Stay Away From Gold?!?

Forbes Senior Contributor Larry Light penned an opinion piece this week titled “Stay the Hell Away From Gold”.

As you can imagine, he took a strong position on whether or not purchasing gold right now is a good idea.

Spoiler Alert: he’s against it.

His argument boils down to this: gold is volatile, and while it may keep rising in dollars after hitting a new record above $1900, it’s likely to come back down later – just as it did in the 2010s following the last financial crisis.

In his brief analysis, Light overlooks a couple of fundamental facts about gold.

Gold Prices Beyond the 2010s

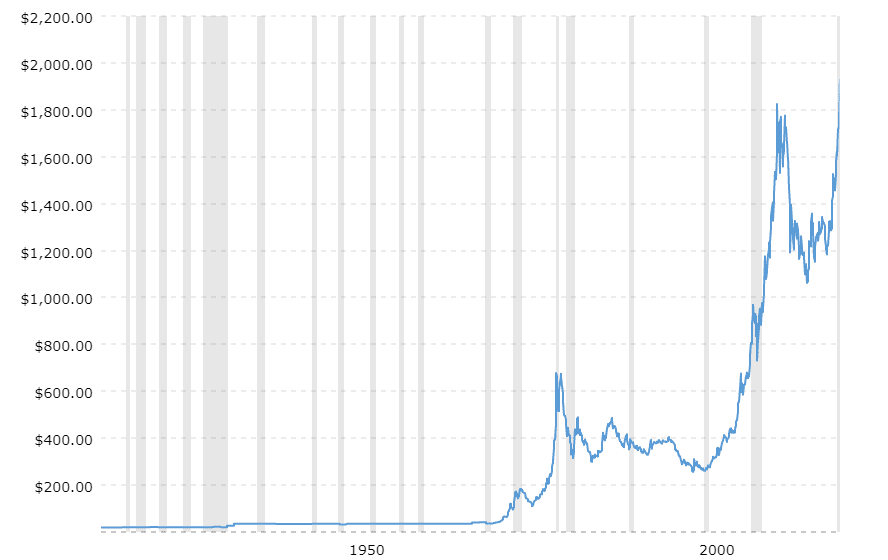

First, instead of taking a microscope to the 2010s as Light does, let’s look at the long-term history of gold prices. Since 1975, the rubber-band dollar has stretched from $140 per ounce to over $1900, against the steel meter stick of an “ounce.” You can go back even further, of course, to the year 1915 when gold was less than $20 per ounce.

Attribution: Macrotrends.net Gold Prices – 100 Year Historical Chart Note: chart corrected on 30 July

As the chart shows, the dollar has lost nearly all its value against gold over the last 100 years. This fact is indisputable and perhaps points to the idea that something might be amiss with our entirely gold-free monetary system. But I digress. The point is simply that, over the long term, gold has a very strong track record. It’s not at all unreasonable to expect that trend to continue.

Consider Counterparty Risk

Second, gold has zero counterparty risk. Gold isn’t just valuable for avoiding the falling value of the dollar, it’s most valuable because it doesn’t depend on anyone else “coming through”.

In other words, gold cannot default. That’s more than can be said for the US dollar, which is ultimately an IOU. Or, as our CEO Keith Weiner wrote at Forbes, it’s a slice of debt owed by the Federal Reserve.

And it’s actually something that may become more in demand during these days of crisis. Investors hold their dollars, after all, in financial institutions which had to be bailed out pretty hard back in 2008. We now seem to be in the midst of another financial crisis. How likely is another round of bailouts going forward?

Additionally, perhaps you remember MF Global, whose clients lost all their money back in 2011 (predicted well by the popular “It’s gone!” South Park clip). Not to mention the possibility of “bail-ins” in this day and age – which reared their ugly head back in 2013 in Cyprus.

Who escaped from these situations completely unscathed? Gold owners.

The point is that gold, while not sexy, is no one else’s liability. That’s perhaps the top reason to own it. And Larry Light doesn’t even mention it.

Who Invests in Gold?

Light tells us that the “smart money” doesn’t invest in gold. (Though he then concedes that gold does benefit an investment portfolio in small doses because of diversification – which lowers overall volatility and raises returns). He notes, as an example, that the Texas Teachers’ Retirement System puts only 1% of its portfolio towards gold.

But Light misses the obvious reason why institutions like Texas Teachers don’t allocate more to gold. Institutional investors are all about yield. They need to earn a yield on their capital so that they can support their programs going forward. That is their mandate. And until recently, gold offered zero yield.

Gold Does Offer a Yield

Big news! We no longer live in a world where gold doesn’t earn a yield. Monetary Metals has been paying interest on gold since 2016 – between 2.0% and 4.5% annual (with minimum investment levels at 10 ounces for gold, 1000 ounces in silver).

If you can get that kind of return on your gold, then that’s one more reason why investors shouldn’t “stay the hell away from it.”

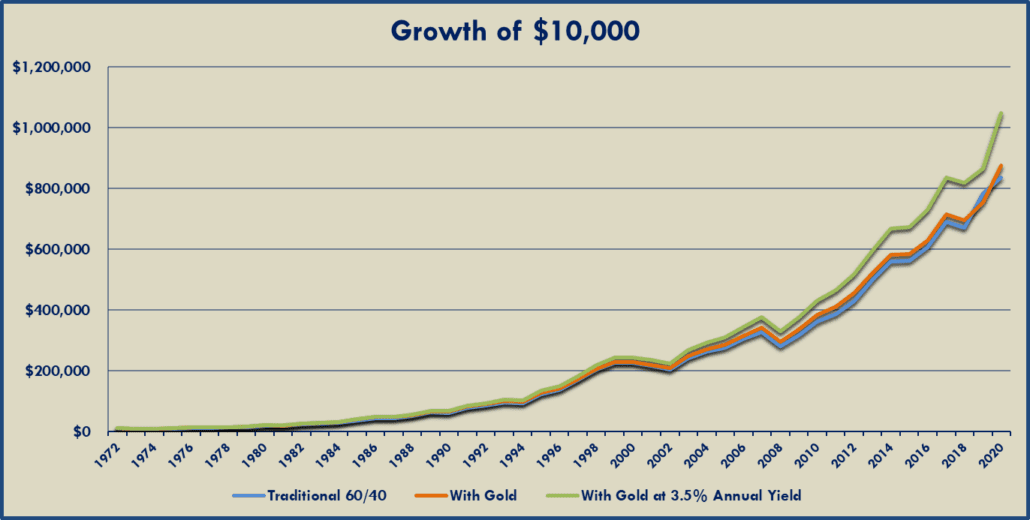

Take a look at this chart, comparing a traditional 60/40 stock portfolio with a portfolio that adds just a 4% allocation to gold. Then replace that gold allocation with gold that pays a yield at 3.5% annually.

(Results based on backtesting simulations of multiple portfolios using custom data sets with assumptions. Past performance is not a guarantee of future results. For more information on the assumptions and the data used for this chart, please download our white paper The Case for Gold Yield in Investment Portfolios)

The contrast is striking. It’s clear that adding some gold to your portfolio increases returns and adding gold-with-yield increases them significantly more.

Overall, we find that Light is doing his readers a disservice. Not only is he shoo-ing investors away from the one financial asset that is no one else’s liability – and an option that is extremely valuable in times of crisis – he’s unaware that gold is no longer a yield-free, dead metal.

Gold-with-a-yield is a reality now. And it’s a game-changer. It merits consideration in a well-diversified investment portfolio – even at $1900 an ounce.

Add Gold to Your Portfolio

To learn more about improving the performance of your investment portfolio and investing in gold that pays a yield, download our white paper The Case for Gold Yield in Investment Portfolios. Or schedule a call with a Monetary Metals team member and get started earning interest on gold today!

Usually for an asset class to significantly move the needle on a portfolio, you need at least a 10% allocation. That gold-with-a-yield can do that with a 4% allocation is very impressive and indeed a game-changer.

Hello dclinde,

Thank you for your comment. Agreed. The larger the allocation the more impact it will have on the overall performance of the portfolio. In our white paper, we run backtests for several different model portfolios, including one with a 10% allocation to “gold with yield” and another with a 20% allocation to “gold with yield.” You can access the paper for free here: http://goldyield.monetary-metals.com/the-case-for-gold

Hi Keith.

It’s the first time I can recall you directly making the argument for gold as an unencumbered asset (otherwise known as “Collateral”, or simply “Money”) vs. being someone else’s liability.

That, plus the ability to earn a respectable yield on owned gold that’s consistent with the risk undertaken, ought to be all a skeptical gold investor needs to understand to decide on that 4%+ allocation. It’s simplostoc enough for even a money manager working for a Teachers’ Union to explain to her clients.

Best.

Whoops! Credit to Addison for this article!

Back of the envelope numbers:

Total wealth of the world $360 Trillion.

What if 4% were allocated to holding gold?

That’d be $14.4 Trillion allocated to holding

the world’s stock of gold, which may be 200,000 metric tonnes or 7,054,792,000 ounces.

Or roughly $2,041/ounce.

So in a sense, the world is almost at this portfolio allocation.

If only all of it were deposited in a Monetary Metals account ;-)