Tragedy of the Speculations, Gold & Silver Report 10 Sep 2017

Bitcoin is often promoted as the antidote to the madness of fiat irredeemable currencies. It is also promoted as the replacement. Bitcoin is promoted not only as money, but the future money, and our monetary future.

In fact, it is not.

Why not? To answer, let us start with a look at the incentives offered by bitcoin. We saw a comment this week, which is apropos:

“Crypto is so exciting and stimulating that is actually very hard for me to be interested in/do things unrelated to it lately.”

This sentiment is chilling. It illustrates another way that bitcoin speculation is affecting the real world. Some people are actually producing less. Speculators like him get free money (i.e. the accumulated savings of others, provided as income). Why should they do mundane work for wages? The net result is that someone at the margin will have to consume less.

We could dub this the “tragedy of the speculations.”

We don’t prefer to focus on the real or alleged intentions of bitcoin creator Satoshi. We do not call this “unintended consequences” (though we doubt that Satoshi could have foreseen this). Instead, we say that the skyrocketing price creates a perverse incentive. A perverse incentive causes a perverse outcome. If people produce less because speculation is so much more fun (and rewarding), this is a perverse outcome.

A monetary system is supposed to enable greater productivity, not reduce it. A stable interest rate—and hence asset prices—is the principle virtue of a free market in money (i.e. the unadulterated gold standard).

Bitcoin’s unstable price makes it unusable as money. Merchants may seem to accept bitcoin, but really they just want dollars. Such merchants use a bitcoin exchange to facilitate transactions. The exchange calculates the current amount of bitcoin to net out to the merchant’s dollar price (after the exchange fee). No merchant can hold any significant amount of bitcoin for the same reason no saver can hold his life savings in bitcoin (as opposed to a HODLer holding his speculation).

Suppose a merchant has 10% net margins, after cost of goods sold plus payroll and rent. That’s not bad, by the way, in this falling-interest rate regime. Just look at the increase in breweries in Switzerland, despite the decline in beer drinking. This is surely putting downward pressure on the profit margins of every brewery.

Anyways, suppose a merchant has a 10% profit margin. He keeps a significant amount of capital in bitcoin. In two days, he loses almost 20 percent as the price of bitcoin drops from $5,000 to nearly $4,000 between Saturday 2 Sep and Monday. That could be enough to bankrupt his company.

Business requires predictability. Some things are not predictable such as the weather (which is one reason why farmers use the futures market). However, the value of money is nearly as important as the rule of law itself, and the right of property. If the value of money is subject to big changes, then the ability (and incentives) to invest for the long-term are undermined or destroyed.

Bitcoin’s unstable price also means it cannot be used for borrowing. We have said in past articles that bitcoin is unsuitable for business loans to productive businesses. Only a bitcoin miner could borrow in bitcoin. A reader argued that there are indeed bitcoin lending exchanges. We found one site, but it had a scant two open loan requests—from bitcoin miners.

We came across bitcoin lending on another leading exchange, Bitconnect. This exchange offers a way to do what it calls lending bitcoin. Question #8 in the FAQ reads: “After completion of my lending contract, would I get back USD or BCC?” The answer is “You will receive USD back into your lending wallet.” If you click to read more, there is a page which reiterates the same answer. The first comment and response are interesting (these do not seem to be official responses by the company).

[UPDATE Nov 23, 2018: Tom Alford of Total Crypto contacted us asking us to remove links to the bitconnect site as it is now accused of being a scam. Our original links no longer work any way. Here is a link to his article on bitconnect.]

<John Currier> Why in the world would you pay back in USD?? I invested $49 on day one. I bought one bit coin at $.98 each. Are you saying that all I get back is the $.98 a coin in CASH??

<Wes Taylor> Lets say you invest $100 worth of bitconnect coin on day 1. Let’s say at the time, 15 BCC equals $100 witch would mean each coin would be valued at $6.66 each. At the end of the 299 lending term, you would receive 100 USD in your lending wallet. If they gave you 15 coins back at the end of your lending term and the price of each coin went from $6.66 a piece to over $20 a piece you would be getting back $300 plus the interest that you received throughout the 299 day Lending period. That would be unsustainable. The reason why you receive USD is because it’s more stable than the BCC coin. Imagine if you lent out $100,000 worth of BCC and then the coin went down from let’s say $100 a coin to $20 a coin then you would be losing value. Stability is the name of the game.

Mr. Taylor is (we assume) a proponent of bitcoin and a participant in bitcoin lending. He does not seem to be trying to make the case that bitcoin is unsuitable for lending. Yet he did just that.

Getting back to our starting point, above, we see speculation running rampant, to the point where it offers an incentive to stop producing and start partying. We see an unstable price, which mostly goes up in recent months—but which is punctuated by violent drops too. We see it’s useless for lending, except for a niche market to finance hardware purchases by miners.

And finally, we see bitcoin used as a mere conduit for dollar lending, which raises a simple question. Why bother with bitcoin—why call this bitcoin lending—if one is lending $100 worth of bitcoin and getting back $101? That’s just a 1% dollar loan (likely minus some bitcoin exchange fees and/or bid-ask spread).

Bitcoin could not work as money when it was $1. For the same reason, bitcoin did not work as money when it hit $5,000. It will not work as money if it hits $50,000 or if it drops back to $5 (or both).

The same applies to gold. Too often, the opponents of the gold standard trot out the trusty old saw, “there’s not enough gold to have a gold standard today” (presumably because they can’t really say gold caused the crisis of 2008).

And equally often, the defenders of gold take the bait. They say “it’s just a matter of price—maybe we can’t have a gold standard at $1,300 an ounce, but if we divide M1 money supply by the US government’s gold—$3.5 trillion divided by 147.3 million ounces—we get $23,760 an ounce. So, this claim amounts to asserting that at $23,760 an ounce, gold will circulate.

It won’t. It couldn’t.

Think about that scenario. The price of the dollar has already fallen from a high over 7 grams of gold in 2001, to its present value just over 23 milligrams (prices should be measured in money, which is not the dollar but gold, so we look at the dollar as falling rather than gold as rising). If gold exchanges at $23,760 an ounce, that means the dollar will have fallen much further, to 1.3 milligrams gold. What would make people want to pay out their gold? Gold is hoarded today, and if anything, the falling dollar will confirm why it was right to hoard gold.

A yield on gold, paid in gold is the key to circulation. Interest makes it possible for one to save money without making a bet on the rising price of said money. Holding money is not a way to get rich—as measured in terms of some other unit of measure. One makes money by… making money. If one has 100 ounces, one seeks to have 101oz.

The root of our monetary problem is not the Federal Reserve. It’s mental. It is that people think of gold’s worth in dollar terms. They know the dollar falls—they know that the Fed has a mandate to devalue it at 2 percent per annum. Yet they think gold goes up—and look forward to it. We (not so eagerly) await the heady headline “Nuclear War with North Korea Will Be Good For Gold!”

Johann Wolfgang von Goethe predicted dollar slavery in 1809, “None are more hopelessly enslaved than those who falsely believe they are free.”

The Fed has put us into a giant Skinner Box, and programmed us to seek speculative gains. With three and a half decades of falling interest, it has trained us to salivate like Pavlov’s Dogs at each rise in asset prices.

If there were not a bitcoin or a dollar, enabling one to bet big for big prizes—someone would invent one. After all, there’s a lot of money to be made!

In this sense, we must conclude by noting that the gold standard will be boring. People will simply get back to work, and money will be earning interest financing this work.

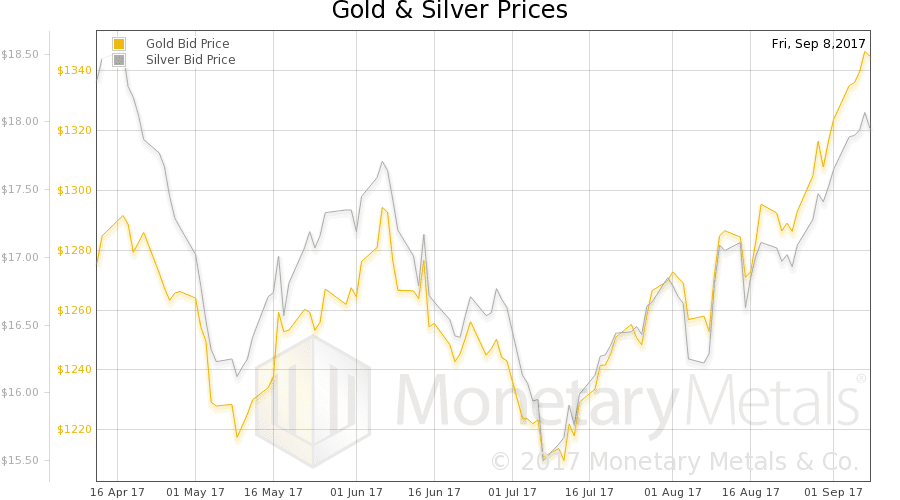

There were big moves in the metals markets this week. The price of gold was up an additional $21 and that of silver $0.30.

Will the dollar fall further? As always, we are interested in the fundamentals of supply and demand as measured by the basis. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

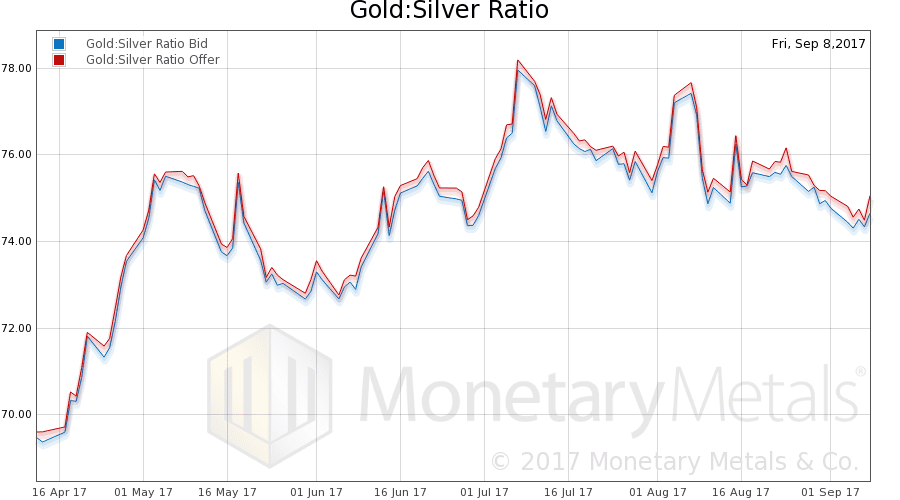

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was all but unchanged.

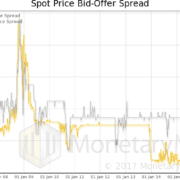

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

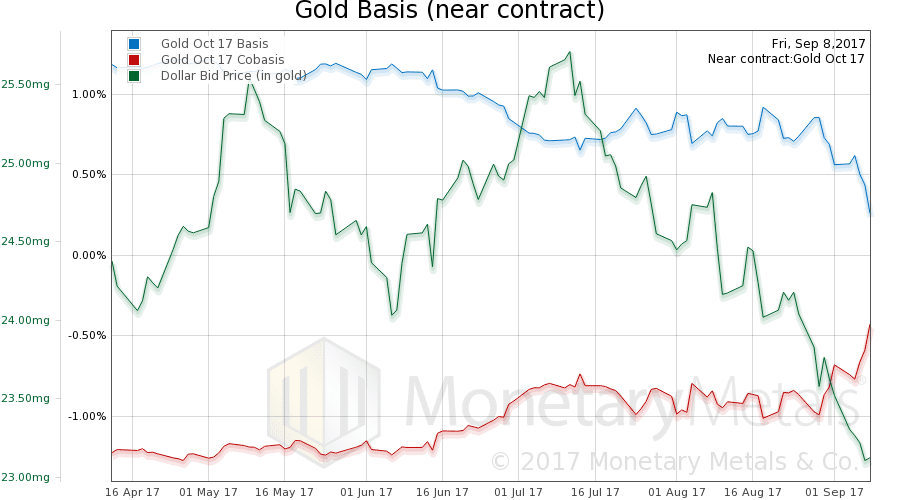

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph (Oct contract), this time showing intraday resolution for the full week (here is the live gold basis chart).

This is the October contract, which is under selling pressure (pushing down basis and up cobasis). However, there has been a significant drop in the dollar (the mirror image of how most people think of it, a rising gold price). Here is the continuous gold basis chart for comparison. There is not much change in continuous cobasis, as price rises (and as you can see above, a rise in October cobasis).

The cobasis of -0.5% for October or -1.3% for continuous is not exactly screaming shortage. Yet the refusal of the cobasis to drop in the face of all this gold buying is. It feels a bit like a stealth bear market in the dollar (i.e. stealth bull market in gold).

Our calculated Monetary Metals gold fundamental price was up $22, to $1,379.

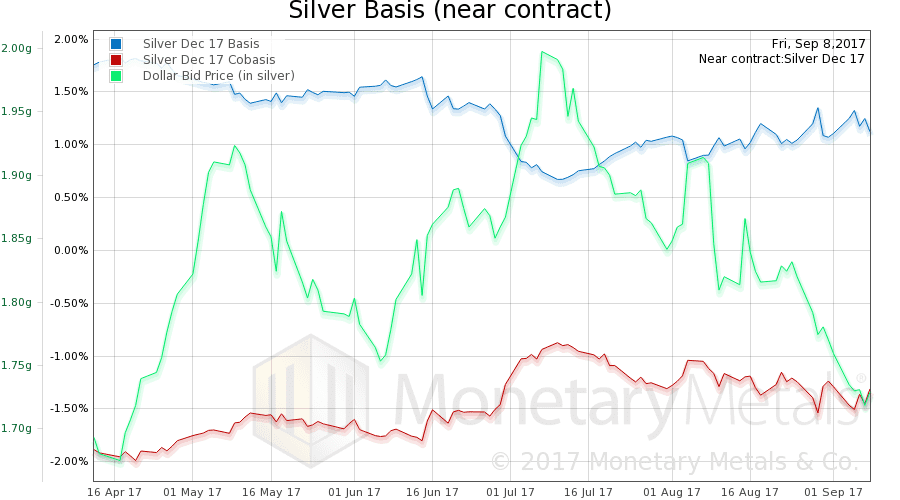

Now let’s look at silver.

In silver, we see a rising basis and falling cobasis in the December contract (and the continuous silver basis chart too).

Our calculated Monetary Metals silver fundamental price increased $0.25 to $17.89.

© 2017 Monetary Metals

Thanks again for your insight. Am I right that 90% or more of the stock market valuations are due to speculation too?

Keith, would you please consider adding more information to your chart of Price Premium/Discount to Fundamental Value showing the differential in percentage terms as well? The down spike (in dollars) back around 2000 looks puny in comparison to more recent discount amounts, but in percentage terms they might not be too different. Thanks, as I’ve said before, you do great work!

Interesting thought. Thank you for your suggestion, Donald.