Last week, we asked where then will silver go. Well, the price moved around this week, dipping on Thursday but then rebounding sharply on Friday. It closed up 13 cents from last week. The price of gold rose $24.

This week, the Federal Reserve announced that it will not hike rates. Most economists (and traders) have long been expecting a hike (not us). A hike is tighter monetary policy, and therefore not-hiking is looser. Which means a greater quantity of dollars. Which means higher prices. Everyone knows that (except us).

So naturally, on the announcement, the price of silver blipped up about 20 cents. It continued to drift another 25 cents higher. And then cascaded down almost 65 cents. Almost no one knows that prices, including the prices of the metals, have anything to do with the quantity of dollars (except us). Then the price began drifting higher, had another sharp drop, and drifted back up again. Though it ended the week quite a bit lower than the post-Fed high of $14.85.

Folks, we have to say it. This is all noise. Not the non-hike. That is serious economics that is undermining capital, crushing business profit margins, driving asset bubbles, and ruining pension funds and banks. The Great Fed Falling Interest Rate since 1981 continues.

The price moves on these events. Over the long term, only buyers and sellers of real metal can set the price. In the short term, leveraged speculators can place big bets and thereby push or pull the price down or up from where it would otherwise be.

Let’s take a look at those buyers and sellers of real metal, in the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

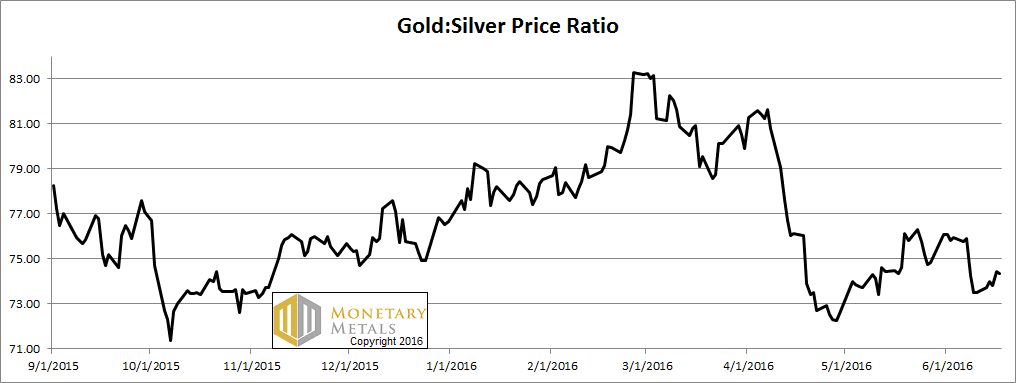

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up a bit this week, interesting when the prices of both metals are up.

The Ratio of the Gold Price to the Silver Price

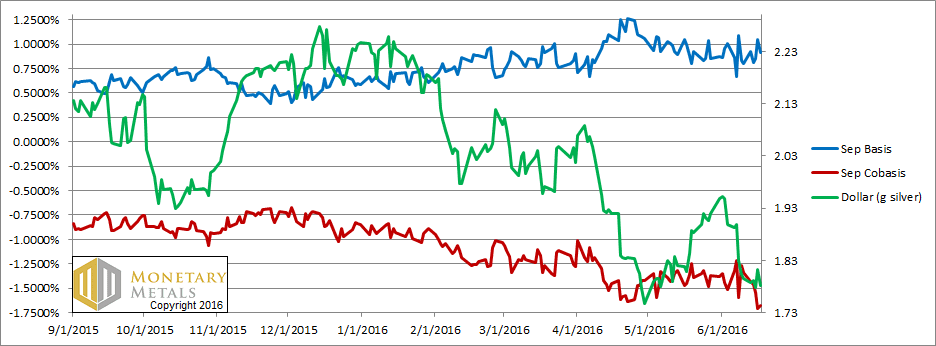

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Look at that red cobasis line (i.e. scarcity of gold). It is dropping along with the price of the dollar (inverse to the price of gold, measured in dollars). In other worse, gold becomes less scarce and more abundant the higher its price. Huh, that’s not what some gold promoters are saying, is it?

Our calculated fundamental price is down almost $40, more than $140 below the market price.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

It’s a similar picture in silver. Note that the cobasis is at a (much) lower absolute level in silver, compared to gold (-1.7% vs. -1.2%).

The fundamental price fell over 30 cents, now $2.40 below market.

© 2016 Monetary Metals

:

:

Where are the subculture SF cinema quotes anymore ? This website has relied on two legs for some time and the the other one is strong sell silver.

It’s always good reading your reports Keith

Good morning Keith,

Yes, money managers are very long precious metals, causing the contangos to widen as they try to roll forward. And yes, more often than not this is a sign of overbought markets. More often than not.

Sometimes however, managed money gets it right, and the trade gets it wrong. When this occurs, the trade is under pressure to cover their shorts, at the same time the indexers and institutions reenter the market on the long side. This very big money has been mostly absent from commodity markets the past several years. When (if) it returns, the prices of many commodities feed off each other, moving higher and higher. AND, sometimes there are good fundamental reasons for the move that managed money discerned sooner than the trade.

If the GOFO or contango always told the full story, trading precious metals would be easy. Needless to say, that is not the case.

A lot depends on whom you mean by “the trade”. We know from the COT report (and Keith’s articles) that speculators are long, while producers + warehousers are correspondingly short. It would be a disaster for the latter, if they all suddenly had to cover – while at the same time, hoarders were losing confidence in the dollar and thus refusing to supply physical into the rally. And is sure to happen, someday. But do you really see it happening now? The point of Keith’s measures/articles is that, in actual fact, it is not happening at this time. Hoarders keep selling into the rallies. Until and unless that changes, it’s the spec longs who will have to cover (i.e., sell out).

Producers can get the timing wrong when they sell futures, sell out their production too cheap, often from fear. The investment banks are pulling back somewhat from fading commodity rallies; in fact I think Goldman was talking it’s book when it predicted $1000 gold. Warehouse buyers selling forward are arbitrageurs, earning interest with no effect on the markets except to take advantage of an expanded contango.

Managed money is very long precious metals; my point is that these managers are not always wrong, and producers and dishoarders are not always right, especially at turning points in the markets. Sometimes changing market fundamentals are first discovered by money managers rather than the trade, i.e. producers, dealers, hoarders, even investment banks. Apparently George Soros and Stanley Druckenmiller believe this theory is credible.

A widening contango is simply a feature of money managers being quite long futures, interesting, but far from dispositive regarding “fundamental value”, especially with institutions and indexers mostly absent from the precious metal markets. When (if) these large buyers return, they could overwhelm trade selling.

“Warehouse buyers selling forward are arbitrageurs, earning interest with no effect on the markets” – No effect? Please. Warehousers are neutral over all time frames together, but not on particular time frames. Obviously I was speaking of the futures and make no mistake, warehousers are short futures right now. That’s what contango is. (The spec long wants a future; the warehouser says, fine, pay me a premium and I will sell you one. The honest warehouser may then buy spot; an important effect on the markets.)

To the larger point: You’re saying, in essence, that the dis-hoarders (which are, those physical hoarders who have been willing to sell back a little as they see the price rally) could be wrong. Sure. I get it. Of course they could be wrong. Someday, the dishoarders will be suddenly overwhelmed by a flood of new/stronger hoarders. “But not today.” That’s what the contango is telling us.

London metals trader Andrew Maguire takes some shots at your analysis that the present contango is indicative of soft fundamentals in this weekend’s King World News interview:

Some excerpts:

“As a result of this liquidity migration from the unallocated over the counter (OTC) flywheel into crystallized allocated physical, means that officials active in the OTC foreign exchange gold market are limited in their gold management efforts.”

“As we know, gold is just one component of the $5 trillion a day foreign exchange market managed by central banks. As far as gold is concerned, these management efforts are coordinated through the Bank of International Settlements (BIS) gold trading desk as part of a much larger global agreed foregin exchange intervention plan.”

“As a result of these offical management efforts, we have evidenced offical trip selling of gold in the XAU/USD crosses (long dollar, short gold), which is ultimately reflected in the widened current spreads between spot and futures”

“”Technical analysts accept the resulting wide spreads at face value, incorrectly interpreting this contango as evidence that there is plenty of gold supply, therefore the fundamental price is well below current demand levels”

“It amazes me that these analysts fail to factor in that this supply relates to unallocated fractional reserve synthetic selling, now until it’s demanded for delivery”

“With the physical markets gaining traction against the paper markets, this represents a major inflection point that technical traders are missing and are going to be wrong-footed on.”

“We have evidence that the spot price reflected in London fixes is based upon this fractional reserve 92:1 ratio. In reality, the wholesale markets are far tighter than officials would like you to believe. And that’s why every effort is made to block any regulatory transparency in the functions of the loco London market where 500 to 600 tons of gold are cleared every day while just 5 to 7 tons are actually delivered.”

“This migration of liquidy out of the rigged loco London LBMA conduit into physical markets increasingly provides immunity from official efforts to contain the rising price of gold”

__________________________________________

The basic point being that “spot gold” as we know it, is more reflective of unallocated gold accounts gold accounts with no legal requirement for delivery in a system with a low percentage of physical delivery vs. total trading volume.

Less and less, the current spot gold price reflects the price of immediately deliverable physical metal.

Spot gold does not measure what it is intended to measure.

Andrew Maguire has been calling for the imminent failure of the bullion banking system for 2-3 years. I will have to record the presentation I did at the Mining Investment Asia conference on how he and other analysts misunderstand how bullion banking actually works. It certainly doesn’t help if one starts off confusing turnover, leverage and reserve ratios.

Yes a lot of spot gold trading is for unallocated, but this ignores the fact that pretty much all of the physical gold traded is based off OTC spot prices. If “the current spot gold price [does not] reflects the price of immediately deliverable physical metal” I would be very interested if you or Maguire can let us know which websites or firms are trading physical gold at the “right” price, which I guess must be much higher than the “spot price”, as that would present a great risk free arbitrage profit as the last time I checked, all the major bullion websites used Reuters or Comex prices as their basis for immediately deliverable physical gold.

Were his calls the last 2-3 years wrong, misinformed or just early?

One site or exchange trading allocated physical metal at a different price is the new Allocated Bullion Exchange. There are numerous different prices depending on the chosen bullion product and market location but all of them are showing prices higher than spot right now.

https://abx.com/markets/pricing/

From what I understand about the exchange rules, only authorized participants can sell new metal into the exchange. The ABX calls them “liquidity providers” and 5 weeks ago they announced four new companies had joined on to the exchange in this role.

Only the “liquidity providers” could tell you whether are earning risk free profits selling metal into this exchange or not. One would asssume they signed on to provide that service with a profit motive.

Maguire’s arguments are his own, I only raise some of his points here to learn more and fill in the grey areas. I am no shill for or against his reputation, services or companies he is affiliated with.

Pizza: you said:

“…therefore the fundamental price is well below current demand levels””

I would like to know what is a demand level? In the Report, I compared the Monetary Metals fundamental price to the current market price.

I second Bron’s comment. If anyone knows where I can sell physical gold at the “real” price which is hundreds of dollars above the phony, bogus, manipulated, fractionally reserved, 100:1 leveraged, paper price… please let me know.

We’ve got access to buy gold metal at said paper price. As much as we want. So if we can sell it for just $1500, much less $5,000, we stand to make a mint! ;)

“all of them are showing prices higher than spot right now”

Really? Comparing NY price for 1kg cast bar on https://abx.com/markets/pricing/ and http://goldprice.org/gold-price-usa.html and it looks to me like Maguire’s own ABX platform is selling at the “fake” global spot price, particularly once you take away the likely fabrication price embedded in ABX’s quotes.

Indeed, I just checked Kitco and, whether you want a 1 oz. coin or a 400oz. Good Delivery bar, they have no unusual delays or premiums going. (Nothing but the normal premiums & delivery times that they’ve had for decades.)

I just spent a few minutes looking at ABX. I focused on London kilobars. There’s about a $1.60 bid-ask spread. The ABX bid price is about $2.40 over what I see on my screen as the spot price (hard to get an exact as I am comparing two different windows, and the spot price is changing once/second while the ABX is updating less frequently).

What else would one expect to see?