The Wealth Effect: Silver Edition

Silver has gone up a lot.

In a post-interest world, one cannot earn much return by financing productive enterprise. Instead, people are forced to speculate on whatever asset bubble is inflating at the moment.

Speculation is different from investment, in that the speculator’s profits come from the capital of the next investor. It’s a process of conversion of one investor’s capital into another’s income, to be consumed.

This is the great feat, which economists call the wealth effect.

The wealth effect is not wealth. The same way that homogenized, pasteurized, processed cheese-food with orange food dye in a spray can is not cheese. It may be good enough for Keynesians and lazy couch potatoes, but then again Keynesians are not economists. The same way microwave nacho cheese platter eating couch potatoes are not football Hall of Fame players.

Hello, Speculation

Speculation, if not a bubble, has now come back to silver, big-time. As we write this, the price of silver is over $27 an ounce.

If the price could more than double from the March low, could it double again from here, making a new all-time high? After all, gold has done it, breaking out decisively above $2,000. So it seems logical enough for silver to do that, too. Well, maybe.

Before we get there, we must note that yesterday’s big silver price move was driven by speculators who bought silver futures with leverage. Before that, two big price spikes were driven by stackers buying physical metal, so the speculators have good reason. There has not been a comparable time in the silver market since 2011.

Robinhood & SLV

Also, in the mix are the so called “Robinhood” investors, the (presumed) punters, dilettantes, and the American equivalents of “Mrs. Watanabe” (who were rumored, back in the day, of driving the carry trade—selling yen and buying other currencies to invest in assets with higher yields). The Robinhooders are assumed to have no business investing (or speculating). Some say that the current leg up in the prices of stocks, especially low quality issues, are the fault of these newly-active traders.

Are they affecting the price of silver? We are not aware that Robinhood lets them buy futures contracts, but it does let them buy SLV.

How can we tell if they’ve been bidding up SLV? Well, the Authorized Participants create more shares and deposit metal into the trust, if they can sell an SLV share at a higher price than the metal that backs it. They are arbitrageurs (as we always write about) only they focus on this spread (vs. the basis). If SLV has increased its ounces under management, then that shows there is retail buying of silver exposure via the stock market.

Let’s Review the Evidence

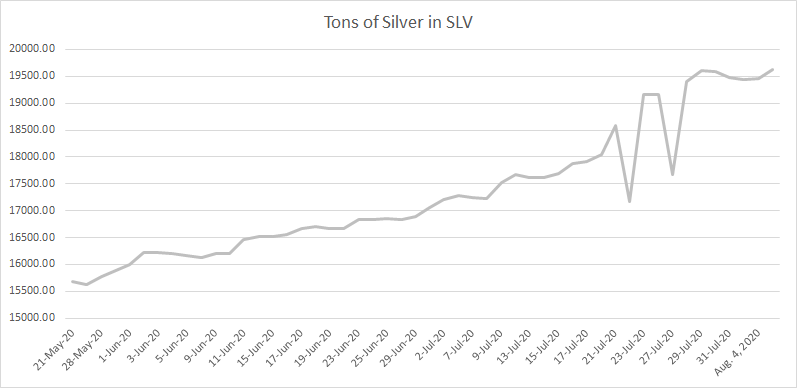

To see if this is so, we start with a table of the daily assets under management value. Alas, it’s quoted in dollars. But if we divide by the silver price for each respective day, and divide by 29166.7 troy ounces per ton, we get tons held each day. Here’s a brief chart.

Since May 12, SLV goes up from 15.6K tons to 19.6K tons, a gain of 26%. Though of course, not all of them are Robinhood investors. A big price move will attract speculators ranging from rank amateurs to sophisticated professionals. For sure, some of this tonnage was added because of Robinhood investors, but we would not credit (blame) the added metal to any one class of speculators.

At today’s price, 4,000 tons is a bit over $3 billion. That’s a few hundred thousand people. So we can form some conclusions. One, this is a tiny group of people. If silver fever catches on in a larger group of traders, the price could indeed shoot up to multiples of what it is now.

Two, this is not a sign of the end of the dollar system. When the dollar is failing, and we plunge into the abyss of permanent backwardation, people will not buy exchange traded funds or futures. Only real metal will do. It will be Armageddon. Right now, it’s not the end of the world, though such a Narrative may help convince people to use SLV as a chip in the Fed’s casino to make more of the dollars they say they hate.

Three, although buying of SLV shows up as a drop in the silver basis (the fund buys bars of metal and stores them), 4,000 tons of silver is not a lot.

And that brings us to the final point.

Four, if silver stocks were really being consumed, then that would mean that silver is being demonetized. That certainly would not be a story that would make us buy the metal! Silver would become, not the poor man’s gold, but the poor man’s platinum.

Speculators or Stackers?

In the meantime, everyone wants to know the explanation for the +4% price move yesterday! Was it speculators like Tuesday? Or stackers like 22 and 27 July?

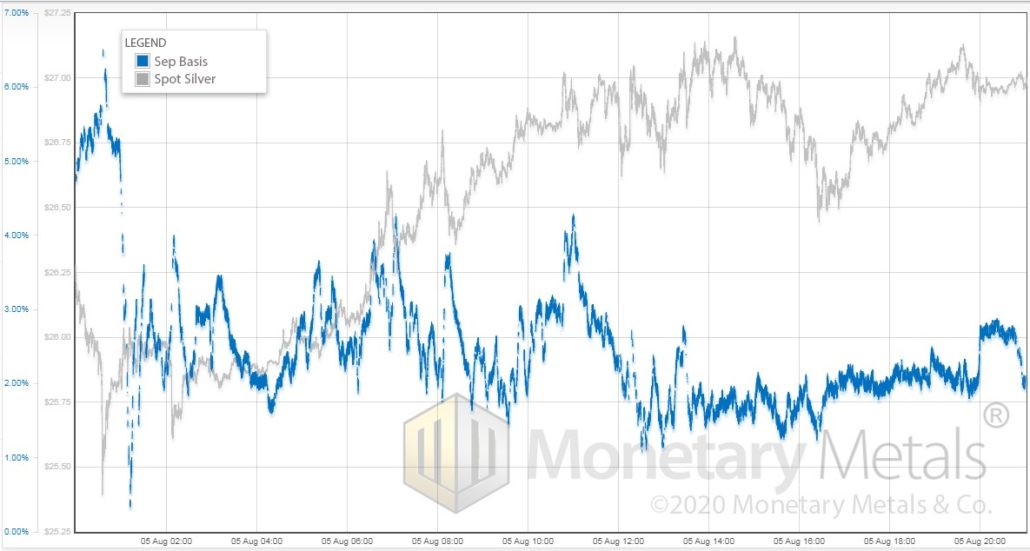

Here is the chart.

Look at that!

The chart begins with the basis basically where our chart ended yesterday, around 5%. But it drops throughout the day, ending at 2%. That’s a big drop (it would be more significant if the banks were acting as market makers). And while the basis fell 3%, the price of silver rose a buck.

In other words, the market more than erased the rise in basis (i.e. abundance of silver to the market) while adding a dollar to the price of the metal. That means silver reverted to greater scarcity, while its price was rising.

This is not the same market as 2012-2019. Stack on!

x

Want to earn interest on your gold & silver?

Set up your account today!

Or schedule a call with a Monetary Metals Relationship Manager to learn more.

Dear Keith,

You write:

“At today’s price, 4,000 tons is a bit over $3 billion. That’s a few hundred thousand people.”

What is the meaning of the last sentence? Specifically, what is “a few hundred thousand people”?

Thank you.

Thanks Keith, a very interesting report.

This is in sharp contrast to https://silverseek.com/article/inflating-silver-bubble

I am watching the silver spot price and the price of the nearest future month on investing.com — the spread has fallen considerably since april/may

Thank you Keith

Nice article, Keith. Thanks.