The Gold-Silver Opposites Report, 17 Apr, 2016

Well that was interesting. Gold went down over thirty bucks and silver went up over thirty cents. How much longer can this silver rally continue in the face of gold’s nonparticipation? Will speculators really be comfortable bidding silver up to $20 while gold sits at $1200? Do the fundamentals support a higher silver price?

How is silver different from gold? Aside from being a lot cheaper per ounce, and that an ounce of silver is almost twice as bulky as an ounce of gold.

There are two differences. One is that Silver has industrial demand. While virtually every ounce of gold ever mined in history is still in human hands, some silver is consumed. Gold is too expensive to put into most products except in minute quantities (though it’s in the iPhone). Most of what goes into electronics is recycled, as circuit boards are equivalent to good ore. As industrial demand falls (witness the collapse in the price of shipping), this component of silver demand falls with it. Smartphone sales may be strong, but silver is used in everything from cars to washing machines. The drop in industrial demand is surely the main culprit in the rise in the gold-silver ratio, predicted and chronicled in this Report for years.

The other is that silver is more the money of the people. If you work for wages and want to set aside something out of your weekly paycheck, with silver you can get a big coin or two. This is metal you can heft. With gold, it would either be a tiny wafer and for this you would pay a huge manufacturing premium. Or else it would be a digital gold credit in an account, which may not have the same satisfaction (or risks) as metal in your hand. It is this sort of demand that has been anemic in both metals for years (notwithstanding demand for certain silver coins).

For now, people are content to be creditors to the government and the banks (or else don’t really understand what it means to hold dollars).

When this demand returns in earnest, we don’t think it will be in silver only. When the next wave of dollarphobia returns, it will likely drive people into both metals. If it turns out to be only one metal, then it will not be silver.

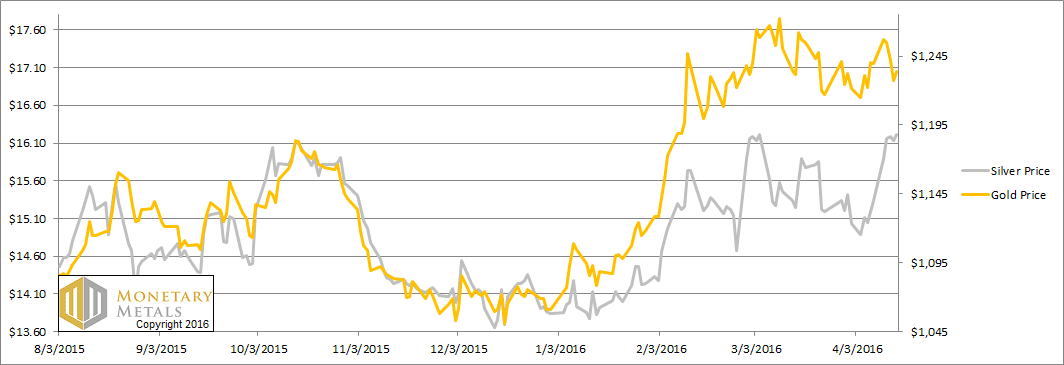

Let’s look at the only true picture of supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

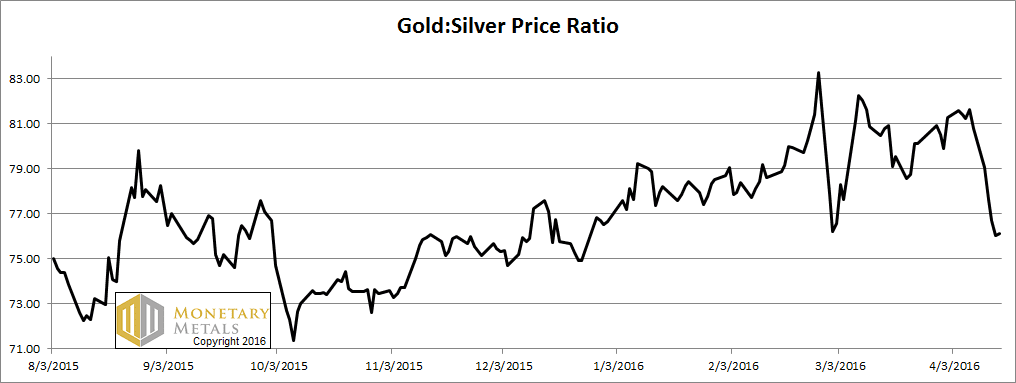

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down 6% this week.

The Ratio of the Gold Price to the Silver Price

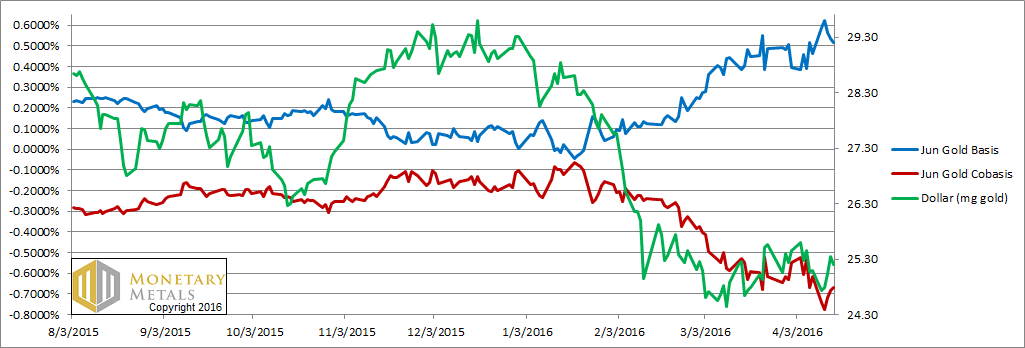

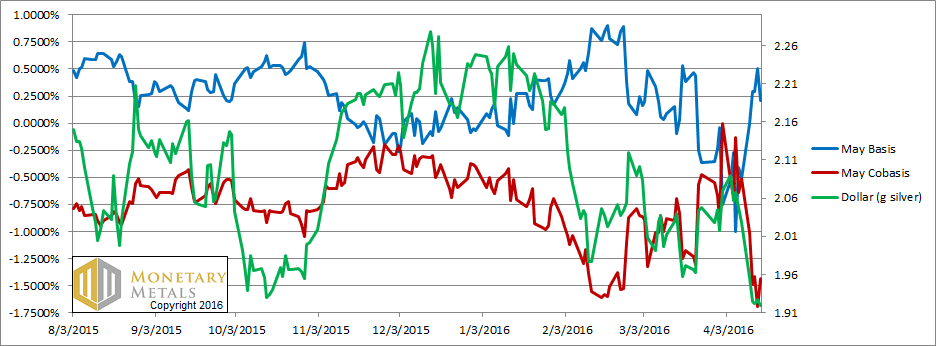

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Look at that. The June gold contract is now offering 50 basis points (annualized) to anyone who wishes to carry it. That is, to buy gold and sell it forward.

This just about matches the two-month LIBOR rate, and is a marked change from the recent past.

What a change. Compare to the Report from 18 October. We showed a December gold basis of around -15 bps (which was then the same time to expiration). Or 14 February, with an April basis barely above zero. The last two months have seen a skyrocketing in gold. Not the price, but the basis.

We would not precisely say that gold is now abundant in the market, but we wouldn’t say it it’s scarce exactly either.

Our calculated gold fundamental price dropped $60 this week. It’s still $25 over the market price, but that’s hardly a significant difference. Gold is almost fairly priced today.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

First, let’s note the dog that did not bark in the night. We have not yet had to switch from the May to July contracts. Normally, the unbridled selling of the contract before expiry causes the basis to fall off the bottom of the chart, and often temporary backwardation readings as well. So we are forced, generally before now, to switch to the next contract to get a good picture. Not so today. We still have a good signal that shows the market action clearly.

And what is that action? As price of silver rises (shown as a drop in the price of the dollar, measured in silver terms) the metal becomes less scarce.

Only a few short weeks ago, we were speculating on the possibility of the silver cobasis to rise above zero, called backwardation. But since then, the price has risen about a buck twenty.

Our calculated fundamental price did rise a bit this week, but it’s a buck twenty below the market price (not directly related to our comment about imminent May silver backwardation, but not entirely unrelated either).

© 2016 Monetary Metals

Personally I think that most folks fall into the second category, namely those who don’t really understand what it means to hold dollars, but even those who do a) do not think that the collapse of the dollar is inherintly emminent and b) are not in a position financially to do much about it. With 93 million plus not in the workforce, that’s a lot of hurt that isn’t being covered. According to the MSM and the government, things are swell.

On another note, I’m just wrapping up reading James Rickards’ “Death of Money”. I’d love to hear your take on it, should you be so inclined, especially in light of the House of Saud threatening President Obama with the dumping of the T-Bills they hold if the US government releases the missing 28 pages of the 9/11 report.

Lastly, thank you very much for the aurum! Way cool stuff! Are you going to put them into production? I think you have a winner there with the .25 gram denomination(?)! I know, I know, “It’s not money” per the Feds. Still, I’ll take J.P. Morgan’s word for it over the Feds any day. Thanks again and keep us informed about that venture.

Peace,

Theo

Does anyone else find it strange that the so-called fundamental price of gold — previously at a huge $150 – $200 premium to spot — has suddenly dropped to almost zero (which means spot, or almost spot) in a relative heartbeat? What happened to the expected rally based on the “only true picture of supply/demand fundamentals”?

This is why I have been repeatedly asking for historical price data as it relates to “fundamental” supply/demand model…. but such data was never forthcoming.

Bottom line: If the dollar denominated price of gold can’t hit the “fundamental” price even once in a year, I’m not sure what good this model is. Buyers will continue to get creamed as the bear market continues. Conversely, sellers will get creamed as the bull market signals restraint.

That’s another way of saying there are some kinks to be worked out with this model. Either that or the model is counter-intuitive. Larger premiums tend to be bearish, and vice versa. That’s a possibility too.

For the record, I completely disagree that ppl will prefer gold. I sure do…(for portability) but one person doesn’t matter. I see that most ppl are relatively poor and therefore will prefer the “poor” man’s gold, i.e., silver. That should drive the GSR lower during a crisis, regardless of whether it can be sustained or not.

At the moment I don’t believe a lower GSR can sustain itself except through psychology. But with ZIRP and NIRP so prominent in the news… well, that’s the definition of psychology.

In other words I don’t think we are to the point of a rapidly falling GSR. The recent drop could just be a NIRP related scare and nothing more. A rookie move.

In the end both gold and silver are money and i think it’s foolish to bet against either except through short term speculation. Stackers should continue to stack. Gold is down from $1900 to $1200… still a great price, even if it goes lower. Silver is essentially half price.

Some — like Goldman — have called for $1000 gold again. Perhaps. But why not $800, or $600… those are targets in a deflation too.

It’s important to keep in mind there is a huge overhang in speculative positions right now. Every continued dip — even $10.00/$20.00 — will create unbearable pressure for marginal sellers to liquidate. Unless and until gold re-captures 1250 and especially 1260 on a closing basis, price trends are bearish and will continue to exert pressure. Market go up or down… rarely sideways.

As prices move lower (again, IF they do) it eventually greases the skids for a quick $150 – $300 point drop based on nothing more than speculators who have jumped the gun and called the next bull market that didn’t happen at the right time. I personally don’t see it happening. But those are the numbers.

Ya’ll see this COT data, right? This market is loaded to the max on the long side with over-leveraged small speculators. It’s bad. So if prices don’t gain traction (go back up) in a hurry, the liquidation lower won’t be pretty.

So far $1150 – $1175 is support — soon to be hit but also in jeopardy unless the liquidation runs its course quickly.

$1315 – $1330 is resistance. That’s a good place to lighten your exposure if you have ‘extra’. I hope you get the chance to sell there… because right now it’s not looking so good.

We have had the $200 rally already.

Nice work! Thanks

Not to be too overly optimistic, but in 2011 when PM’s peaked the GSR fell & fell & fell all the way to the low 30’s, until after silver peaked. In 2011 gold peaked a few months after silver so, of course the GSR was climbing for those few months between the silver peak & the gold peak.

Actually the same thing happened in 1980 or whenever that was that the PM’s went sky high for a short time.

So I don’t think it is too unrealistic to expect that the GSR will be falling the next time the PM’s go into a bull cycle.

Again in 2008 when the PM’s were taking a beating the GSR shot up to over 80:1.

For the past 5 years the GSR has steadily climbed from the low 30’s up to it’s recent high of 83+ and we all know how PM’s have performed during that steady 5 year increase in the GSR.

Perhaps my sample size is too small, but my rule of thumb is that when PM’s are moving upward, the GSR is falling & vice versa.

So now I am wondering if the recent 8% drop in the GSR MIGHT be the start of something interesting.

In defense of Keith, I watch the contango and occasional backwardation in the precious metals, and generally agree with his approach to relative scarcity. Gold costs $15 per contract per month on warrant, platinum $20, and silver approximately $45, all plus the cost or opportunity cost of money. Probably these costs can be partially avoided by metal dealers, banks, and other large market participants, but understanding these costs is helpful to ascertain market tightness.

The silver contango indicates ample supply available to the market, forcing speculators to pay up to roll contracts forward. Gold ample, yet in reasonable balance. Platinum is modestly tight, yet still in reasonable balance. In summation, no smoking gun anywhere, but silver might be overbought by speculators.

Gold and silver have huge above ground stocks; investment psychology will determine the price net net net. Platinum is very scarce in comparison; a small change in sentiment in platinum’s favor as an investment could be very interesting. I’m not suggesting this is likely to occur; but it wouldn’t take much to move the needle back to gold platinum parity, or to a platinum premium to gold.

Fiat money in first world countries (especially the U.S.A., the best house in a marginal neighborhood) is alive and well. Sort of, kind of well. As Keith correctly opines, precious metals are a wealth preservation strategy, not a get rich quick scheme.

Keith, we all appreciate your incites and opinions. Thank you.

Oops, insights. I’m trying to avoid Bernie’s and Donald’s incites.

Does this matter?

http://screencast.com/t/Lj0dhnhltO8

Debt is deferred taxation, no? One way or the other, debts are paid… but how?

http://screencast.com/t/HCrgmWzzrqpw

It’s commonly understood that PM stocks lead the way. So does this chart of the HUI look weak to you?

http://screencast.com/t/XOmqEd0l

My favorite gold stock fund, with 14% held in gold bullion, and a healthy percentage in streaming giant FNV:

http://screencast.com/t/f2vOGYjM

GSR now has a 74 handle, having peaked at 83. It breaches the most optimistic possible 5 year trend line within a couple of percent. History shows once it breaches such lines it is a matter of weeks down to the GSR nadir.

Possible rescue narratives:

“This move in silver is speculatively driven, while that in gold is due to scarcity as shown by the model; expect a reversion”.

“The GSR downside move is already over; this is an unusually small one; expect GSR to rise from here”.

“There has been a sudden upside move in the fundamental price of silver (similar to the sudden downside move in the fundamental price of gold). Fundamental prices based on movement of metal into and out of hoards are actually more volatile and on a shorter time frame than speculative prices. Nevertheless silver is still relatively overpriced and gold is still relatively underpriced.”

“Shanghai exchange has created an imbalance between fundamental prices in Asia and London/NY (where the proprietary model price is calculated). This is a) sustainable (new model will be published soon) or b) unsustainable (expect GSR to revert to the upside).

Take your pick.

Expectation if well correlated with historical moves; this is not a prediction.

IF 81.5 in early April was the last failed upside move, 73 will soon be breached to the downside. Then, IF historical patterns continue to be repeated, something along the following lines would be expected, based on a 30 year history of moves ranging from 20 to 35 points for the rapid segment and a downside velocity averaging 5 GSR points per month:

Almost certainly: 76.5 in early May, 71.5 in early June, 66.5 in early July, 61.5 in early August.

Quite probably: 56.5 in early September.

Possibly (depending on evolution of sentiment caused by aforementioned and geopolitical imponderables): 51.5 in early October, 46.5 in early November and even 41.5 in early December.

Not inconceivably: 36.5 in early January and even 31.5 in early February.

This would not be an unprecedented move; it would be consistent with the normal behaviour of this ratio. Postulating that something completely different will happen requires a “this time is different” assumption, viz: that the underlying situation is now fundamentally different from what it has been for the past 30 years. To be persuasive such a theory should advance evidence.

If you enjoy a good read instead gazing at charts, I highly recommend the latest treat from James Grant:

http://time.com/4293549/james-grant-united-states-debt/

I would then add a follow-up: If you knew with relative certainty that the value of fiat would essentially be zero sometime in the next 20 years, what would you do? And would relatively small fluctuations in price really matter?

We may not be able to “Make America Solvent Again” (to borrow a phrase from Grant) but we can certainly make ourselves solvent.

Thanks bbartlow, James Grant is a reliably wise and articulate counsel.

First World governments can defy the laws of gravity much longer than one might suspect, witness the Yen, and to a somewhat lesser degree the Euro.

Still, from Ernest Hemingway’s The Sun Also Rises: “How did you go bankrupt?” Bill asked. “Two ways” Mike said. “Gradually and then suddenly.” Or, Herbert Stein’s Law: “If something cannot go on forever, it will stop.”

Regrettably, John Maynard Keynes suggested: “In the long run we are all dead.” and “The market can stay irrational longer than you can stay solvent.”

I hope my heirs will wisely employ my growing stash of platinum. Who knows, I might enjoy it too if I live long enough.

The COT reports are followed by many precious metals speculators and investors. This data is imperfect (physical hedges and other non exchange transactions), yet offers an indication of market positioning. Usually the commercials are the smart money, adjusted for common industry practices. Usually, but not always.

When commercials get caught wrong footed, there can be fireworks. Now, maybe, just maybe, this is the case, in silver, platinum, and gold. The commercials may be too close to the trees to see that the forest itself has changed, that perhaps a new investment paradigm is emerging. Precious metals may be more valuable than cash in a ZIRP and NIRP world, a preferable store of value.

The early investors and the then the trend followers are buyers. When the commercial short sellers start racing for cover, who are the sellers? Answer: Precious few. Result: Fireworks.

I’m not suggesting that this scenario is clearly unfolding. Yet we may have a favorable risk versus reward opportunity infrequently offered by the often, but not infallible smart money commercials.

http://www.publisher-jm.ch

https://www.goldbroker.com/news/gold-and-the-minsky-moment-924#1694

Silver: the contango between SIY00 (cash silver) and SIK16 (front month) is averaging half a cent narrower at $17.15 than it was at $16.20 just 24 hours previously. I doubt the proprietary model can explain that away. Scarcity is rising as price rises. This gives the impression of price being pushed higher by physical demand.

GSR is through its trendline.

Things should unfold rapidly now.