobasis is. We want to see more of a trend.

We calculate a fundamental price of silver now over $16.50. That is above the market price for the first time since … January 2016.

© 2017 Monetary Metals

Yuan volatility ?

Interesting that underlying demand is increasing, together with price. Its the most positive development for the gold speculators in some time.

February 2017 gold is now in backwardation, 44 days away from expiration:

Jan 11 2017 00:16:23 EST

Gold Feb’17 Cobasis: 0.126%

Gold Feb’17 Basis: -0.391%

Dollar @ 26.18mg gold