Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate.

You’d think that everyone would know that printing fake money and waving bogus theories around will not create new wealth. The excuse is that the so called wealth effect is so pleasant. Like drugs provide a happiness effect.

There is an old joke about a guy who talks to a psychologist about his crazy brother.

The guys says, “Doc, my brother thinks he’s a chicken.”

The psychologist says, “You should make sure he gets therapy for this delusion.”

“I would, but the eggs are good!”

So it is with attempts to make people feel wealthier so they will spend more money (i.e. consume their capital). It’s not real wealth, but they don’t know it because their account statements show larger and larger numbers every month.

A central bank cannot create wealth. And the corollary is that it cannot produce anything, neither capital goods nor consumer goods. It can merely alter the incentives offered to people (i.e. pervert them).

Nor can the central bank create money. What it creates is credit. It’s a bank; it lends. And it can manipulate the interest rate. That is its one special power. All of its fancy policy tools—including increasing the money supply—amount to manipulating interest rates. It can dictate the overnight interest rate. And because banks can borrow at this rate, to fund their purchase of long-term bonds, the central bank can influence the long-term interest rate too.

Each school has different reasons for what they call printing of what they call money. Variously, these reasons are to counter a downturn, to pay for the welfare state, to employ more of the dumb workers, euthanize the rentier, and to juice up GDP. By the way, it was Janet Yellen who wrote a paper on the bit about printing money so companies can hire more workers, and it’s clear from the paper she regards them as stupid.

And it is the so-called market monetarists who advocate printing to juice up GDP, and make it grow at the rate they deem to be right. They call this idea nGDP targeting (nominal GDP, i.e. not adjusted for the inflation they presume they are causing). What kind of growth will one get if one lowers the interest rate by government diktat? What activities will grow if credit is mispriced (by definition, and by theory if the government forces the rate to be other than what it would be in the free market, it is mispriced)? No matter, we get more of them! More is always better, isn’t it? The market monetarists believe so, at least up to whatever they feel to be the right amount.

If the Fed’s lower interest allows a bank to borrow to buy Treasury bonds from speculators at higher prices, an AA-rated private equity fund to borrow to buy houses off retiring Baby Boomers, or zombie corporations to keep borrowing to keep their doors open, it all adds to GDP. The sellers of the bonds may spend a bit due to the wealth effect. The sellers of the homes can cash out and retire. The money-losing zombies can keep paying employees and suppliers.

There is a little-understood fallacy called Begging the Question. This is when a question presumes what it should be asking. For example: “When did you stop beating your wife?”

nGDP targeting is an alternative means of answering the same Begged Question as all the other schools of money printing: how shall the center planner determine how much money to print and pump into the economy? Their answer whatever amount is necessary to sustain the right amount of growth, which they believe is steady growth.

Eating the seed corn is not growth, though it may cause increases in the amount of employment and the amount of currency changing hands.

This is the meaning of a rising debt—federal government debt, state and local government debts, corporate debt, personal debt, underfunded pensions, unfunded government liabilities, etc. They are all forms of consuming something now, and replacing the consumed goods (i.e. capital goods) with a note that says “I.O.U.” But unless that borrowing financed productive assets that will pay the note with interest, it’s counterfeit credit. It cannot and will not be paid.

We emphasize that the problem with inflation is not a problem with the quantity of something. Or with prices. It is a problem with honesty and integrity. It is the dishonest replacement of a real capital asset, with a dishonorable promise.

If the problem were only that prices are rising, there would be something more important to do than try to help people return to the gold standard. But it isn’t. The problem is that while the monetary system perversely incentivizes people to the perverse outcome of exponentially-accelerating consumption of capital, the economics profession is debating the wrong things: the right rate of this capital consumption, and the best perverse incentives to make it so.

Supply and Demand

The price of gold blipped up another ten bucks, and that of silver eight cents.

Again this week, the groceries did not come flooding into gold and silver. We are using the term increase in groceries to refer to an increase in the purchasing power of a capital asset. This is how many groceries you could get for liquidating that asset.

Groceries flooded into Treasury bonds. Since 1981, speculators in the government’s favorite Ponzi scheme have been rewarded. They fork over their capital to the government or to the previous speculator who forked over his capital to the government. And the Fed’s cockamamie scheme rewards them. Sooner or later the next speculator forks over even more capital them, to consume.

Liquidating capital assets to spend capital on groceries. Isn’t that the purpose of holding a capital asset in the first place? To consume? If we had a fiat penny every time someone said that, we reckon it would add up to tons of gold.

Alas, bitcoin did not prove to be a store of groceries this week. After last week’s pouring-in of 25 groceries (assuming $100 per grocery), 8 leaked out of the noted store of value notorious two-phase skyrocket.

The point of this pointed commentary is that, though people love to speculate, it is the perverse outcome of the perverse incentives offered by the central banks. When people are handed free groceries, they eat them. This is added to GDP. Thus the central bank appears to perform the miracle of turning irredeemable paper currency into groceries, or water into wine. Mises describes what they actually do:

“And then, very late indeed, even simple people will discover that Keynes did not teach us how to perform the ‘miracle … of turning a stone into bread,’ but the not at all miraculous procedure of eating the seed corn.”

Read on for a look at that the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

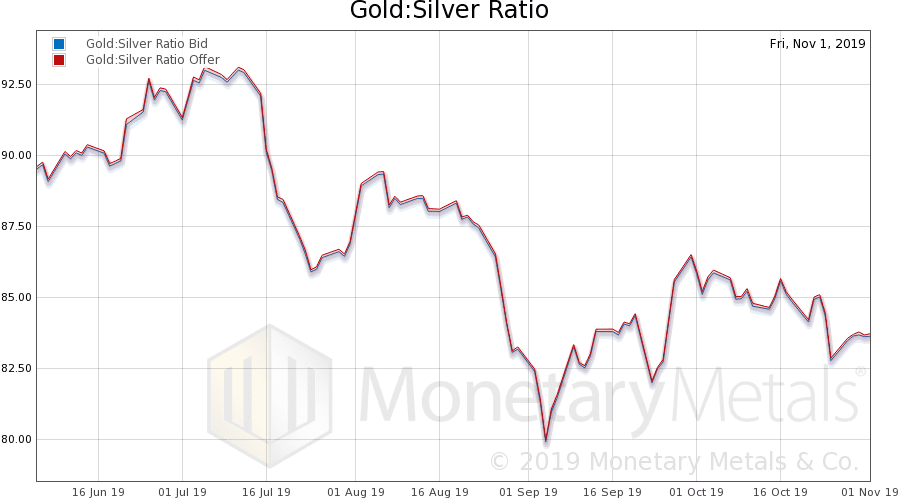

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose this week.

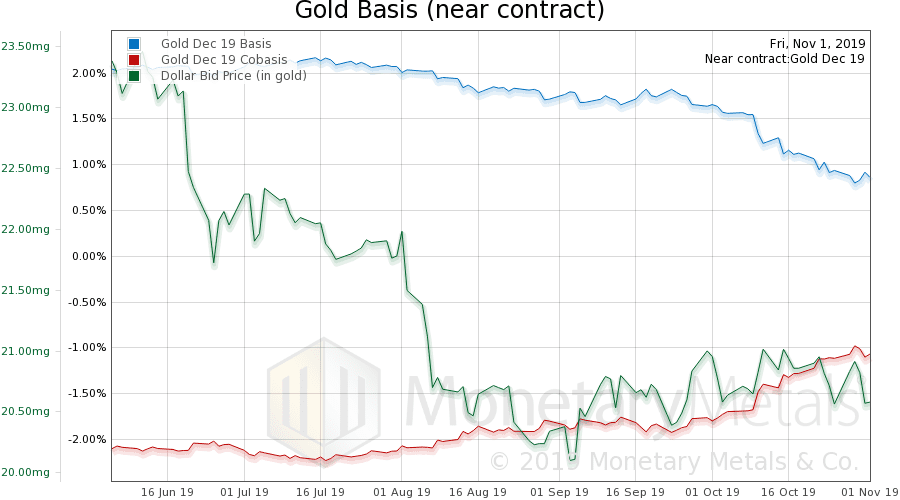

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. It rose this week.

The pattern of last week continued: slightly increase in scarcity (i.e. cobasis) with slight increase in price. At least the scarcity indicated by the December contract. More on this, beliow where the observed effect is stronger.

The Monetary Metals Gold Fundamental Price, was down $26 this week, to $1,485. This is where it was two weeks ago.

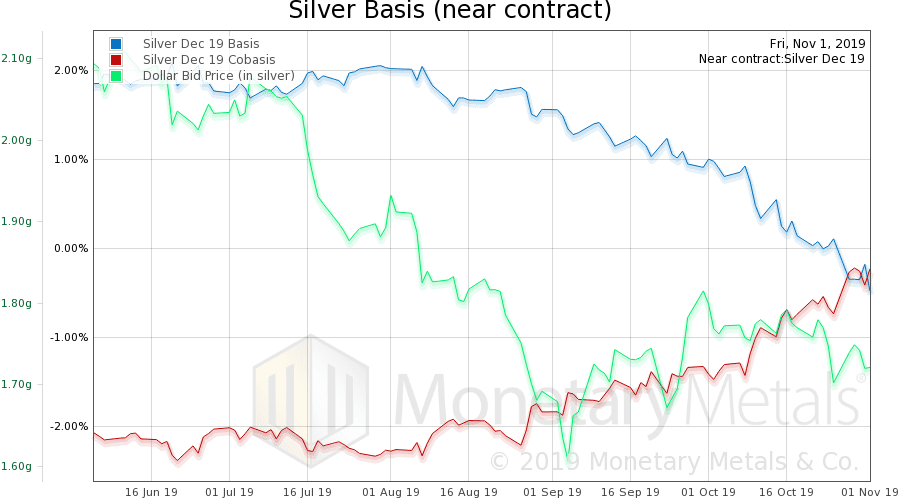

Now let’s look at silver.

In silver, the December cobasis rose sharply, though not the silver basis continuous. We are seeing strong signs of the proof that the banks are not naked short-selling silver futures: as the December contract approaches expiry there is strong selling pressure. A naked short-seller would have to buy the December contract, as he cannot deliver the metal. Whereas speculators who use futures to bet on the price cannot take delivery, and hence must sell. We see a lot of selling pressure on this contract (but not farther-out contracts).

The Monetary Metals Silver Fundamental Price fell 22 more cents to $16.65.

© 2019 Monetary Metals

:

:

Keith,

I believe that Ayn Rand once cautioned against adopting the terms of one’s antagonist(s). If she didn’t she should have. When one allows his opponent to dictate the terms of debate or discussion he cannot effectually argue his own viewpoint.

Sometime after the turn of the century the term “naked short” seller (or sale) came into popular usage with reference to commodities futures markets. The reason for that was to facilitate an outlook that could not withstand logical scrutiny. I’m not sure who the perpetrator of the term was but it may have been a gold propagandist organization known by the acronym GATA or it may have been a self-styled silver (market) expert named Ted Butler. An examination of both of their extensive writings reveals that neither GATA nor Mr. Butler has demonstrated any level of understanding about commodities futures law as it is written in the United States Commodities Exchange Act of 1936 and its updated versions.

Most people who use the term “naked short” fail to adequately define its meaning. Investopedia.com provides a definition that reflects common usage: Naked shorting is the illegal practice of short selling shares that have not been affirmatively determined to exist. Note that the definition references shares or securities. There is no mention of commodities futures.

There is no such thing as a naked short (having sold more futures contract ounces, bushels, pounds, etc. than can either be produced in a year and/or that exist in estimated global stocks) in the futures market. All U.S. futures markets are structured to accommodate an infinite number of buyers and sellers regardless of known physical supplies. In other words, the total open interest in a futures market is theoretically without bound. It can range from 1 to infinity. Whether the short interest of that total is concentrated in the hands of a single seller, a handful of commercial banks or the entire speculative universe, it makes no difference.

In the normal course of discussion regarding a preponderance of a futures position, one refers to the holder as being “unhedged” or “net” short or “net” long but nobody’s “naked”.

In a different context, your next to concluding sentence is false.