There are two views of the markets for the monetary metals. One, as we have discussed many times in this Report, holds that gold and silver will eventually go up so high that those who own the metals will be rich. This is the Schrodinger’s dollar view. Buy gold because the dollar will soon collapse—witness China and Saudi Arabia selling dollars. And gold is going up—when it’s measured in dollars.

Believers in the surgit aurea view are always on the lookout for a new angle to support their thesis. For example, we came across this article. Apparently, silver is in such a massive shortage that a mining company, “…got approached by an electronics manufacturing company … [who] wanted to bid on our silver…”

So, a silver consumer went to a silver produce to bid (at what price?) on the silver. Therefore, silver is going to $100, and there will be “some kind of major reset”.

Our view is the other view. The prices of the metals move in a dynamic process comprising producers, hedgers, consumers, warehousemen, and speculators. In short: supply and demand.

We had the good fortune this week to find another article, pure gold vs. the soggy dollars quoted above. The headline should be crystal clear to regular readers of this Report. “Gold Traders Pay Most in Years to Keep Big Bullish Bet Alive.” The article states:

“The cost of rolling futures into a later-dated contract was recently the highest in about six years, said Bernard Sin, head of currency and metal trading at Geneva-based refiner MKS (Switzerland) SA. Those holding June futures would have paid an extra $3.40 an ounce on May 23 to swap that position for the most-active August contract…”

The last paragraph calls it by name: contango.

So what do you believe could drive the prices of the metals?

- Silver is going higher because consumers are talking to producers?

- Gold could go lower and the catalyst is speculators may be weary of spending $3.40 every two months ($20 per ounce per year)

This holiday-shortened week (Monday was Memorial Day in the US), the prices of the metals were sideways to down. Until Friday. And on that day, a labor report hit that motivated gold hoarders to stock up and silver consumers to go into an absolute frenzy of manufacturing thousands and thousands of tons of silver into products ranging from mobile phones to antimicrobial surfaces, to solar panels. Or is that what happened at 8:30am New York time?

Read on for the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up over a point this week, notable when the prices of the metals were up sharply.

The Ratio of the Gold Price to the Silver Price

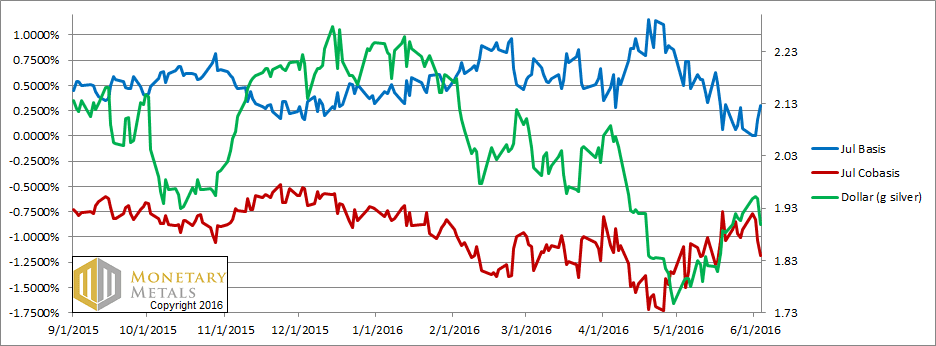

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Look at that blue line (abundance) rising, especially on Friday. Gold became even more abundant than it was last week, even when the price was not rising. And when the price spiked on Friday, there were even fewer buyers of metal and even more sellers.

For now, the speculators are making up for the lack of real demand. Perhaps because they are reading other analysts, they believe market conditions are tight and going to get tighter. Or perhaps they are still stuck on bad labor market à Fed money printing à rising quantity of dollars à rising gold price.

They are wrong.

The fundamental price of gold did rise this week. About $6, to $1175. In other words, it’s about $70 under the current market price. When the speculators realize they are wrong—or when other events force them to let go—the price could return to that level. Or if it overshoots by an equal amount to the downside, we may learn to say hello to 10 handle again.

It’s always possible that the fundamentals will get tighter from here, and an initial wrong bet may turn out to be right. However, we wouldn’t bet on it.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

There was a big decrease in the scarcity of silver this week, especially Thursday when the price was going nowhere and even more so on Friday when the price spiked.

Our calculated fundamental price—the level at which supply matches demand at current market conditions—fell further to below $13.70.

To put this in perspective, if the silver speculators let go and the market price snaps to its fundamental, it will rapidly drop about $2.70. If it overshoots by the same magnitude to the downside, we may get to enjoy $11 silver. At least, it will be enjoyed by those who haven’t lost too many dollars betting on silver.

Perhaps that mobile phone manufacturer, driven by falling volumes and compressing profit margins, is pressured to approach silver mining companies (and all other suppliers) to see if they can cut their costs. Perhaps they were not bidding up scarce silver at the source, but putting in a lowball bid below market. We don’t have that information, but one thing’s for sure.

Silver demand is weak while silver supply is robust.

© 2016 Monetary Metals

:

:

Thank you for the update Keith.

This is a little off topic but does anyone know if the spot silver bid price shown on the Kitco site is really accurate ? It seems a pip or so too low but I am not sure.

Here’s the link: http://www.kitco.com/charts/livesilver.html

Ah, what to do, strong sell silver for sure but also strong sell gold from now.

By the way it appears that in late stage capitalism, there is some kind of financial abstraction which is taking place into the monetary skies which are disconnected from the reality or rather impact them. Increditble…

Thanks’s for the information Keith. Very useful for me.

Great post, thank you. I could not agree more; gold and silver are both horrible investments at these prices, and at best are used only as insurance and a hedge against central bank actions, but NEVER an investment. I think you’ve made this point clear and it goes against so much of what is being told in much of alternative media.

Keith needs to do a better job communicating, judging from the clarity gleaned by Sage!

Factoring demographics alone at current debt to GDP dictate a logical conclusion that central banks will inevitably end up monetizing all the debt, cancelling it through holding it indefinitely at 0% coupon and no maturity. As ignorant as everyone is they will probably get away with continuing QE for spending money while they do it. What we must ask ourselves is how long this can possibly go on before the ignorant masses start getting wise to what is actually happening and chose to put at least some of what they can in monetary metals. Remember there is something over 20T in retirement assets, and it only takes a meager 125B to buy all the major Gold producers in the world, and an additional 7.5T to purchase all the gold ever mined. A small fraction of retirement assets seeking safety has the potential to send gold much higher than current FRN prices. To me the timing all hinges on when more sheople become less ignorant. Those of us that have bothered to do the math are already there, and we continue to stack. We are fine with leaving the 10.4T and climbing in negative yielding debt investments for the fools that can’t do math. Keith’s fundamental price analysis is just a good indicator of growing or decreasing ignorance to me, but like Keith says the indicator gives stackers like myself a chance to enjoy better stacking prices. It is not about greed for capital gain upon trading gold for evermore more FRNs in the future, it is about precious metals maintaining or possibly buying more organic food in the future, it is sad governments make us pass through FRN’s at all to get the food from sellers. I applaud Keith’s effort to change that, and am saddened by the ignorance of governors that won’t listen to him.

@Bob I half agree that Sage has missed some of the nuance in Monetary Metals’ position.

Nothing about gold going up as it has seems horrible to me except for what it says about the real economy denominated in dollars (or at least mass perception of the real economy).

OTOH, Sage has it right that this site doesn’t align with the media (alternative OR mainstream)!

“The fundamental price of gold did rise this week. About $6, to $1175. In other words, it’s about $70 under the current market price.”

I’ll hazard a guess that the fundamental has tracked spot higher this week.

Calling a price “fundamental” is an overloaded term, but since Keith disavows it as a trading instruction, I’m leaning toward the idea that this price measures what the market thinks gold is worth in trade for commodities and for other heavy-duty monetary uses–not measuring this directly of course, but by factoring out speculative effects and using basis it may be letting us see which buy/sell points the major banks, sovereigns, and key commodity players choose in line with their subjective fundamental valuation for gold. The blogger FOFOA portrays these savvy movers and shakers who are literally using gold as money as an elite who think quite differently about wealth. I’m not calling out “smart money” here. I’m rather hoping that the market is moving (in part) in response to the accumulated capital and wealth of the modern industrial age–wealth not bound to legal tender laws but living in the actual anarchy of global finance.

Further @Bob…

There is, certainly, a conceptual divide separating stackers and those still caught in the hand-to-mouth subsistence economy. But I resist collectivist labels, in particular “sheeple”, however you spell it. These words and the mindset they engender are tools of the herders:

You are a sheep or you are a wolf. Ultimately the herder takes license to kill both.

I don’t see that as the fundamental human dichotomy. Be good or be evil, but be careful if you want to become a herder of humans, none of us are actually sheep.

“”using basis it may be letting us see which buy/sell points the major banks, sovereigns, and key commodity players choose in line with their subjective fundamental valuation for gold. The blogger FOFOA portrays these savvy movers and shakers who are literally using gold as money as an elite who think quite differently about wealth. I’m not calling out “smart money” here. I’m rather hoping that the market is moving (in part) in response to the accumulated capital and wealth of the modern industrial age–wealth not bound to legal tender laws but living in the actual anarchy of global finance.””

wonderful statement. the other day i pondered >50K bars daily notional. more recently i heard, approximately 97+% “cash” and 2-3ish% phyzzzzz settlement. which indicates to me 2-300 bars a day possibly moving from private basement to private basement. that makes more sense to me. there’s the anarchy of global finance. I see 97+% of people foregoing delivery of gigantic gold bars as the power of legal tender animating peoples lives and moving commodities and armies all over the face of the earth. is it fair to say of paper traders that they’ll be out by expiry and immediately back in? what’s a hedge fund, or even a bank, gonna do with a LBMAGDB? slice em up and mail em out for redemption calls? i doubt whether the world could reverse course by taking delivery via these abstract markets although it might be tried. stay tuned to the basis report.

If you want to use the fundamental as a trading signal, which is something Keith does not advocate, you must make sure you can remain solvent for longer than the speculators can remain irrational. Given that the latter is unknown, you should never naked short.

3.3 tons~250 bars (daily phyzzzz bar mvmt?)

500 tons~37,500 bars (low range london?)

2500 tons~187,500 bars (high range london?)

Stock Guess bars equivalent 160,000 tons~12 million (loose in the world and coins, temples, jewellry, teeth, mementos, car bumpers, gearshifters, etc, etc, etc)

Update on two critical metrics Keith has mentioned in the past:

1) Total debt grew 10x the amount of nominal GDP in the first quarter of 2016. Or $10 in new debt to generate just $1 in new nominal GDP growth.

2) Switzerland government bonds are negative from 1 day to 20 year maturities. Only the 30 year Swiss bond has a positive yield at 0.072% – a record low.

It would be nice to have some additional commentary or measurment of this fundamental model applied to gold & silver across different currencies. The current analysis ignores a large portion of the global population that does not transact in United States dollars.

A comment was once made that doing this would mostly reflect the (wider) bid-ask spread of the other currency. Doubtful that this case could be made for the other large major currencies like the Euro, Yen and British pound.

Perhaps next week’s report will be called “Revenge of the Speculators” :-)

On a more serious note, I found this an interesting comment from the head of research at BullionVault:

“We’re still seeing big chunks of managed money coming into the silver market. Inflows from our clients match those at the all-time highs of early 2011.”