Last week, we joked that we don’t challenge beliefs. Here’s one that we want to challenge today: the dollar doesn’t work as a currency, because it’s losing value. Even the dollar’s proponents, admit it loses value. The Fed itself states that its mandate is price stability—which it admits means relentless two percent annual debasement (Orwell would be proud). So there is no question that the dollar loses value. The only mainstream debate is whether this is good or bad.

Our focus today is whether this is why the dollar doesn’t work, why it’s failing.

Prices have been rising for 100 years. There is no reason why they couldn’t go on rising for another 100. Or 1000. The inflation argument, as we call it, does not reach anyone other than those who already think the dollar is failing. The rest shrug it off. Most people really care only if their income goes up slower than prices go up.

As an aside, this is an inaccurate view. Measured in gold, prices are falling. This is the simple consequence of relentless productivity improvements in every industry from mining and farming to distribution to manufacturing. In an article for Forbes, Keith found that the resources that go into producing a gallon of milk fell by about 90% between 1965 and 2012. And wages are falling also. Read the article to see just how much.

Anyway, people care if their wage is falling faster or slower than prices. Mainstream economics encourages this with its paradigm of purchasing power. They don’t encourage thought about how much cheaper things really have become.

The argument that “we need to move to the gold standard, because inflation” is not compelling to most people. We believe it’s more compelling to show that the dollar makes it profitable to destroy capital. Unlike rising prices, capital destruction is not sustainable. And also unlike rising prices, capital destruction is a real worry to the 1%.

Now let’s get back to the argument: the dollar doesn’t work as a currency. Is that even true? Everyone knows he can take out a twenty dollar bill and buy dinner or gasoline. Anyone can write a check to pay the landlord dollars. Or deposit his paycheck. Everywhere you look, you see people using the dollar as medium of exchange (which is not our definition of money).

What, exactly, isn’t working here?

How do you explain to all those wage earners, employers, landlords, restaurants, and gas stations that they aren’t successfully doing, what they are doing? Keith spoke at an Austrian economics conference at King Juan Carlos University in Madrid in November. The speaker before him said that only gold is money. The audience—these are professors and PhD’s and graduate students interested in Austrian economics—were incredulous. They demanded if the guy really said there is no money today, and if so how does he explain the vast flows of commerce around the globe?

The explanation is that we have a currency that’s working just fine as a medium of exchange (and Keith stood up and explained that the definition of money is either (A) the most marketable commodity or (B) the extinguisher of debt).

Marketability refers to the loss you incur if you trade in and out of something. In more technical terms, this is the bid-ask spread. The bid-ask spread of the dollar is zero. There is no spread.

This means that trade using dollars is frictionless (well, at least frictionless on account of the medium of exchange). Not only is the dollar working as a medium of exchange. It could not possibly work better (though it’s not working for other functions).

Now let’s look at gold.

An American Eagle gold coin, in the typical retail shop on the corner of First Street and Main, has a bid-ask spread of 5% or more. On the Internet, you might get this down to 2% (though the transaction is not instantaneous) plus shipping cost.

How is this better than the US dollar? It cannot compete as a currency.

Online gold accounts, which hold generic bulk bullion, are better still. One industry leader sells gold to you at spot + 0.5%, and buys it back from you at spot – 0.5%. This is a bid-ask spread of 1%. It is closer to the dollar, but it still cannot compete (unless the price of gold is rising rapidly and consistently enough that a gold account is a free-dollar-machine, like bitcoin was in 2017).

We can hear the objection all the way through the Internet. “Yes, but no one is using gold now. If people were to start to use it, these spreads would tighten.” That is true, they will tighten, perhaps significantly. But our point is that they cannot go to zero. The spread on the dollar is zero, so that’s the number to beat.

Money (gold) is the most marketable commodity. If you don’t believe us, we suggest you ask how much the local landscape center will pay you for a load of gravel. Compare that to how much they will charge to sell it to you. Or go to a scrap metals dealer and ask for their bid on some lengths of copper pipe. Or a jewelry shop to sell your diamond.

Not even in the gold standard, does the bid-ask spread on the gold coin go to zero (unless, as in 19th century America, the government subsidized the coinage). Even bulk generic bullion in a storage account would not be frictionless.

Enter, currency. Currency is the most marketable credit instrument. People today often wonder what would have made anyone in the 19th century accept paper bank notes, if they weren’t warehouse receipts. And what makes people today accept the US dollar (no, it’s not the military threat to blow up Libya that makes Americans happy to accept dollars).

Currency, unlike gold metal, can have a zero-spread. That means it’s perfectly frictionless. The engine of commerce seeks the lowest-friction lubricant for its gears and cogs. An individual may hoard gold coins under his mattress (which is his right that should never be questioned). But production and trade demand greater efficiency. They demand currency.

Absent a zero-friction gold currency, they will use the zero-friction irredeemable currency. The US dollar.

The dollar is failing as a stable store of value. Even dollar apologists know this. That’s why they prefer to own assets that are going up. The dollar is failing as a unit of account, notwithstanding the fact of a low inflation rate. The dollar is failing as a unit of measure of economic value. It’s failing as a vehicle for savings, thus rendering saving impossible, thus dooming young wage-earners to never achieve their retirement goals.

However, it is not failing as a medium of exchange.

In order for gold to get into the same arena to compete with the dollar as medium, much less displace it, there will have to be a gold currency with zero spread.

Such a currency would offer people the best of both worlds: frictionless medium of exchange plus act as a stable numeraire, stable measure of value, and a stable vehicle for savings.

We think the outcome of such a contest is easily predictable.

Supply and Demand Fundamentals

Monday was Martin Luther King Day in the US.

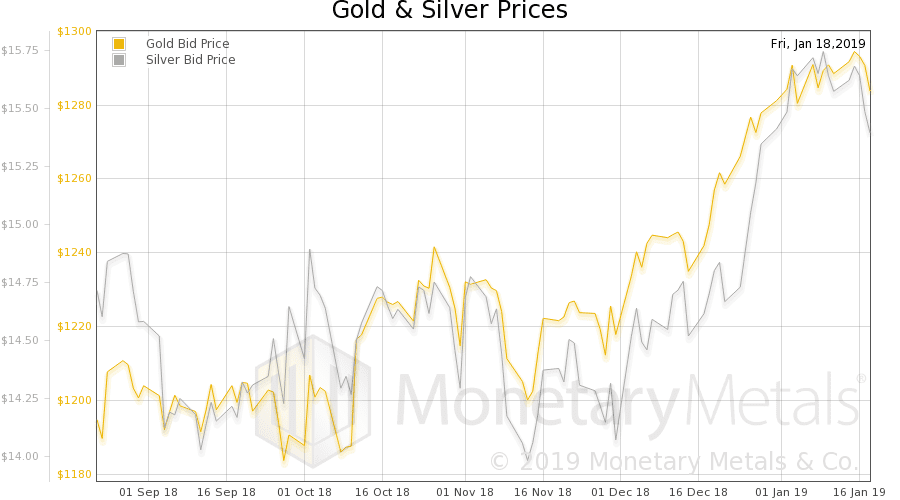

The price of gold dropped six bucks. The price of silver fell 26 cents, a greater percentage.

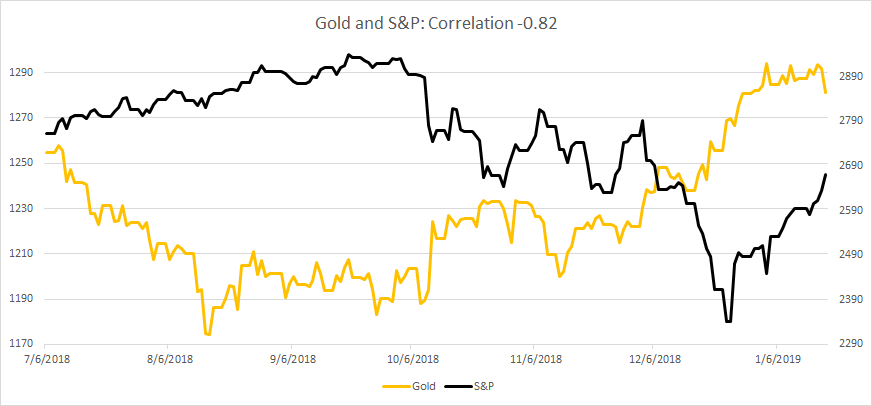

The price of gold can sometimes correlate well with the price of stocks. For example, April 2009 – July 2011. The price of gold went from $892 to $1,626, while in the same time period the S&P went from 841 to 1,289. The percentages are different—gold’s was 82% and the S&P’s 53%— but they moved together.

And now, they seem to be anti-correlated.

We often argue that the obvious explanation for price moves is wrong. But in this case, we think that gold is trading as the un-confidence asset. But let’s add some color to this.

No one vacillates back and forth on a daily basis, believing that the system will collapse alternatively with everything is fine. That’s not what these safe haven / risk on trades are about. For now, the gold buyers are not buying Armageddon or even insurance against systemic collapse. The vacillation comes from them trying to figure out of the Fed has effectively added a third mandate: a rising stock market. They’re wrong, the Fed hasn’t done any such thing. But so long as people believe in the mythical Greenspan put (or now, the Powell put), they will trade this way.

The Fed cares about credit, not stock prices. But in a near-zero interest rate world the price of stocks would be astronomical—but for concerns about credit. So the more the Fed can do to fix credit, the more stock prices can go up. And by fix, of course we mean enable profligate and zombie* borrowers to borrow more, at dirtier-cheaper rates. So long as the Fed is doing this, then speculators feel safe to buy more assets including stocks. And why shouldn’t they?

Anyways, people are still very much in a bubble frame of mind. When facing the prospect that the Fed cannot or will not keep pumping air into the stock market (as they picture it), they just turn to the next asset to bet on. In this case, gold. If the price of gold rises enough, then many may conclude that “it’s on”, and gold could get a risk-on greed bet too.

When they finally lose the bubble mentality, then they may buy gold much more than today. But, then, it won’t be for price gains. We will see that trend change long before the price action shows it. So let’s take a look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

*the Bank for International Settlements defines a zombie corporation as when profits < interest expense

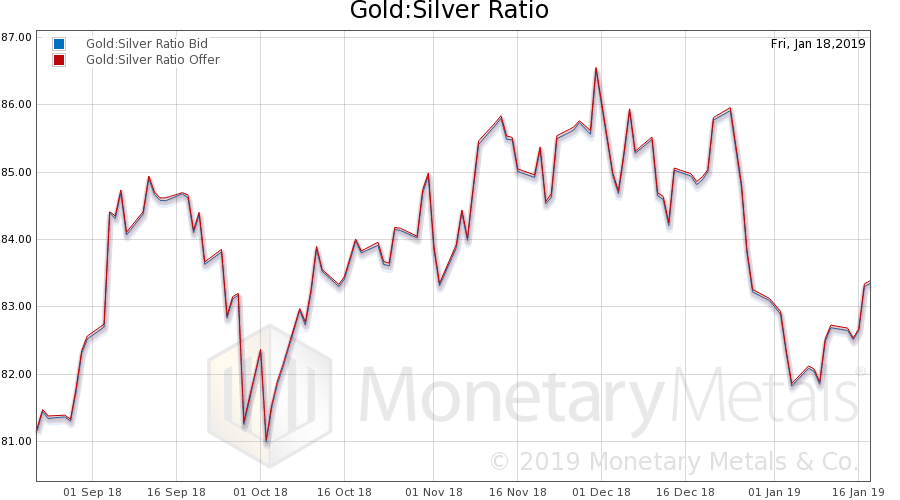

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose this week.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

We just rolled to the April contract. The rise in the cobasis, ongoing since mid-December, is evident. This is despite (or not) the drop in the value of the dollar (inverse to the rise in the price of gold). And also with Friday’s $10 sell off in gold.

The Monetary Metals Gold Fundamental Price fell $10 to $1,334.

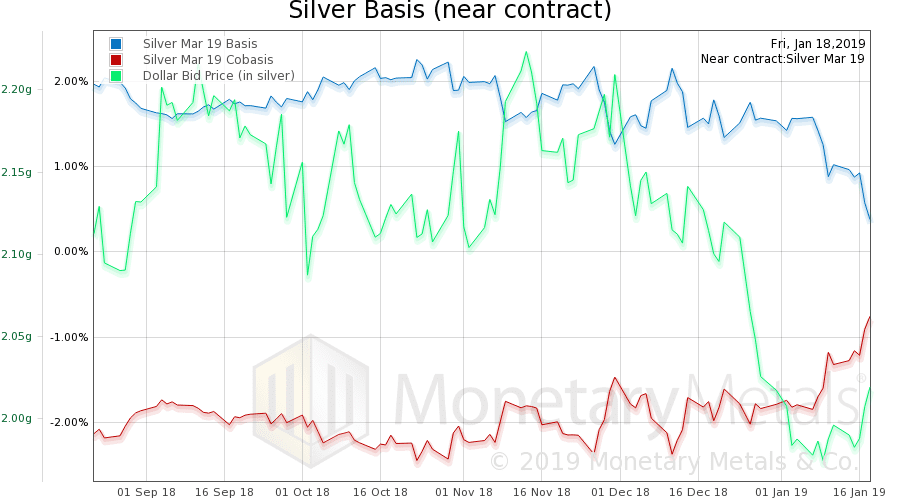

Now let’s look at silver.

As the price of silver fell more, the cobasis (scarcity) rose more.

The Monetary Metals Silver Fundamental Price is unchanged $16.00. Isn’t that incredible? The market price dropped almost two percent and our model of the fundamentals is stable.

© 2019 Monetary Metals

:

:

Keith:

I was touting your work to a friend. He has always been a valued friend, but a “tried & true” quantity-theory-of-money bigot. He asked why I seem to value your work? Today’s article reminded me of “why.” Your reasoned thinking is always on great display in your articles. You NEVER lose sight of facts upon which the science of economics must be based. For example:

“CURRENCY!” No one can argue in its utility nor its “frictionless” lubrication of commerce. You acknowledge this without, in any manner whatsoever, yielding to the idea that gold, because it is a relatively cumbersome commodity, and resting in one’s pocket, would somehow be less-preferable to paper currency. Gold is ONLY needed within a certain context, quietly resting as one of those inescapable “facts” resting at the base of economics, that need NOT be resting in one’s pocket.

What Fekete only made me aware of, you have since taught me to further understand and appreciate!

Thank you Dave.

Ditto! I found Keith thru Fekete too!

Keith, the “industry leader” you spoke of already offers the ability to instantly transfer gold to another account holder free of charge. So the “gold currency with zero spread” already exists, sort of.

But there are impediments to wide-spread adoption. Of course both parties have to have an account. But more importantly, keeping track of the tax basis of the transferred gold would be a nightmarish problem. If I pay someone with gold, which gold in my account did I pay them with, and how much did I pay for that gold originally? If I pay with low-basis gold, the receiver will have to pay capital gains taxes (in the U.S. and most other countries) when they sell it for dollars. If I pay with high-basis gold, I lose the potential capital loss. And the problem is compounded as gold is transferred from one party to another.

Gold can’t become a medium of exchange until capital gains taxes on it are eliminated.

Isn’t the capital gains friction what Quintric (https://quintric.com/) claims to have overcome by only holding as custodian legal tender bullion coins?

Dave,

You still have to buy it at a premium, and the recipient still has to sell it at a discount.

another fantastic article. thanks, Keith.