The Fed’s Passive Aggressive Play, Report 4 Feb 2018

Singing the song of rising rates

Last week, we took a break from the theme of the consumption of capital, for our annual Outlook 2018 report. We are going to leave the topic for one more week, while we address a market move which is on everyone’s mind.

Are interest rates now in a rising cycle?

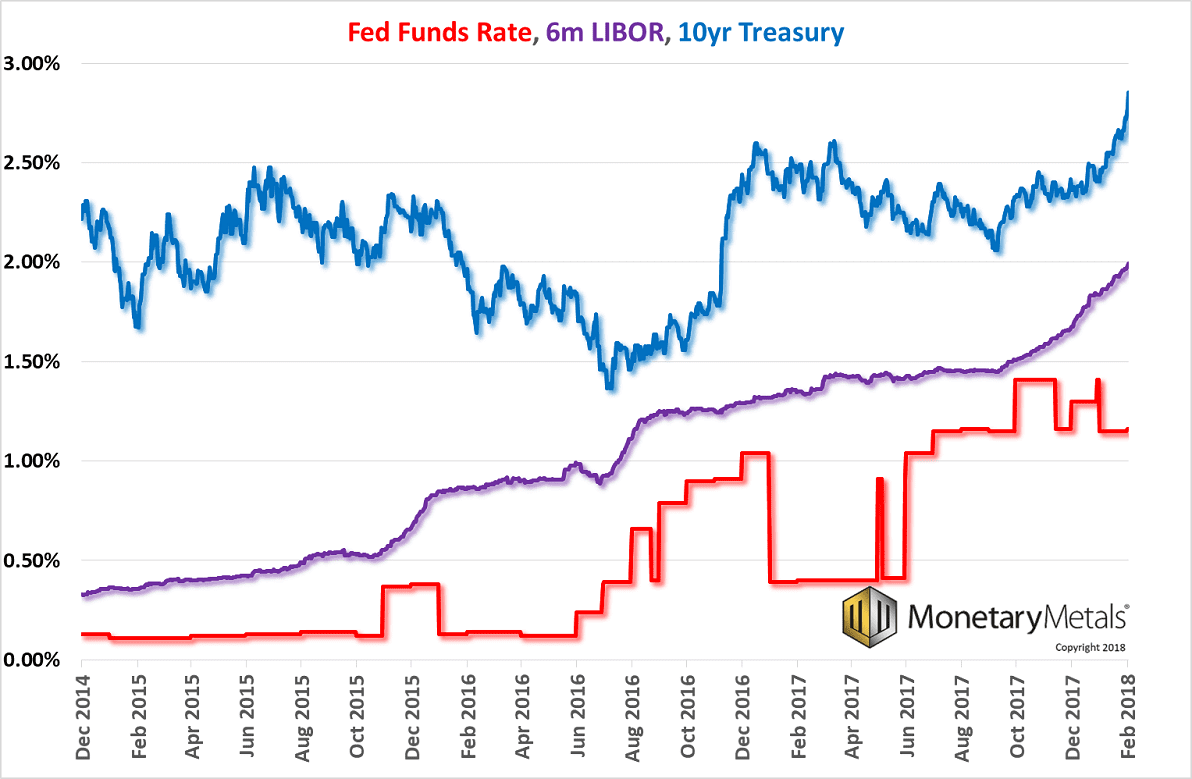

The Fed has been singing the song of rising rates since Yellen hinted at it in September 2014. The Fed’s first hike was December 2015. Here is a graph showing the Fed Funds Rate, which the Fed controls, with 6-month LIBOR and the 10-year Treasury.

The Fed does not control LIBOR, which is the rate banks offer to lend to other banks. But LIBOR moved up smoothly above the Fed Funds Rate. Even in this limited period, we can see that the rate on the 10-year Treasury is not so correlated. It has moved up recently, but does not show a rising trend through late 2017.

The first thing we must say about this is that people should pick one: (A) rising stock market or (B) rising interest rates. They both cannot be true (though we could have falling rates and falling stocks).

We do not think of rates in terms of the quantity of what people insist on calling “money” (i.e. dollars). It is not true that money pours into various containers such as bread, milk, eggs, cheese, and Apple shares, with the level of the liquid indicating the price. It is not true that an increase pours more in to some buckets, and hence higher prices. This is not even wrong (to borrow again from physicist Wolfgang Pauli).

We think in terms of arbitrage. For example, corporate CFOs may borrow to buy back their own shares, if the interest rate is below the company’s earnings or dividend yield. As rates rise, surely corporations become less interested in borrowing more to buy shares, and may even sell shares to pay down debts.

The wealth effect

OK, that point about stocks made, let’s talk about the so called wealth effect. Oh how economists love this. Keith saw Dick Fisher (president of the Dallas Fed at the time) give a keynote. Someone asked him about the wealth effect. He smiled broadly, spread his hands, and said “the wealthy have been very affected.” The audience, mostly one-percenters, applauded. It’s wonderful fun, this wealth effect!

Of course, it’s wealth the way Velveeta cheese food is real cheese. Economist Ludwig von Mises observed in 1950:

“…Keynes did not teach us how to perform the ‘miracle … of turning a stone into bread’, but the not at all miraculous procedure of eating the seed corn.”

He could have been describing the wealth effect, because that’s what it is. A perverse incentive to consume capital. The incentive is from rising asset prices, and the response is speculation. But speculation is a process of conversion of one man’s wealth into another’s income, to be consumed. Those who own assets, particularly those who borrow to buy them, are making money. So they spend.

The flip side of rising asset prices is falling yields. Falling interest rates drove falling yields in other assets especially stocks and also real estate. But now the Fed is tentatively raising rates. So what does this do?

Obviously, it slams the wealth effect into reverse. If people feel richer and spend more when their portfolios are rising, they feel poorer and spend less when their portfolios are sinking.

Leverage, which was so much fun on the way up, becomes so much pain on the way down. There is a powerful incentive to sell assets (driving prices down further) in order to repay the debt used to finance the portfolio. We are not so much interested trying to predict a stock market crash (we are not stock analysts), as in this dynamic of repaying margin debt, repaying loans.

Asset prices factor in to the monetary system in another way. Bonds are used as collateral for other lending (so are other assets, such as real estate). A falling bond price reduces the amount of collateral available to support borrowing. The same is true with home mortgages.

If the falling price of a bond reduces the capacity to borrow, what of outright bond defaults? Junk bonds are rated below investment grade because they are the highest risk of default. Rising rates will cause defaults, as cash flow is harmed. Suppose Marginal Corp pays $10,000,000 a month in interest, at the old, low rate. It has monthly profits of $9,000,000. It is a zombie—it can’t even pay its interest expense without relying on further borrowing. When its bonds mature, it depends on a forgiving market to offer it continued cheap credit.

At the new, higher, rate Marginal’s interest expense is $11,000,000. It has a negative cash flow of not -$1,000,000 but -$2,000,000. Its already-high risk of defaulting has just risen.

Marginal’s creditors will experience big losses. Many of them may be leveraged, that is they borrowed to buy Marginal bonds. These creditors will have reduced demand for credit, themselves.

Marginal and its creditors will have to lay off workers (even in a restructuring bankruptcy, Chapter 11 under US law). Unemployed workers borrow less. The vendors to Marginal and its creditors will suffer reduced revenues, and themselves will reduce demand for credit, and likely lay off workers.

Most people take a quantity approach to prices. They try to calculate supply and then demand. But this doesn’t predict or explain the epic collapse in the price of cell phones. Once, a mobile was a toy for J.R. Ewing on Dallas in the 1980’s, but now even beneficiaries of charity food kitchens have them. Demand is up 10 gazillion times what it was then. And so is supply.

The rising cycle

However, a market is a dynamic system. And credit is the most complex market, by far. We want to know as the price changes, how does that motivate the various participants? Do they want to supply or demand more, or less, as price changes? The classic supply and demand curve does not explain a dynamic system.

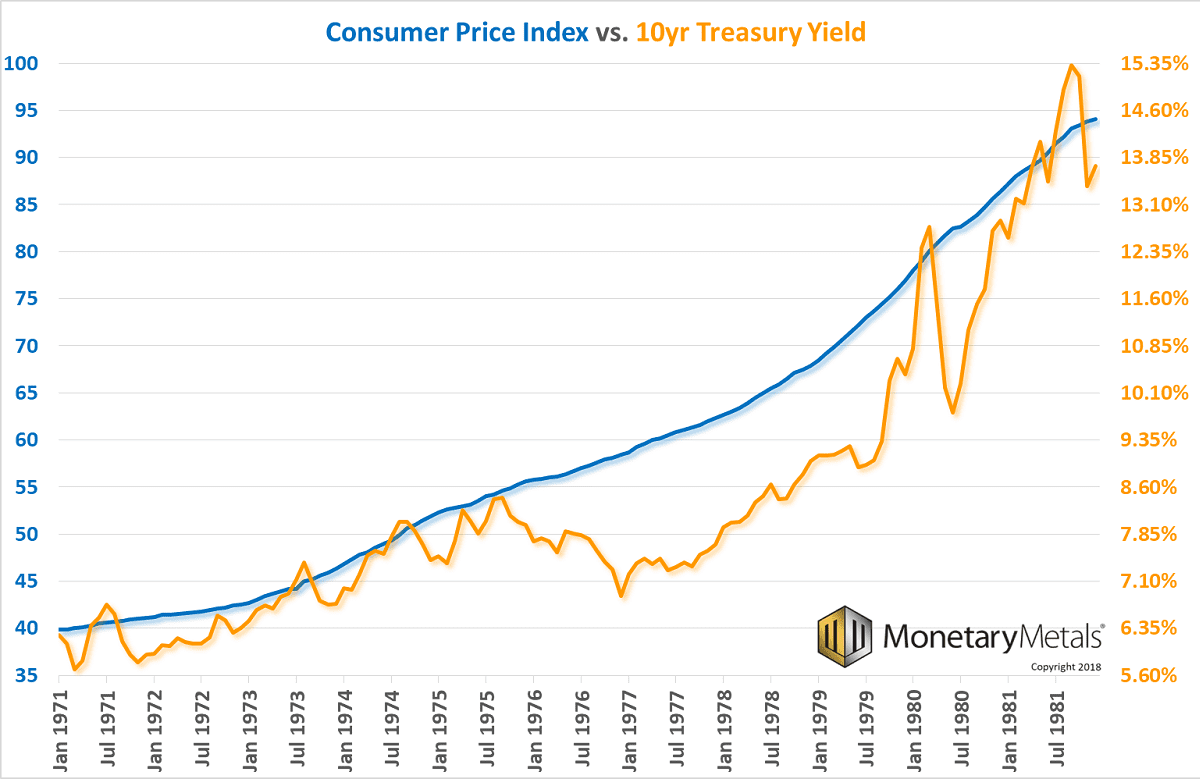

We had a protracted period of rising rates, from after WWII through 1981. Let’s look at the 1970s through 1981, the most egregious decade for prices and rates, the 10-year Treasury yield overlaid with the consumer price index.

If you were CFO of a major manufacturer, you could exploit this by selling more bonds to raise the cash to buy more raw materials. You would accumulate inventories up to the rafters, and then build more warehouses. Why? There is a guaranteed profit just to sit on inventory for a few months, before selling finished goods.

The interest rate is the price you pay to borrow money. A rising rate means that money you previously borrowed, presumably at a fixed rate for a long term in those days, looks cheaper and cheaper compared to the current market. With each uptick in interest, the burden of all extant debt is lighter. With each uptick in consumer prices, the incentive to increase this trade is stronger.

The above process is a ratchet. The process keeps going, with prices, interest rates, and time preference all rising (consumers at that time went to the grocery store and loaded up on canned tuna fish or paper towels, rather than hold cash). Perversely (all incentives in irredeemable currency is perverse), the higher the rate the greater the incentive to borrow. At least with regard to commodities and work-in-process.

If this had continued without bound, the currency would have collapsed. People would be calling it a hyperinflation, though it was not about the quantity of dollars. But something occurred to break the cycle.

By 1980, the interest rate had gotten over 12.5%, dropped briefly, and then in 1981 finally spiked over 15%. This not only got over marginal time preference—people began to prefer the bond to commodities—but also it got over marginal productivity. That is, the economy was running out of businesses who could borrow at such lofty rates and still make a profit. Even with the built-in increase in prices during the time from procurement to sale of product, it was not enough to enable them to borrow any more to add to this trade.

The falling cycle

After the rising cycle broke, the falling cycle began. With interest above marginal productivity and also time preference, rates begin to fall. Now, each dollar of previously-incurred debt has a greater and greater burden. The net present value of a dollar to be paid in the future is discounted by the interest rate. As the interest rate falls, so does this discount, so future payments are worth more today.

It is no coincidence that lean and just-in-time inventory management gained traction at this time. Unlike the previous era of borrow-more-to-accumulate-more-inventories, the game was to eliminate inventories to free up capital.

Corporations are happy to borrow to buy capital assets, if interest < asset yield. As they continue this trade, they bid up asset prices, which means push down asset yields. But the interest rate keeps falling because businesses are finding ways to be more capital efficient. Businesses and consumers do not want to borrow to hoard commodities, they want to dishoard to repay borrowing.

With each downtick of the interest rate, businesses find more capital assets to buy. This perfectly describes a falling rate environment: demand for credit only picks up on a downtick of the rate.

After decades of falling rates companies have learned to use short-term financing. If rates rise, interest expense quickly rises too. Cash flows are pinched, a serious threat to razor thin margins after so many years of falling rates.

The same occurs with consumers. Housing demand drops, if the monthly payment rises. What happens to demand for cars, if the cost to finance the same cost goes up? So far, at least, American car makers continue to offer 0% financing for 72 months. The rise in rates so far is eating carmaker margins, but not volumes yet.

Breaking this cycle

So unlike the 1970’s, we are now in an environment where an uptick weakens credit demand. Unlike then, business and consumers are now saturated with debt.

Borrowers and creditors are often using duration mismatch. If a business issues a 2-yr bond to finance a factory that will be amortized in 10 years, that is a form of duration mismatch. It relies on the market to roll its liability five times. If the market doesn’t accommodate, at the same or lower rate, what is it supposed to do? Sell the factory?

Banks openly purport to be in the business of what is euphemistically called maturity transformation. They borrow short to lend long. If short term rates are pushed above long-term rates, then banks will have negative cash flow.

One final factor, and then we will address what it would take to break this cycle. The Treasury bond is the center of the monetary system. It is defined as the risk-free asset. It is the asset owned by the most conservative investors such as pensioners, banks, etc. Their demand for this asset is relentless, so long as they are gathering assets.

If you have $100, you can put it in your pocket. However, by owning a Federal Reserve Note, you extend credit to the Fed. And hence to the Treasury and the banking system.

If you have $100,000, you can put it in a bank. And then, you are extending credit to the bank. The bank, by business model and regulation, buys Treasury bonds.

If you have $100,000,000,000 you can only buy Treasurys. No other market has the liquidity you need.

All roads lead to the Treasury bond… and people say rates are going to rise, that is selling of the bond will lead to more selling and so on in a ratchet process as the rising cycle 1947-1981 was?

No.

Since 1981, the forces in our monetary system have been aligned for falling rates. There is no particular bound. Switzerland proved that even a 20-year bond can have a negative yield (impossible under the gold standard).

To break this cycle, what would it take? Well one way is if time preference rose above interest. But there are reasons for falling time preference. One is rising indebtedness. If you’re deeply in debt, you need a cash buffer. The more the debt, the more the cash. And in a world of just-in-time product delivery—think same-day Amazon drone delivery—there is less reason than ever to hoard goods in anticipation of needing them.

As an aside, unlike 1947-1975, gold is legal now. So people whose time preference is violated by low rates have an outlet which does not affect commodity prices. Instead of hoarding tuna fish or paper towels, they can hoard gold.

Profit margins could rise, and productivity could go above interest. We mention this only for completeness.

It would take something calamitous to make rates rise significantly and durably. For example, a mass movement of people deciding they prefer a pantry full of cans of tuna fish to a bank account full of dollars. Picture people installing tanks to hold 10,000 gallons of gasoline to fuel their car for the next ten years. And businesses abandoning just-in-time, returning to borrowing to increase inventories.

This would be a huge attitude change, to recklessness about default. Only when they grab the last cans of food, does this happen. Mises called it the “crack up boom”. Culturally, does this even resonate today? Do millennials relate to their grandparents’ closets which may still be full of old old stuff?

So long as people are in massive debt, and so long as they are concerned about defaulting (and so long as lenders are concerned about their debtors’ defaults), then upticks in interest will, for many reasons, reduce demand for credit.

Rising rates is a time of relentless and aggressive bond sellers. When bond sellers are running ahead of bond buyers, selling on the downtick. Not caring about the downtick, or even carefree.

A durable rise in rates would cause a calamity. Defaults would occur first among marginal borrowers. But this would damage creditors, lay off workers, and reduce revenue to their suppliers. That would spread in a contagion. Even the most powerful borrower in the world would find it is eating more and more of its revenues just financing its $20 trillion dollar debt.

We are comfortable saying that the Fed’s timid little rate-hiking adventure is nothing more than a passive aggressive play. Right now, active traders sell bonds to front-run (we don’t mean this in the sense of the illicit brokerage trading ahead of a client order) what they assume is the general trend.

The falling-rates trend will resume soon enough. The only question is how big a crisis occurs before the Fed abandons tightening and aggressively reverts to loosening.

The above ideas are an application of Keith’s Theory of Interest and Prices in Paper Currency.

Supply and demand fundamentals

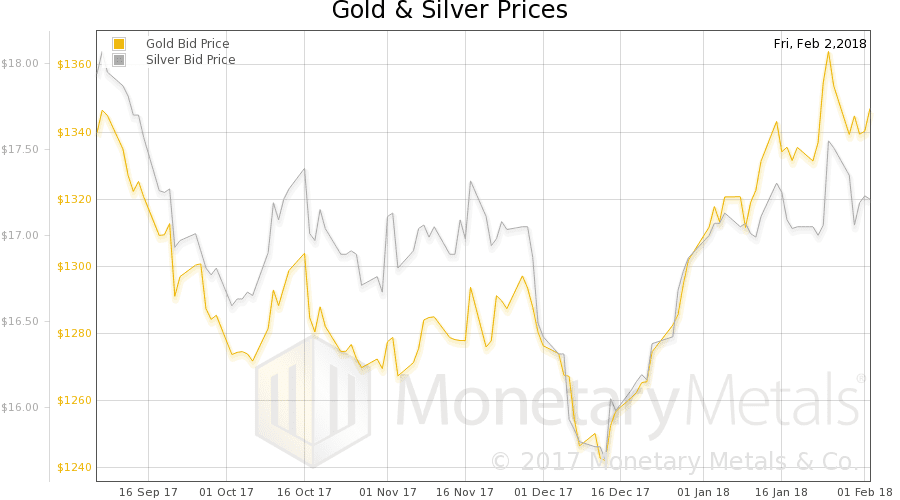

The price of gold fell a bit this week, -$15, and that of silver dropped a lot especially on Friday -$0.81. If one were a speculator, betting on the prices of the metals to make dollars, this move would almost be enough to make one believe the prices are manipulated. Except that the Fed doesn’t care about the price of silver any more than it cares about the price of a 1955 Ferarri or a Picasso or any other speculative asset.

Recently, some traders were arrested. Doesn’t this prove a long-term price suppression? Actually, they were caught spoofing, a short-term game to make short-term gains. If the prices of gold and silver are supposed to be $50,000 and $1,000 respectively, then it could not be spoofing that pins them to $1350 and $17.00. To make an analogy to a conspiracy alleged to commit murder, it is not evidence in support if one of the suspects is caught shoving a pack of chewing gum in his pocket and walking out of a grocery store without paying.

By the way, some of their spoofs caused the price to rise. These guys were equal opportunity manipulators.

Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

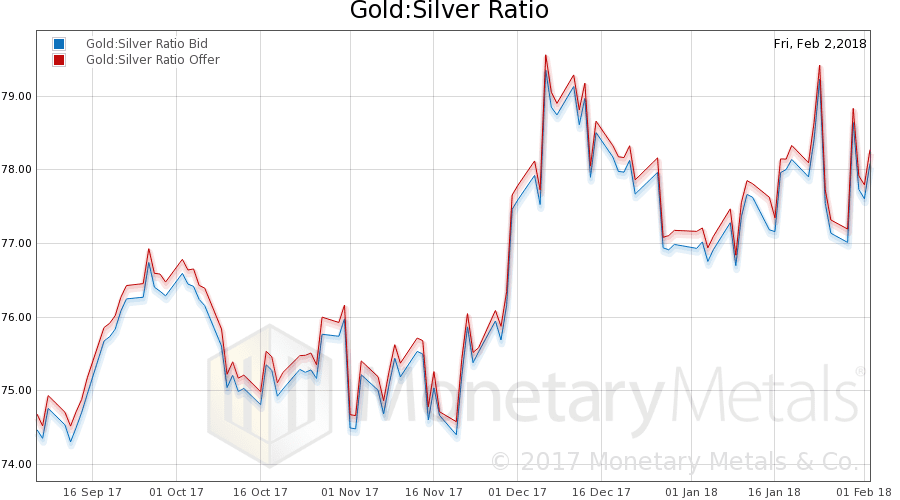

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio).

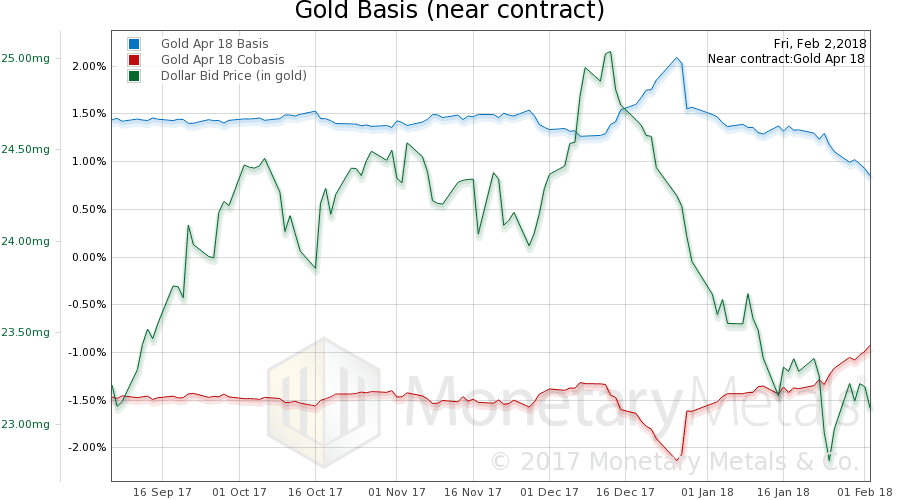

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Gold is hardly scarce, with a basis near +1% and cobasis at -1%. Yet, there’s a noticeable uptrend in cobasis from just before the New Year (not even counting the upspike after Christmas), to go along with the fall in the dollar (i.e. rise in the price of gold meter sticks measured in rubber dollars).

The Monetary Metals Gold Fundamental Price fell $5 this week, to $1,372.

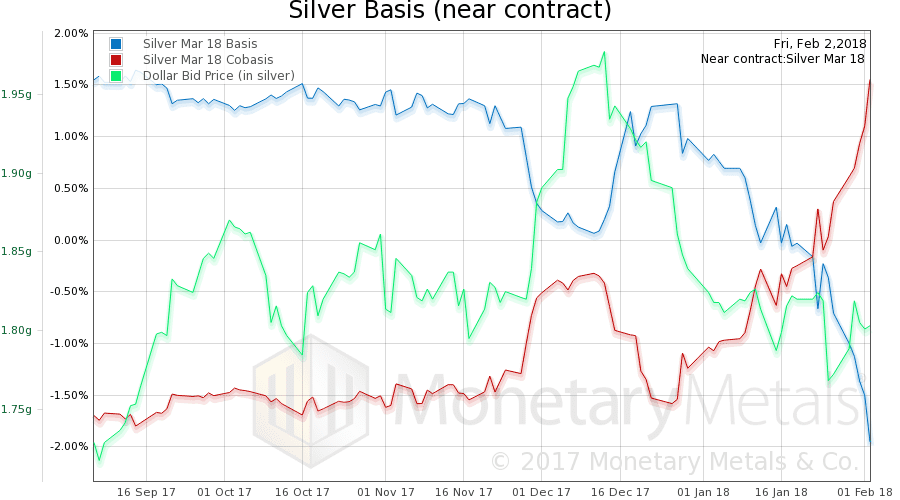

Now let’s look at silver.

There is a more dramatic rise in the cobasis in silver. This is mostly because as we near First Notice Day for the March contract, there is selling to roll the position. This happens farther out in silver than in gold, and to a greater degree. The silver continuous basis does not show nearly this picture.

The Monetary Metals Silver Fundamental Price fell 31 cents to $17.23.

We plan to write a piece this week showing the Friday intraday price and basis action for silver.

© 2018 Monetary Metals

Hi Keith,

Your chewing gum analogy is excellent although I imagine it will go right by the heads of “manipulation” theorists.

“By the way, some of their spoofs caused the price to rise.” is hilarious.

What about this in the stock market?

https://www.paulcraigroberts.org/2018/02/08/stock-market-rigged-paul-craig-roberts-dave-kranzler/

How about using leased gold/silver contracts in the futures markets rather than naked shorting? Real gold or representing real gold and would drive down the current gold/silver price which could then be purchased at lower prices or could be purchased by partners and refed into the market as price rise, and then rinse and repeat.

Rising rates and rising stock markets anything is possible when central banks buying both bonds and shares. The markets could be massaged almost anywhere couldn’t they.

Same with the low level spoofers (im not quite sure what a spoofer is but it sounds like an understatement for criminal activity) Perhaps a better title might be fallguy. The perfect smokescreen for more serious crime.

Are there bigger fish?

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K. – Eddie George, then Governor of the Bank of England, 1999

How would they do this?