Summary of Keith Weiner’s Interview on Capital Account with Lauren Lyster – Debunking the Naked Short Position

Last Friday, I was interviewed on Capital Account with Lauren Lyster. We discussed one of the more popular conspiracy theories regarding gold price manipulation. The claim is that a banking cartel is surreptitiously suppressing the price of gold by selling contracts short “naked” (i.e. without having the metal to deliver) in the futures market. We believe this theory to be false, and I present the evidence in this article in more depth than I could cover in a few minutes on TV.

Let us first clarify two things. First, we do not dispute that the banks hold a large short position in the futures market. This is an accepted fact.

Second, we are no defenders of the current regime of irredeemable paper money that is centrally planned by the Fed. As I said to Lauren, we are advocates of the gold standard and of free markets. We offer this criticism of the conspiracy theory because it is not helpful, either to those who adhere to it or to our cause of bringing the gold case to the mainstream.

Third, we are not claiming that the current system is a free market, without manipulation. The whole point of irredeemable paper is to give the power of expanding counterfeit credit to the Fed (Inflation-An Expansion of Counterfeit Credit). One of the ways they do this is by buying bonds, thus causing the rate of interest to fall.

According to the conspiracy theory, the banks offer an excuse for their short positions in the futures market. The banks claim they are “hedging”. This is a big reason why many believe in the conspiracy theory. It makes no sense to buy metal and then “hedge” it.

We offer a different view. In our view, the market is offering the banks (or anyone who has access to dirt cheap credit) a profit to hold a gold bar. The reason why this is not widely recognized is that the market does not directly quote a price to hold a gold bar. However, it does quote a price on gold futures and a separate price on spot gold for immediate delivery. What do you get if you subtract spot from future? What is the meaning of this spread?

Gold Basis = Future Gold – Spot Gold

The Gold Basis is the profit one could make if one *simultaneously* bought gold in the spot market and sold a contract in the futures market! This is an arbitrage.

Now we have to alternative theories. One theory says that the banks are selling futures short “naked” (to drive the price down). The other says they are “carrying” gold (buying metal and selling it forward), doing arbitrage. Whenever one has two alternative theories, one should look for a way to obtain data that would read one way if theory A is correct, but read another way if theory B is correct.

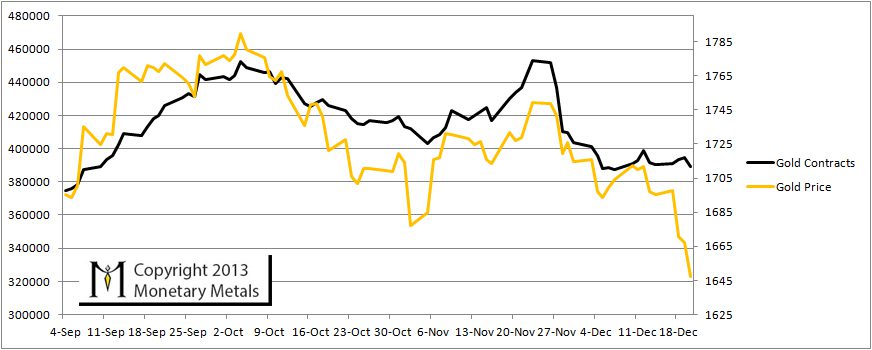

On Capital Account, I presented two graphs. The first showed the number of contracts open (“open interest”) overlaid on the gold price. To understand this, it is important to realize that there are two kinds of selling in futures. If one owns a future, one can sell it. This will often close it (but not necessarily). If one does not own a future, one can sell a future short. This will often open a new contract (but not necessarily).

What would we expect to see when the price is falling, if the conspiracy theory is true? We would expect to see a rise in open interest. The banks would be driving the price down by selling more future contracts. What would we expect to see when the price is falling, if the arbitrage theory is true? Open interest would not necessarily be rising or at least in some cases would be falling.

Gold Price and Number of Open Future Contracts

Sure enough, we see a falling open interest as the price falls. Naked shorting by the banks would almost by definition have to be selling to create new contracts. The whole point of the manipulation theory is that they are sopping up real demand by creating counterfeit futures. If the arbitrage theory is correct, then the open interest is declining when “naked longs”, who speculate on the gold price by buying futures using leverage, sell their contracts. This data alone may not prove conclusively that the conspiracy theory is false and the arbitrage theory is true, but at least it should give anyone reason to stop and consider.

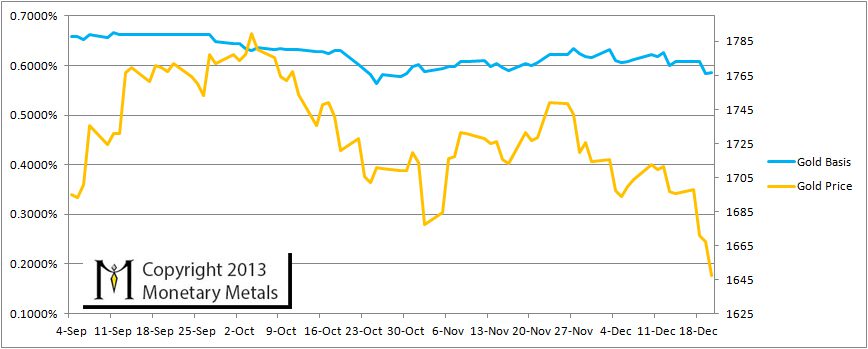

Open interest data is readily available to everyone. We claim nothing new in this analysis so far. Now let’s look at the basis data. What would happen to the basis if the conspiracy theory is true? The basis should fall as the price falls. This is because the banks would be selling only futures, and not physical metal. So they would be driving down the price of futures and not the price of physical metal.

It stands to reason that when the price of the gold future contract falls below the spot price of gold, there is no profit to be made by carrying gold. This condition is called backwardation and it has very serious implications when it happens in the gold and silver markets (See my paper When Gold Backwardation Becomes Permanent).

If the arbitrage theory is correct, then we would not expect to see much of a change in the basis and the basis could fall or rise as the price falls.

Gold Price and Gold Basis

The first thing to take note of on this graph is the range of the basis. The basis is quoted as an annualized percentage and this graph shows the basis for Dec 2013 gold. A bank could make around 0.6% to carry gold! This is about 3X more than they could make by carrying a one-year Treasury Bill. Carrying gold is a profitable business (if you can borrow at near-zero and you don’t have to pay commissions). The banks are beholden to Wall Street and must show a profit every quarter just like every nonfinancial corporation. The gold carry trade helps them produce predictable profits.

Next, let’s look at the $100 price drop in gold between November 25th and December 20th. The basis stays remaing in a range of +0.64% and +0.59%. Its decline is around 0.05% (which is around 85 cents). In the conspiracy theory, the banks are pushing down the price of the future but not the price of spot. If they sold enough futures to drop the price by $100, then the basis would fall to around -6%. In the arbitrage theory, the banks are long physiscal metal and short futures. If they buy back a future from a panicky “naked long” then they will sell the physical metal. Thus both markets remain locked together. It is worth noting that a graph of the price of a future overlaid on the price of spot is a very boring graph. The two traces track virtually perfectly and one would overwrite the other and obscure it.

In the past, I have written about gold and silver manipulation several times, in chronological order:

NB: In this article, we used gold market data. The same analysis applies to silver as well.

“All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident”.

-Arthur Schopenhauer

Trackbacks & Pingbacks

Yahoo results

While searching Yahoo I discovered this page in the results and I didn’t think it fit

Comments are closed.