The Precious Metals Conspiracy, Report 10 Apr, 2016

For at least a few weeks now, we have noticed a growing drumbeat from a growing corps of analysts. Gold is going to thousands of dollars. And silver is going to outperform. Reasons given are myriad. Goldman Sachs apparently said to short gold, so if one assumes that the bank always advises clients to take the other side of its trades—a tricky and dangerous assumption at best—then one should buy gold. Then there’s the change in ETFs, for example the Sprott Physical Silver Fund has had inflows and Sprott bought more silver. And there’s currency wars, money printing, negative interest rates, etc.

Most of these stories are based in fact (well except the belief that Goldman’s research is always wrong). However, they have little to do with the price of gold. The money supply has grown steadily since 2011 while the prices of gold and silver have not. Hell, the money supply has been growing since forever. And the price of gold has gone up as well as down.

Something tells us that this effort to draw in buyers is concerted. Certainly there has been an 8.4% increase in silver held in trust for SLV. This is the result of relentless buying of SLV shares. When buyers push up the price of SLV relative to the price of silver, that creates an arbitrage opportunity for Authorized Participants. They buy silver metal, create SLV shares, and sell the newly issued shares. They can do that as much as they want while there’s a profit to do so. But of course this pushes down the price of SLV until it is very close to the price of silver.

SLV is somewhere between metal and futures. It can be a speculative play on price, but it’s bought with less leverage and it can also be a long-term holding for many people.

Another sign of increasingly bullish consensus is the discussion last week at Mines and Money in Hong Kong. If everyone agrees that price should go up, then that may indeed occur. The exchange-traded funds are being bought, which further supports a price rally, one that may be a bit more durable than these Yellen announcement rallies.

However, keep one thing in mind. The speculators are trying to front-run the hoarders. Speculators need to sell, to take profits or cut losses. What they can drive up, they can drive down ten times as fast. A durable rally can only occur if there is movement of metal out of carry trades sold to speculators, and into the hands of stackers.

But who knows? Such a rally could in turn spark hoarders to buy and the fundamentals could develop to support it. We keep saying that the price of the dollar will fall far indeed, it’s just that the time hasn’t been ripe yet.

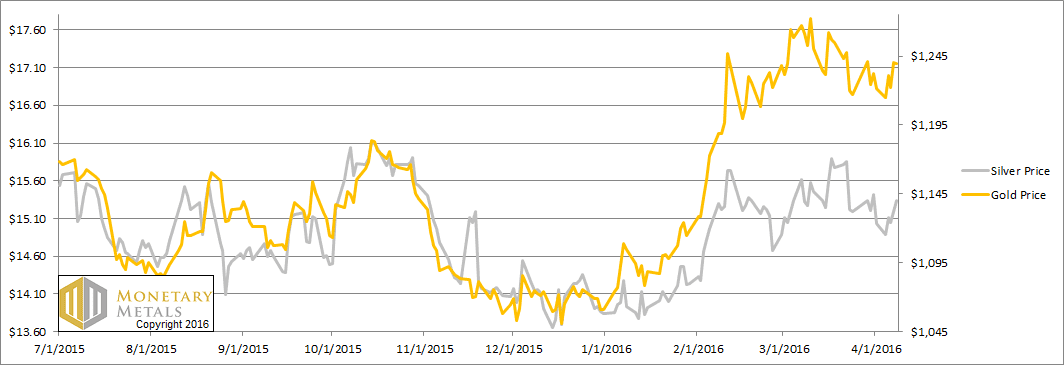

The prices of the metals were up modestly this week. Let’s look at the only true picture of supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

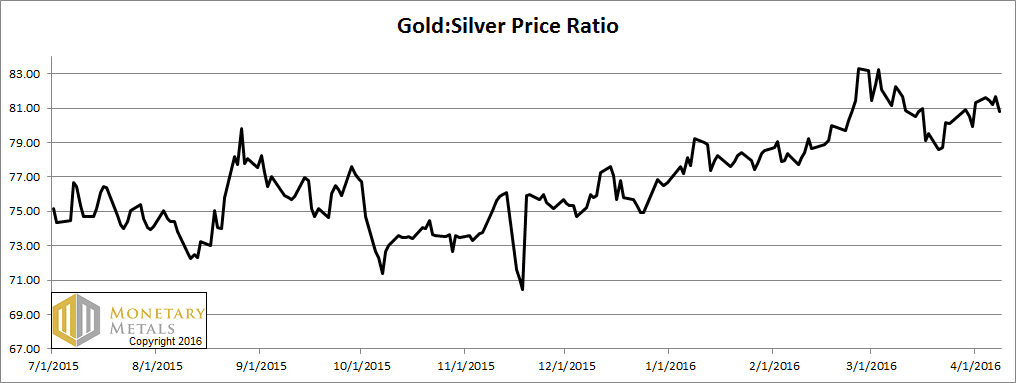

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down this week.

The Ratio of the Gold Price to the Silver Price

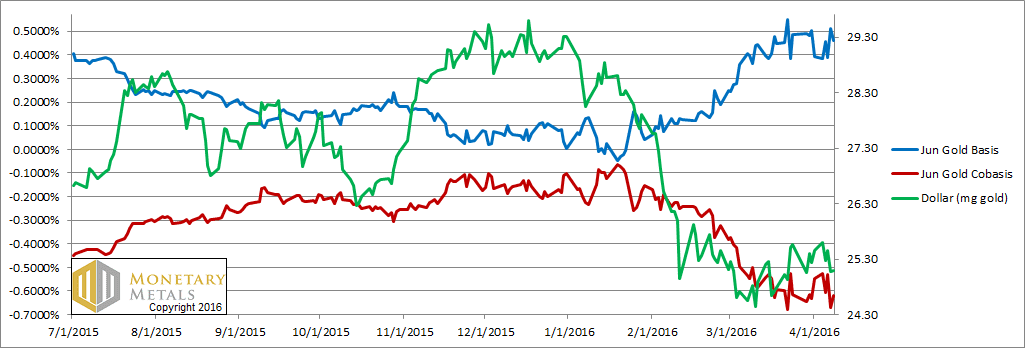

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

After it separated in mid-March, the green dollar price line and the red gold scarcity line have been tracking once again. That is, gold becomes more scarce the more the dollar goes up (i.e. the more the price of gold drops). And vice versa.

The price of gold was up $17 this week, which is the same as saying the price of the dollar was down 0.36 milligrams. The cobasis, our scarcity measure, fell from -0.55% to -0.62%.

That said, the fundamental price moved up about $15. It’s almost a hundred bucks above the current market.

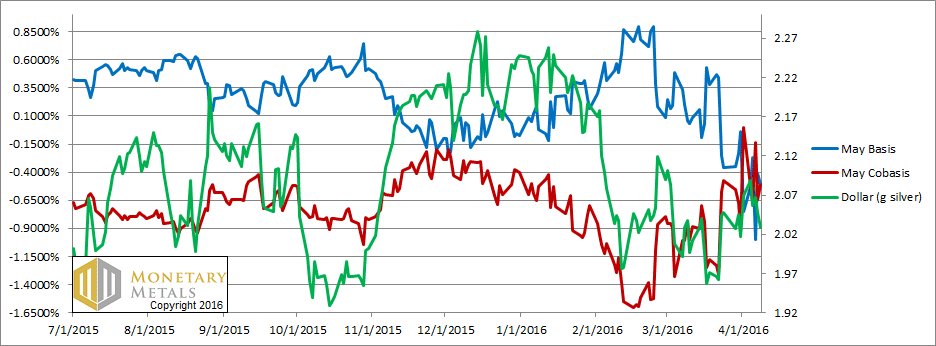

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the scarcity would appear to be holding up better in light of the rising price. However, some of this is the distortion that formerly caused temporary backwardation. The May contract is under steady selling pressure, as naked longs have to sell before First Notice Day. For July by contrast, the cobasis is -1.1%.

Last week, we said:

“If the May cobasis goes positive this week, it will be a recurrence of temporary backwardation. For years, we documented the tendency of each contract to tip into backwardation as it neared expiry. For silver it tended to happen a bit farther out than for gold. If it happens this week, it will not be particularly early compared to what we saw occur in contract in contract.”

As it turned out, the cobasis fell sharply. From 0%, it dropped to -0.66% by Tuesday. It bounced around from there, with quite a lot of volatility. Volatility approaching First Notice Day is to be expected, especially in the present regime where market makers are under more regulatory scrutiny.

Our calculated silver fundamental went up a dime, which is de minimis.

We are in Singapore this week for Mining Investment Asia. Keith and Bron are both speaking.

© 2016 Monetary Metals

Your prediction on silver’s failure to outperform is noted; also the large outperformance of silver this week and the collapsing GSR. Predicting the future is dangerous. As GSR breaches 78 to the downside the question comes again: if you see signs of GSR breaking its uptrend and losing its fundamental support, of tightness in silver even according to your metrics, of gathering and sustained interest in silver, will you highlight this at an actionable time? Or will you continue to bang the old anti-silver drum, find some shred of weakness in the move so that you can continue the narrative and scorn the poorly educated silverbugs until the GSR move is substantially over? Half over? A third over?

This beastie moves quickly, as you can see. On a historical look she is definitely high. On every measure of momentum and sentiment she is collapsing. I find it hard to believe you are going to call for another reversal and a visit to 85. Let’s hear it for a lower GSR.

Bump: 76 handle on the ratio. Having started at 83 and bearing in mind the modest downside expectations of those most bearish on silver – say in the 50s – we are now down 7 points, maybe 25% of the way there. If that is the case, a quarter of the ratio reversal trade has already been lost. Perhaps irrevocably; the next few days will probably tell.

This is the reason for my urging to take seriously the unsustainably high ratio while it chugged up the last couple of points at the rate of 0.5 points per month. You are picking up dimes in front of a steamroller. Previous ratio reversions have occurred so rapidly that you just cannot wait for market (pundit?) sentiment to catch up with it.

By the time anyone in the mainstream mentions it, it is over. Whether your contango-derived scarcity measures give any warning will be interesting to see, and their failure to do so will not go unnoticed.

Thanks for the information

Keith, I very much appreciate you sharing your knowledge and ideas regarding monetary / precious metals with us. You are an intelligent source of worthwhile information and opinion.

With no disrespect, I believe that you have overlooked the value and potential of platinum, a much rarer store of value, and a reasonably liquid investment as well. Gold, silver, and platinum are trading much more as a store of value rather than as commodities, properly so I believe. Platinum is almost as much a monetary metal as gold and silver, given worldwide tax regimes, capital gains taxes in particular, and trades as such.

As you know, platinum is much more scarce than gold or silver, and has substantial industrial uses too. The perfect blend, and, importantly, platinum is priced at an historic discount to the other metals. Please don’t be captured by the pure tradition of monetary metals; consider platinum as an eligible substitute, especially when the price is right.

All the best, please continue with your quality work and analysis.

Oops, disclaimer: I am long, as an investment, substantial quantities of physical platinum and CME platinum futures for investment purposes. I prefer owning platinum to cash in the bank or competing investment opportunities. I don’t expect to hit a home run; I’m simply trying to preserve and grow capital in a zero interest rate environment.

Platinum is not a monetary metal, thats the problem, it will not beneficiate from the monetary vector, the rarety of a metal does not define their price, the price is defined by supply and demand, so dont be fooled by the ratios as they come out of earth.

Unlike palladium, rhodium, osmium, iridium, and ruthenium, platinum trades much more in sync with gold and silver as a store of value and a hedge against reckless government policies. Platinum is the only other precious metal to do so. ALL commodities and metals are priced based on supply and demand, including gold and silver; gold and silver do not possess magical qualities transcendent of the laws of supply and demand . And capital gains taxes apply equally to dollar, euro, yen, etc. increases in the fiat currency value of gold, silver, and platinum.

Substantial industrial uses of platinum put a floor under its price, whereas the huge above ground stocks of gold and silver do not. I’m not against investing in gold or silver; I simply believe that platinum is a better store of value at today’s relative prices, in my opinion.

My Aurum arrived today in the mail. Thank you Keith for giving me free gold! I’m going to frame this because I think it will become a collector item some day and worth $1 million under the “right conditions”. Hehe.