This is Not The Silver Breakout You’re Looking For!

To listen to the audio version of this article click here.

Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Oh well. Our consolation is that they most likely are not calling for lower silver prices based on the same indicator we observe.

The basis.

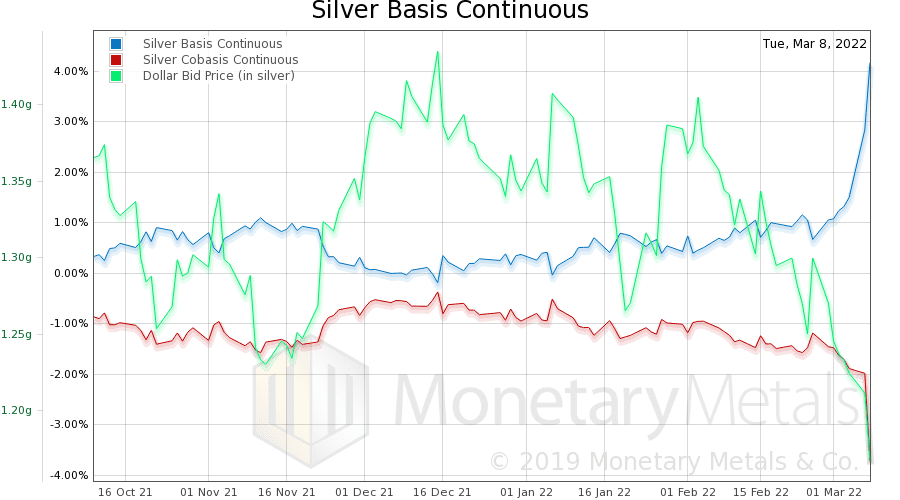

Here is the chart.

Silver Price Basis Chart

Look at that moonshot!

basis = future(bid) – spot(offer)

cobasis = spot(bid) – future(offer)

As the price has risen since February 25, from under $24, to yesterday around $27, the silver basis shot up. It went from 0.67% to 4.18%.

Silver Buyer Beware

Folks, it does not get any clearer than this. The big price rally in silver was driven by big buying of silver futures.

NOT physical metal.

This is not a bullish sign. Those who buy futures are playing with leverage. In the best of times, they will sell to take profits. And in volatile times, they may need to sell to cover margin calls. Even when the silver price is rising, they may have margin calls on other positions in their portfolio. Or they may just be jittery.

Argentum emptor cave.*

*Silver buyer beware

We will continue to update you as the situation develops. To receive reports like this as soon as they’re published directly in your inbox, be sure to subscribe!

Leave a Reply

Want to join the discussion?Feel free to contribute!