We will take another break from capital destruction, to treat a topic which has come up this week. On March 11, we said:

“…central bankers do not think about gold.

Granted, they once did. In the 1960’s, there was the now-infamous London Gold Pool to keep the price of gold at $35. This is endlessly cited as evidence of current central bank price suppression, without bothering to mention that until 1971 the official US policy was to maintain the dollar to gold exchange rate of $35 to the ounce. …

But today? We see no sign that central bankers care about the price of gold.”

This turned out to be very controversial. Some conspiracy theorists cited Deputy Secretary of State Thomas O. Enders in 1974. The State Department records the minutes of a meeting with Secretary of State Henry Kissinger. Here is an excerpt:

“Henry Wallich, the international affairs man, this morning indicated he would probably adopt the traditional position that we should be for phasing gold out of the international monetary system…”

Changing the Dollar

This meeting can only be understood in context. So let’s review three key changes to the dollar that led up to it. The dollar had long been redeemable in gold. However, in 1933 President Roosevelt was desperate to stop the run on the banks (and to push interest rates down). He ended gold redeemability to Americans in 1933 (and criminalized the possession of gold).

When the soon-to-be-victorious Allied Powers met in 1944 at Bretton Woods, they agreed to an insane postwar monetary system, in which the national currencies would be pegged to the US dollar which would be redeemable in gold at a fixed exchange rate. This system contained the seeds of its own destruction as Robert Triffin said in the 1960’s. However, the Allied economies were in ruins (not to mention the Axis)—so who was in a position to say no?

By the late 1960s, gold was flowing out of the US under relentless and accelerating redemptions. This was a process of de-moneying the dollar (as we have written about currencies de-dollarizing today). The money was literally being sucked out of the dollar.

This crisis came to a head in 1971. So President Nixon decreed that—temporarily—the dollar would not be redeemable in gold. Of course, it was not temporary, but permanent. However, it took time for the new reality to become clear. In 1973, the regime of fixed currency exchange rates was ended, and the world moved to so called floating rates (they’re all sinking, but most people only see relative changes).

This brings us to the April 25, 1974 meeting with Kissinger and Enders. They had grown up with the understanding that gold is money, unlike most people alive today who were programmed from the earliest age to think of money as pieces of paper (or electronic digits).

Gold was the base of the monetary system, though bit by bit, the various governments were changing their views and their policies. Gold was not phased out yet, in 1974, but things were heading in that direction. Thus Enders’ remark quoted above.

Now consider a later exchange in that meeting.

Kissinger: “But why is it against our interests? I understand the argument that it’s against our interest that the Europeans take a unilateral decision contrary to our policy. Why is it against our interest to have gold in the system?”

Enders: “It’s against our interest to have gold in the system because for it to remain there it would result in it being evaluated periodically. Although we have still some substantial gold holdings—about 1 billion—a larger part of the official gold in the world is concentrated in Western Europe. This gives them the dominant position in world reserves and the dominant means of creating reserves. We’ve been trying to get away from that into a system in which we can control—“

Kissinger: “But that’s a balance of payments problem.”

Enders: “Yes, but it’s a question of who has the most leverage internationally. If they have the reserve-creating instrument, by having the largest amount of gold and the ability to change its price periodically, they have a position relative to ours of considerable power.”

The first thing to note is what this is not. It isn’t the facile belief that whoever has the most of a commodity controls its price. Traders know that the more you buy, the more you push the price up and the more you sell the more you push the price down. If you are a famous player, such a government, the very rumor you will buy spikes the price up.

Kissinger and Enders are discussing something else. They are still thinking in an environment where gold is officially money, notwithstanding Nixon’s recent order. They are discussing possible new world orders. If things go one way, then gold continues as the central bank reserve asset, but the Federal Reserve would be disintermediated. The Banque du France, Deutsche Bundesbank, or Bank of England, would still have gold as their reserve assets. But, going forward, they would not hold their gold in the form of US dollars (which they could no longer trust after Nixon). They would hold the gold directly. This means they would no longer be granting credit to the US.

This move would withdraw massive amounts of credit from the US. Thus the State Department was talking about it, and trying to do what they could to prevent it.

Enders’ view prevailed. Gold is not in the system any more. The long-term future—the present day in which we now live—was sacrificed for the political expediency of the crisis that came of Nixon’s gold default. That crisis ultimately came of Bretton Woods 30 years previous to Nixon, which was the logical evolution of the Roosevelt’s gold policy 11 years before Bretton Woods. And the Roosevelt crisis was baked in the cake by the imposition of the Federal Reserve in 1913.

Over the following years, the old guard retired one by one, replaced by younger people who lacked the same perspective of gold as the monetary reserve asset. This takes time, as later Fed Chairmen Paul Volcker and Alan Greenspan both grew up in a gold world.

Greenspan Stands Ready

This brings us to the now-infamous 1998 quote by Fed Chairman Greenspan, in his testimony before Congress. He was asked to testify by the House Committee on Banking and Financial Services. The thrust of his testimony was: the Federal Reserve Board does not favor additional regulation of derivatives, whether they continue to trade over-the-counter or whether they move to an exchange with a clearinghouse.

He compared agricultural commodities that were the original justification for the Commodities Exchange Act to financial derivatives and to gold. Financial derivatives do not have a strictly limited quantity, as wheat does at the end of the harvest. Here is what he said about gold:

“But unlike farm crops, especially near the end of a crop season, private counterparties in oil contracts have virtually no ability to restrict the worldwide supply of this commodity. (Even OPEC has been less than successful over the years.) Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

This short quote is packed with important ideas. First even oil, which is an ordinary commodity, is not subject to market corners the way wheat is. Second, private parties cannot restrict supplies of gold.

He did not say, but it is important to understand, that virtually all of the gold mined in thousands of years of human history is still in human hands. This means that the ratio of stocks to flows—current inventories divided by annual production rate—is measured in decades for gold. For ordinary commodities, stocks to flows is months. The idea of a corner in gold is absurd. You might as well worry about what if all the people on the planet flew to New York to all jump at the same time, and knock Earth out of its orbit…

Third is his point about leasing. It is taken as an axiom among the conspiraratti that leasing means short selling which means price goes down. This assumption is so strongly believed that a quote by Greenspan talking about leasing is taken as prima facie evidence that Greenspan said the Fed is suppressing the price of gold. Therefore we must say it again.

Leasing is not short selling.

In a lease, the lessor gives the metal to the lessee in exchange for the commitment to give the metal back to the lessor, plus interest. Of course, some lessees engage in this transaction for the purpose of selling short. But most are doing it to finance a gold-producing business such as a mine or refiner.

Now we must return for a moment to the evolution of thought (and personnel at the Fed) after 1971. Greenspan is an intermediate step. On the one hand, he’s old enough to have held gold coins in his hand when they were in general circulation. He came of age during the Bretton Woods era, when gold was the reserve asset of the Federal Reserve, and the Fed’s credit paper was the reserve asset of the other central banks. He wrote an essay on gold and money that Ayn Rand published in her book Capitalism: The Unknown Ideal in 1966.

On the other hand, he came to the Fed 16 years after Nixon ended gold redeemability. By the time of his remarks to Congress in 1998, the Nixon gold default was 27 years old. Greenspan was moving forward into a new era, a more technocratic era. And he was, by all accounts, such a master of the details to be the “Maestro”. His thinking had evolved (or devolved), and he had settled into his role as chief monetary planner, the job that John Galt refused in Ayn Rand’s magnum opus Atlas Shrugged.

In 1998, asked about commodities regulation and thinking about the Commodities Exchange Act and whether it should be applied to derivatives, he was thinking of what happens when a commodity is cornered. He certainly understood that in a shortage, the commodity goes into backwardation. Backwardation is when the price is higher in the spot market than in the futures market.

As a central planner, he concedes that it’s the job of the government to prevent anyone from cornering a market. As a technocrat, he is thinking of the mechanism of how to do it.

Leasing.

Suppressing Backwardation

A lease allows the lessee to put the physical commodity into the market to alleviate the shortage, and get it back later when the shortage has passed. Because of backwardation, this is a profitable trade. Consider the following transactions, all executed simultaneously.

- Lease gold from the Fed

- Sell gold in the spot market

- Buy a contract for gold to be delivered in the future

As this trade involves both buying and selling, it does not push gold down (even if you think of gold’s value in dollar terms). Yes, it pushes the spot price down but also pushes the futures price up. What this trade changes is the basis. Which is the cure for backwardation. Greenspan is thinking about how to stop corners, without further expanding commodities regulation.

He is saying that the Fed and other central banks have enough gold that Congress need not worry about a corner in the gold market, or give the commodities regulators more power. He is not talking about the selling gold to push the gold price down.

If you read his whole testimony, it is not about price and it is not about the value of the dollar in terms of gold, or monetary policy. And gold is just this one offhand remark. A long pet peeve of ours is when people try to read too much and too deeply into a comment. This is typically done to affirm a bias, such as gold price suppression conspiracy. It’s taking someone’s words out of context, to come to a conclusion that the person never intended.

This error in thinking, by the way, is prevalent in the wide world outside of gold. You can hardly watch TV news, let alone log into social media, without seeing it over and over. The anti-gun movement (to pick one current controversy in the US) often tries to torture the words of a prominent pro-gun person into an admission that guns cause many deaths. And not to be outdone, the pro-gun movement does the same thing to show the alleged hypocrisy of the anti-gun people who are caught red-handed admitting that guns save lives.

When someone really intends to say something, he will say it openly and clearly. By contrast, if Greenspan gives 2,400 words of testimony to Congress to argue against more commodities regulation, covering currencies, interest rates, oil, wheat, and gold, then don’t read too deeply into it. He did not say that the Fed wants a lower gold price, nor that the Fed can suppress the price with leases.

By the way, at the time Greenspan said this, the price of gold was around $290. When he left office seven and a half years later, the price had about doubled.

Also, by the way, if the mechanism of alleged gold price suppression is central bank leasing, then that leaves silver lacking an explanation. Central banks have no silver. The price of silver has fallen to 1/80 the price of gold, which needs to be explained. If gold is suppressed, and silver is not, then how do we explain why silver is cheap relative to gold?

You can’t look at what someone said about gold historically and interpret it in the modern context. Back in 1974, gold was the monetary reserve asset. Today it’s a speculation held for price gain.

Ironically, the whole driver for this conspiracy in the first place, is that some people are upset at their lack of big dollar profits from their speculation on the price of gold. The context today—where the dollar is money, and gold is a chip in the speculative casino—is not the same as 1971 or even 1974.

We have said that the central banks care no more about the price of gold than they care about the price of antique Ferraris. Next week, we will drill deeper into why.

Supply and Demand Fundamentals

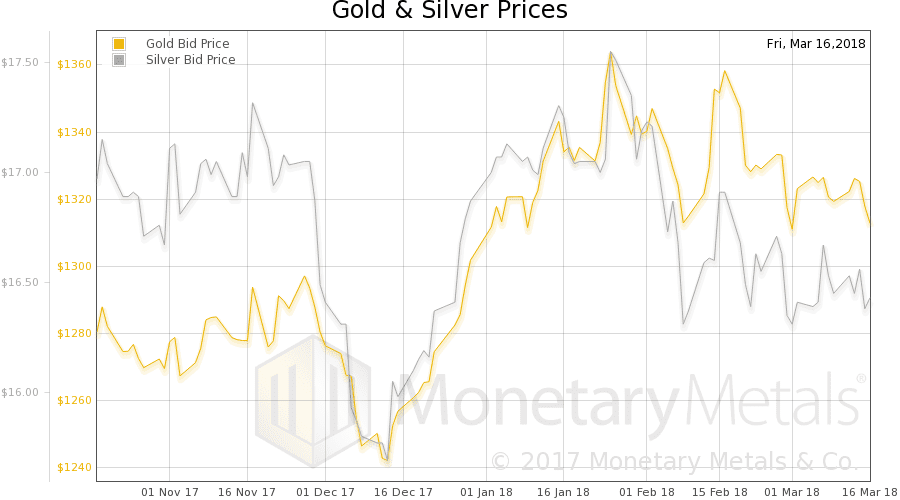

The price of gold fell nine bucks to $1,314, and that of silver fell 21 cents to $16.33. Do these moves signify a real change in the market dynamics? Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

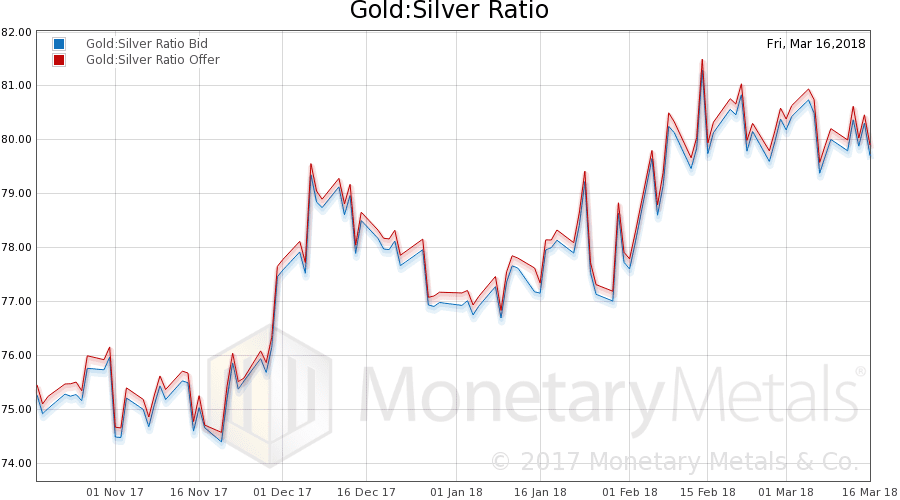

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose a bit.

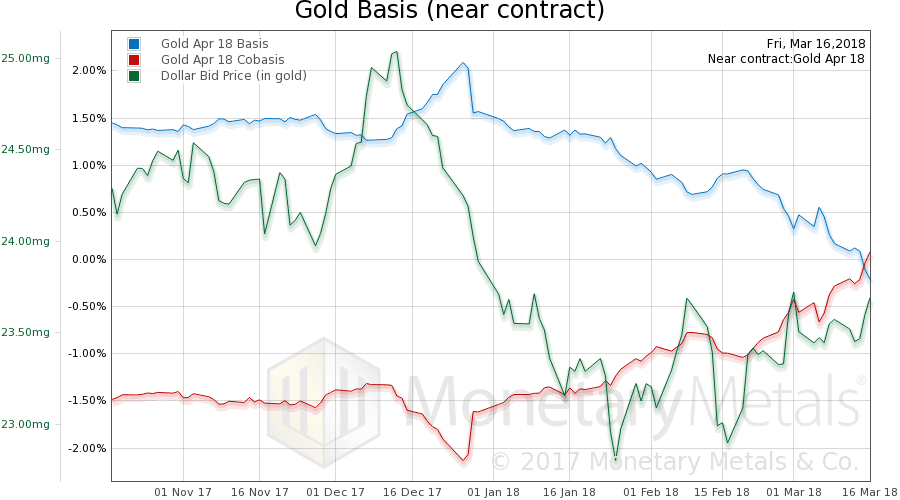

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Note that little bit of backwardation in the April contract (it is under selling pressure as it nears First Notice Day). Note also the correlation between rising scarcity (i.e. cobasis) and the price of the dollar measured in gold as it should be (i.e. green line, inverse of the price of gold as most people think of it). As the price of gold sells down, the metal becomes scarcer to the market.

The Monetary Metals Gold Fundamental Price rose $18 this week, to $1,419. Now let’s look at silver.

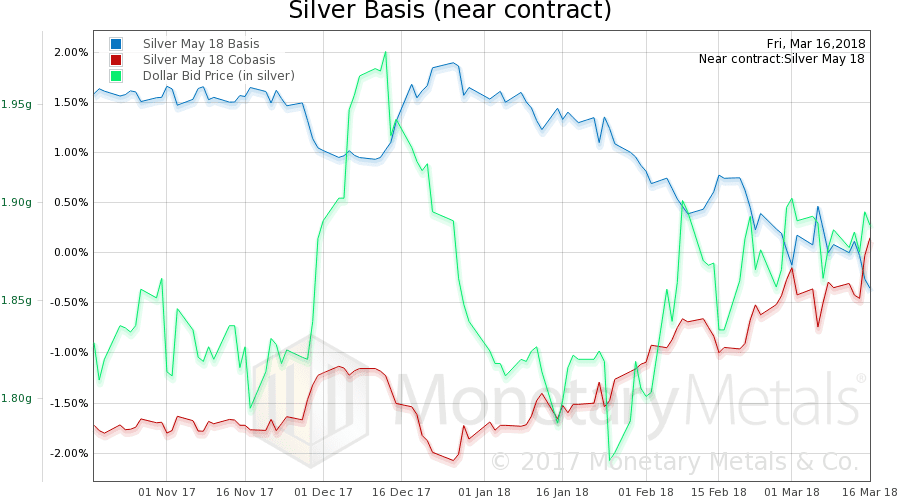

Silver also has a touch of temporary backwardation (which tends to occur earlier than in gold), in the May contract. Silver also shows the same correlation. The metal is scarcer now than when its price was a buck higher in mid-January.

The Monetary Metals Silver Fundamental Price rose 11 cents to $17.36.

At the top, we asked if this was a new trend. The silver fundamental price has trended sideways since last August. However, the gold fundamental has been trending up since the start of the year.

Make of that what you will. We see it as one more sign of a weak economy. Silver has industrial as well as monetary demand. Industrial demand must be weak. Retail demand for coins and small bars of both metals is weak, but monetary demand for gold is more robust.

© 2018 Monetary Metals

:

:

If it were true that central banks ‘care no more about the price of gold than they care about the price of antique Ferraris’. They would not have gold and gold receivables as a one line item on their balance sheets, and they would also agree to have independent audits & assays of their gold stock.

The comments from Eddie George are probably best suited, than Greenspan’s about central bank interest in gold price suppression. There is credible evidence that the episode known as Brown’s Bottom was about the bailout of London based bullion banks which were heavily short the market.

“In front of 3 witnesses, Bank of England Governor Eddie George spoke to Nicholas J. Morrell (CEO of Lonmin Plc) after the Washington Agreement gold price explosion in Sept/Oct 1999. Mr. George said “We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K.”

His quote implies quite clearly that gold was not previously being manipulated or managed: “Therefore at any price, at any cost, the central banks had to quell the gold price, manage it…” It was a temporary expediency of controlling the price to enable the bullion banks to extract themselves from a precarious position, which any group of large players can do in any commodity temporarily.

If ongoing central bank gold price management is being asserted, then the central banks are responsible for the subsequent run up to nearly $2,000?

Tthe former “quell the gold price”quote indicates a lack of gold. manipulation requires available gold as i understand it.

Angus manipulation does not require available (physical) gold. We have absolutely no vision into the wholesale markets, there is no trade reporting, no transaction reporting, and the LBMA admit 90% of the Loco London market is trading imaginary gold, these are claims on gold that is simply not there, it is gold that has been sold 90x over.

now even the Turks get it

https://www.dailysabah.com/finance/2018/03/18/central-banks-have-long-history-of-manipulating-gold-prices-expert-says

You should be able to see a pattern now both the Russians and the Turks publish such findings.

Donald, the management of price can be in both directions. Gold is not a market free of surreptitious intervention, proof you have participants such as BIS & Banque de France, both publicly say there is intervention in the gold market and even offer intervention services to other Central Banks.

Thanks for the interesting article Keith

The Treasury has the gold the fed has certificates.

First off, I must declare that I am seriously challenged n my understanding of the world vis-à-vis how the capital markets operate, much less the gold market. I’m a simple dirt-farmer wanna-be in rural Tennessee, (they actually have classes for this these days here-abouts, in which I am currently enrolled). My only grace, if it can be called such, is that I read.

From this practice I know some things to be truths eternal. They are irrefutable nuggets of knowledge which have, time and again, withstood the tests of time. The one that comes to mind, and is standard boilerplate in just about any prospectus is, “Past performance is not an indicator of future price activity”, or something of the sort.

This axiom can be extrapolated to the larger “Just because things have gone a certain way in the past does not mean they will remain the same in the future”. As Dr. Weiner clearly points out, the US government has been cooking the gold books in favor of a banking cartel for over a century, (needlessly I point out that this has always been at the expense of the American taxpayer/citizen). In fact, successive US administrations have consistently favored central bankers, (US & European), over its own citizens and continues to do so to this day. Any doubt of that can be vanquished by simply looking at how the gold futures markets operate with nary a gold bar in sight. The latest over-hypothecation stands around 147:1 paper-to-physical ounces available at the COMEX. It is these contracts that drive the current price of gold.

I would refer all to Gijsbert Groenewegen’s recent posts on why he thinks things are about to change:

http://www.gold-eagle.com/article/recycling-us-dollars-financing-us-deficits-going-end-part-1

&

http://www.gold-eagle.com/article/recycling-us-dollars-financing-us-deficits-going-end-part-2

Mr. Groenewegen believes that the upcoming March 26th introduction of the petro-yuan-gold contracts are going to make a large move against the US$ hegemony as it will further weaken the use of the US Dollar as reserve currency. Is he right? Meh. I’m a simple wannabe dirt farmer. But I add what Groenewegen says to Adam Hamilton’s “Gold Miners’ Q4’17 Fundamentals” (http://www.321gold.com/editorials/hamilton/hamilton031618.html) and it all tells me that maybe it is a wise idea to a) take distribution of any gold, silver, platinum and/or palladium assets held in a gold SDIRA before any change in current metals prices and b) buy in to some of the marvelously undervalued PM miners to be had.

TL;DR: I believe Keith when he says the warehousemen are honest. It’s just the guys they work with that leads me to have my doubts. I think that it is a wise time to bring your chickens in as the hawks are circling. YMMV.

Peace,

Theo