Super-Duper-Irrational Exuberance, Report 11 Mar 2018

Think back to the halcyon days of the dot com boom. This was a time after Greenspan declared “irrational exuberance”. Long Term Capital Management collapsed in 1998, and Greenspan decided to risk propelling exuberance to a level beyond irrational. Super-duper-irrational exuberance?

Anyway, Greenspan cut interest rates a few times in late 1998. Technology companies were able to raise $5 million or more with just a sketch on a napkin (“serviette” for those outside the US). Companies at a “later stage”, though without revenues, could raise $30 million. A company called “Webvan” was able to raise nearly a billion dollars without ever becoming profitable.

These companies should not have been able to raise so much capital. At any given point in the development of a company, there are only so many things that need spending. Not to mention can be justified to investors.

It is obvious in retrospect that those particular companies wasted investor money (if not the broader principles), after investors booked the losses, but it was anything but clear at the time. Keith recalls debating the so called hypothesis of efficient markets with some people who believed that all market prices are correct. That all changes in price are random, unpredictable.

We have written a lot about how falling interest rates cause capital consumption. It drives speculation, which is a process of conversion of one speculator’s wealth into another’s income. No one wants to spend his wealth, but people are happy to spend their income.

Force-Feeding Capital

Greenspan’s super-duper-irrational exuberance shows another mechanism. An equity market boom force-feeds companies more capital than is good for them. Consider the AOL acquisition of Time Warner. By any rational measure, the latter was a much bigger company. Take your pick of assets, revenues, profits, etc. However, by one irrational measure—which is the one measure that mattered—AOL was bigger.

It had a larger market capitalization.

Whereas Time Warner was merely an old media company, AOL was everything hip and new-economy-ish. And technology. Tech was going to change the world, don’t’cha’know? So the latter acquired the former. The super-duper-irrationally exuberant stock market had given AOL the currency with which to buy anything it wanted to buy. In a normal world, AOL could not have acquired Time Warner. But a stock market boom fueled by falling interest rates under central bank socialism is not a normal world.

At the end of the day, the AOL Time Warner merger was a failure. So was Webvan. So were the companies who raised millions before they had a business. And so many others. Keith recalls a statistic that something like 2.5% of GDP was invested in technology startups in 1999. We will get back to this point in a moment.

There has got to be a principle, an iron law of investing, that for each enterprise there is an appropriate amount of investment. By lowering yields, which causes share prices to rise, the central banks are injecting more capital than businesses can rationally use. Therefore they use it irrationally. This is inevitable because the very metric to measure rationality and irrationality is collateral damage of the central bank’s monetary policy.

False Signals

Interest emerges in the market as a function of time preference and productivity. When a central bank distorts the interest rate, it does not change the human condition and its consequent preference for cash over a long-term promise to pay. It changes only the means of measuring these things. It gives business managers false signals. Imagine hacking a traffic light to turn the light facing your car green as you approach. You are bound to crash.

There is a positive feedback between mal-investment and GDP. We note above the absurd level of investment in technology startups, far greater than the opportunities these companies really had. Too-low and falling interest are the cause. Let’s now focus on the effect.

Every penny of that malinvestment was spent. It was spent on things that add to GDP. GDP was increased as the effect of malinvestment. The capital of investors was converted into income, to be spent. Everyone is poorer for this process (well except for a few who earn fees on the transactions).

Much of this spending was on other technology products. For example, every tech startup had to buy computers with Intel chips inside, routers from Cisco, and software from Microsoft. So revenues at these companies was artificially elevated. We say artificial, being that it was merely the accumulated wealth of investors going up in digital smoke.

The artificial, temporary revenue increase was not exclusively at major technology vendors. It was boosted at office furniture companies, office remodeling contractors, even quarries in Italy where they cut the stone slabs for sexy new conference room tables. And of course all of the employees at the tech startups got salaries and bought groceries, cars, vacations to Las Vegas, etc.

This rising revenue caused rising profits at these vendors. That in itself could cause their share prices to rise. And in addition to rising earnings, was rising price to earnings ratio. The net effect is that these companies were over-overvalued. If earnings doubled, then share price could have doubled. But the P/E also rose, so the share price went up by even more than that. This stock price surge was temporarily fueled by someone else’s capital.

We are sure glad that no such super-duper-irrational exuberance or false signals is going on today. Good thing that investors learned their lessons…

Digging Holes

This is one reason why we argue that GDP is no measure of the health of an economy. It adds capital destruction in as a positive term. Many readers will be familiar with the Keynesian rubbish that paying a thousand men to dig a hole adds to GDP. It’s true—it does add. This is not an argument in favor of paying for useless holes—it is an argument against misleading macroeconomic statistics!

Many people assume that such waste comes only from government spending. They might say “yes, there’s a problem with this formulation, Government should not be added:”

GDP = Consumption + Government + Investment + Exports – Imports

That’s correct, government should not be added. However, we are arguing that a part of Consumption and a part of Investment are also capital destruction. Eating the seed corn employs people, generates revenues, and attracts investment, etc. During Greenspan’s super-duper-irrational exuberance period, a lot of seed corn was eaten.

A falling interest rate causes capital destruction in a myriad of ways. We have not even covered all of them yet in this ongoing series. So far, under the post-Nixon-default regime of pure irredeemable currency, we have had 37 years of falling rates (notwithstanding the present premature pronouncements of the passing of this trend).

Forget about rising consumer prices. This—the falling interest rate and destruction it wreaks—is a compelling argument for why we need to move to the gold standard. We need a stable interest rate, which is not possible nor desirable under central bank socialism.

We need a free market in goods and services, but most of all in money. Socialism is killing us.

Supply and Demand Fundamentals

We were reminded by a hail of tweets this week of a popular view of the gold futures market. It is: futures exist to siphon off demand that would otherwise go into physical. We have a few things to say about this.

First, be aware that many institutional investors are barred by either charter or regulation from owning a commodity. They may own securities and other financial products. These institutions can bring their demand to the gold market today, whereas if the market was physical bars and coins only, they would have to sit on the sidelines. Futures reduce the friction in gold trading. There is an old rule for sophisticated investors “if I can’t get out easily when I need to, then I don’t want to get in.”

Second, the implicit theme of our Supply and Demand Report every week (and the explicit topic of pieces such as Thoughtful Disagreement with Ted Butler) is to look at the interactions between the physical and futures market.

WHEN YOU BUY A GOLD FUTURE, THE MARKET MAKER IS BUYING PHYSICAL, SELLING YOU THE FUTURE, AND CARRYING THE GOLD FOR THE DURATION. During this time the market maker may or may not lease the metal.

It cannot be overemphasized, or stated too often. Please tell your conspiracy-believing friends. Futures do not take demand away from physical metal. They pass the demand right through.

Beyond merely siphoning demand, some go farther and call futures a simple fraud to get away with selling each bar of gold 100 times over. This is a hypothesis that, if it were true, would cause certain effects in the world. We can identify what those effects would be. We can study the data to see if these effects occur. We provide that data and analysis in our Ted Butler piece. We proved this fraudulent multiple selling allegation is false.

Finally, these tweets asserted that the central banks have to suppress the price of gold. They gave many reasons, but we want to focus on just one. They need to prop up the value of their currencies. We want to note the absolute irony of this.

Who in the world measures the value of the dollar (or any currency) in gold terms?! Other than Monetary Metals—we say the dollar is currently 23.6mg gold—who else thinks like this? The central bankers, their academic enablers, and their most harsh critics alike all agree to measure the dollar either in terms of its so called purchasing power or in terms of its derivatives euro, pound, yen, etc.

Either the dollar is 1/P (where P is consumer prices), or it is the dollar index, a basket of currencies.

Aside from this, central bankers do not think about gold.

Granted, they once did. In the 1960’s, there was the now-infamous London Gold Pool to keep the price of gold at $35. This is endlessly cited as evidence of current central bank price suppression, without bothering to mention that until 1971 the official US policy was to maintain the dollar to gold exchange rate of $35 to the ounce. Alan Greenspan wrote an essay that Ayn Rand published in 1966, in Capitalism: The Unknown Ideal that showed he understood gold. At least then. During his tenure as Chairman of the Federal Reserve, not so much.

But today? We see no sign that central bankers care about the price of gold. They, and the gold bugs, think of gold as a volatile asset that one can buy just like a 1955 Testarossa or a 1983 Chateau de Rothschilds. One buys to diversify one’s portfolio, hedge risk, or bet on its price. And the central banks care about the gold price about as much as they do the price of antique Ferraris.

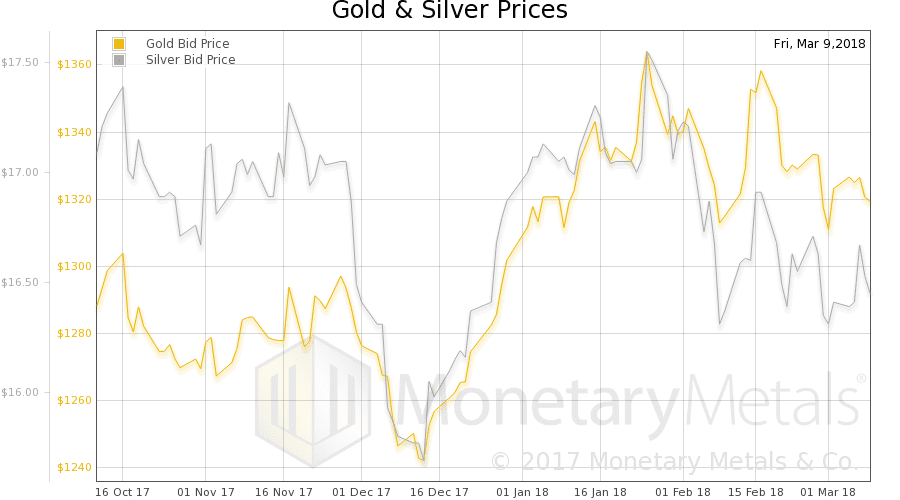

This week, the price of gold was basically unchanged with the price of silver moving up a few pennies.

Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

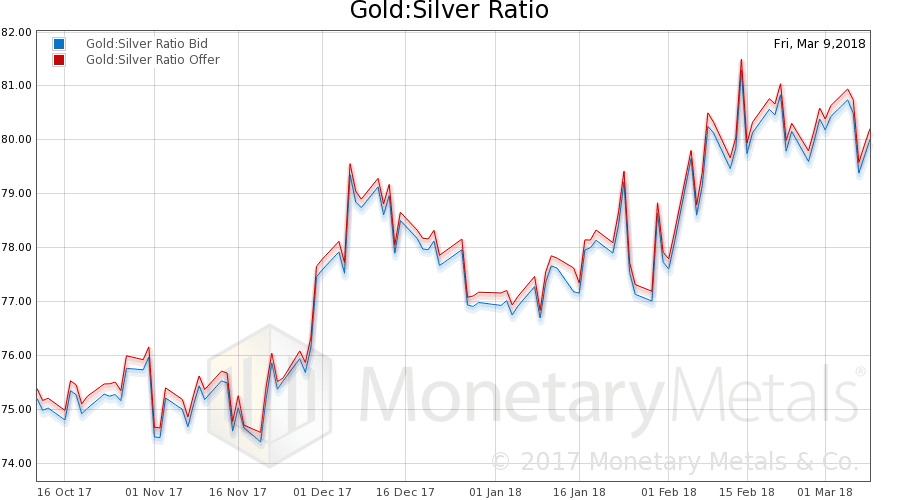

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio).

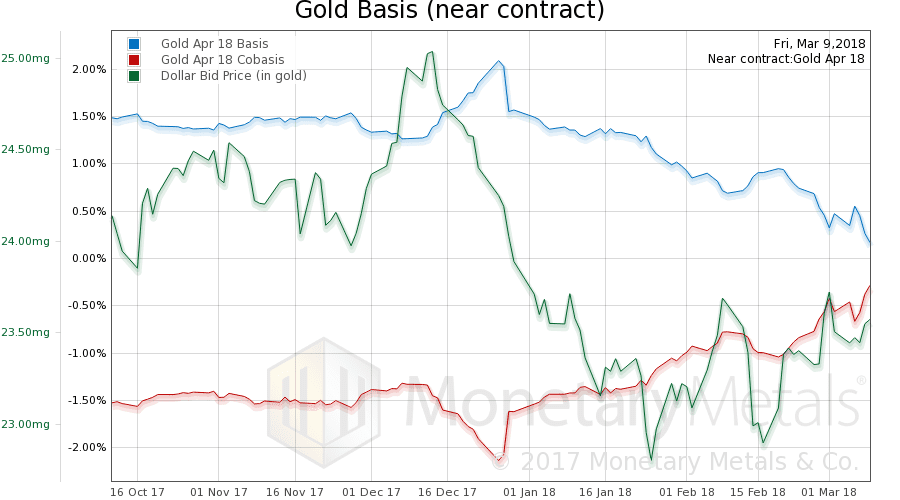

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

We see a small rise in the April cobasis, but this is more due to the selling ahead of the impending contract expiry—the contract roll.

The Monetary Metals Gold Fundamental Price rose $20 this week, to $1,401. Now let’s look at silver.

Our scarcity indicator for silver moved sideways this week. The Monetary Metals Silver Fundamental Price rose 4 cents to $17.25.

© 2018 Monetary Metals

Can you explain this quotation?

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K. – Eddie George, then Governor of the Bank of England, 1999

The 1999 gold crisis is discussed in the 2007 edition of Time of the Vulture. Because fractional reserve banking is a con game wherein confidence is paramount, governments and bankers’ did not want either the crisis known or its cause revealed so speculation and rumor existed in place of fact. In 2012, however, the cause of the 1999 crisis was substantiated in the media and was included in my 2012 update of Time of the vulture

Darryl Robert Schoon

http://www.drschoon.com

I work for a company that builds products primarily out of formed sheet metal. Over the past twenty years, it has gotten to the point where I can now swing a dead cat in any direction and hit a shop with a laser cutter and CNC forming equipment, all of whom are furiously undercutting each other to bid on outside work, and this in a semi-rural area. We used to outsource our work to these guys. Now, our new owners have insisted on installing the identical capacity in our own shop, apparently because of the needs of Just In Time manufacturing. But now our equipment sits idle for a good portion of the work week. When I question the feasibility of this investment, I get a funny look. But I think it’s a result of the process by which falling interest incentivizes capital consumption, and the private sector is not exempt.

Keith is another conspiracy theorist and funnily it’s the same culprit that GATA : everything is the (socialist) central banks’ fault ! (You have always to add socialist/socialism to be more credible !).

If only we could go back to the capitalism golden age of the 19th century…

It reminds me the “globalists” of Brandon Smith of alt-market…

Something I said in this article has struck a nerve! Let me try to offer some brief comments, and maybe a longer followup piece later.

Angus: one curious feature of the gold conspiracy side is that it answers data with quotes–real or alleged–often from decades ago. I don’t know what George said in 1999, but I do know what the price of gold did in 1999. It briefly dropped from $288 to $260–and ended the year unchanged. We published an article a while back on the impact of Gordon Brown’s gold selling on the basis. I encourage you to read for further insight into this adventure.

I must insist that fractional reserve is not a con game. There is nothing wrong with fractional reserve banking per se (though duration mismatch is a problem). Here is my original article on FRB: http://goldstandardinstitute.us/?p=436

Liberty: that sounds like a consequence of falling rates. It overstimulates overcapacity.

RD: I define what I mean by socialism and central planning. And I show precisely how and why it causes destruction. If you are new to my writing, there is a wealth of back articles on the consequences of falling rates. Also, my theory of interest and prices. And it is *NOT* a conspiracy. At least it’s not hidden, it is quote out in the open.

Hi Keith,

Thanks for your article and your ongoing work/mission. Once again a brilliant analysis of the situation.

Could you elaborate further on one issue which I personally didn’t understand and other readers I am sure would love to hear more about?

“WHEN YOU BUY A GOLD FUTURE, THE MARKET MAKER IS BUYING PHYSICAL, SELLING YOU THE FUTURE, AND CARRYING THE GOLD FOR THE DURATION. During this time the market maker may or may not lease the metal.”

Hi Keith,

Can you share your thoughts about “Absolute deflation and inflation” as Irving Fisher described it. As per Fisher the changes in price levels has to do with the increase or decrease of money and goods circulated. NOT how much gold can the dollar buy or vice versa. To relate this, he pointed to the fact that when the dollar was pegged to gold they would both go up an down together. Just as 2 pints of milk is always quart. The quantities of milk will always stay the same . “The Money Illusion” by Irving Fisher.

Keith where do you think we are now with absolute deflation/inflation?

Some real disingenuous comments in this week’s article:

“central bankers do not think about gold”

“And the central banks care about the gold price about as much as they do the price of antique Ferraris.”

Elvira Nabiullina is the governor of the Central Bank of the Russian Federation. From her appointment in 2013, the country’s gold reserves have risen 85% from 1,000 tonnes to 1,856 tonnes with new purchases almost every month. Is this because they “do not think” about gold? How many antique Ferraris are on the central bank balance sheet? Please tell us the number.

China strategically and non-transparently updated their published number for gold reserves at very irregular 5 year intervals, both times showing very large increases. Perhaps they purchased the gold without thinking, and also not caring about it? Tell us how much antique wine the People’s Bank of China holds as a reserve asset.

The Reserve Bank of India purchases 200 tonnes of gold in late 2009, sold by the IMF. The comment on the purchase being “it is a way of spreading its assets which are said to be currently over-weighted with foreign currency, mainly in the form of sovereign US Treasury bonds. In other words, it is a hedge against a falling dollar.” Note that India did not purchase classical paintings instead.

Kazakhstan has increased their gold reserves 332%, 70 tonnes to 303 tonnes since 2010. Surely they purchased this gold, because they were not thinking about gold.

Why have there been 3 versions of the Washington Agreement on Gold if central banks “do not care” about gold?

The Federal Reserve and ECB stated during QE that they were prepared to monetize any asset, except Gold. Surely they explicity left out gold, because they were not thinking about gold.

The Central Banks used in the comment have a very different motivation…protection from the US dollar based system, SWIFT, and other forms of monetary/financial repression the US has engaged in, in the past, to maintain its “exceptional nation” status. Russia, Kazakhstan, China, and to a lesser extent India (the largest holder of gold on the planet-estimated to be north of 20K tons (except is held by the people and their houses of worship) so it’s not counted as nation-state held gold.

The Fed and the ECB don’t need to “monetize” gold by any decree of theirs as gold is money everywhere on the planet. It has been and always been money. Everything else is “currency,” as only gold holds all 7 attributes of “money.” Currency has all but one…a store of value.

So these CB’s aren’t thinking about gold directly, but how to protect themselves against US hegemony and the currency, trade, and other wars we’re engaged in not including the “hot” ones.

The “Kaz” is the largest producer of yellow cake uranium on the planet-think Fusion GPS. China is a ponzi and no one has any idea of how much they have…and will need when that ponzi falls apart. Russia will continue to add gold, just like they’re spending a lot of rubles on modern weapon systems to combat the “Imperial City’s” Russiaphobe narrative.

CB’s are arms of the state. It’s the state that’s dictating the purchase for their reasons, just like the Fed keeps up its insane posturing as we can never repay our debt and only barely can pay the “vig” on it. If the ECB stopped buying sovereign debt of the EU, it would, maybe except for Germany, collapse in a heartbeat.

My view is Keith is correct about Au and CB’s. My view is the conversation changes when you talk of the health of the state.