The Demand to Hoard, Report 13 May 2018

Since 1981, interest rates have been in a falling trend. Last week, we said this trend will continue, and the present blip up in rates is just a correction. We did not argue technical analysis, nor quantity of dollars, nor the general price level.

Instead, we asked a question:

…It seems obvious that if one wishes to say that a trend has changed, after enduring for well over three decades, one needs to explain why. The Question of the Day is: what has suddenly happened?

For extra credit, no scratch that, to get any credit your answer should include an explanation of why the rate has been falling for so long. Is this too much to ask? Your explanation should contain three parts:

- The cause that drove interest rates to fall for most of the time that Generation X has been alive, for most of the duration of the careers of even the oldest Baby Boomers

- Why the old cause is now inoperable

- Identify a new cause, and show why it will drive the new trend for rising rates

We discussed a graph from the BIS, showing that as of 2015, 10.5% of corporations did not earn enough gross profit to pay the interest expense on their debt. Even at the lower interest rates of 2015, it is a sharply rising trend (from 5% in 2007). Who knows how much it would have risen even if rates had remained unchanged? And how much did it rise with the little blip up in interest rates we have had so far?

To answer part 1, we identified the cause of the trend. The cause is when interest > productivity (return on capital in this context), and each drop in interest drives down productivity. It’s a ratchet.

We promised to answer questions 2 and 3 this week, as a hypothetical. We do not believe that the old cause is inoperable, or that a new driver exists for higher rates. So our topic this week is: what would break the old cause and create a new one?

Let’s start with the old cause of falling rates.

Interest > marginal productivity

There are two ways to alter this relationship. Interest could fall below productivity. We mention this for completeness, but we are not going to look it this further because we are trying to explain rising rates not a further fall.

The other way is, of course, that productivity can rise. This means that deeply-indebted firms (we are looking at the margin, not the few tech giants without much debt) will find a way to increase their return on capital. They can’t just borrow more to buy more plant or build a nicer restaurant. They must either raise prices or cut costs. And we are not going to look at cost-cutting, because again this is an exploration of a generally-rising price trend.

We do not mean rising costs due to tax, regulatory, litigation, environmental, zoning, permitting, licensure, compliance, audit, and other non-monetary government policies. These factors can all force prices up. But notice that they push profit margins down. For example, the price of gasoline rises due to a new road tax. It rises further due to environmental regulation that forces the refiner add ethanol. While most people call this “inflation”, it has nothing to do with the rising cycle.

By rising prices, we mean that all businesses, from makers of commodities to low-value-add goods, all the way up to high-value complex products, have pricing power. They can raise prices almost arbitrarily, and competitors will match. And the people will pay. Businesses know that if the consumer does not pay their price this week, they can hold their goods, and the price next week will be even higher.

If prices were to begin rising like this, it would be a godsend to struggling businesses. Their margins would expand (and expand and expand). Interest would quickly be under marginal productivity. This is not happening today, and it won’t happen any time soon.

Marginal Time Preference

Let’s address the cause of the rising cycle, when prices and interest rates are going up. It happened from 1947 through 1981. It is not only that interest < productivity. Interest is also under marginal time preference. This is the key.

The central bank pushes interest rates down (initially) below time preference. The protest-response to this sets in motion a ratchet in the upward direction. People begin hoarding finished goods (Keith’s parents in the late 1970’s used to stock up on canned tuna fish). And enterprises borrow to increase stocks of raw materials (commodities), plus buffers of inventory at every step in the production process.

With relentlessly rising consumer prices, time preference keeps rising ahead of prices. The central bank’s initial violation is not so easily cured. The interest rate would have to rise—without prices also rising. But the interest rate and prices are linked. Not by inflation expectations and nominal vs real rates, and certainly not by the mythological creature known as the Bond Vigilante Unicorn. They are linked because individual savers are buying more and more goods to hoard. Their demand for goods is rising (and as we shall see below, supply is constrained or declining).

We don’t recall that consumers bought stuff on credit back in those days. However, they were sellers of bonds. They preferred goods to bonds. It’s obvious why: bond prices were falling and goods prices were rising.

One feature of the rising-rates cycle needs explanation. The dollar is a closed loop. That means that if you trade a dollar for goods, the seller of the goods has the dollar. A dollar is not consumed in the transaction, unlike the goods (e.g. a can of soda). The dollar is backed by the bond. This means that if the seller of the goods does not want to buy the bond, he may deposit the dollar in a bank. And then the bank buys the bond. Or he can hold the paper note, in which case he is financing the Fed who buys the bond. There is no escape. Savers are disenfranchised.

If this is true, then it raises a question. Why would selling the bond cause interest to rise back in the 1970’s but not today? Part of the explanation lies in looking at the behavior of the enterprise. Enterprises were borrowing to buy goods. By selling bonds, they push down the price of bonds which is the same as saying they push up interest rates. And they do this to buy more and more raw materials and intermediate products in the middle of production. Enterprises were also pushing up prices. And they were pushing up interest rates too.

The other part of the explanation is that this is not an environment for banks to borrow short to lend long, which many call maturity transformation and we call duration mismatch. In this trade, a bank takes a demand deposit or other short-term liability to buy a long bond. There are two problems with this in a rising-rates environment. The income from the long bond is fixed but the expense from the short borrowing keeps going up. And the value of the long bond keeps falling. The bank would be taking losses on its portfolio. It will be much more meticulous about matching duration of asset to liability in a rising-rates environment. That way, the liability is falling along with the asset.

The bank has less reason to use leverage, as it costs a lot to borrow. And less incentive, as the rising interest rate environment offers wider margins for everyone, including banks.

The net result is that bond selling occurs on the banks’ weak bid price, rather than as in a falling-rates environment at the sellers’ offer price.

In other words bank bond-buying, in this environment, is a lagging and weak force. Saver and enterprise selling is the stronger force. This particularly applies to the selling of bonds by enterprises, as they create and dump new bonds on the market in unlimited quantities. They can, so long as they are seeing a greater return in rising consumer prices than they pay in interest. This is a key condition of the rising-rates cycle.

And enterprises certainly are rewarded for hoarding inventories. The longer the time between initial procurement and sale of finished goods, the more that prices have risen in the meantime. And therefore, the greater the profit to the enterprise.

Stagnant Markets

This monetary condition is necessary, but not sufficient. The rising cycle also requires one business condition. Markets must be stagnant. Products can’t change much, in the rising cycle environment.

Compare to today. The new big-screen TV is 61-inch, and it has higher resolution and greater contrast ratio than the 60-inch screen that it replaces.

But, back in the 1970’s, a maker of TVs knew that the price of a unit might be $400, but could be $500 in 6 months. So he is happy to borrow at 12%. He can obtain the raw materials, the glass and copper and so on. He sends it from the suppliers to his factory on a slow boat. Once it arrives, he takes his time unloading it, processing it, and putting each finished component on a shelf in a huge warehouse. He can accumulate big batches, and then move them to the next step. Six months later, the gross selling price is $100 higher, or 25%. His costs were largely locked in (except labor) 6 months ago. So the 25% increase to final selling price could represent 50% or more increase to gross profit.

Of course, if TV technology is changing rapidly (as it is today), if every competitor has two or three teams leapfrogging each other to introduce major new standards (as they do today), let alone features, in ever-larger sizes then this strategy does not work. The market does not want the old, obsolete TV. So this strategy of slow production with massive buffers of inventory works only in a stagnating business climate.

And there is one other catch to this rising-rates environment. When his plant is worn out, or finally obsolete, the entrepreneur needs to borrow to buy new machines and refurbish his factory. He may find that at the new, higher interest rate, he cannot justify the loan. He must close his doors. A rising-rates environment is giving businesses who still survive more pricing power by removing their competitors one by one (and blocking new entrants). It is removing productive capacity and supply of goods from the market.

Note the rising prices are not due to rising quantity of dollars. The cause is ever-increasing demand for commodities from manufacturers. Also they have ever-increasing demand for intermediate goods. While manufacturers hoard ever-increasing amounts of their own finished goods, so do distributors and retailers. At the same time, consumers hoard ever-increasing amounts of goods too.

Note that the rising interest rate is not due to bond vigilantes, quantity of dollars, or even consumer prices per se. The rising rates is caused by ever-accelerating selling of existing bonds by savers, in preference for consumer goods. And perhaps more importantly, the ever-increasing supply of bonds newly issued by enterprises who are also hoarding.

Note finally that consumers are not increasing their consumption (salaries are rising less than prices). It is not falling dollar causing rising consumption as a tradeoff. They are increasing hoarding. They prefer to store a greater and greater percentage of their wealth in cans of tuna fish, extra tanks for heating oil and gasoline, paper towels and toilet paper, and all manner of other things such as liquor, firewood, and extra sets of silverware.

Not to consume, but to hoard.

A rising-rates environment helps the marginal entrepreneur by fattening his margins. He borrowed previously, at lower rates. As rates rise, so does his pricing power However, it hurts him at refinance time. He previously borrowed at 6% and built a great business, but at 12% he cannot justify refurbishing his plant.

This is the opposite of the (current) falling-rates environment, which encourages financing of more capacity but hurts the marginal entrepreneur who borrowed previously at higher rates. More competitors are enabled, than you can possibly imagine in your worst nightmare. They jump into your market to chase after your ever-shrinking margins with ever-more capital investment. Thus increasing productive capacity hence increasing supply.

Liquidate the Zombies

To summarize the above, to transition from the current environment to a rising-rates environment, we would have to liquidate all the zombies. And then further liquidate the marginally productive enterprises. And then liquidate the next batch of newly-made marginal enterprises. We would have to destroy supply of everything, to bring us back to an environment where companies are once again rewarded for sloth, for lack of innovation—for 6-month manufacturing cycles. Their reward is pricing power. The people would have to go back to a level of privation that even those of us who remember the 1970’s could hardly believe—and would not want to tolerate.

Look at cars. Ford has left the market. That still leaves GM, Chrysler, Tesla, Kia, Hyundai, Toyota, Honda, Nissan, Mitsubishi, Mazda, Volkswagon, Audi, Mercedes, BMW, Fiat, and many smaller niche makers. How many more factories and whole brands shuttered to “achieve” the environment we describe above?

Incidentally, this is an environment in which people keep old cars for a long time. If the average new car buyer today leases or owns the vehicle for 5 years, that would have to increase. We don’t know what it was in the 1970’s, but in Keith’s childhood it seemed to him like everyone had 10-yr old cars. If cars are not changing much from year to year, then you are not missing so much to keep them longer.

We don’t think this scenario sounds remotely plausible.

And there is one last problem. The debt loads at every level from government to corporate to business to personal are an entirely different beast than what they had in the 1970’s. Rising rates will precipitate a systemic crisis, rather than benign ratcheting into a rising cycle as we had 40 years ago.

Next, consider time preference, which is now very low as evidenced by very low interest rates. Why would this be so? Compare two people, let’s call them Dave Debtor and Frank Freedom. If interest rates drop at the bank, who can afford to say, “OK if you’re going to lower the rate below my preference, I will just trade my bank balance for a pantry full of canned food”? Frank could do that. But Dave needs liquidity. He has debt to service. If he fails, they will foreclose his shelter and his wheels (at the least).

Or consider two businesses, Weborrowed Inc, and CashandCarry Corp. Which can afford to tap credit to increase its inventories? Like Dave, Weborrowed must keep a much higher cash balance. When seasonal demand slows, the company must continue to make payments. It must plan in case it cannot roll over a maturing note.

All too many consumers are like Dave, and most producers are like Weborrowed.

We don’t think any of the characteristics of a rising-rates environment exist today. If you work in a business that produces or deals in inventory, try suggesting to the board a new strategy. Propose that your company begin a program to borrow to begin hoarding merchandise. We jest, this would be a good way to get fired.

A durable rising cycle is when demand relentlessly outraces supply. Normally, if consumer demand increases then production capacity will be increased to meet it. For example, mobile phones. But in the rising cycle, it is not demand to consume but demand to hoard. And production capacity is curtailed by rates rising with prices.

We reiterate one last time, that we don’t see anything like this dynamic today.

Monetary Metals is hiring a bookkeeper to support our continuing growth. Do you have a passion for gold, with strong accounting and organizational skills? Please contact us.

Supply and Demand Fundamentals

One well-known commentator this week opined about the US health care industry:

…the system is designed the churn and burn… to push people through the clinics as quickly as possible.

The standard of care now is to prescribe some medication (usually antibiotics) and send people on their way without taking the time to conduct a comprehensive examination.

Nope. That is not the standard of care. And anyone who works in health care knows that the above is BS.

This same guy has touted the conspiracy theory which claims the gold price would be thousands of dollars higher, but for a long-term gold price-suppression racket. And anyone who works in banking knows that’s BS. And anyone who doesn’t work in banking, but who works in health care, would suspect it.

Be careful who you buy your gold from. Also be careful who you buy your macroeconomic analysis from. Not everyone uses the same standard of care with the facts.

This segues into a pet peeve of ours. Who puts more tarnish on gold? The central bankers and the apologists for fiat currencies? Or the people who care little for truth, touting whatever speculation they hope to sell or get paid to pump? They treat gold like it’s nothing more than a speculation. And when the price doesn’t go up it’s because, “manipulation”.

Folks, look all around you at regular people. If they have a distaste for gold, a vague dislike that they can’t quite articulate, then perhaps this sort of behavior is part of the reason why.

Civilization cannot exist without money. Gold is money. This is serious stuff. Money should be treated with respect, if not reverence. It’s not some get-rich-quick scheme, and a conspiracy is the only conceivable reason not to be rich already.

The price of gold rose four bucks, to $1,318.85. Actually, that is not quite precise. $1,318.85 is the last cleared price for spot gold at the end of the day on Friday. While the market is open, there are two prices. There is the bid and the offer (also called the ask). Late on Friday, gold was bid $1,318.85 and offered $1,319.75.

If you own gold, then $1,318.85 is the price (in dollars) you will be paid, to permanently get rid of it.

Interest, on the other hand, is the price (in gold) you are paid to part with it for a year, and then get it back again. Which is more important? But which is more popular? We hope this makes it clearer why we scorn the conspiracy theory.

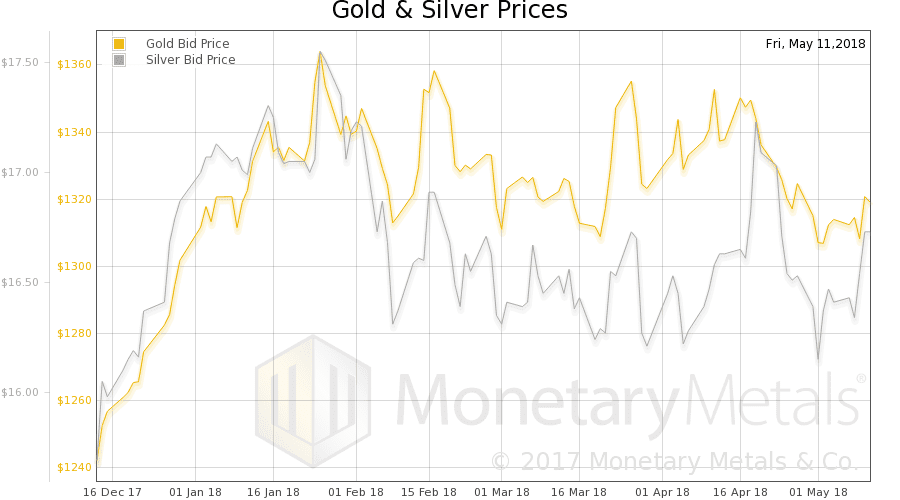

Here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell slightly this week.

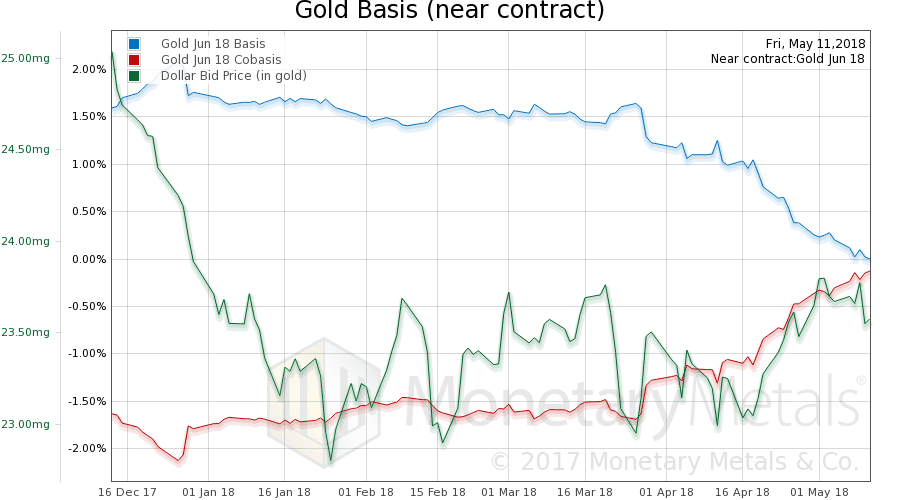

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The June gold contract is approaching backwardation, with a cobasis of -0.1%, though farther-out contracts subsided slightly. This is selling pressure on the near contract, which goes First Notice Day in a few weeks.

The Monetary Metals Gold Fundamental Price fell $4 this week to $1,493. Now let’s look at silver.

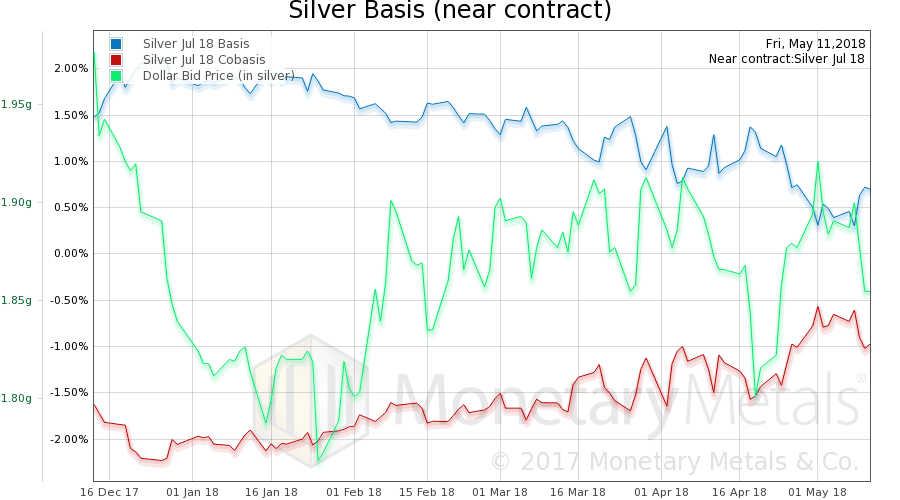

The July silver cobasis fell a bit, as did farther-out contracts. This corresponds to the fall in the price of the dollar, measured in gold (inverse of the price of silver, conventionally viewed in dollar terms). In other words, speculators bid up silver futures… so what’s new?

The Monetary Metals Silver Fundamental Price fell 9 cents to $17.60.

© 2018 Monetary Metals

Just to be clear, I’m a big fan of your interest rate and basis model, which is why I like to read and study up on the concepts and analysis MM presents. Long-term wealth & business planning are incomplete without a solid understanding of interest and gold basis.

First, I’d like to point out that the quote you are criticizing as the health care industry is not based on opinion, but on someone’s personal experience. If your issue is with the generalization and extrapolation of that experience then at least you need to acknowledge that the generalization is true at least some of the time, within some of the health care industry. Same as your point about good care.

However, your constant bickering with the rest of the gold crowd really makes you guys sound like just another annoying gold bug. I just spent the time to read your thesis on why interest > production results in dishoarding, and then you end up concluding that general distaste for gold is because of charlatans? Interest has not much to do with saving gold then I guess? Far as I can tell, legal tender laws enforced at gun point are manipulation of free market forces, so at least to some degree the conspiracy crowd has a point. The same crowd also couldn’t have been more wrong about the direction of the usd/gold price since 2011, but was generally right on for several decades preceding that period.

Please do me a favour and let your work speak for itself, and leave out the annoying rant. Maybe take the time to proofread and and make your work a tad more presentable. Maybe then your marketing reach with the rest of the gold crowd would be that much better. Because that is your target market is it not?

Well said, Tom. While I don’t care for the “gold bug” label or characterization — it belittles the proponents and dismisses their arguments before a fair hearing — it’s a worthwhile reminder that we all need to be better objective historians (and therefore less emotional) when discussing what constitutes good money.

Naturally many of us long for the day when we can use gold-backed money (or gold itself) as a medium of exchange, but that’s certainly not the case today, is it? In that sense gold is certainly not money, it’s an asset.

So what money? Is debt (the dollar) money? (“Credit is money and money is credit” were words written on these very MM pages) So yes, debt is money in our upside down world — unfortunately. Of course, only by fiat… by decree. Like you said, it is forced upon us at the point of a gun.

Someday the world will see the error of its profligate ways and phony “money”… but to quote one great Thinker: Today is not that day.

Fair enough, we all get our rants in every once in a while I guess. There’s usually some truth in stereotypes. My intent was to show that putting your work at odds with others in your industry takes you to the same level they are at. Whether that takes you up to their level or down, depends on the relative quality. Obviously I have much higher regard for Keith’s work than the rest of the gold crowd and MM’s relative track record shows the same.

The dollar system works by force. So how could this not involve manipulation? For countries to hold dollar debt (with a 2 cent intrinsic value according to Prof. Fekete) in their reserves above gold proves its contrived and manipulated . Who would accept depreciating IOUS instead of real money? If dollar reserves were sold on to the market for gold, then the dollar would lose value and gold, including existing reserves at central banks would appreciate. There being a potentially unlimited quantity fiat, and a finite quantity of gold. Gold would go to its true value.

Health care is a monopoly selling drugs, which are bad for the health, controlled by big Pharma (who are in bed with the FDA), who put profits before the patients best interests, which are largely ignored.

There are proven therapies available in mexico curing almost every disease known to man. There are substances passed as safe by the FDA, for sale in the US which are withheld by the same authority from treating patients, because these treatments would make existing drugs and systems redundant. They are cheap work fast and readilyavailable.

I honestly find it incredible that you seem so unaware of the realities of life. Is 911 and the collapse of building seven a another conspiracy theory?

@Angus,

I think that you have misunderstood or misstated Professor Fekete. I think that he would say the USD has no intrinsic value but that, perhaps, it would buy $.02 today of what it would buy for $1.00 in 1971 (when the USA defaulted on its gold convertibility obligation).

Well your’e wrong it cost 2 cents or less to create a dollar debt. its the biggest scam in the world

Thanks for the comments and the feedback.

In medicine, “standard of care” describes the consensus of what treatment is appropriate. One can have a bad personal experience, of course, but that does not change what is the standard of care.

I spoke to a few doctors before I wrote that.

Mr. W is correct.

Although I find the great majority of doctors (in my personal experience) very helpful and concerned about my health, who can deny the pressure they are under to prescribe a pill for every ill?

When I’ve questioned my doctors about holistic remedies, the responses are generally similar: “I wasn’t trained in that approach”.

They are only allowed to proscribe pharmaceuticals as i understand it.

Fair enough about standard of care. The experience in question has more to do with mis-diagnosis than treatment. Accepted treatment options are likely better today than in the days of sawbones, especially with availability of Eastern methods. But as Bruce mentioned, I’d still question the general consensus in the West re appropriate treatments. There’s certainly much more to the picture besides pharmaceuticals and surgery.

Thanks for your reply

“Monetary Metals’ Fundamental price seeks to back out speculative forces in the gold market to reveal the underlying physical supply and demand picture.” Right? That quote is directly from the website.

So, MM “seeks” to back out speculative forces…. but how successful is it? As you’ve noticed, not very. Rather, I continue to obverse a distinct psychological component in Fundamental and have outlined the evidence for months.

In the most recent example, how can we explain the nearly $300 dollar run-up in Fundamental (impressive!!) with only lackluster participation in bullion? Then, rather than bullion remaining firm and eventually catching up to Fundamental, what happened? That $300 surge in Fundamental — as is typical — occurred simultaneously with a bullish psychological backdrop in bullion (Daily Sentiment Index reached over 80% bulls for example) which means what was likely to happen?

Listen folks, when over 8 of 10 of the investing and trading public is already bullish it means only one thing — the market is vulnerable to a drop.

So what happened? Bullion dropped $80. So far. (Not surprisingly sentiment is approaching the opposite extreme)

If the Fundamental was at all leading bullion, you see, we would have expected bullion to remain firm and eventually rise — or stay flat — to meet a moderating Fundamental. That’s not what we observed at all, is it? And lest we forget, for Fundamental to be $250 over spot gold is a considerable spread based on historical data. This isn’t noise level stuff.

Rather than bullion eventually following the so-called “Fundamental”, Fundamental is actually following bullion lower — just as occurred previously when there is a bullish psychological extreme. Take note of these situations.

Think back to last year when gold hit $1,230…. Remember that wicked, almost last minute plunge of $100 in Fundamental (to below spot gold) moments before bullion raced higher by an even greater amount? That’s when the opposite occurred, the bullion market was facing capitulation (DSI was under 10% for example) and Fundamental was clearly parroting the negative psychology that was dominating the bullion market at the time.

I don’t know much stronger the evidence needs to be.

Bruce,

Shouldn’t you be looking more closely at the premium/discount of fundamental price to the market price, and not just at the absolute movements of the fundamental price? The fundamental price is tied at the hip with the market price, but the differential between the two is, in theory at least, the indication of the likelihood of future movements in the market price. It would be helpful to see an analysis of these factors, with a focus on causality. Is there a relationship between premium/discount and price, does one lead the other, or is any relationship just coincidental? On the face of the longer term charts available, the relationships are fairly tenuous, although the premium/discount has definitely led price on occasion. Also, the premium/discount tends to persist for periods of up to several years, and the ‘leash’ tied between the price and fundamentals seems to be a rather long and flexible one.