The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Whether the writer is a bullion dealer, or whether just some HODLer (a term from bitcoin—it means Holding On For Dear Life) hoping for a higher price, and an opportunity to unload some gold to make profit$, it matters not. The “buy gold” message undermines the economic point. Perhaps the economics (or pseudo-economics) point bolsters the buy-gold message, but it certainly hasn’t over the last 8 years.

Faulty Logic

On to our topic for today, this economics point often takes the form:

- Defect X causes currencies to fail

- The dollar has defect X

- Therefore the dollar will fail…

- …And that means people want to pay gold to merchants

Gresham’s Law states that if two forms of money have equal monetary value set by the government, then the one that is undervalued will not circulate. It is often taken to mean that if a precious metal coin and a base metal coin are both legal tender, then the base metal will circulate and people will hoard the precious metal. That is true, but its application is broader than that.

The Coinage Act of 1792 established an official policy of bimetallism. A dollar was defined to mean 24.75 grains of pure gold, or 371.25 grains of pure silver. It fixed the ratio of gold to silver at 15 to 1.

The market ratio was closer to 15.5 (of course, it was not a fixed ratio, but moved as all market prices do). 15, being a lower number, overvalues silver slightly. That is, the monetary value of silver was a bit higher than its commodity value. And the opposite for gold.

Predictably, silver circulated and gold did not. Gresham’s Law was in full force and effect.

A more well-known case occurred in 1965 when the US Mint switched from silver to base metal (a copper-nickel alloy) for quarters and dimes. We had read an excerpt of a speech by President Johnson (which now seems to be offline), in which he promised that the old silver coins would circulate alongside the new slugs. But it did not work out that way. It cannot. And Gresham tells us why not.

Why Gold Does Not Circulate Today

Today, despite vast quantities of gold and silver coins, they do not circulate. Gresham is not quite the explanation. Although the US one-ounce silver coin is stamped with a legal tender value of $1, people are not stupid. These coins are freely bought and sold based on the market price of silver (plus a premium for being manufactured into a recognizable coin).

So why does no one pay the restaurant tab in silver Eagles, or pay debts in gold Eagles? (Yes, yes, we know about the legal tender laws, not relevant here).

We have said many times, that some people may be happy to be paid in gold or silver, but no one wants to pay gold or silver out.

We are not going to describe here the reasons why people value gold and silver, or why they expect the dollar to continue to be debased. The steady desire to hold a gold coin is something entirely different than the weak desire to hold a dollar. Even dollar proponents will often say “cash is trash”. That expression would not have been popular (or even understood) during the gold standard.

Suffice to say that once they own a gold coin, people prefer not to let go of it. When it comes to paying for a steak dinner, or a home repair, they will take out the credit card but leave the precious metals hidden and safe.

So gold does not circulate. We have repeatedly said that the only force capable of pulling gold out of hoards and into circulation is: the payment of interest (we plan to issue the first gold bond soon—denominated in gold ounces, with interest and principal paid in gold). Gold comes out, to earn a return (if the return is sufficient to justify the risk). And otherwise is hoarded. It may be sold to take (dollar) profits, or when there is need for liquidity, but otherwise it is held out of the market. Vast, vast amounts are off the market. Virtually all of the gold mined in thousands of years of human history, in fact.

That elephant is lifting its trunk, trumpeting a fact to all who would listen. While the debate (and innovative business models) keeps going. What’s the fact? What is the elephant in this room?

Gold is capital.

A Dollar Income

No one (well, other than the Prodigal Son) wants to spend his capital. People want to spend their income, not their capital. So the gold is kept offline.

No one (except for gold miners, and Monetary Metals clients) has income in gold. Income for everyone else is exclusively dollars.

Dollar-earners would have to exchange their dollars for gold. Then pay the merchant. Since gross margins are usually very tight, the merchant would have to sell most of the gold to pay its vendors, payroll, rent, etc.

Regular readers will be thinking: the round-trip through gold, from dollars to gold to dollars, incurs a frictional loss. That loss is the bid-ask spread. For retail investors, that spread is likely 1% or more (some online accounts are less). This spread is the dollar-earner’s loss. Why would anyone want to take a loss—on purpose?

They don’t. And gold is not used as a payment by dollar-earners. It’s that simple.

Ideal Medium of Exchange

One can write at length about the problems of the dollar—we do every week—but that does not alter the fact that the dollar is a great medium of exchange. It is perfect, in fact. Let’s state that again for emphasis.

The dollar is a perfect medium of exchange.

This is because it trades at no spread. There is no loss to use the dollar, it always trades at par.

The dollar will fail one day, it is inevitable. That will be a catastrophe to make a mere caldera like Krakatoa seem a walk in the park by comparison. Millions of people will die, and the survivors will be impoverished almost beyond comprehension of Americans today. But economics operates the way that it operates. This is economics’ revenge against the dishonesty of irredeemable currency and inflation—i.e. the counterfeiting of credit.Each economic actor seeks to maximize his gains and minimize his losses. No one acts to “try to bring a better system” (other than a few entrepreneurs, and they are seeking profit anyways). No one says “let me pay out my gold, because it will be good for the economy”, or “good for society”, or “it’s honest money.”

They pay out dollars because they are paid in dollars, and there is no loss to pay them out. They may buy some gold as savings, but they don’t pay out their savings. They pay out their income. Dollars.

And they will continue to do so, until they have an income in gold.

Now that he’s been acknowledged, maybe this elephant can calm down and stop making such a racket!

Supply and Demand Fundamentals

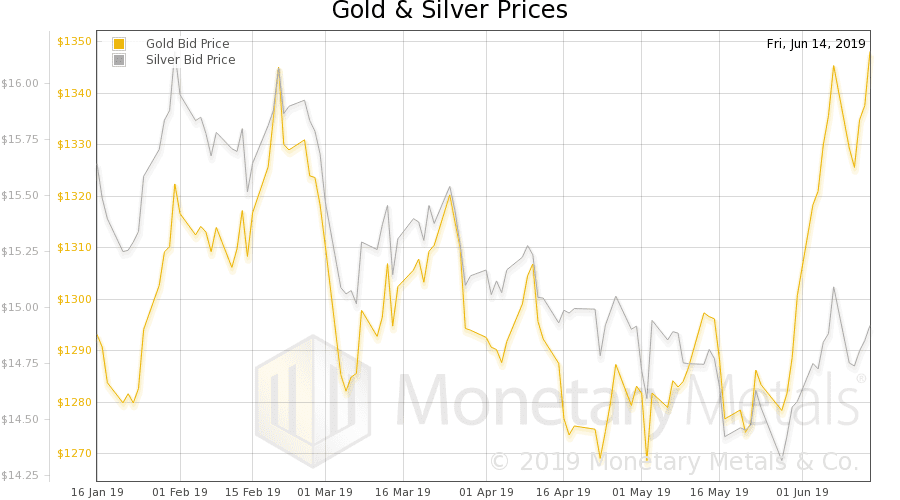

The price of gold went up a buck, but the price of silver dropped back 13 cents. And the gold-silver ratio marches further upwards.

Keith spoke at a conference this week, about how to analyze the fundamentals of supply and demand in gold and silver. He talked about the basis of course. Another speaker spoke later, about the supply and demand fundamentals of silver. He covered all the topics we eschew—solar, increasing use of sensors and electronics in automobiles, etc. And at the end of his presentation, he had two graphs.

Without the ability to reproduce them here, we will just summarize them. One showed the correlation of silver to gold, copper, and oil. It showed a very noticeable correlation to gold, and not so much copper, and virtually none with oil. The second showed, for each trading day over a period of time, a gold colored up-bar if silver traded with gold, or a gray down-bar if it traded with other commodities. By eye, it looked like over 99% of days, silver was with gold.

In other words, you can safely ignore all the talk about industrial uses of silver. And mine production. And recycling. Demand for silver, as with gold, is monetary reservation demand. Silver is still money (whew, right?!)

So why a ratio over 90:1? Those who demand gold for monetary reserve are a different group than those who demand silver. As always, gold is owned by those rich enough to afford it. An ounce of gold is several weeks of the wages of an unskilled laborer, or more than a week of the wages of the median worker in the US. And more than that outside America.

Institutions, including central banks, demand gold almost exclusively, with little silver other than perhaps family offices and hedge funds that may have a broader charter.

A 90:1 ratio tells us that the wage-earners who cannot afford gold are either not able or not willing to increase their monetary reservation demand. At least this is true relative to the asset owners (who are near peak levels of equity after so many years of bull markets).

For a $20 silver (and 75:1 ratio, assuming gold is priced at $1,500), look not to a great increase in consumer electronics or industrial demand. Look to a shift in either mindset or capacity to buy silver among the wage-earners. And maybe a shift in sentiment among wealthier savers who have the option of using silver—and who may be attracted to the relative bargain.

However, from the look of that chart we’ve been updated (see below, under silver) today is not that day.

Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing.

Now let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver.

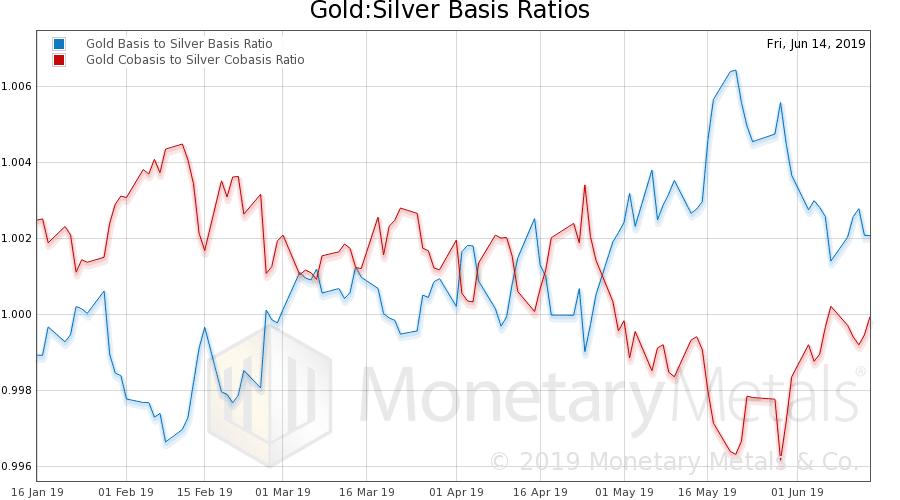

Next, this is a graph of the gold price measuredin silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose further.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The dollar was basically unchanged. The scarcity (i.e. cobasis) dropped a hair.

The Monetary Metals Gold Fundamental Price dropped slightly to $1,402. It’s a bit above market, but not a lot.

Now let’s look at silver.

The July silver contract approaches expiry, and it’s no surprise that it has tipped back into backwardation, with a sharp increase in the cobasis. However, the silver basis continuous shows a slight drop in scarcity.

The Monetary Metals Silver Fundamental Price dropped back to $15.49.

Here is an update of the ratios of the gold to silver basis and cobasis. Higher basis ratio means gold basis is above silver basis, which means silver is less abundant.

There is a move favoring silver (i.e. silver being the scarcer metal in current market conditions), but this week it was a small one.

© 2019 Monetary Metals

The gold/silver ratio, despite being legislated at 15:1 in 1792 in the USA, moved above that “fixed” level a few years before silver was demonetized both in the USA (Coinage Act of 1873) and in Europe (1871 – 1874). At any time in the intervening 145 years “the wage-earners who cannot afford gold” have had the opportunity to buy silver to their hearts’ content (and to thus shift the ratio to a lower value). But they haven’t.

Instead the gold/silver ratio has been in a generally rising trend (presently at the highest level since 1993 but still below its all-time high in 1991. There is something about that condition – about 145 years of history – that suggests forces other than sentiment of the relatively “poor” precious metals buyers is at work. As regards “wealthier savers who have the option of using silver”, I ask, why would they? Your phrase, “… the relative bargain…” is subjectively judgmental and can only be verified in hindsight.

I have a lot of respect for your work, Keith, but I think that you are missing something here and it’s not an elephant.

Dear Keith,

Thank you for this article, which somewhat answers the question I had asked earlier ” Why should anyone hold savings in precious metals? When you or your heirs need to spend or use those savings it will be dollars (or whatever future currency the world decides it wants) that you will need anyway.”

Thinking about this and reading your post and Jim’s comment above, I have made a hypothesis… Precious metals are being used to save that capital which people intend to pass onto future generations, perhaps in perpetuity. They don’t intend to convert this capital asset back to dollars unless it’s the last resort. If that is indeed the psychology at work, it will explain why gold continues to remain off the market (and why it’s scarcity might increase over the decades…I wonder if that’s true?) as well as why the gold silver ratio has fallen so drastically (people expect gold to hold value far more than silver over the coming centuries). It explains why people with a sociocultural proclivity for long term intergenerational saving (read Chinese/ Indian) buy so much gold (even though it’s barely 10% of the assets of the Chinese and Indians I know!) while people with the cultural background of self independence (one life/ spend it while you can/ the kids gotta look out for themselves) prefer to hold no gold or even go into debt ( that credit card debt is certainly written off on death!).

So what do you think?

Agreed, the larger trend has been away from silver. Question is, has there been a meaningful break in historical parameters? And I would answer there has not been — at least not yet.

Longer term parameters are well established — generally 30:1 on the low side and 100:1 on the high side. Long gone are the 70’s/80’s when silver was almost trapped in a 40:1 to 30:1 range, back and forth, back and forth. Since then silver has effectively been a huge bear market relative to gold. That is what most of us see and feel. Silver is a has-been.

But the longstanding parameters of 30:1 – 100:1 remain reliable reference points until proven otherwise.

In fact, the ratio traded at 32:1 as recently as 2011 (just 8 years ago?) in the midst of that year’s speculative blow off. Of course, such a feat (32:1) required a massive influx of speculative and leveraged money, which more typical of market tops than bottoms. So I find today’s ratio –being just 10 pts from the 100:1 extreme — to be a ‘low-risk’ proposition compared to gold.

More importantly, the high ratio — especially in the midst of gold breaking out of its large consolidation pattern — is very encouraging on its technical merits. Why? Because it shows an complete lack of speculative interest in silver, which is called “the poor man’s gold” for good reason, as it’s the go-to investment vehicle for those who cannot afford gold. And where I come from a market devoid of leverage and speculation — especially when a bullish position is somewhat warranted — is a bullish sign.

In a very real way it’s the flip side of 2011. Gold is breaking out and nobody cares. If they did care, the ratio would moving back down, at least some. But it’s not.

There’s an old saying that “Markets make opinions”. People don’t get bullish and wait for prices to rise. Prices rise and investors then get more and more bullish until there is a widespread plurality of opinion… which is the top.

No doubt a long bear market in silver has pushed many-a-bull to the breaking point, even to the point of discarding silver altogether. But as silver prices rise we will see opinions change once again, just a day follows night.