Wealth Accumulation Is Becoming Impossible, Report 20 Oct

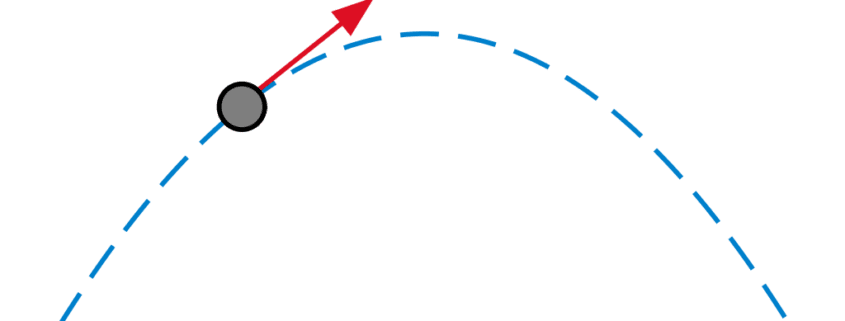

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them […]