The Dollar Is Going to 1/10,000 Ounce, Report 31 July, 2016

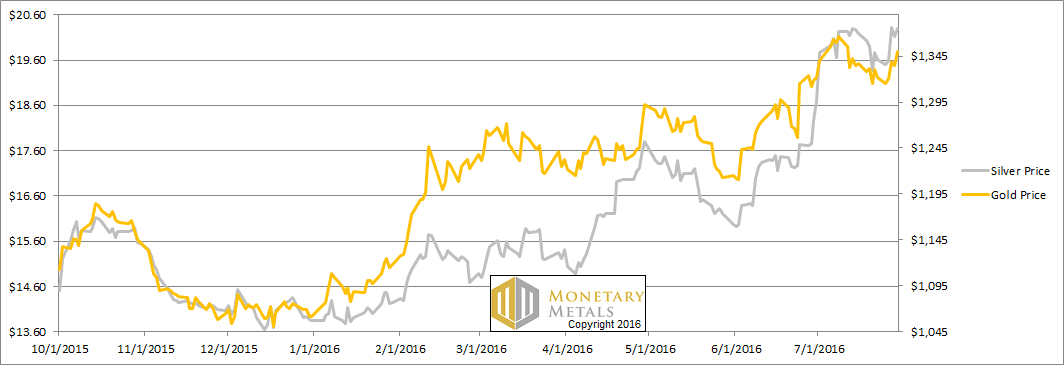

The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents.

Last week, a reader reminded us that in the long run the dollar is going to zero. He said:

“At some point in time, unknown to me, the futures market for gold/silver will collapse… and the price will undoubtedly be multiples higher…”

Yes, but a lot can happen between now and then. This idea is not tradeable. It was just as true when the price of gold hit $1,920 as it is today at $1,350.

So if this doesn’t work, how do you trade gold? One way is to look at charts of price, or the integral (sorry for the calculus) of price—momentum. While these charts can give you probabilities of the next move, they can’t tell you anything about the fundamentals. And if there’s a truism, it’s that the market may be a voting machine in the short term but in the long term it’s a weighing machine. The fundamentals will matter.

Of course, trading gold is really trading the dollar—but in a mirror that reverses how everything looks. Gold futures traders say gold is going up, but we say it’s the dollar that is going down. Who is right?

It’s entirely uncontroversial that the dollar is not a stable store or measure of value. Heck, its manager the Federal Reserve, has set a policy of 2% annual declines in their paper. Unfortunately (for them), they are not getting the rising trend of consumer prices that they want.

So why would anyone insist on measuring the value of gold—which has been precious for thousands of years—by reference to a dollar that’s designed to go down? Would you measure the height of the lighthouse by reference to deck of your sinking ship?

We think there’s but one answer. Traders want to believe they’re getting richer. It’s rather boring to think that one’s 100oz of gold is still worth … 100oz. Not to mention, it leads to the uncomfortable question of whether one wants to spend one’s gold down.

At any rate, let’s look at the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices.

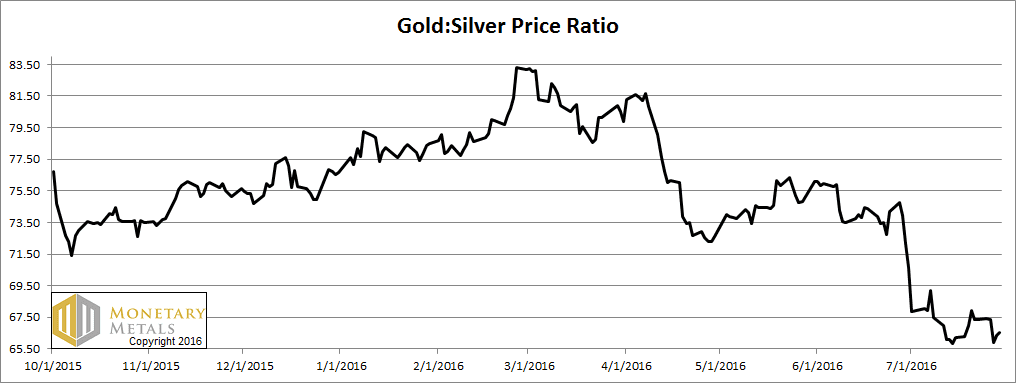

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio fell this week.

The Ratio of the Gold Price to the Silver Price

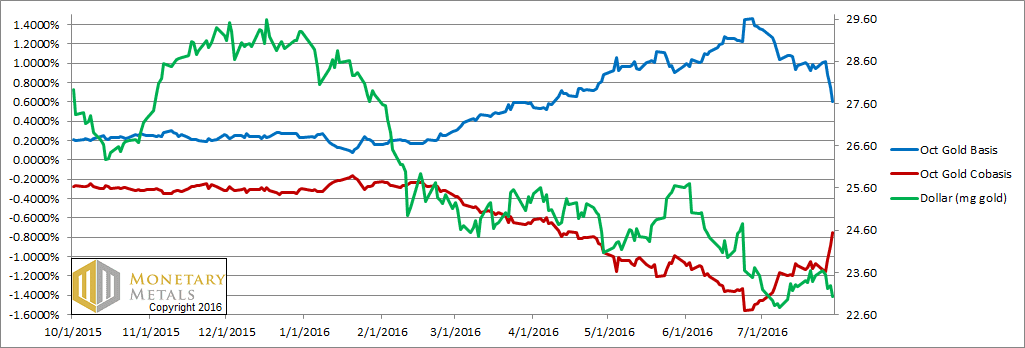

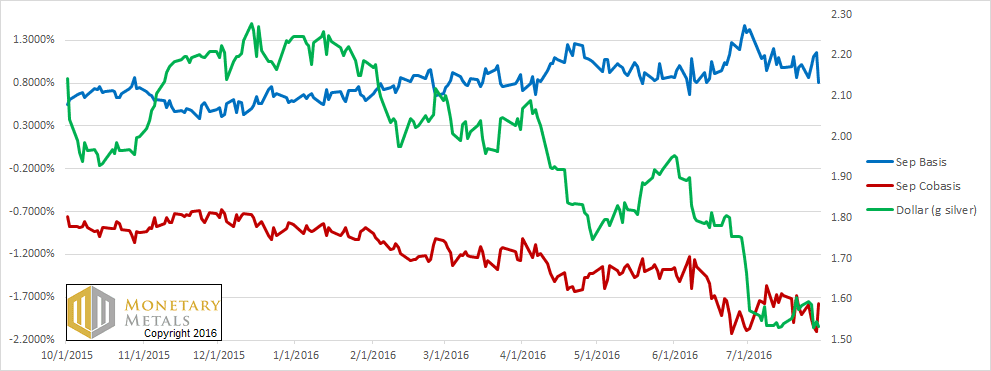

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Now there’s a move! Gold became a bit less abundant (blue line, i.e. the basis) in the latter part of the week. At the same time, its price was rising (i.e. the dollar was falling).

Unsurprisingly, the fundamental price spiked up $90. Unfortunately, while it’s closer to the market price, it’s still about $110 below. Gold is less overpriced but still no bargain here. This is the mirror of saying the dollar is less underpriced, but still not a sell today.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

The big moves we see in gold are reflected as pale shadows in silver.

The fundamental price did move up, but only 44 cents. It is now a whopping $3.63 below the market.

We find ourselves in almost exactly the same position today as in April 2014. The market price of silver then was just over $20. The fundamental price was in the 16’s too. We said that the price could snap back down, and of course if it did that it could overshoot and we could see a 12 handle.

The same setup exists today. Market price just over $20. Check. Fundamentals in the 16’s. Check. We recall the permabull silver commentators back then, and they are certainly out in force today, check.

By the way, after that point was a long slow slog down to $13.98 in August a year later. There were ups and downs, but the fundamentals—like gravity—won in the end.

That episode—indeed the whole business of the falling price after it peaked in 2011—should have put to bed the quantity theory of money. You know, the Fed and other central banks are printing money (it’s not printing, it’s borrowing anyways) and this causes prices to shoot up. Especially the prices of the monetary metals. Here we are in 2016, with the quantity of dollars continuing to increase, and the prices of the metals may be up recently but they are down considerably from 2011.

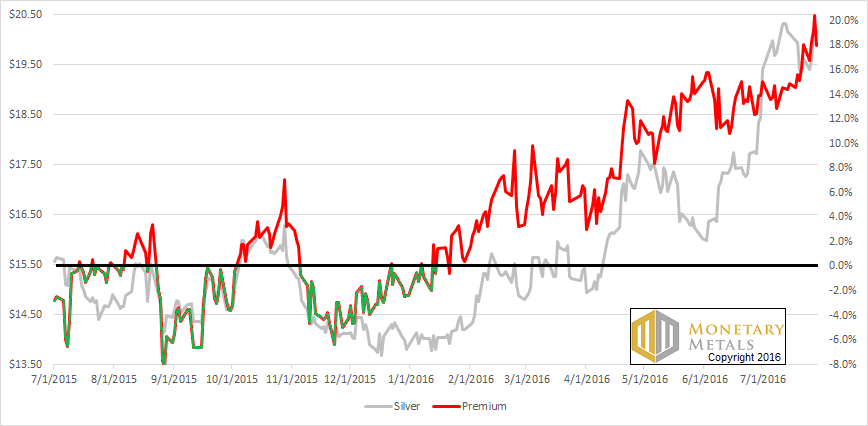

Here is a graph of the premium of the silver market price over silver fundamental as a percentage – the premium price that silver market demands to sell you the metal. It has been steadily rising (with some zigs and zags) since last August, and particularly aggressively since late November.

We do not attempt to predict when sentiment will turn. All we can say is that unless the fundamentals turn first, the price of silver is likely to crash. Again.

© 2016 Monetary Metals

Thank you Keith another great article likely your best in the reports.

S

Keith,

Thanks for that graph (The Growing Silver Premium). Very useful. Could we prevail upon you, further: for the base data – silver price v silver fundamental and for as far back as you have been publishing it?

Many thanks

lol… that’s funny. You must be new here. But welcome!

Keep in mind a person can make any chart appear as they wish by simply manipulating the x and y axis.

Also keep in mind that every one of us “talks his book”, meaning that we tend to defend the rationale behind our current investment stance. Point being, because Monetary Metals is bearish on silver — at least relative to gold — the MM Fund is currently favoring gold over silver. What that means is MM will look for ways to defend their bearish silver position. They won’t be thinking ‘hey, maybe we’re wrong this time because of a, b or c. They will be convinced they have the correct position simply because they have that position in the market… and because they’ve always used x, y, z as their variables, not a, b, or c. And like i said, we all have the tendency to do it.

Keith,

Could you please summarize how you arrive at your “fundamental price” of each of the metals? Thank you

hedles & bgwms52 – the details of how we work out the fundamental price is proprietary, hence we don’t publish a full data set/charts or detailed explanation. Keith has explained the thinking behind it in general terms here https://monetary-metals.com/introduction-to-the-monetary-metals-supply-and-demand-report/

Today’s tidbit — according to the large dealers i work with, physical silver continues to sold back. So instead of getting spot price on your silver sale, you’ll get something much less… even a $1.00 or more less. That is not true of all dealers, however. Still, the price of silver continues higher… which i find odd under these circumstances. Then we have the COT data which indicates speculation is off the charts. Again, that’s typically a very bearish indicator. The data is at a new 4 year high. Silver should have started to break down by now.

Yet, silver continues higher…. so the only conclusion i can come to is that something very usual is going on. So the only thing to do is watch price itself for signs of exhaustion. But note: It doesn’t have to happen anytime soon. It could be several weeks from now.

It could be the ‘disappearing yield’ that is causing hedge funds to speculate more than usual

Greetings Keith;

I just finished reading a report by CFTC market analyst Ed Steer, and he has just put out a RED ALERT that something BIG maybe coming up in the PM market…

The question is; Are we headed for another Bear Sterns moment ???

It seems the positions of certain traders are at ‘EXTREMES’…

According to Craig Hemke, from TFMetals, the amount of gold leaving the COMEX, is also at extremes…

Stand by, and hold on to your desk chair…we could be in for an interesting ride,

ESPECIALLY, since this Friday is NFP reporting day….watch the 8:20 AM open for

another ‘drive by shooting’

Take Care

Tony

So it’s Friday Aug 5th @ 8:30 AM….

How is it I personally knew that gold would sell off at opening…

Down $14-15 at opening….just like clock work….

DUHH !!!!

The game is rigged….MANIPULATED…by the powers that be…

SOO!!! Do you want to trade against people like that….

LOL !!!