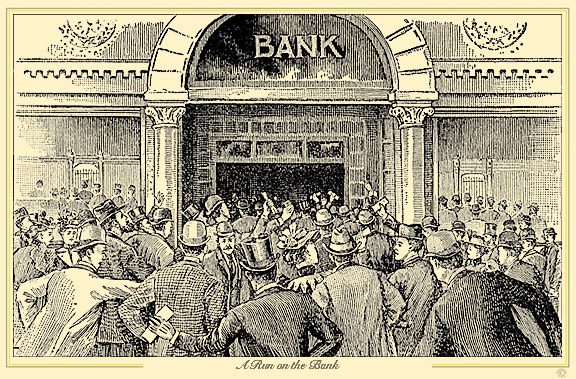

Cyprus Collapse Triggers Unintended Consequences

Some people believe that by imposing losses on investors and reducing the Cyprus banking system liabilities, the European powers have addressed the problems in Cyprus (if harshly). Others think that it was just an unjust tax on depositors. I have written about the sequence of events. Cyprus banks borrowed money and bought Greek government bonds. […]