Savers are Just Collateral Damage, Report 29 Apr 2018

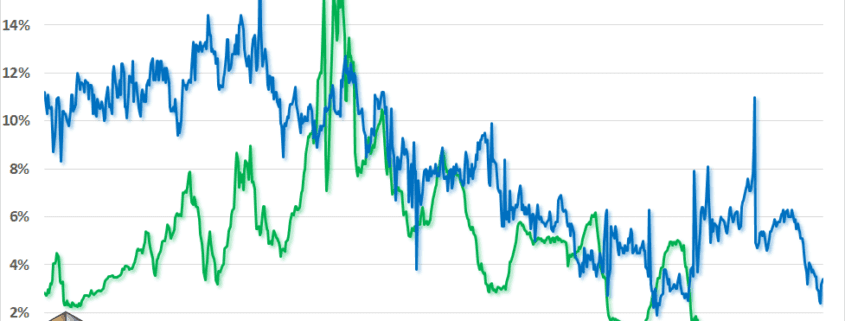

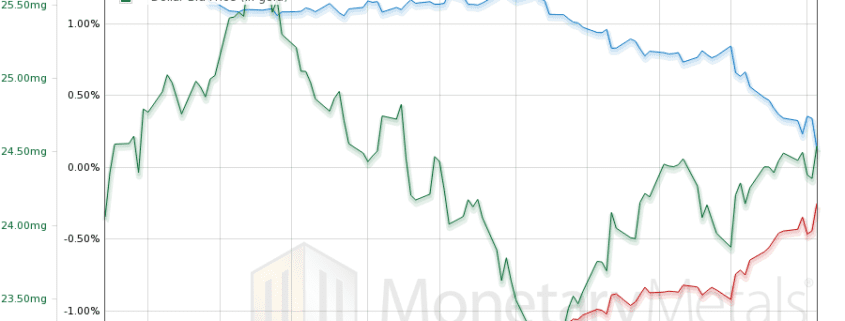

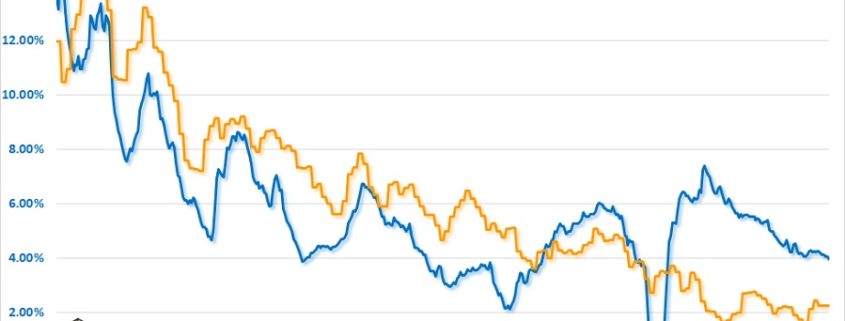

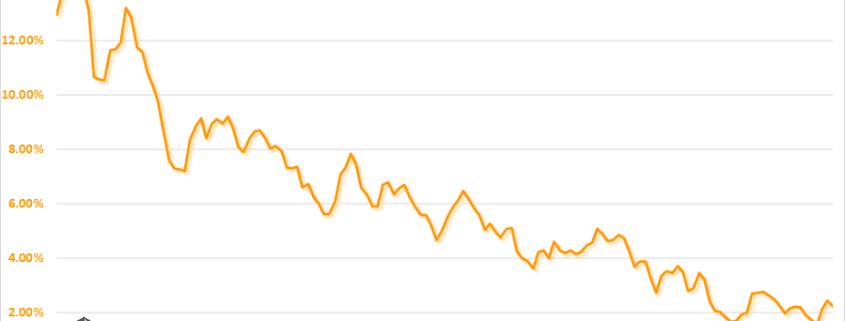

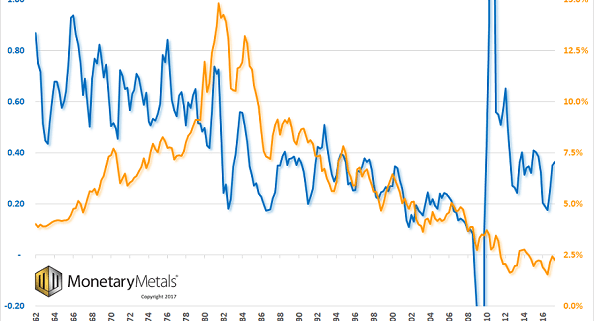

A reader asked us this week about the personal savings rate. Most people can sense that something is wrong if the rate is in a long-term falling trend, or if it falls too low (whatever level that may be). We argue that falling savings is part of the larger process of capital destruction. And unfortunately, […]