Why Are We Here?

I don’t mean the meaning of life, the universe and everything. I mean why are we in the gold market?

This week and especially today, I have seen so many emails, messages, and articles with the same theme.

“Woe is me.”

Seriously? The price of gold dropped $100 in a couple of months, and it’s like the end of the world.

If you really feel this way, we respectfully suggest you take a step back. Ask yourself why you’re in this market. We can think of four reasons:

1) You are a professional, an asset manager or on a trading desk. In this case, our advice may not apply to you.

2) You are speculating for bucks. With leverage. You may want to decrease leverage, or at least become more conservative about when to take big positions.

3) You are accumulating a position in metal, held outside the banking system, unleveraged. You should be happy that your paycheck goes father now and buys more gold!

4) You have gold as a hedge and/or to prepare for a monetary crisis. A falling price should take some of the pressure off. Gold will not be cheap when the real monetary fireworks go off.

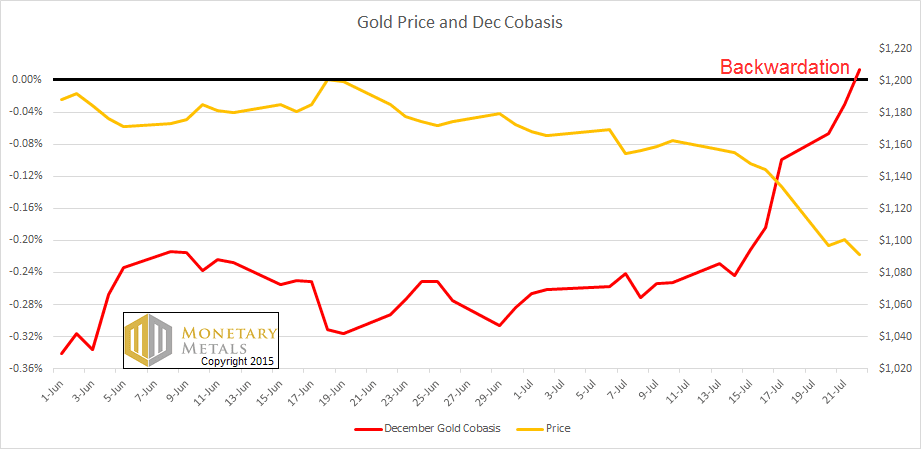

We have one thing to add today. The market made a new milestone. Last week, the October gold contract plunged into backwardation (where it remains). Today, the December contract tipped in.

Scarcity is rising. Three contracts are now in backwardation, and the farthest is about 94 trading days (by our quick guesstimate) before December. This is interesting, and we haven’t seen anything like this since (as we recall) two years ago.

This is not a recommendation to go buy gold, and definitely not with leverage. This is an advisory and a situation that bears close monitoring.

(c) 2015 Monetary Metals LLC

If one had given thought to the “why am I buying gold” question at the very opening of your position, and the answer was similar to “…fiat paper is irredeemable and look at its track record…” than why bother now? Same question, same answer – even if one is disturbed by the purchasing power.

The purchasing power of The Irredeemable One is even more shaky. If the answer was anything else that is similar to “doing your accounting in rubber bands”, than by all means, you should have extradited your gold holdings against whatever you hold in higher esteem. I can’t think of what that would be, but I guess you somehow deserve it.

Thanks for info Keith!

Woe really is me!

3) Describes me exactly, but I am also a victim of the huge American manufacturing sector jobs degradation, and after having lost a good paying job (replaced with a low paying job), I had to roll over a 401K (mid 6 figures, that took 26 years to accumulate) into an IRA. Having sudden control of my IRA investment choices in the year 2011, and being able to read and do some simple math while looking at the debt clock info, I naturally was lured to precious metals. No other choice seemed to be able to stand the test of time, especially with all the malinvestment and QE going on, and I wanted to preserve what took most of my life to hard earn, not caring much about growth. The funny thing is that even though I lost more than half of what took a lifetime to earn, I still think there is no better choice especially from here, so what little I can save buys more (physical only). Of course I look for opportunities to lever and get my savings back before I need it for retirement, which is fast approaching. Needless to say, I’m glued to every single bit of what Keith has to say and advise, after all my family is depending on me not failing! I do hope to someday read that Keith does recommend going to buy gold.

Amazingly, Keith “recommendations” are nearly the same that simple technician analyst.

It has been prefered USD for gold since charts are “bearish” (and he was right like any wall street junior 25 years old analyst or blogger like dan norcini) and will continue to do so…unless permanent banckwardation on all maturities ie when (and if) there will no gold for sale !

I sympathize with Bob and his timing. I bought my first $1000 face silver bag in 1989 after reading the Coming Currency Collapse. It was some 10 years later when Cheney revealed that debt doesn’t matter and sadly he has been right. Buying gold is injecting honesty into the monetary conversation. It’s not always appreciated. Consider it a small revolutionary act. There is not enough gold production at current prices for every American to even buy a 1/2 ounce coin. (But if they did-Oh the fireworks we would see!) I have become concerned about the eventual investment potential of gold simply because the blizzard of paper can “set” a price unrelated to its eventual use as a monetary anchor. If conditions (not manipulation) drive its price down, the authorities can simply declare the lower price what they will pay to re-purchase the gold to reset the system. Hoarders are then criminals. The 95%of the people who never had any gold will not care.

Chinese have they key regarding gold and worldwide Financial issues but… they have no balls and will be old before being leader.

That’s it : they are waiting the west will fail on its own sword and debt.

Western banks and oligarchy have still many bullets left unfortunately for the little guy.

The west will never buy (in big way) a falling asset (labeled in official fiat such usd or eur).

is silver in backwardation and premiums on physical, gold and silver, going up? no? then this is nothing to worry about. gold, paper gold that is, will go down further yet. for a long time.

Long time could be 6/18 months IMO but could be 10/30% additional losses for paper gold vs usd.

Keith,

2.7 Billion in “Paper Gold” strategically dumped,

I liked to here what you think ,If you like

Thank You

Just want to second Peter V C’s way of inoculating us against capitulation.

And to add a link to Jim Grant speaking today who wants ” to have exposure to the reciprocal asset of the paper assets that are the most popular.” The mathematical promise of having the dollar denominator vanish to 0 is apt and worth considering as we watch gold backwardation spread over the market, knowing what we do of the Real economic meaning of that condition.

Thanks for all the good comments.

Another way of understanding why people think of their gold simply as a means to get capital gains, to sell to make more dollars, is that there’s scant yield to be had anywhere. So we are acclimated to trading in the casinos that markets have become, seeking price appreciation. If one does not like stocks and bonds and real estate, then one turns to gold. But gold is not a tool suited to that same purpose. Thus “woe is me.”

Bob: I have not been saying not to buy gold to have and hold. I’ve been rather more cautious if one is trading gold, especially with leverage. As of today, the fundamental price is about $100 over the market price. Can there be more selling? Yes. The basis not a timing indicator.

Which is why I am amused by RD’s comments that my analysis is almost the same as a 25 yr old chartist or junior Wall Streeter. He must not have been reading this site for very long. There were distinct times when the chartists were saying “breakout” and I was channeling Obi Wan Kenobe to say “this is not the breakout you’re looking for.”

ex nihilo: backwardation refers to the premium to buy a commercial bar (i.e. 400oz gold or 1000oz silver) relative to a contract. It does not refer to retail-sized products, which can have very large premia sometimes, due to inelastic manufacturing capacity. Sep silver is backwardated, but December is not.

RD: What do you mean “losses” and what do you mean “paper gold”? Do you mean a lower price of gold in dollars? And do you mean that the price of a futures contract is divorced from the price of a gold bar? (They are close enough that most people would say they are the same).

mikestline: I’ve written many articles over the last several years, debunking these claims. Scroll back on the site…

Greg: Good point that gold is the reciprocal of the dollar.

I did not say it was the comments, it was the same conclusion with a different analysis (ie charts vs basis study). There were never gold break out for years as norcini for example has been bearish from 2013 “breakdown”.

By paper : it mean everything (like futures or physical buying) but big OTC gold transactions which I believe can have hefty premiums on paper spot gold.

I know you will say it is impossible because comex basis tells you so but I think that is.

Losses definition : when for the same quantity of fiat, you can have more gold : for me that is a loss or a fiat gain if you prefer.

10 years ago, when the resurrection of the gold price once again put it on peoples’ radar screen, The Quantity Theory (of money) camp fixated on that “reciprocal” relationship and too-confidently predicted hyperinflation. It was at that juncture that Fekete caught my attention when he made the case that the QE to come would be deflationary, instead. And here I have to inject the interpretive note that to Fekete, (in,de)flation is indicated by commodity prices (vs. financial asset prices).

As we now face that commodity price deflation, we also see the backwardation he’s warned us about for over a decade. The question to ask is whether his simple explanation (that all commodity trades ultimately appeal to the gold trade) represents Reality. Fekete’s (Menger’s) view – that gold is the best-evolved monetary Good which leads directly to the prediction that gold vs dollar backwardation spells the end of all other commodities’ dollar pricing as well – depends on that purely rational reading of the economy.

In explaining money elsewhere this week, I summarized the difference between dollars and gold by quipping that “a dollar is a unit of force, whereas gold is a unit of value”. Not to make too much of one flippant remark, but it goes to the key economic roles they play. Because the force behind a dollar is the huge political will of very powerful agents, it can (& has) distorted the subjective-consensus (cum Objective) valuations of everything, gold included. It is this unintended “distorting” effect that the government economists find so confounding. I feel that Fekete gave those of us, who (like Keith) have some computer science background, an important clue when he talked about Economic Entropy – referring to Shannon’s Information Theory definition where low entropy corresponds to high Certainty about a system’s state. I see that even George Gilder has picked up on this in a superficial way. If there is anything coherent to this “Entropic Theory of Money”, then the fiat money supplies are in deep trouble. The debt-pyramids in each central bank’s reserve vault are open to very high entropy revaluations by far more actors and agents than just the FOMC and company. That rising uncertainty will eventually price the fiats out of the market for the commodities needed for life. That is the thesis behind Fekete’s dread vision of “negative basis” backwardation. Keith’s “positive co-basis” definition is just the actionable way this fact gathers market force in opposition to fiat.

The battle over what axioms truly hold sway will be profound