Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master.” While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but merely a small gesture of disloyalty. Of course, he will not get his liberty (but maybe a beating).

Today we do not have slavery, but we are shackled nevertheless. Savers are forced to use the government’s debt paper as if it were money. Most are content, but one says “gold will go up.” He does not expect a beating (but maybe a price suppression).

The slave cannot escape from his bondage, until he stops thinking of the brute as “Master” with a capital M. Freedom does not come from a little show of resentment. So long as malcontent slaves are content to limit themselves to petty disobedience, the Master is content that his rule is absolute. Freedom first takes an act of thinking. One must see the brute for what he is.

Today’s investor cannot escape from the bondage of the Federal Reserve, until he stops thinking of the dollar as “Money” with a capital M. So long as malcontent investors are content to limit themselves to betting on the dollar-price of gold, the Federal Reserve is content that its rule is absolute. Freedom takes an act of thinking. One must see the dollar for what it is.

The slave must stop using the brute’s whip to tell him what’s good and what’s bad. The investor must stop using the Fed’s credit paper to tell him what’s up and what’s down.

We continue our hiatus from capital destruction, to treat the topic of central bank concern with the price of gold. Last week, we said:

“We have said that the central banks care no more about the price of gold than they care about the price of antique Ferraris. Next week, we will drill deeper into why.”

In light of the above, we say that the central banks care not about the price of gold any more than they care about the price of a 1955 Ferrari or a 1945 Chateau Mouton Rothschild. Stocks, real estate, antique cars, wine, and gold are just different chips in the casino. They all have the same purpose, to convert the asset buyer’s capital into the seller’s income. Central bankers call this the “wealth effect”, and it’s an important way that they attempt to increase GDP as they manage our economy.

Let’s consider the two main arguments offered to bolster the belief that a higher gold price will lead to the gold standard, and hence the end of the Fed’s power. These explain the purported motive for why the central banks want to suppress the price of gold (we have already proved that they are not).

There Isn’t Enough Gold

Have you ever been in a discussion of the gold standard, and someone blurts that, “we don’t have enough gold for a gold standard!” There is a stock retort, given so many times, that we could recite it by rote.

“Any amount of gold is sufficient, it’s just a matter of price.”

Back when an ounce of gold traded for about 250 of the Master’s Notes, even the most defiant investors had a hard time picturing that in about a decade, the same ounce would trade for eight times as many of the Master’s now-debauched Notes. Back in 1999, some would have thought that surely gold will circulate as a medium of exchange, even at a lower price than that.

Yes, in 2011, the price did hit nearly 2000 Master Bucks. Gold did not circulate. Not only did gold not circulate, it was not close to circulating. Not only was it not close to circulating, there was not even a hint that it would ever circulate.

This is a curious environment in which to assert that the Master fears a higher price, on grounds that gold would replace His Paper when its price is sufficiently high.

There is no mechanism for high price to cause circulation. If anything, a much higher price creates an additional disincentive. If you trade away your gold, that is considered to be a sale of gold at the current price. The higher the price, the greater the loss due to tax.

Let’s use an extreme gold price because it provides a clear example: the price shoots up to $101,300. So nearly everyone has bought it $100,000 cheaper. Any sale of gold has a $100,000 capital gain. If your marginal income tax rate is 45.6%, then you lose $45,600 to tax, which is about 45% of the gold’s value. Unless you’re starving and need food, most people will decide it’s better to keep the gold.

And it should be obvious that if the price of gold quickly skyrockets to $100,000 that is not a gain in gold but a collapse of the dollar. The gold owner is not richer, the dollar owner is (much) poorer. This will not cause gold to circulate.

Tax aside, a high price does not cause gold to circulate because the obstacle blocking gold circulation is not a too-low price. This may sound like a tautology, but it’s not. What we are saying is: first understand the problem, then propose the solution.

The problem is that we all earn our incomes in dollars. We don’t have gold, unless we buy it. To buy gold you incur a loss, as you must pay the offer price. If you trade the gold for merchandise, the merchant must sell it to cover the cost of goods, rent, payroll, debt service, etc. He will sell at the bid price. The round trip loss is a significant disincentive.

Not to be confused with a nascent gold standard, there will be some use of gold in an environment where the gold price is rising predictably. In this case, just like with bitcoin, people will happily buy gold, wait for a bit, and sell it when they want to buy something. But this is not a use of gold (or bitcoin) as medium of exchange. This is using it as a free purchasing power machine. Other speculators are giving you their purchasing power, when they buy your gold (or bitcoin). They fork over their wealth, in the hopes that the next speculator will give them even more wealth later. Speculation is a process of conversion of one party’s wealth into another’s income, to be spent.

There will be an event tomorrow (March 26), which has been trumpeted by the usual suspects recently. They believe that the dollar will die. On March 26, the Shanghai exchange begins trading an oil futures contract. Now oil producers will be able to sell their oil forward and buy gold forward. Thus, they are effectively selling oil for gold. With no need for the dollar, the dollar bubble will be pricked and the dollar will go away.

There is only one problem. They don’t want gold for their oil. If they did, they would have been doing this trade since 1974 in New York. The fact that they haven’t demands an explanation. We will get back to that in a moment.

The Dollar is Backed by Nothing

First, let’s address the other argument for why a rising gold price is supposed to cause an end of the dollar. The dollar, it is believed, is backed by nothing and has no value. Therefore it is like some mass illusion, waiting for one little pinprick to burst the bubble. And then the dollar will reach its true intrinsic value: zero.

This belief explains the never-ending quest by some gold bug sites, to seek out (or manufacture) stories of shocking government malfeasance, Big Important Players who have bought gold, statistics about gold moving from Here to There, corrupt central bank officials, historical quotes (often taken out of context), rising government debt, etc. They are on a quest for the Holy Grail, that magical pin to burst the dollar illusion bubble. And when people “wake up” and see the truth—presumably all at once—then there will be a rapid dollar exodus.

“Hyperinflation,” we are told, “is a political event,” and has nothing to do with the quantity of the Master’s Money. We note that those who quest for this Holy Grail do often print graphs showing the quantity of the Master’s Money. They seek anything that might scare the other slaves into their own personal acts of defiance.

However, the dollar’s value is no illusion. It has value because nearly every producer in the economy owes a dollar debt. If a farmer owes $1,000,000, then he must grow and sell a lot of wheat, enough to raise the revenues to service his debt. If not, his creditors will foreclose on his farm. He is a price-taker. That is, he sells his wheat on the bid price.

Every producer of everything, including labor, is doing the same thing. And so the net result is that producers have little pricing power.

Ironically, most people (including the gold bugs) believe that the value of a currency is 1/P (where P is prices). Desperate producers outworking each other in relentlessly soft markets makes the dollar look strong indeed.

There is a force that could cause debtors to walk away from their businesses and properties and assets, and allow foreclosure to happen. One day it will, but as Aragorn would say “today is not that day”. The reason is not that suddenly people get woke. It is not that they read of some government, like Hungary recently, repatriating its gold. That will not make them think that, “the Master is no longer the Master.”

The oil producers don’t want gold for their oil. They want dollars for it, because they must service their dollar debts. Accepting oil would just add a new risk: the gold price could drop.

There is a path forward to the gold standard. That path is paved with interest, not higher prices.

Supply and Demand Fundamentals

Gold went up by 33 of the Master’s Notes, but silver went up only 22 of the His Cents.

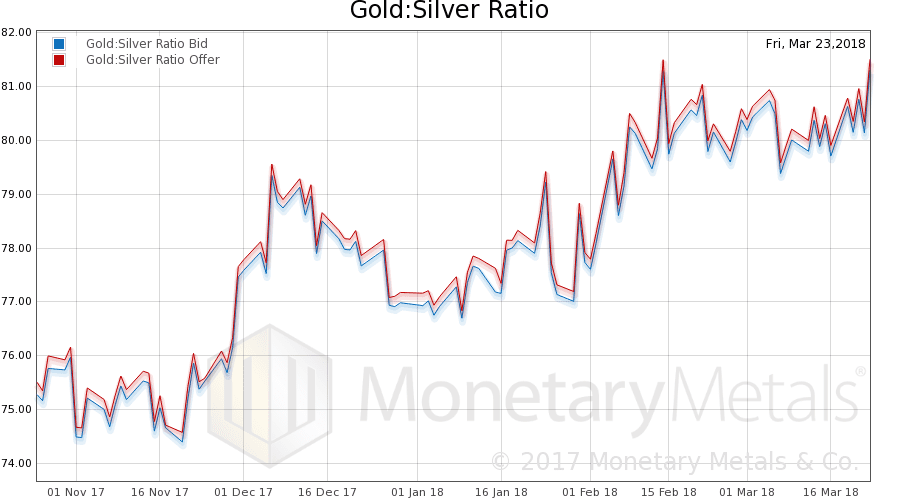

The rising gold-silver ratio is one thing we add to others that signal the not-good economy. Silver has industrial uses, but gold basically does not. So a rising ratio shows rising monetary demand relative to industrial demand. Copper, remember when everyone heralded copper as either a signal of rising inflation or a growing economy? What a difference three months and 36 cents makes. Now, with a falling price and a 2-handle once again, copper is predicting neither. Add a protracted tumble in stocks, rising interest rates—especially a growing spread between the interbank rate and the comparable-duration Treasury, and you have a picture of an economy stumbling once again. Or perhaps something more serious, we shall see.

Silver bugs may be forgiven their enthusiasm to buy the white metal in preference to the yellow, at this gold-silver ratio. From a historical perspective, they are likely to do well with the trade. However, those who claim that silver has outperformed gold as smoking something, and we mean of the sort that President Trump would like to execute the dealer who sold it to them. By definition, for the ratio to rise from about 31 in 2011, to its present well over 81, silver has underperformed gold. Massively.

Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose about another point.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

There is a big change in the dollar, down 0.7mg gold (the opposite of gold going up as measured by the Master’s Notes). But with this rise, we see little increase in the metal’s abundance to the market. This is a sign of fundamental buying, of metal not of futures.

The Monetary Metals Gold Fundamental Price rose $21 this week, to $1,440. This is the highest in exactly three years. Now let’s look at silver.

In silver, there is a bigger drop in the scarcity (red line, cobasis) while silver went up less in terms of MN’s. The absolute level of the cobasis is much higher, but this is partly due to the nearer expiration of the May silver contract (vs June gold contract). The silver basis continuous is higher than the gold basis continuous.

Unsurprisingly, the Monetary Metals Silver Fundamental Price fell 9 cents to $17.27. We could see a gold-silver ratio at 83 if this keeps up.

© 2018 Monetary Metals

:

:

Correction – I think where you say “Accepting oil would just add a new risk”, you mean “gold”.

Sure, it is true that Saudis have had ample opportunity to sell oil to buy Dollars to sell Dollars to buy gold since 1974. But Petro China was also forced to sell Yuan to buy Dollars to buy Oil, and now they’re not. Should we be slightly concerned that the world’s largest importer of oil no longer needs to create demand for Dollars? Do we assume that the demand for Dollars will still materialize on the oil producer side? Wouldn’t the producers rather lend their Yuan for a higher interest rate than convert those Yuan to Dollars?

Each party has a desire to hold whatever currency for whatever reason. The yuan oil contract does not change that.

Who wants to be a lender to the Chinese government, to finance the next wave of ghost cities? In a currency with capital controls. And no liquidity. And a population desperate to get their money out.

Well, if you are running a trade surplus with China in oil or iron, creating a “virtuous” circle of your surplus funding more ghost cities, seems like a win-win, until the music stops.

Thanks for recognizing that dollars may be irredeemable, but they are not unbacked. There is the ‘dollar indebtedness’ keeping demand steady as you say. There is also the entire section of the Federal Reserve Act devoted to requiring that FRN printing requests put up collateral. And another section saying dollar deposits may be invested in Tbonds etc

.Despite (circularly) being denominated in dollars, these policies indicate the intent to have the dollar be ‘backed’ by other money-like resources that are removed from the marketplace as precondition of issuance.

That whole system is still flawed, and circular and observed to gradually fail (like boiling frogs), but not because it is ‘fiat’ (i.e. unbacked) but because it is inadequately backed.

In fact, there is one way in which a rising gold price might contribute to re-adoption of the gold standard: Should the value of gold on the Fed’s balance sheet grow enough to ‘back’ those dollars, one could argue that this might halt the fall in the dollar’s value. New Austrians know that this is hardly all it would take to reinvigorate a functioning gold standard, but I could not resist offering it as a counterargument.

I am not one who thinks the standard will arrive this way, I especially think that dollars 100% backed by gold are a very very very bad idea.

One last note: HR 5404 was just entered for consideration.